Report Overview

Antimony Recycling Market - Highlights

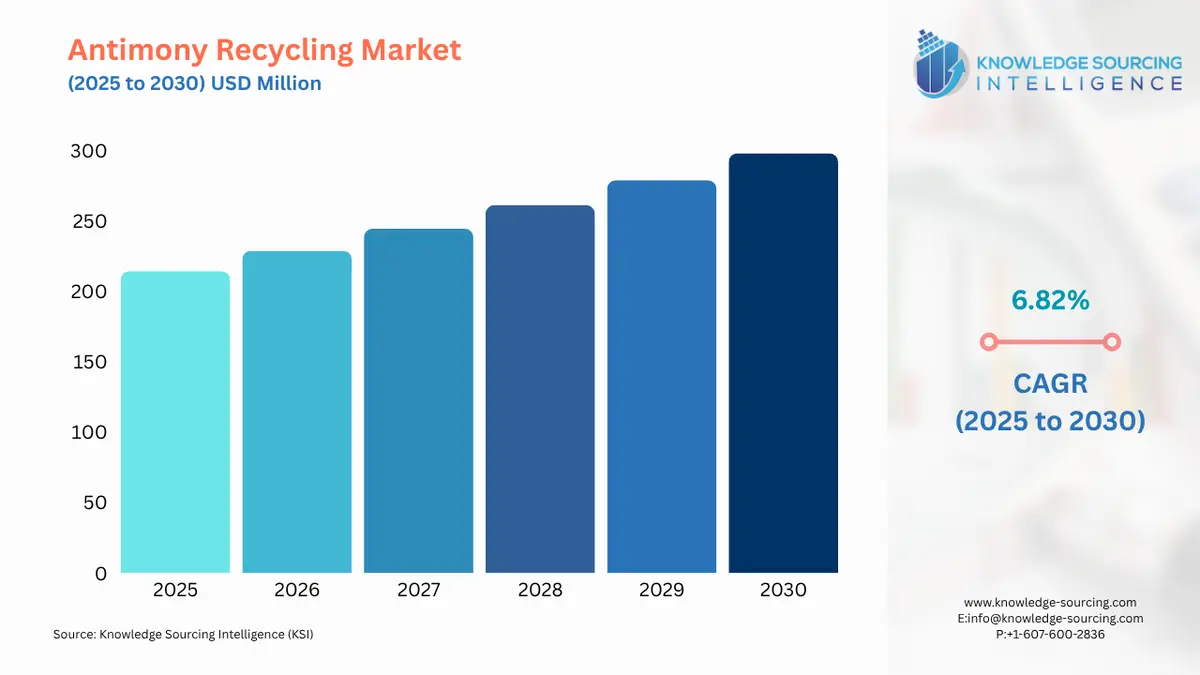

Antimony Recycling Market Size:

The Antimony Recycling Market is expected to grow at a CAGR of 6.82%, reaching USD 298.005 million in 2030 from USD 214.270 million in 2025.

Antimony Recycling Market Key Highlights:

- Increasing recycling of lead-acid batteries is ensuring a steady secondary supply of antimony while reducing environmental waste.

- Technological advancements in recovery processes are improving efficiency and making recycled antimony more competitive against primary production.

The antimony recycling industry is becoming increasingly important as manufacturers seek sustainable and secure sources of this strategic mineral. The majority of recycling originates from lead-acid batteries, industrial lead scrap, and electronic waste. This is contributing to a decreasing reliance on primary mining, reducing global supply risk. With rising concern about the supply concentration in only a few countries, as well as mining's environmental impacts, recycled antimony can offer a stable supply alternative. Growing investment in recycling will further be driven by increased demands from the automotive, electronics and chemicals industries. Current technological advances in pyrometallurgical and hydrometallurgical recovery technologies are continually improving recovery rates to make recycling economically viable.

Antimony Recycling Market Overview & Scope:

The Antimony Recycling Market is segmented by:

- Source: The market is segmented by source into lead-acid batteries, industrial lead scrap, electronic waste, and others. The lead-acid battery category accounts for the vast majority of recycled antimony by source, as antimony has long been added in the production of lead-acid batteries. By recycling the lead-acid batteries, suppliers keep a steady secondary supply of antimony and help provide a sustainable approach through the reduction of hazardous waste.

- Recycling Process: The antimony recycling market is segmented by process into pyrometallurgical process, hydrometallurgical process, and the emerging technologies processing category. The pyrometallurgical process is by far the most common, with this high-temperature treatment recycling antimony efficiently and reliably. It has become so common because it has the most developed infrastructure and is generally cost-effective despite its energy-intensive and emission problems.

- End-User Industry: The antimony recycling market is segmented by end-use industry into automotive, chemicals, electronics, industrial manufacturing, defence, and others. The automotive industry is leading demand, as recycled antimony is being reused in the manufacture of lead-acid batteries as the cost-effective choice to grow their supply in a circular economy.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Antimony Recycling Market:

- Growing Focus on Circular Economy Practices

Many industries that rely on antimony are adopting circular economy models due largely to waste reduction and securing reliable raw material supplies. Particularly, recycling antimony from lead-acid batteries and electronics is gaining traction as it limits unnecessary mining and addresses environmental issues. Significant investments from governments and companies are increasing the number of advanced recycling facilities where secondary antimony can offer a credible option to fill gaps of excess supply and demand globally while creating long-term reductions in market price volatility. - Advancements in Recycling Technologies

Local improvements in hydrometallurgical (water-based) and pyrometallurgical (fire-based) processes can enhance recovery and decrease environmental impacts. Developed technologies are leading to reliable and steady yields from complex waste streams such as electronic scrap while releasing fewer emissions than traditional processes. Advancements in recycling technology are expanding the economic viability of recycling antimony and becoming a more competitive substitute to primary production while shoring up the global supply chain in a time of continued uncertainty for antimony-dependent industries.

Antimony Recycling Market Growth Drivers vs. Challenges:

Drivers:

- Rising Demand for Lead-Acid Batteries: Lead-acid batteries are still the largest source and application of antimony. With increased demand in automotive, backup power, and industrial equipment, these industries will benefit from recycling spent batteries, that will result in a reliable stream of antimony for consumption and reducing environmental waste. The act of recycling provides a consistent and reliable stream of antimony, which provides reduced reliance and mining schemes for antimony, cost reductions, and an opportunity to amplify circular economics, creating one of the largest growth opportunities in global markets.

- Environmental Regulations Encouraging Recycling: Governments, following public demand and increasing scrutiny for ecological best practices, are significantly tightening regulations regarding hazardous waste disposal, emissions related to mining, and presenting additional pressure to reduce their ecological footprint. With many hazardous regulatory plans now focusing on the discharge of hazardous waste, such as antimony remediation practices in electronic waste, industrial scrap, and used batteries, are all either fully or partially aligned with these environmental regulations and minimise their ecological impact and obligations.

Challenges:

- High Capital and Operational Costs: In general, complex recycling processes involving hydrometallurgical or pyrometallurgical processes require high capital and energy costs. The recovery costs can result in recycled antimony, not being as cost advantageous as primary production rates, given the cheaper mining costs for most of these regions.

Antimony Recycling Market Regional Analysis:

- Europe: Due to regulations around its environmental standards and continued developments around its circular economy, Europe is well-positioned to emerge as a direct competitor in the antimony recycling supply chain. The overall drive to reduce continued reliance on import-dependent critical minerals has promoted significant sustainable investment towards recycling infrastructure generally, but specifically surrounding lead-acid batteries and electronic waste. There are a number of recycling companies, many of whom are beginning to recycle antimony with equal to greater efficiency with their new battery technologies, thus all remain of benefit from the sustainability perspective. Hence, Europe now maintains a regulatory and industrial inertia that leaves it well positioned to develop a critical supply of secondary antimony in the future.

Key Development: Ace Green Recycling recently launched the Grid Metallics Processing System (GMPS), a room temperature process for recyclers of lead-acid batteries to recover high-quality antimony alloys from scrap and then recover this scrap without smelting it. The practical benefits of this process, in addition to recovering valuable alloying materials such as antimony, and more efficient recovery of antimony due to reducing complex recovery steps, are that this technology will increase battery processing throughput by up to 25% with lower emissions.

Antimony Recycling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Antimony Recycling Market Size in 2025 | USD 214.270 million |

| Antimony Recycling Market Size in 2030 | USD 298.005 million |

| Growth Rate | CAGR of 6.82% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Antimony Recycling Market | |

| Customization Scope | Free report customization with purchase |

Antimony Recycling Market Segmentation:

- By Source

- Lead-acid batteries

- Industrial scrap

- Electronic waste

- Others

- By Recycling Process

- Pyrometallurgical process

- Hydrometallurgical process

- Other emerging technologies

- By End-User Industry

- Automotive

- Chemicals

- Electronics

- Industrial manufacturing

- Defense

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America