Report Overview

Artificial Intelligence In Education Highlights

Artificial Intelligence in Education Market Size:

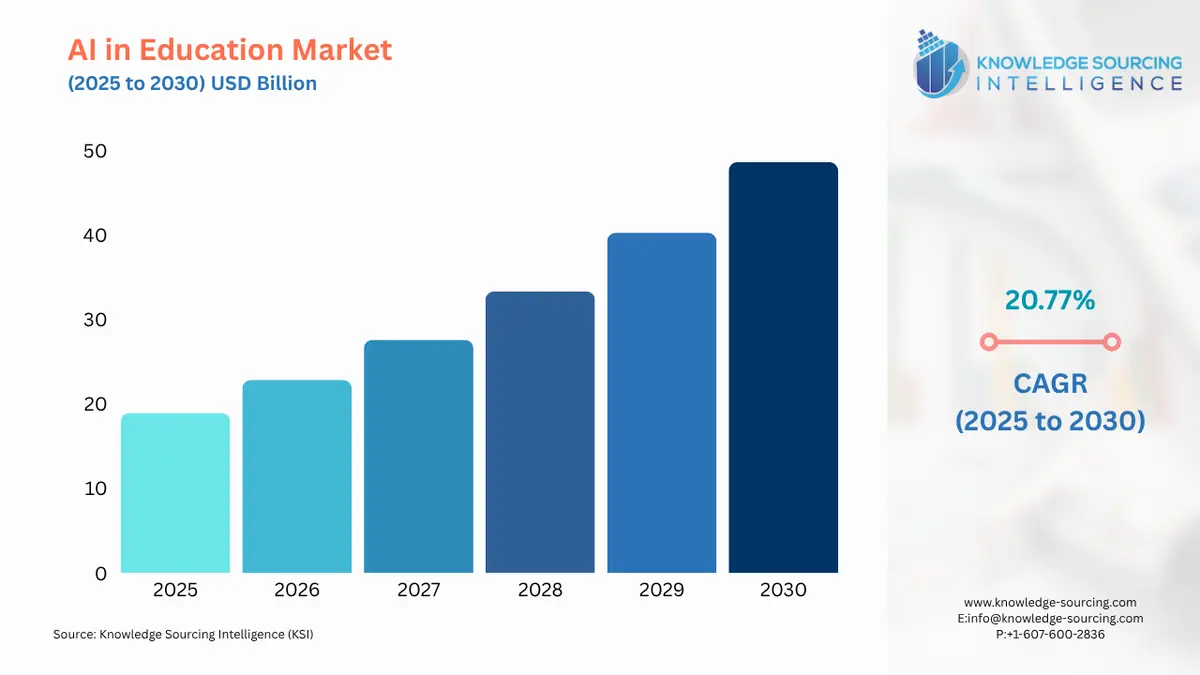

The Artificial Intelligence (AI) market in education, valued at US$18.924 billion in 2025, is projected to grow at a CAGR of 20.77%, reaching a market size of US$48.626 billion by 2030.

The increasing adoption of artificial intelligence in education can be attributed to several factors driven by the widespread use of smart devices and the growing trend of digitization across various sectors. In addition, AI solutions offer tailored learning experiences, adapting to individual user needs. The growing advancement in Artificial Intelligence technologies, supported by various government initiatives as well, is driving the market of artificial intelligence in the education sector.

Artificial Intelligence (AI) in Education Market Overview & Scope:

The Artificial Intelligence (AI) in Education market is segmented by:

- Technology: Artificial Intelligence (AI) in the education market is segmented into deep learning, machine learning, natural language processing, and computer vision.

- Deployment: Artificial Intelligence (AI) in the education market, into the cloud and on-premise.

- Solution: Artificial Intelligence (AI) in the education market is segmented into software, hardware, and solutions.

- End-User: Artificial Intelligence (AI) in the education market is segmented into Higher-Education Institutions, Education, and Corporate Training.

- Delivery Mode: Artificial Intelligence (AI) in the education market is segmented into Mobile Applications and Web-Based Platforms.

- Region: Artificial Intelligence (AI) in the education market is segmented into North America, South America, Europe, the Middle East & Africa, and Asia-Pacific.

Top Trends Shaping the Artificial Intelligence (AI) in Education Market:

1. Trends towards personalized and adaptive learning

- There is a growing trend towards demand for personalized and adaptive learning based on each student's strengths and weaknesses, creating demand for personalized and adaptive learning.

- AI is being combined with details of individual needs and preferences, and customizing the learning styles to create learning paths for each.

2. Trend towards virtual tutors

- There is increasing demand for virtual tutors that use natural language processing and machine learning to interact with students.

- It is helping in the reduction of teacher workload.

3. AI-driven AR & VR for immersive learning

- There is a growing shift in the use of augmented reality and virtual reality for making learning more immersive and interactive.

- Its demand is more in K12, higher education, and corporate training.

Artificial Intelligence (AI) in Education Market Growth Drivers vs. Challenges:

Opportunities:

- The rising investment in artificial intelligence technology is propelling the growth of the market: There is growing investment in Artificial Intelligence technologies by market players supported by various government initiatives. This is leading to increasing innovation in Artificial Intelligence technology and its integration for education is growing, driving the market. For instance, European Union has adopted Action Plan in 2020 which aims at adoption of “The Digital Education Action Plan (2021-2027)”, aiming at having a high-quality, inclusive and accessible digital education in Europe to support the adaption of the education and training system to the digital age, giving a significant boost to Artificial Intelligence adoption in education.

Challenges:

- Lack of infrastructure for artificial intelligence adoption in education: In many regions of the world, such as third-world countries or low-income countries, which a lack of infrastructure and necessary resources for the adoption of artificial intelligence in education. This is one of the major restraints for the market expansion, limiting its market growth.

Artificial Intelligence (AI) in Education Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is projected to grow significantly in the AI in education market, driven by several other factors such as the growing economies of Asia-Pacific countries such as India and China. It is leading to growth in digitization, supported by various government policies and initiatives. Till the end of the forecast period, Asia-Pacific will constitute a major market share and is anticipated to grow at a robust rate.

- North America: North America is projected to hold a significant market share in the global Artificial Intelligence (AI) in Education market, with advanced infrastructure and necessary resources needed for the adoption of artificial intelligence in the education market. At the same time, the market is propelling due to a tech-savvy population, who have easily integrated into the education driven by artificial intelligence technologies.

Artificial Intelligence (AI) in Education Market Competitive Landscape:

Artificial intelligence in the education market is characterized by strong consolidation trends and intense competition. Key players operate both in regional and global markets and employ diverse strategies to expand their market share. Some of the prominent competitors in the industry include IBM, Microsoft, Google, and others.

- Leading Players: Microsoft is a leading player in artificial intelligence (AI) in the education market. It offers products such as Microsoft Azure AI for building personalized learning tools and AI applications in education.

- Market Entry: In January 2025, Samsung will integrate EMBIBE’s AI-Powered Learning Platform into the Samsung Education Hub App for smart TVs & smart Monitors. The collaboration aims to transform TVs into educational tools with personalised learning experiences for CBSE, ICSE, IB, Cambridge, all State Boards, JEE & NEET students.

- Collaboration: In January 2025, Microsoft Corp. and Pearson, the global leader in lifelong learning, announced a strategic partnership to help address one of the biggest issues facing businesses worldwide: preparing for the AI era. To help prepare the present and future workforce across industries for the era of work in an AI-driven economy, the partnership will concentrate on offering new AI-powered products and services to employers, employees, and learners. This collaboration will be crucial in assisting organizations in reskilling to fully utilize AI by fusing Microsoft's cloud and AI technologies with Pearson's learning and assessment expertise.

List of Top AI in Education Companies:

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- NVIDIA Corporation

Artificial Intelligence In Education Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Artificial Intelligence In Education Market Size in 2025 | US$18.924 billion |

| Artificial Intelligence In Education Market Size in 2030 | US$48.626 billion |

| Growth Rate | CAGR of 20.77% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Artificial Intelligence In Education Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in Education Market Segmentation:

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Computer Vision

By Deployment

- Cloud

- On-premise

By Solution

- Software

- Services

- Hardware

By End-User

- Higher-Education Institutions

- Education

- Corporate Training

By Delivery Mode

- Mobile Applications

- Web-Based Platforms

By Region

- North America

- South America

- Europe

- Middle East and Africa

- Asia Pacific