Report Overview

Global Remote Access Software Highlights

Remote Access Software Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

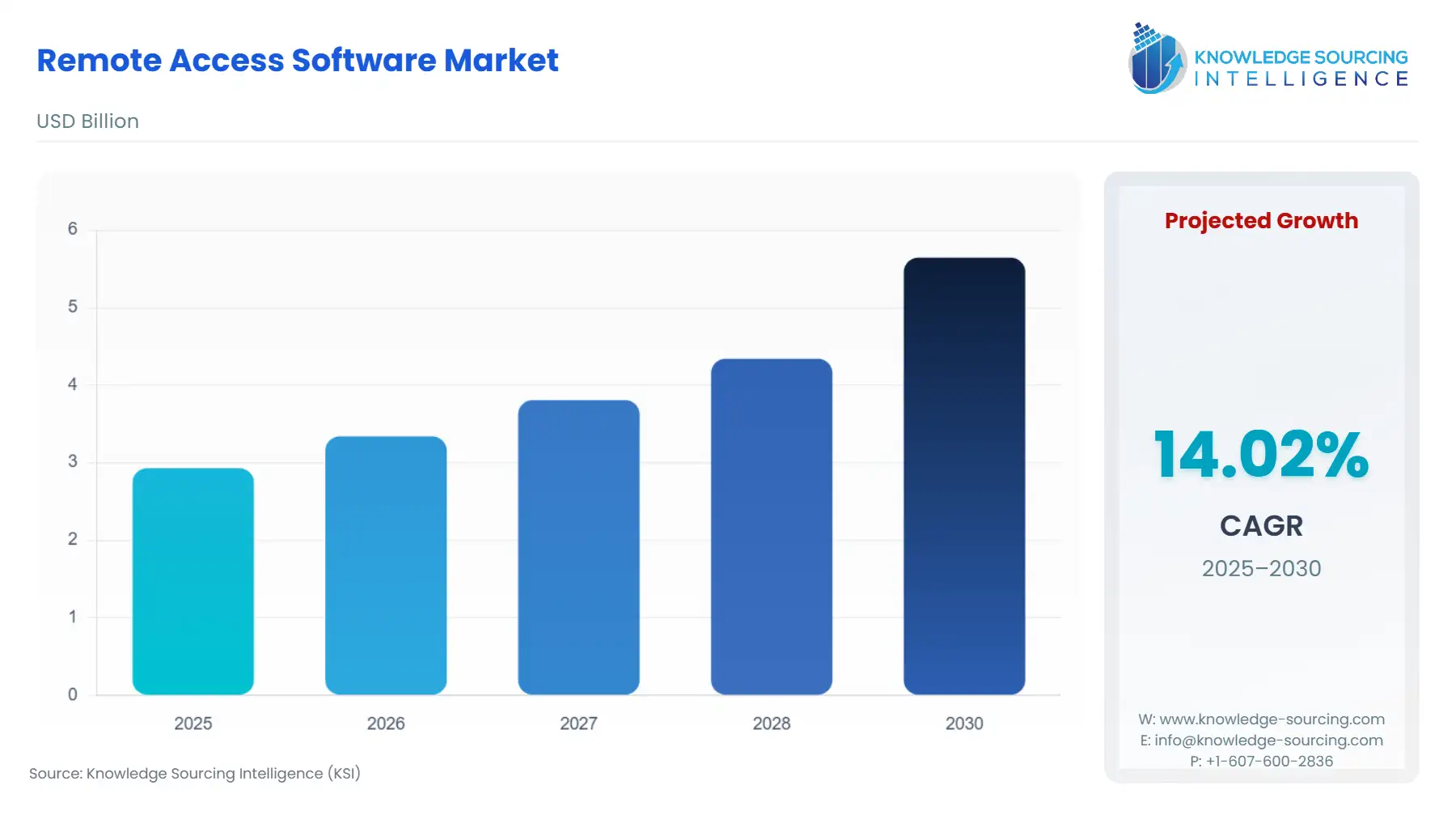

The global remote access software market is expected to grow at a CAGR of 14.02%, reaching a market size of US$5.645 billion in 2030 from US$2.929 billion in 2025.

Remote access software enables employees to securely access the company’s official data while working from a remote location. The data can be related to various business aspects, including financing, sales, administration, and marketing, which require remote access software in their enterprises for smooth workflow and efficiency.

Business verticals share diversity across different locations with multiple employees, thereby having different information needs. However, the data generated at the work front is highly confidential and complex, and to safeguard its data integrity, various security and privacy regulations are becoming more stringent. This has provided a major scope for the development of applications that are compliant with such regulations.

The ongoing adoption of work-from-home (WFH) and Bring Your Own Device (BYOD) policies across various organizations, regardless of size, has contributed to the overall market expansion. Additionally, the boom in internet-rowing cellular network capabilities and technological advancements in remote access solutions are further driving the deployment of these software solutions across different industry verticals, stimulating market growth.

Remote Access Software Market Overview

The global remote access software sector is continuing to grow steadily as companies build hybrid workplace connections and cloud-based operational schemes. Corporations are carefully evaluating platforms that provide secure, high-performance connections to the corporate system for all remote users. The market leaders, including Microsoft, TeamViewer, AnyDesk, Zoho, and iDrive, are developing an advanced authentication, cloud integration and other enhancements of real-time facilitating, which enterprises regard for security and scaling.

Microsoft has broadened its Azure Virtual Desktop and Windows 365 product lines to provide secure virtual environment access support and centralised access management for varied teams. TeamViewer and AnyDesk continue to strengthen their positions by raising encryption standards, reducing latency, and improving cross-platform abilities, among others. Zoho Assist integrates remote access function into IT management systems, allowing businesses to manage functions such as remote workstation control, monitoring, troubleshooting, and sending electronic communication to various locations from a relatively common interface. iDrive’s Remote PC aids are developing a primary focus to provide flexible access for enterprises managing hybrid and remote workforces to allow effective remote workstation connectivity, together with access, monitoring, and backup to the cloud.

Overall, companies offering advanced security architecture, efficient session management, and seamless integration across operating systems are consolidating their market presence. As enterprises transition toward permanent hybrid infrastructure, remote access software is a fundamental component of enterprise IT ecosystems.

Microsoft’s gross margin increased by USD 6.8 billion in fiscal year 2024, driven primarily by growth in its cloud services, including Azure and Windows 365. The rise in operating expenses by USD 3.9 billion reflects continued investment in cloud infrastructure, AI integration, and security development. These financial trends directly support the global remote access software market, as Microsoft channels higher revenue and expenditure into expanding secure cloud access platforms like Azure Virtual Desktop and Remote Desktop Services. Enhanced performance, scalability, and compliance capabilities from these investments strengthen enterprise adoption of remote access solutions across industries worldwide.

Major market players are TeamViewer SE, Microsoft Corporation, AnyDesk Software GmbH, BeyondTrust Corporation, and Citrix Systems, Inc. These companies continue to innovate with advanced security layers, AI-based monitoring, and seamless interoperability across platforms to further strengthen their global market shares.

Remote Access Software Market Growth Drivers:

- Growing end-user demand has propelled the market expansion.

Remote access software provides a cost-effective approach for companies to maintain their productivity and track their workers' activities. Today’s growing technological adoptions have increased the scope of such software adoption among various end-users, including government, retail, BFSI, IT & telecommunication, and manufacturing.

The research study “Trends in Remote Service and Monitoring”, which includes data collected from interviewing 144 VPs and CEOs across the USA, was issued by the Association for Packaging and Processing Technologies in January 2024. It stated that 51% of end-users utilized remote services in 2023, while 37.5% utilized them for remote monitoring. The growing adoption is attributed to the benefit of reducing machine downtime for end-users.

- The growing remote working culture has accelerated the remote access software market.

The COVID-19 pandemic had a positive impact on the remote access software market. As a result of the lockdown, more people began working from home, which led to the closure of businesses and institutions, dramatically raising the demand for remote access software. Though the pandemic situation has been tackled, the trend of remote working still prevails and continues to grow.

For instance, according to a study published in the International Journal of Creative Research Thoughts, in 2022, work-from-home culture is becoming popular in India, driven by work dynamic changes and technological advancements. The study further showed that by 2025, the number of Indians working remotely will vary from 60 million to 90 million.

- Growing Cellular and Other Network Capabilities

Remote access software is being widely adopted across different industry verticals. The surge in high-speed internet access and mobile network capabilities is also complementing the remote access software market’s growth by providing a robust medium for data access through various channels.

The internet speed and network capabilities have grown from 2G and 3G to 4G over the past decade. Moreover, rising competition in mobile communication has led to the entrance of new players, thereby reducing the cost of internet subscription services. The increasing adoption of internet-connected devices worldwide through IoT (Internet of Things), coupled with stringent regulatory obligations, is leading to growing bandwidth requirements on the current network.

According to the June 2022 Ericsson Mobility Report, the number of 5G subscriptions will surpass 1 billion by the end of 2022. This is further expected to increase to 4.4 billion 5G subscriptions by the end of 2027.

Additionally, the source further stated that the total global IoT connections are anticipated to increase from 14.6 billion in 2022 to 30.2 billion by 2027, growing at a CAGR of 13% through the years. Wide-area IoT and Cellular IoT connections are expected to grow at a significant CAGR of 19% while the Short-range IoT connections are estimated to grow at a CAGR of 12% during the same period.

The rapid growth of 5G deployments, Enterprise Wi-Fi, and IoT subscriptions worldwide is driving increased global data traffic, thereby positively impacting the global remote access software market’s expansion. The rising demand for logging onto a network remotely is driving the demand for remote access software. Additionally, significant actions taken by industry players, such as product launches, partnerships, and similar initiatives, are further expected to benefit market growth.

Remote Access Software Market Segmentation Analysis

- By Enterprise Size: Small

By Enterprise Size, the Remote Access Software market is segmented into Small, Medium, and Large. The adoption of this software among small enterprises is witnessing a significant rise due to a significant number of vendors available in the market offering affordable solutions to them based on their business needs. Since most small enterprises operate on limited budgets, they can be seen adopting practices that offer flexibility while significantly reducing costs. Bring Your Own Device (BYOD) is one of the practices that are popular and gaining traction among small enterprises. The significant cost reduction offered by this practice, coupled with enhanced productivity seen across many enterprises, is strengthening the traction of BYOD in small enterprises. This is pushing many market players, who, for long, had been focusing on large and medium-sized enterprises, to focus on small enterprises. Vendors such as LogMeIn, Inc., TeamViewer, BOMGAR, and Citrix Systems, for instance, are increasing their focus on providing affordable remote access solutions to small enterprises to expand their customer base while increasing their overall market share.

Simultaneously, according to the data offered by US Bureau of Labor Statistics, U.S. establishments with fewer than five employees are highly concentrated in service-oriented sectors such as Professional and Business Services (1.95 million), Education and Health Services (1.71 million), and Trade, Transportation, and Utilities (1.16 million) industries that rely heavily on digital workflows and client interaction rather than large physical infrastructure. This dominance of micro-enterprises signals a vast base of small firms operating with limited IT resources and often adopting remote or hybrid work models, which directly fuels demand for remote access software. These businesses increasingly depend on affordable, cloud-based, and secure platforms to manage remote collaboration, data access, and client servicing without dedicated IT departments. As a result, the proliferation of such small-scale establishments acts as a key growth accelerator for the remote access software market, pushing vendors to offer simplified, scalable, and subscription-based solutions tailored for SMEs and freelancers.

Furthermore, product innovation is moving toward integrated ecosystems that combine remote access with IT support, endpoint security, and remote monitoring. For instance, solutions from LogMeIn and Zoho Assist embed helpdesk automation, device health analytics, and AI-based troubleshooting, all designed for SME affordability and ease of use. Cloud optimization, reduced latency through edge computing, and compliance-ready encryption protocols (such as AES-256) are also enhancing reliability. Moreover, Rockwell Automation’s launch of OptixEdge highlights the growing convergence of remote access, edge computing, and data connectivity in industrial and SME environments. By enabling secure remote monitoring, control, and analytics at the edge, the solution reflects the evolution of the remote access software market beyond basic connectivity toward integrated, intelligent platforms. This trend signals rising demand for secure, cloud-enabled remote management tools that help SMEs and manufacturers optimize operations, improve uptime, and manage distributed assets in real time.

As SMEs continue to digitize, these technological developments not only make remote access software more robust but also position it as a core enabler of SME productivity, cybersecurity, and operational resilience, fueling sustained market expansion in the years ahead.

- By End-user: Manufacturing

Based on the end-user, the global remote access software market is segmented into BFSI, government, manufacturing, IT & telecommunication, retail, healthcare, and others. The ongoing industrial digitalization trend has provided new approaches to operating a business. With the rapid adoption of modern concepts such as Internet of Things (IoT) and cloud platforms, the demand for software that complies with such tools is also progressing globally.

Moreover, the manufacturing sector is among the major industrial fields with a high scope for automation and digitalization, and nations are investing in Industry 4.0, which empowers smart manufacturing. Hence, the demand for remote-access software that offers real-time monitoring of various operations is expected to grow.

Furthermore, the post-pandemic shift in work policies has accelerated off-site collaboration in the manufacturing sector, leading to the gradual establishment of hybrid and teleworking setups. According to the data provided by the U.S Bureau of Labor Statistics, in April 2025, the number of individuals who teleworked or worked from home for pay reached 2,803, reflecting a 2.2% increase compared to the same month the previous year.

Additionally, companies like TeamViewer, Zoho Corporation Pvt. Ltd, and AnyDesk Software GmbH provides remote access software for various sectors, including manufacturing. These companies are investing in product innovation and entering in strategic partnerships with major manufacturing firms, contributing to an upward market trajectory.

Remote Access Software Market Geographical Outlook:

- North America: the US

The work culture in the United States is witnessing a considerable change, fuelled by the growing transition towards edge & cloud platforms, and ongoing investment in digital infrastructure expansion. Additionally, the rising concern regarding constant work monitoring of different regional branches has provided new growth prospects for the adoption of online platforms for remote work management, which is expected to drive overall market expansion.

Various industrial sectors, inclusive of healthcare, IT & telecommunication, manufacturing and other public sectors are investing in adopting hybrid and remote working model. For instance, according to the U.S Bureau of Labor Statistics, in March 2025, the number of individuals who teleworked all hours stood at 1,237 in manufacturing, 2,638 in financial sector, and 1,914 in healthcare & social assistance.

The same source also specified that the number of part-time workers aged 16 years and above who teleworked some hours was 18,137, representing a 4.9% increase over the number recorded in the preceding year for the same month. Additionally, the booming internet penetration, 5G network development, ongoing technological advancements, coupled with the establishment of the strongest cybersecurity laws and investments in Artificial Intelligence (AI), is assisting in the development of a rigid framework that provides anomaly detection and identity access management.

Such developments, along with the ongoing trend of BYOD (Bring Your Own Device) and post-pandemic changes in work policies, provide a significant opportunity for companies and employees to utilize remote software regardless of their location, which is expected to drive overall market expansion.

Remote Access Software Market Key Developments:

- In March 2024, TSplus launched new remote access solutions on its website, enabling site visitors to gain profound knowledge of the company's remote access software and its diverse applications across varied business types. Through this remote access solution, TSplus aims to provide organizations with a roadmap that would enable them to optimize their operations via remote access capabilities.

- In 2024, Microsoft launched the Windows App as a unified remote access client, enhancing cross-platform support and integrating FIDO/passkey authentication for stronger security.

- In September 2023, TeamViewer launched its next generation of remote access & support solutions, which features such as 1-click sessions. Modern & intuitive interface, which enhances overall web security. The new interface bridges the gap between desktop & browser interactions and allows customers in remote monitoring & management (RMM).

- In September 2023, Syncro, an All-in-one professional service automation (PSO) and remote monitoring management platform, expanded its partnership with Splashtop to provide the latter's enhanced remote access features and functionalities. This would improve users' overall productivity and further provide them with comprehensive remote support.

- In April 2023, WALLIX launched “SaaS Remote Access”, which is integrated into its remote access management solution “WALLIX PAM4ALL”. The SaaS remote version is designed for organizations across various sectors who are aiming to provide digital access to their IT infrastructure to external users via simplified management.

Remote Access Software Market Scope:

| Report Metric | Details |

| Remote Access Software Market Size in 2025 | US$2.929 billion |

| Remote Access Software Market Size in 2030 | US$5.645 billion |

| Growth Rate | CAGR of 14.02% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Remote Access Software Market |

|

| Customization Scope | Free report customization with purchase |

Remote Access Software Market Segmentation:

- By Deployment

- On-Premise

- Cloud

- By Enterprise Size

- Small

- Medium

- Large

- By End-User

- BFSI

- Government

- Manufacturing

- IT and Telecommunications

- Retail

- Healthcare

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Taiwan

- Thailand

- Indonesia

- Others