Report Overview

Agricultural Biologicals Market Size, Highlights

Agricultural Biologicals Market Size:

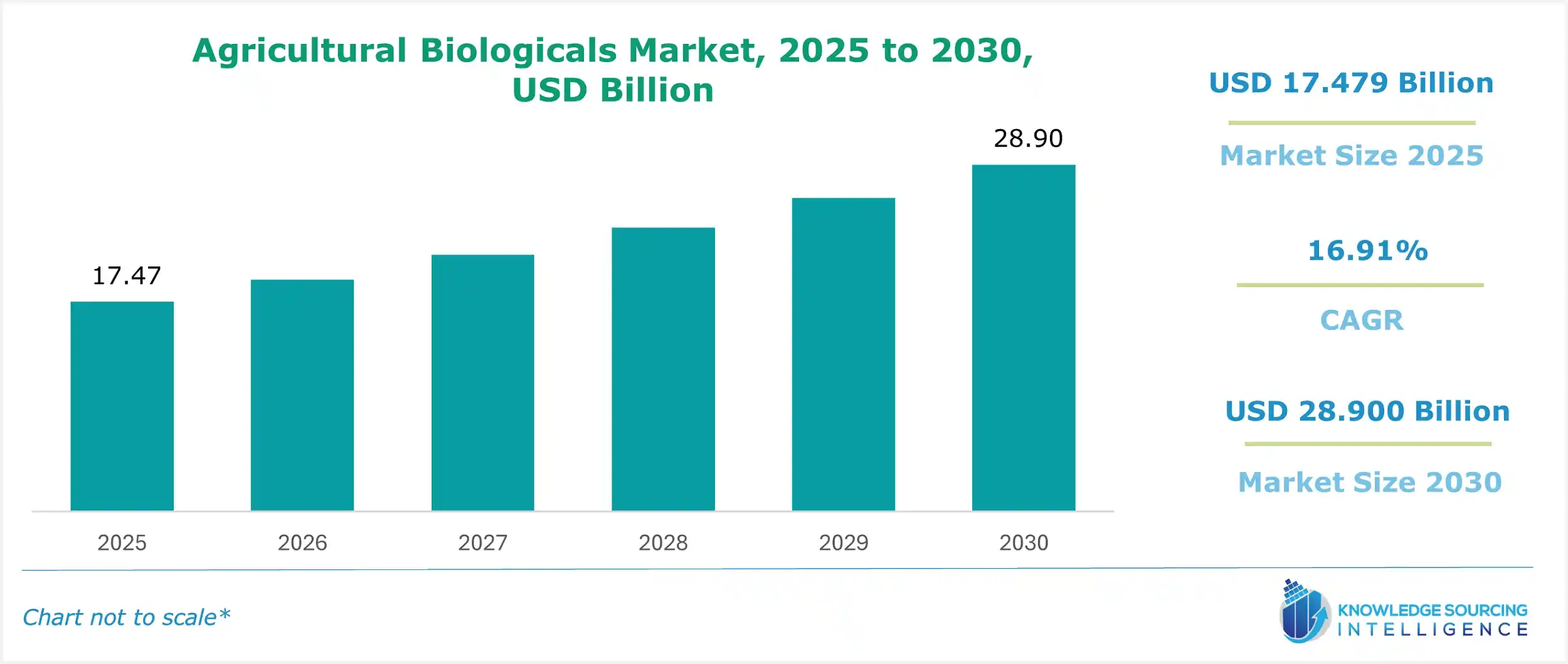

The Agricultural Biologicals Market will surge from USD 17.479 billion in 2025 to USD 28.900 billion by 2030, at a CAGR of 10.58%.

Agricultural Biologicals Market Introduction:

Agricultural biologicals are a distinctive group of natural products, derived from naturally occurring micro-organisms, beneficial insects, plant extracts, and other organic matter. The agricultural biologicals market is pivotal in advancing sustainable agriculture inputs, offering eco-friendly alternatives to conventional chemicals. Bio-agri solutions, including natural crop protection products like biopesticides and biofertilizers, enhance crop resilience while minimizing environmental impact. These solutions align with the growing demand for eco-friendly farming practices, supporting soil health and biodiversity. Regenerative agriculture biologicals, such as microbial inoculants and plant-based extracts, promote long-term productivity and carbon sequestration. As global agriculture faces climate challenges and regulatory pressures, the market for biologicals is expanding, driven by innovations that deliver effective, sustainable outcomes for modern farming systems.

Biological products, such as agricultural biologicals, are the fastest-growing segments in the agricultural input market. The key developer of this industry is the growing demand for eco-friendly, chemical-free products for better yield. Chemical fertilizers and pesticides do increase yield, at the cost of the quality of the crop. The chemicals may end up in the end product, harming the health of the consumers. Agricultural Biologicals, on the other hand, do not contain chemicals and make the plant and yield more nutritious and healthier. Bio-stimulants help in increasing plant metabolic and enzymatic processes, thus improving the production level and the crop quality. Bio-pesticides protect the plant from incest and other microbe attacks, saving the yield.

The market growth is driven by many factors, including R&D and innovation, to meet the growing food demand as a result of the surging global population. Further, consumer interest in organic products will also drive the market. Furthermore, insect and weed resistance towards chemicals used in agriculture, accompanied by rising environmental concerns, will have a positive impact on the agricultural biologicals market.

Rapid Urbanization and Industrialization, along with growing disposable income, will have a positive impact on the market, driving the demand further.

The prime driver of growth in the agricultural biologicals market is anticipated to be the growing demand for food owing to booming population growth. The World population is expected to increase to 9.8 billion by 2050, from 7.8 billion in 2019. This growth will increase the demand for food products. Further, rapid industrialization and urbanization, especially in developing countries, will decrease the arable land available for cultivation. Hence, intense pressure will be on agricultural lands to increase yield. Farmers will turn towards agricultural biologicals, which help in increasing yield.

Moreover, growing disposable income will also boost the market. growth in disposable income redefines a better standard of living. Along with this, consumers are becoming more health-conscious and are demanding natural, organic products. To meet this demand, farmers are employing bio-products. These factors combined will boost the market for agricultural biologicals.

Agricultural Biologicals Market Overview:

The global market for agricultural biologicals is currently undergoing a structural transition, driven by the referenced policy levers, environmental pressure to reduce chemical dependence, and increased farmer interest in sustainable and regenerative crop inputs. Across all major economies producing agricultural commodities, national government regulation and approval methods have aided governments in implementing changes affecting registered organic crop protection products.

By doing so, government regulatory agencies are openly sharing their intentions from 2023 to 2025, with the aim of stimulating the development, registration, and use of biopesticides, biofertilizers, biostimulants, and other biological alternatives to chemical crop inputs in the agricultural value chain. For example, the Environmental Protection Agency (EPA) in the United States de-listed several low-risk biopesticides, such as methyl mannoside, from further review in November 2024, which helped to encourage a faster approval process and quicker speed to market for natural alternatives to crop protection. The European Union has also reformulated its pesticide registration policies and regulatory framework. For instance, policymakers in the EU will fast-track registration approval for biopesticides by the end of 2025, while also undertaking the initiative to disentangle existing legislative mandates for the Pesticide Regulation 1107/2009 from outdated guidelines on product registration through new genomic techniques. Additionally, the EU's Council adopted a negotiating mandate in March 2025, which recommended a separate regulatory framework for plants derived from genetic improvements through new genomic techniques, providing more precise rules on product developments, seed labelling, and related patent disclosure policies with general public availability.

Brazil is significantly streamlining regulatory processes for biological inputs. Based on Law No. 14,785 ratified in December 2023, the average timeline for biopesticides was contrastively reduced from several years down to between 12 and 18 months for many new biopesticide registrations, with over 100 biological products approved in official registration in 2024. Argentina initiated advancements to expedite its digital registration platform for biological products related to crop protection, aiming to streamline the full approval process for registering biological crop protection products in October 2023.

In parallel with these developments, the global biologicals industry has witnessed a proactive integration of precision farm technology with biosolutions, ranging from widespread use of drones, sensor-based nutrient management, and microbial soil enhancers, in Latin America, Southeast Asia, and Sub-Saharan Africa. Biotech innovators have increasingly prioritised markets with advanced approvals, as slow approval processes hindered by long timelines, especially in the EU, where approval can take as long as nine years, prevent biologicals from scaling.

With growing public sector interest, incentives for regulatory streamlining, and private sector investment and interest in pilot projects for deploying microbial and biochemical products in the field, agricultural biologicals are shifting from niche products and alternative inputs to foundational products and inputs in farmer portfolios in developing and developed markets.

The data, as reported by the Central Statistics Office in Ireland, is inextricably linked to the global move towards sustainable crop protection. The 2023 numbers showed a decrease in pesticides sold in Ireland to 2,274 tonnes (the lowest sales figures recorded since 2011) and a Harmonised Risk Indicator (HRI 1) decrease to 45, and, therefore, a risk reduction of 55% below the baseline. This statistic reflects a stringent regulatory environment and a decreased reliance on conventional chemical inputs by farmers.

There is an important point to consider - as governments continue to restrict the use of synthetic pesticides, the rate of adoption and demand for viable and effective alternatives will increase exponentially. The biological range of products - including biopesticides, microbial formulations, and biostimulants - is ready to fill the gap, as the accompanying data show. The numbers from Ireland are a reflection of what is occurring across Europe and other regulated regions - a fundamental shift toward the use of inputs that meet safety targets while maintaining yield. The information presented here demonstrates a case for adoption and investment in the agricultural biologicals marketplace and, further, all markets are scaling back and moving away from high-risk chemicals as prompted by policy and environmental pressures.

Several firms are at the forefront of developing the agricultural biologicals sector. These include Biolchim S.p.A., Koppert Biological Systems, BASF SE, Certis USA, and Valent BioSciences. All are developing biopesticides, biostimulants, and microbials in various global markets to support the transition to sustainable, research-oriented crop-input products, subject to regulatory approvals, and dedicated global marketplace structures.

Agricultural Biologicals Market Trends:

The agricultural biologicals market is evolving with cutting-edge innovations. AI in agricultural biologicals optimizes product development and application, enhancing efficacy. Genomics for biologicals drives tailored microbial solutions for crop resilience. Precision agriculture biologicals, integrated with digital farming biologicals, enable data-driven, site-specific applications, maximizing yield and sustainability. Nano-formulations for biopesticides improve delivery and bioavailability, boosting performance. Integrated pest management (IPM) biologicals combine natural solutions with traditional methods for holistic pest control. Carbon farming biologicals support regenerative practices, promoting soil health and sequestration. These trends underscore the industry’s shift toward technology-driven, sustainable solutions for global food security challenges.

Agricultural Biologicals Market Drivers:

- Rising Demand for Sustainable and Organic Farming

Sustainable and organic farming is imperative for preserving environmental health, enhancing soil fertility, and ensuring long-term food security. These practices reduce reliance on synthetic chemicals, promote biodiversity, and mitigate climate change. The Union government of India is actively advancing these approaches through various initiatives. The Government of India has launched landmark schemes to support organic agriculture, improve production quality, and strengthen the resilience of farming systems nationwide.

The growing need for sustainable and organic farming is changing the global agricultural landscape. Consumers are more aware of the health and environmental effects of synthetic pesticides and fertilizers. This awareness has led to a strong preference for organic, chemical-free produce. As a result, organic food markets are growing worldwide, increasing the demand for biological inputs like biofertilizers, biopesticides, and biostimulants. These products help farmers meet organic certification standards while ensuring crop productivity and soil health.

Sustainable farming practices focus on the long-term health of agricultural ecosystems. Biologicals used in soil treatment are essential to these practices. They boost microbial activity, improve nutrient cycling, and restore degraded soils. Unlike conventional agrochemicals, which can harm beneficial organisms, cause soil erosion, and lead to water contamination, agricultural biologicals provide a low-impact solution that supports environmental balance. As farmers seek ways to preserve natural resources, maintain biodiversity, and lower greenhouse gas emissions, adopting biologicals becomes a key part of sustainable farming.

Governments and international organizations are also supporting this change through policy initiatives, subsidies, and research funding. Programs aimed at promoting regenerative agriculture, lowering chemical residues, and enhancing carbon sequestration have created a supportive environment for the growth of biologicals in agriculture. With sustainability becoming a major focus in food production, agricultural biologicals are not just a market trend; they are essential tools for achieving global food security while protecting ecological health.

Agricultural Biologicals Market Restraints:

- Low shelf life and lack of awareness are hindering market growth.

Major hindrances faced by the agricultural biologicals market are its low shelf life and lack of awareness.

Agricultural biologicals are plant-based or bio-based with minimal or no involvement of chemicals. As a consequence, biologicals product has a lower shelf life, i.e., they cannot be used for a longer period. Hence, it cannot be stocked and stored by farmers. Moreover, these products are less adaptive and cannot be transferred easily from one container to another. Lack of awareness of these products is another constraint facing the market.

Agricultural Biologicals Market Segment Analysis:

- Soil Treatment to hold a significant market share.

By Application, the market is segmented into Soil treatment, Seed treatment, and Foliar Sprays. Of these, soil treatment and foliar sprays are anticipated to hold a significant market share due to awareness and non-technical usage. The seed treatment segment of the market will also hold a noteworthy share and is anticipated to increase at a considerable rate with growing awareness.

Agricultural biologics used in soil treatment are becoming more popular as sustainable alternatives to synthetic agrochemicals. These biologics consist of beneficial microbes, natural extracts, and organic compounds. They improve soil health, increase nutrient availability, and protect crops from diseases. When applied to the soil, biologics colonize the rhizosphere, or root zone, promoting plant growth and strengthening the plant’s natural defenses. This method of application is especially important in regenerative agriculture, where keeping the soil healthy is a major factor for long-term productivity.

The effectiveness of biologics in soil treatment comes from their ability to create a beneficial relationship between soil organisms and plant roots. Products like biofertilizers, such as nitrogen-fixing bacteria and phosphate-solubilizing microbes, and biopesticides, like Trichoderma and Bacillus spp. help improve nutrient cycling and reduce soil-borne diseases. Additionally, some biologics increase the availability of essential micronutrients and improve root structure, making plants more resilient to stressors like drought or salinity. Their non-toxic nature minimizes disruption to native soil ecosystems.

Indian Government, for the years 2020-21 and 2021-22, released funds amounting to INR 1756.3 crores and INR 2422.7 crores to the states to adopt new technologies such as drones, artificial intelligence, blockchain, remote sensing, and GIS, among others, in agriculture. Additionally, the Government also spent INR 7302.50 crores and INR 7908.18 crores in 2020-21 and 2021-22, respectively, under ICAR (Indian Agricultural Research Institute) for conducting Research and Development in Agriculture for developing new technologies, their demonstration in farmers' fields, and farmers' capacity building for the adoption of new technology.

Apart from this, the market for soil-applied biologics is growing due to stricter rules on chemical inputs, an increase in consumer demand for organic produce, and rising awareness of soil degradation. Farmers are turning to soil biologics not only for immediate yield improvements but also to restore microbial diversity and enhance long-term soil fertility. This trend is especially notable in crops like vegetables, pulses, cereals, and fruits, where soil health directly impacts productivity and quality.

Key developments in the agricultural biologics sector are further significantly fueling market growth, especially in the soil treatment segment. Advances in microbial genome sequencing, fermentation technology, and formulation science have enabled the production of highly effective and stable biological products. Companies are therefore able to develop biologics tailored to specific soil types, crops, and regional conditions. In line with this, in February 2025, Syngenta, a world leader in developing the next generation of biological products for agricultural use, is significantly expanding its biologicals research and development capabilities. In April 2025, DPH Biologicals announced groundbreaking mode of action findings in addition to results from a comprehensive multi-year field trial program for its next-generation biofertilizer, TerraTrove AmplAphex™, demonstrating its transformative impact on crop yields and soil health.

Despite their potential, challenges still exist in the wider adoption of biologics for soil treatment. Issues such as inconsistent field performance, short shelf life, and lack of standardized application methods can limit their effectiveness. Ongoing research and development, along with precise delivery systems and farmer training, are essential for realizing the full potential of soil-applied agricultural biologics. As innovation and infrastructure improve, using biologics for soil treatment is expected to become a key aspect of sustainable farming worldwide.

Agricultural Biologicals Market Geographical Outlook:

- The Asia Pacific region is anticipated to grow at the fastest pace.

The agricultural biologicals market is experiencing robust global growth, segmented into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. Agricultural biologicals, including bio-fertilizers, bio-pesticides, and bio-stimulants, are increasingly adopted for sustainable agriculture, driven by health concerns and environmental sustainability. The Asia-Pacific region is projected to grow at the fastest pace, fueled by rapid urbanization, industrialization, and population growth.

In Asia-Pacific, India and China, the world’s first and second most populous countries, respectively, drive demand due to a population boom and rising disposable incomes. Growing health awareness and demand for organic products boost the adoption of natural agricultural inputs. Government initiatives further support this trend. For instance, in August 2020, the Government of India mandated farmers to purchase bio-fertilizers with every urea bag to promote sustainable farming and reduce chemical fertilizer use (Ministry of Agriculture, India, 2020). This policy encourages bio-fertilizer adoption, enhancing soil health and crop yield. China’s focus on green agriculture and organic farming aligns with sustainability goals, driving demand for bio-pesticides and bio-stimulants.

North America holds a significant market share, supported by advanced infrastructure and high consumer awareness of organic farming benefits. The United States and Canada lead in agricultural innovation, with research and development advancing biological products for precision agriculture. Educational campaigns promote sustainable practices, boosting bio-fertilizer and bio-pesticide use in crop production. Europe, particularly Germany and France, emphasizes eco-friendly agriculture under EU regulations, driving demand for biological inputs. South America, led by Brazil, and the Middle East and Africa are emerging markets, supported by agricultural modernization.

Challenges like high production costs and limited awareness in rural areas persist, but government subsidies and technological advancements in bio-formulations mitigate these issues. The agricultural biologicals market thrives on sustainability, organic farming, population-driven demand, and policy support, with Asia-Pacific leading due to its agricultural transformation and health-conscious consumer base.

Agricultural Biologicals Market Segment Analysis:

- In April 2025, the CGIAR Sustainable Farming Science Program (SFP) builds on progress from the Excellence in Agronomy, Plant Health, and Mixed Farming Systems Initiatives and promotes agricultural transformation towards productive, resilient, and sustainable farming systems. One of the program’s goals is to achieve water-resilient farming systems for at least three million producers by 2030 by adopting water innovations and integrated management practices that mitigate water-related risks and address the unsustainable use of water resources.

- In April 2024, the Union Cabinet approved the Clean Plant Programme (CPP) proposed by the Ministry of Agriculture and Farmers Welfare. With a significant investment of Rs 1,765.67 crore, this initiative aims to transform the horticulture sector in India, setting new benchmarks for excellence and sustainability.

- In 2024, BASF partnered with AgroSpheres to develop a novel bioinsecticide, enhancing crop protection with eco-friendly solutions.

List of Top Agricultural Biologicals Companies:

- Biolchim S.p.A.

- Marrone Bio Innovations

- BASF SE

- Valent BioScience

- Syngenta

Agricultural Biologicals Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Agricultural Biologicals Market Size in 2025 | USD 17.479 billion |

| Agricultural Biologicals Market Size in 2030 | USD 28.900 billion |

| Growth Rate | CAGR of 16.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Agricultural Biologicals Market |

|

| Customization Scope | Free report customization with purchase |

The Agricultural Biologicals Market is analyzed into the following segments:

- By Type

- Biofertilizers

- Biopesticides

- Biostimulants

- By Source

- Microbial

- Biochemicals

- Others

- By Application

- Soil Treatment

- Seed Treatment

- Others

- By Crop Type

- Fruits & Vegetables

- Cereal & Grains

- Oilseed & Pulses

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Navigation

- Agricultural Biologicals Market Size:

- Agricultural Biologicals Market Highlights:

- Agricultural Biologicals Market Introduction:

- Agricultural Biologicals Market Overview:

- Agricultural Biologicals Market Trends:

- Agricultural Biologicals Market Drivers:

- Agricultural Biologicals Market Restraints:

- Agricultural Biologicals Market Segmentation Analysis:

- Agricultural Biologicals Market Geographical Outlook:

- Agricultural Biologicals Market Segment Analysis:

- List of Top Agricultural Biologicals Companies:

- Agricultural Biologicals Market Scope: