Report Overview

Artificial Intelligence (AI) In Highlights

AI in Genomics Market Size:

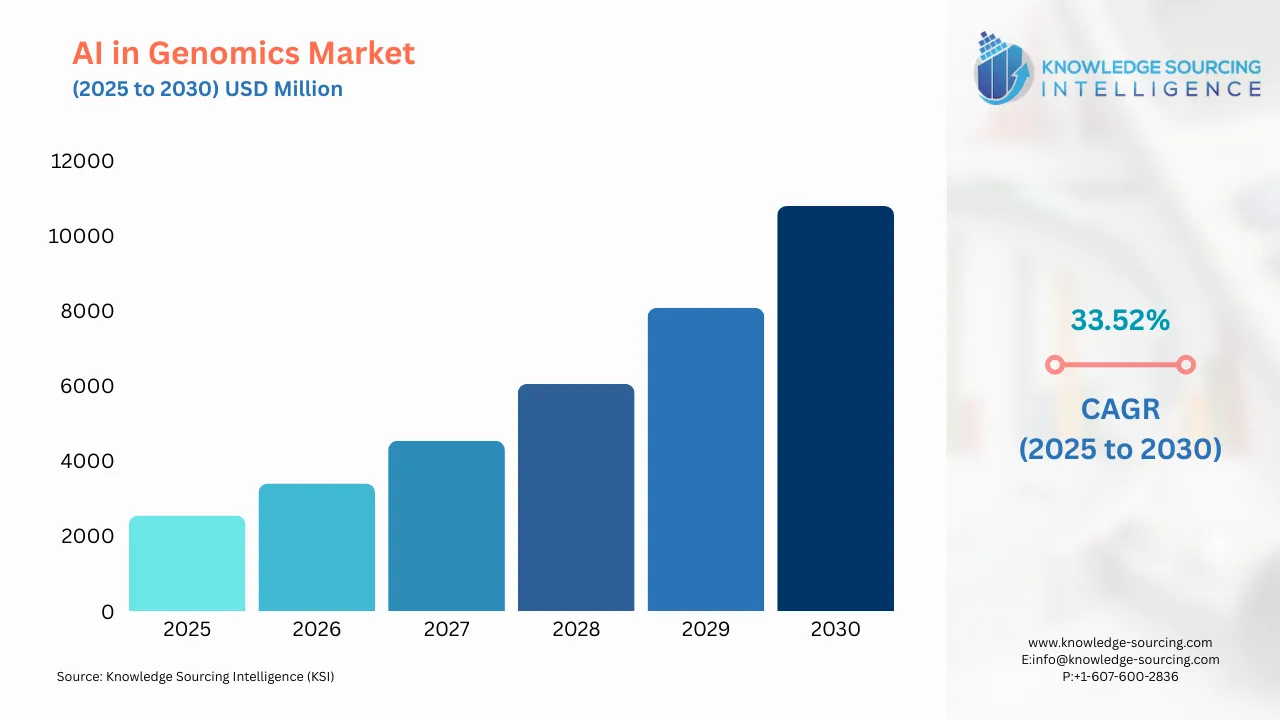

Artificial Intelligence (AI) in Genomics Market is projected to witness a CAGR of 33.52% during the forecast period to reach a total market size of US$10,788.200 million by 2030, up from US$2,542.240 million in 2025.

The AI in the genomics market is growing rapidly with the rising demand for precision drugs and targeted therapies for specific health disorders. The market is anticipated to expand due to the burgeoning genomics research initiatives and the increasing demand for better data management and integration solutions. It is employed in all areas of drug discovery, disease diagnosis, and treatment planning to find new drug targets and improve therapeutic efficacy.

Moreover, it can analyze large genomic data datasets for disease diagnostics and identify early-onset disease signals by customizing the treatment planning per the patient's condition. AI could additionally optimize treatment results by transforming the clinical guidelines according to the genome sequence, with AI detecting a new way into the genomics market in the future.

AI in Genomics Market Growth Drivers:

- Growing adoption of AI technology across different sectors is expected to increase the global market for AI in genomics.

Precision medicine is expanding the market for AI in genomics. Precision medicine considers an individual's unique genetic makeup, external conditions, and lifestyle decisions to create personalized treatment plans that take action rapidly. AI technological advancements can process large cohorts of genomic data to identify patterns and correlate them depending on capability or similarity, assisting in initiating personalized treatments.

Furthermore, AI has been incorporated into precision medicine applications in healthcare and treatment concerning some areas, mainly cancer. AI can be used to analyze genomic data, i.e., the genetic makeup of a mutation in cancer, and recognize the best therapies beneficial for the patient's recovery. It can also be harnessed to identify people who have an increased risk of developing certain cancers, facilitating earlier detection and more targeted treatment capabilities. The market for AI in genomics is potentially finding opportunities with the growing cancer cases.

According to the Union for International Cancer Control (UICC), by 2050, an estimated over 35 million new cancer cases are projected to occur. This figure is a predicted increase of 77% from approximately 20 million reported in 2022. The most substantial absolute increases are for low HDI countries, with an increment of 142%, followed by medium-HDI countries, with a rise of 99%. At the same time, cancer deaths are expected to nearly double in these countries by 2050.

Furthermore, rising investments in incorporating AI in genomics and healthcare are also predicted to accelerate the market. For instance, WhiteLab Genomics, a French company that provides gene and cell treatment through predictive computer programs, revealed the conclusion of a $10 million funding round in September 2022. It plans to spend the funding on an AI platform for discovering and advancing genomic-based therapies.

- The increasing requirement by pharmaceutical and biotechnology industries is anticipated to drive the market's growth.

AI is widely used in the pharmaceutical and biotechnology industries for applications including personalized medicine, drug discovery, disease diagnosis, and research assistance. AI can analyze genomics to find distinct genetic markers that cause the diseases and treat them with fewer side effects on treatment. Further, with the help of AI algorithms, pharmaceutical companies could also get valuable insights regarding potential targets and save time and cost in predicting those interactions, leading to the acceleration of drug discovery. It can also aid in predicting the evolution of disease and its complications.

Moreover, it can be employed to analyze large amounts of genomic data, helping researchers discover useful biological data with improved accuracy and reduced time in scientific research. As pharmaceutical and biotechnology companies are investing heavily in personalized medicine that requires genome data analysis & interpretation, they are emerging as major end users of AI in genomics.

For instance, in September 2023, Verge Genomics announced a collaboration with Alexion: AstraZeneca Rare Disease to develop AI-powered drugs for rare neurodegenerative and neuromuscular diseases. Under the preclinical oncology deal, Verge will receive up to $42 million in upfront payments and equity and near-term payments over four years, with a total potential transaction value topping nearly $840 million plus downstream royalties. In addition, these biopharma companies are increasing their spending on genomics research due to decreasing costs of genomic sequencing and increased availability of genetic data. The quick and accurate research driven by AI tools and services that can analyze and interpret a large amount of genomics insights can benefit such businesses.

AI In Genomics Market Geographical Outlook:

- The North American region is expected to hold a substantial artificial intelligence engineering market share.

North America is a significant market for AI in genomics due to numerous genomics firms, significant financing in genomics research, and a developed healthcare system. Additionally, the advancement of AI-based genomics products and applications, as well as the rising demand for personalized treatment, are propelling market expansion in the coming years.

Moreover, North American countries like the United States and Canada are increasing the employment of AI in healthcare, and government and private organizations are increasing investments in genomics studies. Further, the presence of a sizable patient base will also promote the advancement of the market in the region.

AI In Genomics Market Key Developments:

- May 2024- Fujitsu created a reasonable AI innovation for genomic medication and cancer treatment management. The innovation employs information from text, pictures, and numerical groups to form knowledge charts. This technology illustrates world-leading exactness against key benchmarks for cancer typing, permitting users to draw meaning from large-scale information sets with high accuracy in areas like pharmaceuticals.

- June 2023- Illumina designed PrimateAI-3D, an AI program that can foresee disease-causing genetic transformations in patients with the highest accuracy achieved thus far. The software utilizes primate DNA and advanced AI to progress genetic hazard forecasts and target discovery, making it a noteworthy development in DNA sequencing and array-based innovations.

List of Top AI in Genomics Companies:

- IBM

- Sophia Genetics SA

- QIAGEN N.V.

- Fabric Genomics, Inc.

- Congenica Ltd.

AI in Genomics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Genomics Market Size in 2025 | US$2,542.240 million |

| AI in Genomics Market Size in 2030 | US$10,788.200 million |

| Growth Rate | CAGR of 33.52% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in Genomics Market |

|

| Customization Scope | Free report customization with purchase |

AI in Genomics Market Segmentation:

- By Offering

- Software tools

- Services

- By Application

- Precision medicine

- Diagnosis and prognosis

- Drug discovery and development

- Agriculture and animal breeding

- Others

- By End-User

- Pharmaceutical and biotechnology companies

- Academic and research institutes

- Hospitals and diagnostic centers

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Vietnam

- Indonesia

- Others

- North America