Report Overview

Application Delivery Network (ADN) Highlights

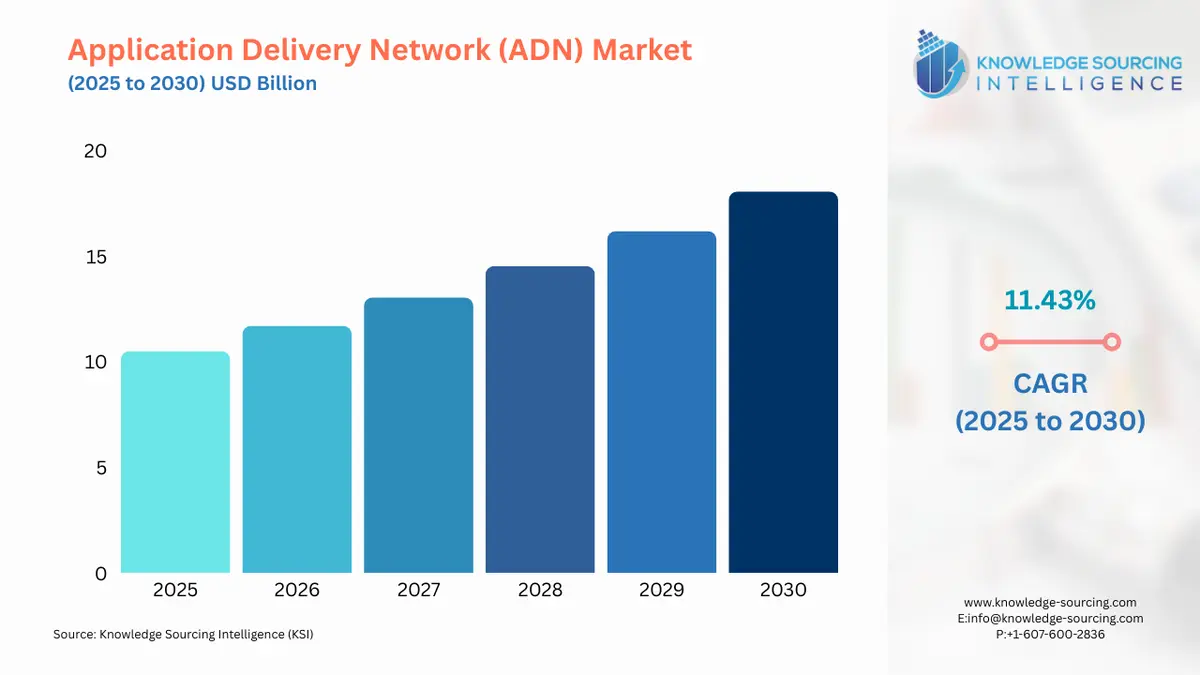

Application Delivery Network (ADN) Market Size:

The application delivery network (ADN) market is expected to grow at a CAGR of 11.43%, reaching a market size of US$18.058 billion in 2030 from US$10.502 billion in 2025.

Application Delivery Network (ADN) Market Trends:

Application Delivery Networks comprise services deployed over the network to provide application security, visibility, availability, and acceleration from servers to end-users. The system consists of application delivery controllers (ADCs) and WAN optimization controllers (WOCs). Furthermore, the rising adoption of cloud computing, SaaS platforms, and the use of public and private clouds is projected to drive the use of a cloud-based application delivery network.

With the rapid increase in cloud-based applications and the rising trend of bring your own device (BYOD) in many organizations, the overall market is expected to grow during the forecast period. Moreover, the ongoing shift towards consumer-based applications, followed by booming cloud computing and IoT adoption, has paved the way for future market expansion.

Application Delivery Network Market Growth Drivers:

- Favorable initiatives and investments to bolster industrial automation propel market expansion.

Witnessing the ongoing shift towards the latest technological innovations and digitization, governments are undertaking investments to bolster the same. For instance, the US$100 million loan was approved by the Inter-American Development Bank (IDB) for a program to promote Internet access and digitization in Argentina. The investment would further accelerate the growing network connectivity capacity and digital capabilities in remote and urban areas. Furthermore, the Industry 4.0 initiative is majorly driving the adoption of technological innovations in business culture, with various investments and schemes occurring in accordance.

- Product innovations and strategic mergers are anticipated to drive the market growth.

Market players to provide new ADN offerings are investing in strategic maneuvers such as collaboration and new launches, which are set to positively impact the overall market growth. For instance, the operational launch of Orange’s European tower company TOTEM, whose passive mobile infrastructure portfolio includes over 26,000 sites in France and Spain, respectively.

Likewise, in December 2022, F5 Inc. launched “F5 Distributed Cloud App Infrastructure Protection”, a cloud workload protection solution that expands the application’s observability and protection to cloud-native infrastructure. This product would enable organizations of any size to simplify and secure their application-driven digital experience.

- Bolstering growth in cloud computing and data center services drives market expansion.

Over the past couple of years, cloud computing adoption has witnessed remarkable growth among organizations implementing it for securing and analyzing network connections and applications. To further the scale of computing, various investments are being made in hyperscale infrastructure development, and emerging technologies such as AI and IoT are catching the eye of large firms looking to implement them in their operations. Such transformation has expanded the scope of IT infrastructure in various major economies, which is expected to stimulate the overall market growth during the forecast period.

For instance, the Danish government’s “National Strategy for Artificial Intelligence” enables companies to use AI and helps to promote Denmark as the leader in AI technology. The ongoing technological shift in the Middle East, where nations such as the UAE, Kuwait, and Saudi Arabia are at the forefront of innovations, has provided new growth prospects. For example, the government of Kuwait has taken steps to develop a digital economy by developing its national-level policies for e-health and e-government, which is projected to increase the ADN demand across the country.

Vantage Data Centers is expanding its operations into the Asia Pacific market by acquiring Agile Data Centers and PCCW’s Data Center Business. The company will provide its data center services across Osaka, Tokyo, Hong Kong, Malaysia, and Melbourne. Juniper Networks a leader in secure, AI-driven networks, has completed its acquisition of WiteSand, a pioneer of cloud-native zero trust Network Access Control (NAC) solutions. Aryaka, the leader in fully managed Cloud-First WAN and SASE solutions, acquired Secucloud GmbH, a proven SASE platform provider, delivering network security from the cloud. The developments in the market are expected to have a positive impact on the overall market growth. Moreover, the rising traction of AR and VR application in the gaming, media, and entertainment industries will positively contribute to the ADN market expansion in the coming years. Increasing penetration of video streaming services such as Amazon Prime and Netflix and the growing availability of video content across various social media websites is anticipated to drive market expansion.

Application Delivery Network Market Geographical Outlook:

- North America is expected to account for a significant market share.

Region-wise, the ADN market is analyzed into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The North American market is expected to account for a significant share of the market, fuelled by the growing public and private cloud ecosystem in major regional economies, namely the USA and Canada. Moreover, the well-established presence of major cloud computing players such as Amazon Web Services, Juniper Networks, and Microsoft that provide their services to corporate and government agencies has led to an upward market trajectory.

Additionally, favorable investments in data center establishments are expected to provide new growth prospects for the regional market. For instance, in May 2024, ESET announced the launch of its first local data center in Canada, which marked the company’s commitment to providing unparalleled services to its customers in the country. Moreover, in January 2023, ManageEngines launched two new data centers in Montreal and Toronto, which showcased the company’s effort to meet demand from Canadian organizations for localized data processing and storage.

The US is known for its digital infrastructure, significant number of users surfing the web on smartphones, tablets, and other devices than on a laptop or desktop, leading to a large amount of data generation. With the rising market for faster information and growth, the momentum for high-speed technological systems is improving. According to the GSM Association, the US may have the highest smartphone adoption by 2025, accounting for 49% of connections globally. Moreover, with the rising population of technology users and developing technologies, consumers are willing to experience newer and better browsing, which in turn is resulting in increasing data traffic in the US. Higher growth of data center traffic and rapid evolution of digital infrastructure is ultimately increasing the demand for ADC and pushing the market for application delivery networks towards growth. All these factors are adding to the need for adequate content and ADN systems, aiding the growth of application delivery controllers in the US.

During the pandemic, the industries were suffering losses due to the disruption in the supply-chain mechanism. Hence, a new way of lifestyle emerged on a larger scale to keep organizations running, which was working through remote areas during pandemics. It resulted in an increasing need for technological advancements in the market. Moreover, the networking barriers needed to be removed to operate through technology and networks for professional work. The need for moving data through the networks quickly for real-time organization management became necessary during the pandemic. Furthermore, the personal devices which were used for home-based office work required improved network security to access, plan, perform and coordinate the work within the organization’s server, hence the application delivery network market gained momentum during and after the pandemic. More efficient traffic management with a load balancer that can provide health checks enabled the operators to automatically reroute the traffic when needed, offering the organizations smooth virtual work management during and post-pandemic. With increasing technological innovations and higher investments owing to the increasing competition in the application delivery network market, it is expected that the market will experience growth during the forecast period.

Application Delivery Network Market Segmentation Analysis:

- Application delivery controller segment is expected to gain significant market share

By component, the ADN market is segmented into application delivery controller, WAN optimization controller, application security equipment, and others. The application delivery controller is anticipated to grow significantly due to its increasing data centers and network traffic. Rising internet traffic and infrastructure investments in servers and computing facilities are major factors driving this segment’s growth. This controller supports advanced traffic management by evenly distributing traffic among different servers or geographically remote sites.

According to the Huawei’s Intelligent World 2030 report, there will be 200 billion global connections with an annual generation of 1 yottabyte (YB) of data, representing 23-fold rise from 2020. The same source also predicts a 1.6 billion fiber broadband subscribers and 40% of the companies to have access to 10-gigabit Wi-Fi networks by 2030. It also noted that 1 million companies are expected to build their own 5G private networks and cloud services will account for 87% of the enterprises’ application expenditures.

This expanding data connections and cloud integration of enterprise services are propelling the need for data centers and thereby significantly raising web traffic. This growth will in turn boost the demand for ADN including application delivery controller for balancing the large data traffic on servers. Additionally, the source also stated that by 2030, 32% of the total investments made by enterprises will be on general computing and AI computing servers as a proportion of total IT hardware investment annually. This includes data centers, edge, and device hardware.

Figure: Global enterprises’ annual it hardware investment proportion, percentage, 2030 forecast

Source: Intelligent World 2030, Huawei

According to the State of the Edge 2021 Report by The Linux Foundation, an estimated sum of US$800 billion will be spent as cumulative capital expenditures on new and replacement IT server equipment and edge computing facilities. The source further mentioned the December 2020 launch of Google’s ecosystem comprising 200 applications from 30 independent software vendors (ISVs). Similar efforts were observed by IBM and Amazon Web Services. Further, the source also noted that the global IT power footprint for infrastructure edge deployments is forecasted to increase from 1 GW in 2019 to 40 GW by 2028, growing at a massive CAGR of 40% in the respective duration.

The lockdown of COVID-19 pandemic has positively influenced this segment’s growth due to the high internet penetration worldwide during this period.

- Media and entertainment segment is anticipated to grow significantly in the market

By industry vertical, the ADN market is segmented into BFSI, healthcare, education, retail, government, media & entertainment, and others. The media & entertainment is anticipated to increase significantly during the forecast period due to the rapidly increasing percentage of Internet users. The media and entertainment industry in India has created several job opportunities without spending a lot on public infrastructure. The shifts in the adoption of technology, big data, and analytics as well as structural changes that will necessitate a significant reskilling of the current workforce will be vital in the employment creation for young people. Most media and entertainment organizations give Facebook, Twitter, and Instagram top priority, increasing the demand for cloud storage and ADN.

The COVID-19 pandemic has accelerated the availability of work-from-home platform, which may, directly and indirectly, lead to higher media consumption. Additionally, online courses and training programs will increase IP traffic, which will lead to wider use of ADNs worldwide. In the modern workplace, technologies like BYOD enable employees to communicate crucial company data from their own cellphones, iPads, and laptop computers, among many other devices. On the other hand, the current corporate networks are not designed to manage high volumes of data traffic from apps. As a result, network suppliers are using ADN to satisfy these requirements.

Market leaders also reacted fast, introducing virtual formats as a transitional step toward reopening and a way to keep customers engaged. Many of these solutions will continue to exist beyond the pandemic as integrated additional products to the main product. With a renewed focus on in-venue safety precautions and digital add-ons, the time-tested attractiveness of congregating for shared experiences, particularly for sports, live music, and business-related events, promises to fuel a robust resurgence over time. For instance, in June 2022, to highlight advancements, inspire creativity, and foster networking among the Cisco community, Cisco launched Cisco LIVE 2022, the leading networking and security event. This marked the first time Cisco Live has ever sponsored a hybrid event, with an expected 15,000 participants in person and a live-streamed digital event that anybody around the globe may watch. Cisco has hosted an all-digital Cisco Lives for the previous two years.

Application Delivery Network Market Key Developments:

- September 2023: Juniper Networks Inc. launched “Juniper® Apstra”, the company’s first multi-vendor intent-based networking solution that provides new experience-first data center features inclusive of simplified data collection. The solution transforms network operations by predicting and analyzing troubleshooting.

- August 2023: AppDirect announced the acquisition of ADCom Solution’s VEEUE platform and Network Operation Center (NOC), enabling the former to launch a suite of its managed infrastructure and network services. This would offer organizations additional business intelligence insights and advanced incident monitoring.

- February 2022: F5 Inc. launched “F5® Distributed Cloud Services”, which further expanded the company’s application & delivery portfolio. The solution provides edge-based computing and multi-cloud networking on a unified SaaS platform.

- August 2023: Array Network formed a partnership with LUNA Technologies, one of the leading network performance solution providers in Malawi. The collaboration enabled Array Network to deploy its application security technology to Malawian organizations, enabling them to achieve application security and scalability.

- October 2022: LUNIQ formed a partnership with Canada-based Inuvika, through which the former can provide its cloud solution, including “Secure-Application-As-A-Service,” via Inuvika’s application delivery platform. The collaboration aims to assist customers unable to run end-user services in the cloud.

Application Delivery Network (ADN) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Application Delivery Network (ADN) Market Size in 2025 | US$10.502 billion |

| Application Delivery Network (ADN) Market Size in 2025 | US$18.058 billion |

| Growth Rate | CAGR of 11.43% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Application Delivery Network (ADN) Market |

|

| Customization Scope | Free report customization with purchase |

The Application Delivery Network market is segmented and analyzed as follows:

- By Component

- Application Delivery Controller

- WAN Optimization Controller

- Application Security Equipment

- Others

- By End-Users

- Cloud Service Providers

- Enterprises

- Telecommunication Service Providers

- By Industry Vertical

- BFSI

- Healthcare

- Education

- Retail

- Government

- Media and Entertainment

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- Italy

- Spain

- Others

- Middle East and Africa

- Israel

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Application Delivery Network (ADN) Market Size:

- Application Delivery Network (ADN) Market Key Highlights:

- Application Delivery Network (ADN) Market Trends:

- Application Delivery Network Market Growth Drivers:

- Application Delivery Network Market Geographical Outlook:

- Application Delivery Network Market Segmentation Analysis:

- Application Delivery Network Market Key Developments:

- Application Delivery Network (ADN) Market Scope:

- Our Best-Performing Industry Reports: