Report Overview

Artificial Intelligence In Manufacturing Highlights

AI in Manufacturing Market Size:

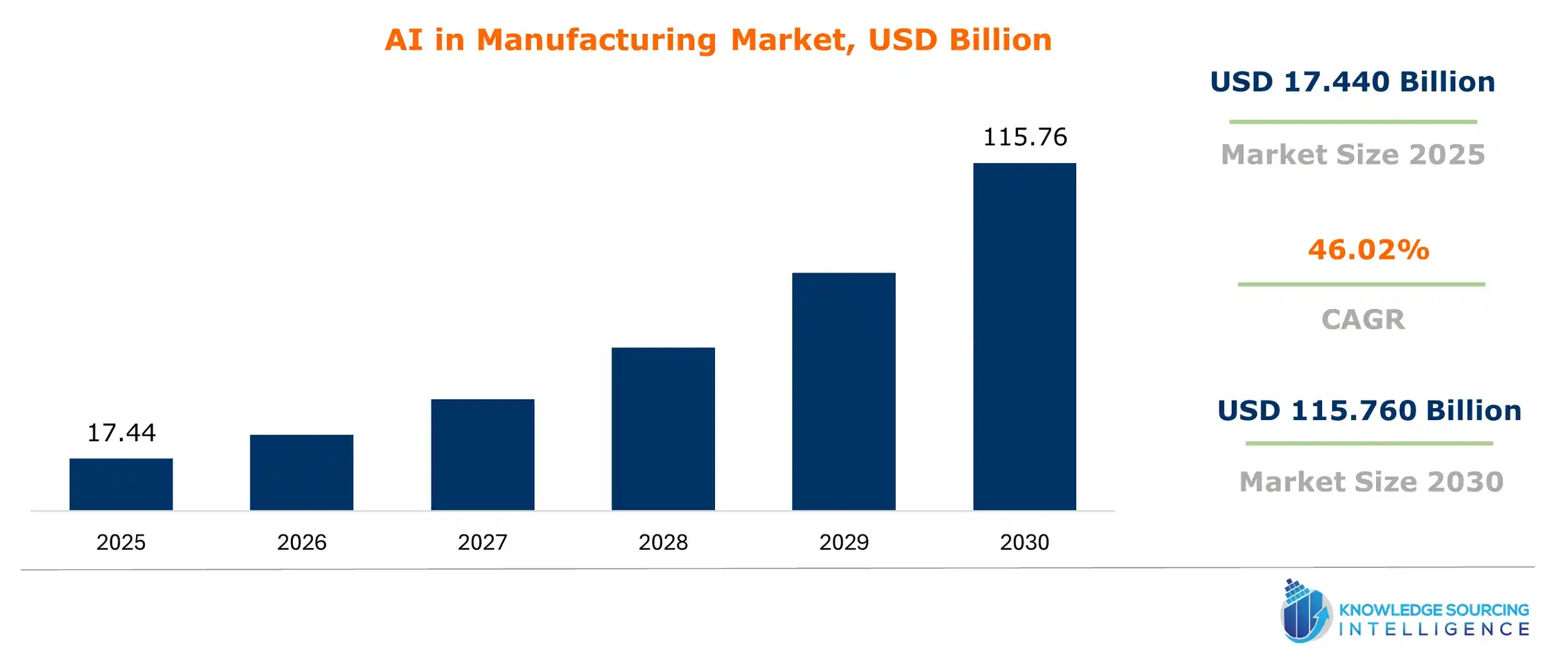

The Artificial Intelligence in Manufacturing Market is projected to expand at a growth rate of 46.02% CAGR to account for US$115.760 billion by 2030, up from US$17.440 billion in 2025.

The global manufacturing sector is becoming hyper-competitive, and artificial intelligence (AI) is establishing a strong foothold in the industry. This competitiveness in the sector is compelling industry players to indulge in high R&D investments and incorporate new technologies across all key business functions that will propel AI deployment in the manufacturing sector in the coming years. The continued popularity of machine vision cameras in manufacturing applications such as inspection, material movement, and field service will play a key role in propelling the rise of AI in the manufacturing industry.

Additionally, another innovative way manufacturing is using AI is in quality control, in which an AI-driven visual inspection system easily spots defects that are far harder for the human eye. This reduces costs and protects the brand image. Additionally, predictive analytics and maintenance requirements are also benefiting from AI as it predicts equipment failures. AI applications in manufacturing, such as optimizing energy use, minimizing waste, and fulfilling sustainability guidelines, lead to higher demand for AI across different sectors.

AI in Manufacturing Market Growth Drivers:

- The increasing focus of end-user industries on reducing costs is anticipated to boost the demand for AI in manufacturing.

The rapid adoption of AI in most of its sub-sectors in the manufacturing industry and robust expenditure by the market players on research & development to launch novel, competitive, and innovative products are factors driving this market’s growth. A long time out from the singularity, companies are now spending a lot of money on AI innovations in manufacturing-related facilities and machinery. As a result, it facilitated fewer errors, shorter reaction times, accuracy in assigned tasks, and optimization of production systematically and sustainably.

Additionally, AI is gaining recognition in this sector, as it aligns with the goals of Industry 4.0. The application of AI has increased across many business functions. Further, Industry 4.0 has also increased production and enhanced worker safety while securing factory assets, resulting in manufacturers producing personalized products at reduced costs and shorter lead times. All this would add to the necessity for AI in manufacturing in the coming years.

- An increase in the use of robots in the industry is expected to boost AI in the manufacturing market.

The automotive industry is witnessing increasingly more robots and robotic parts assisting automakers in building cars. This surge in automation will contribute to a greater requirement for artificial intelligence in manufacturing. This has enabled a smoother production system, and AI and machine learning have recently been increasingly employed worldwide. This results in significantly reducing errors drastically, decreasing lead times considerably, assigning and completing tasks clearly, and ultimately optimizing production systematically and sustainably.

According to the January 2024 World Economic Forum report, companies' investments in AI for manufacturing are predicted to surge by 57% by 2026, accounting for an increment from $1.1 billion in 2020 to a value of $16.7 billion in 2026. This represents a huge step forward in which machines will act intelligently and carry out complicated functions similar to those of a human mind. Besides increasing revenue and cutting expenses, it could also reduce risk exposure and transform the manufacturing sector.

Additionally, with trends toward miniaturization constantly changing in the electronics industry, the use of AI is expected to be more in demand in the consumer electronics sector. New market players investing in these technologies and growth in other industries are expected to continue strongly over the forecast period, leading to advancement in the market globally.

AI in Manufacturing Market Restraint:

- The shortage of skilled workforce could hinder artificial intelligence in manufacturing market expansion.

One of the main market barriers is the lack of a skilled workforce in the manufacturing industry. The sophistication of AI technologies and their implementation in manufacturing requires particular knowledge of skills that many businesses do not possess. Implementing AI itself requires skill and labor, which can increase the cost of business by hiring external experts in this field and training existing employees. This may impact time-to-market, resulting in more failures and negative business consequences. The lack of qualified workers can slow business processes and lead to errors and safety issues.

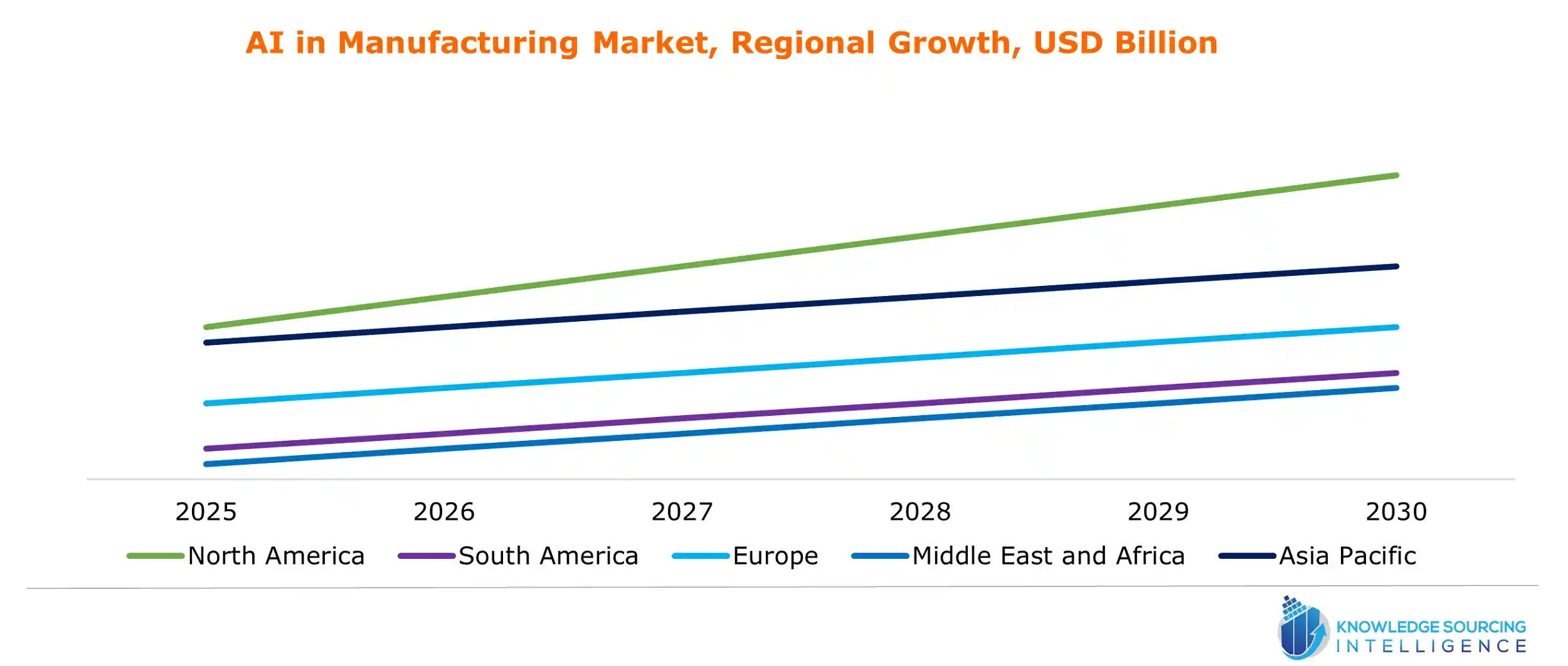

AI in Manufacturing Market Geographical Outlook:

- The Asia Pacific region is expected to hold a substantial artificial intelligence in manufacturing market share.

The market in the Asia Pacific region has consistent growth potential during the forecast period due to the rampant adoption of newer technologies by companies in the region. Many manufacturers use automation technologies to enhance their manufacturing processes, expanding the market. The growth is largely backed by heavy investments poured into this region by the industry players due to its abundant resources.

Moreover, companies in this region's dynamic manufacturing market, notably in countries like China and India, where a large-scale manufacturing opportunity exists, are prioritizing and enhancing their production lines by adapting new-age technologies based on AI. Additionally, increasingly stringent government regulations regarding the environmental conditions to be met by manufacturers have driven companies to adopt sustainable forms of manufacturing products, leading to regional market growth in the coming years.

AI in Manufacturing Market Key Developments:

- May 2024- ABB Robotics introduced the 2024 Robotics AI Startup Challenge, which focuses on accelerating advancement in mechanical technology and AI. The competition energizes new businesses and scaleups to yield insights into natural language programming, expertise learning, and independent decision-making.

- April 2024- Microsoft exhibited AI features for manufacturers at Hannover Messe. The company showcased its Microsoft Dynamics 365, which assists manufacturers in modernizing benefit operations, finishing work orders quicker, conveying end-to-end personalization, and increasing visibility in item ancestry over supply chain steps. The new Copilot capabilities in Dynamics 365 Field Service improve information experiences, boost efficiency, and give more customization for field service directors.

- November 2023- Schneider Electric coordinated with Microsoft Azure OpenAI to drive efficiency and sustainability arrangements. This collaboration focuses on forming innovative energy management and automation arrangements, engaging customers, and changing internal operations.

List of Top AI in Manufacturing Companies:

- Hewlett Packard Enterprise

- ABB

- Emerson Electric Co.

- Schneider Electric

- Tripp Lite (Eaton)

AI in Manufacturing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Manufacturing Market Size in 2025 | US$17.440 billion |

| AI in Manufacturing Market Size in 2030 | US$115.760 billion |

| Growth Rate | CAGR of 46.02% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in Manufacturing Market |

|

| Customization Scope | Free report customization with purchase |

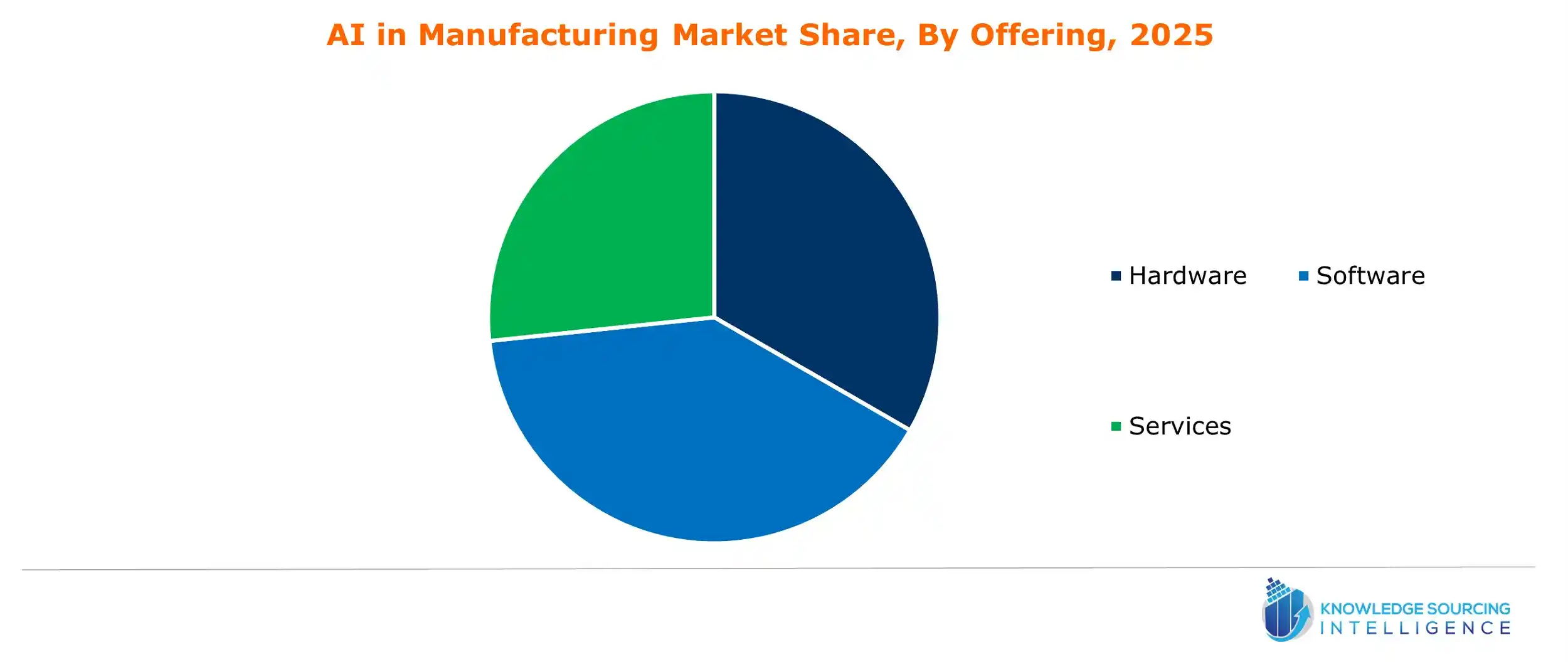

The Artificial Intelligence in Manufacturing Market is analyzed into the following segments:

- By Offering

- Hardware

- Software

- Services

- By Technology

- Natural language Processing

- Machine Learning

- Deep Learning

- Image Recognition

- Others

- By End-User

- Automotive

- Consumer Electronics

- Healthcare

- Food & Beverage

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

- Smart Factory Market

- Data Protection Market

- Cloud ERP Market

- Customer Communication Management Market

Navigation

- AI in Manufacturing Market Size:

- AI in Manufacturing Market Highlights:

- AI in Manufacturing Market Growth Drivers:

- AI in Manufacturing Market Restraint:

- AI in Manufacturing Market Geographical Outlook:

- AI in Manufacturing Market Key Developments:

- List of Top AI in Manufacturing Companies:

- AI in Manufacturing Market Scope:

- Our Best-Performing Industry Reports: