Report Overview

Artificial Intelligence (AI) in Highlights

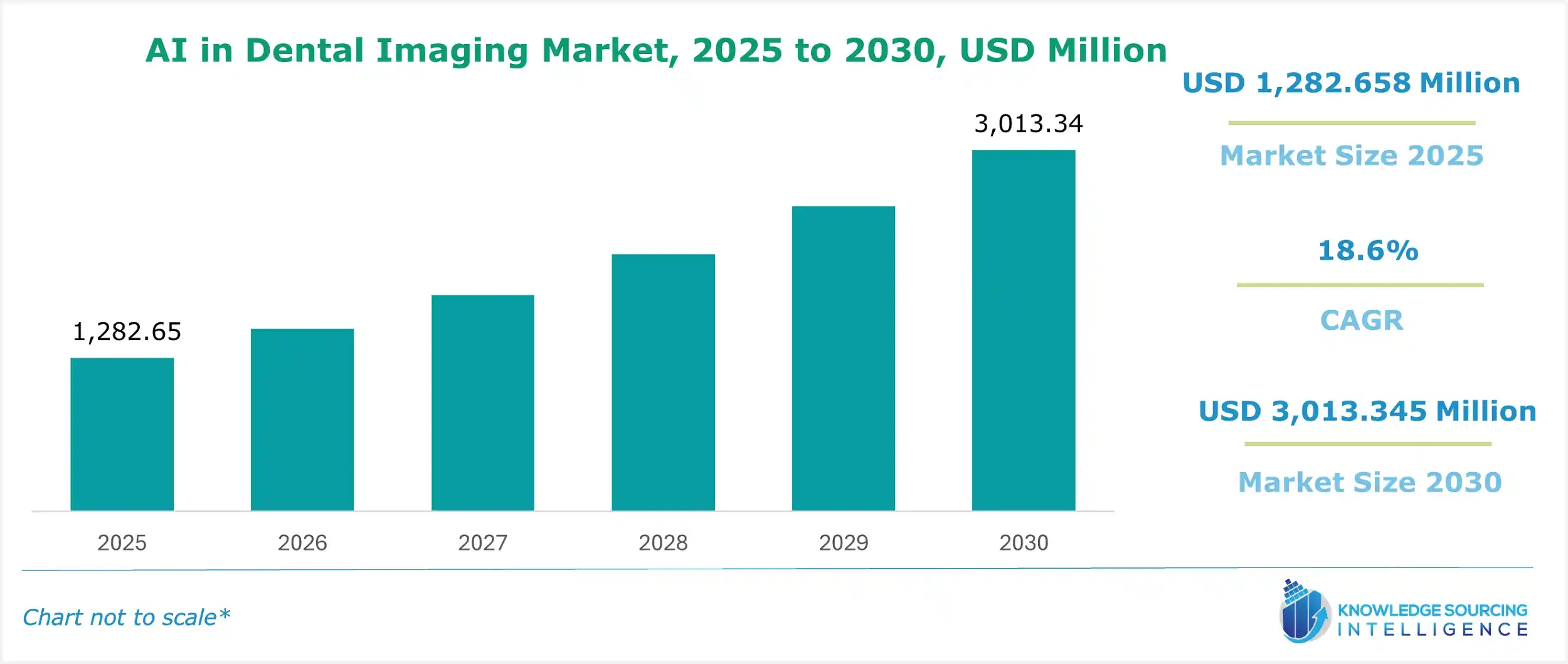

AI In Dental Imaging Market Size:

The Artificial Intelligence (AI) in Dental Imaging Market is projected to grow at a CAGR of 18.6% over the forecast period, increasing from US$1,282.658 million in 2025 to US$3,013.345 million by 2030.

A key factor accelerating the use of Artificial Intelligence (AI) in the Dental Imaging Market is the growing technological advancement in AI technologies and their increasing adoption for faster diagnosis and analysis in the backdrop of the increasing prevalence of dental issues. Additionally, the growth in demand for aesthetic dental procedures and dental tourism is driving the market. The market is witnessing a rise in the integration of AI with 3D imaging.

Artificial Intelligence (AI) in Dental Imaging Market Overview & Scope:

The Artificial Intelligence (AI) in Dental Imaging Market is segmented by:

- By Technology: The Artificial Intelligence (AI) in Dental Imaging Market, by technology, is segmented into Machine Learning, Deep Learning, Natural Language Processing (NLP), Computer Vision, and Others. During the forecast period, Deep Learning and Machine Learning will constitute a major share of the market.

- By Imaging Type: The Artificial Intelligence (AI) in Dental Imaging Market, by imaging type, is segmented into Intraoral Imaging and Extraoral Imaging.

- By Application: The Artificial Intelligence (AI) in Dental Imaging Market, by application, is segmented into Dental Implantology, Orthodontics, Endodontics, Periodontology, Dental Caries Detection, and Others. Dental Caries Detection holds a major share in the market, followed by Orthodontics.

- By End-User: The Artificial Intelligence (AI) in Dental Imaging Market, by end-user, is segmented into Dental Clinics and Laboratories, Hospitals, Research Institutes, and Others. Dental Clinics hold the largest share in the market.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. North America is poised to hold a prominent position in the Artificial Intelligence (AI) in Dental Imaging Market, particularly due to its increasing R&D activities and rapid adoption of AI technologies. While the Asia Pacific is witnessing exponential growth during the forecast period, it is driven by the expanding dental care infrastructure and technological advancements.

Top Trends Shaping the Artificial Intelligence (AI) in Dental Imaging Market:

1. Growing adoption of cloud-based AI platforms for remote diagnostics

- The market is shifting towards increasing adoption of cloud-based AI platforms, which enable remote diagnostics, real-time collaboration, and scalable integration of imaging solutions.

For example, Dentsply Sirona’s DS Core integrates a cloud solution for dentists and labs, offering a range of tools that enhance efficiency, productivity, and growth.

2. Emerging Use of Natural Language Processing in Dental Imaging

- NLP solutions aid in processing unstructured patient data and dental image reports to expedite and more accurately diagnose oral diseases such as cavities, periodontitis, and mouth cancer. NLP also automates report production to reduce human intervention and optimize paperwork, thus improving efficiency for dental professionals.

For example, in February 2025, Pearl partnered with Open Dental Software, integrating its second opinion AI into Open Dental’s imaging module. In June 2024, it will release Precheck, which uses natural language processing to easily aggregate and integrate patient insurance information. Precheck automates the insurance verification process and delivers dental practices and their patients' authoritative coverage information.

Artificial Intelligence (AI) in Dental Imaging Market Growth Drivers vs. Challenges

Opportunities:

- Increasing prevalence of dental diseases: There is an increasing prevalence of dental diseases, with 3.7 billion people with oral disease in 2025, due to lifestyle changes and eating habits, leading to the growing prevalence of dental diseases such as dental caries, periodontal diseases, and oral cancers. As the prevalence of dental diseases is increasing, the demand for precise diagnostics, streamlining workflow, and treatment planning is growing, leading the AI in dental imaging market to grow. AI is helping in revolutionising the treatment and diagnosis of dental diseases by highlighting the early-stage cavities, bone density analysis, pathology detection, nerve cavitation detection, and others, and with the growing dental diseases, the market is expected to expand.

Challenges:

- Data Quality and Availability: The lack of datasets on dental imaging limits the training of AI models, limiting their applications. Also, the inconsistency in data leads to inaccurate results, restraining its applications.

- Bias and generalizability: The errors in data, algorithms, or model outputs can lead to inaccurate predictions. Also, the generalizability of AI models limits their use in real-world dental practices.

Artificial Intelligence (AI) in Dental Imaging Market Regional Analysis:

- North America: The North American region will dominate due to the growing expansion and adoption of AI technologies in the dental imaging market in the USA, Canada, and Mexico. The increasing cases of dental diseases, as per the statistics mentioned by the MyToothFairy, approximately 75% of American adults plan a visit to a dentist in the coming year, and 65% of adults aged 18 and over had a dental visit within the past year. Also, the shortage of professionals is driving the demand for AI. For example, according to the Centers for Disease Control and Prevention (CDC), as of 2024, there were approximately 57 million Americans who live in dental health professional shortage areas, whereas about 67% of those shortage areas belong in rural communities, which demands the need for efficient growth of Artificial Intelligence (AI) in the dental imaging market.

Artificial Intelligence (AI) in Dental Imaging Market Competitive Landscape:

The market is moderately fragmented, with some important key players such as Dentsply Sirona Inc., Planmeca Group (Planmeca Oy), Envista Holding Corporation, Vatech Co., Ltd., Apteryx Imaging Inc., and others.

- Innovation: In March 2025, Align Technology Inc. added new capabilities, i.e., Near Infra-Red Imaging Technology, to its next-generation iTero Lumina™ intraoral scanner, delivering faster scanning speed(2 times faster scanning), higher accuracy(full-jaw accuracy), superior visualization (3x larger field of view), a 50% smaller wand, and a more comfortable scanning experience.

- Collaboration: In February 2025, Pearl, the world leader in dental AI technology, made a partnership with Open Dental Software to bring its AI solutions into Open Dental's practice management system (PMS). As a result of this collaboration, Pearl's Second Opinion AI is entirely integrated into Open Dental's Imaging Module, making AI-powered radiographic examination convenient for dentists across the country.

- Product innovation and collaboration: In May 2024, Vatech, a market player in the dental medical device sector, developed and implemented various AI technologies for dental diagnosis. It collaborated with Ewoosoft and Eyes of AI and has enhanced the accuracy of 3D dental segmentation technology by leveraging the abundant CBCT data owned by Eyes of AI.

List of Top AI In Dental Imaging Companies:

- Dentsply Sirona, Inc.

- Planmeca Group (Planmeca Oy)

- Envista Holdings Corporation

- Vatech Co., Ltd.

- Apteryx Imaging Inc. (Planet DDS Inc.)

AI In Dental Imaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI In Dental Imaging Market Size in 2025 | US$1,282.658 million |

| AI In Dental Imaging Market Size in 2030 | US$3,013.345 million |

| Growth Rate | CAGR of 18.6% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the AI In Dental Imaging Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in Dental Imaging Market Segmentation:

By Technology

- Machine Learning

- Deep Learning

- Natural Language Processing (NLP)

- Computer Vision

- Others

By Imaging Type

- Intraoral Imaging

- Extraoral Imaging

By Application

- Dental Implantology

- Orthodontics

- Endodontics

- Periodontology

- Dental Caries Detection

- Others

By End-User

- Dental Clinics and Laboratories

- Hospitals

- Research Institute

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others