Report Overview

Argentina AI in Finance Highlights

Argentina AI in Finance Market Size:

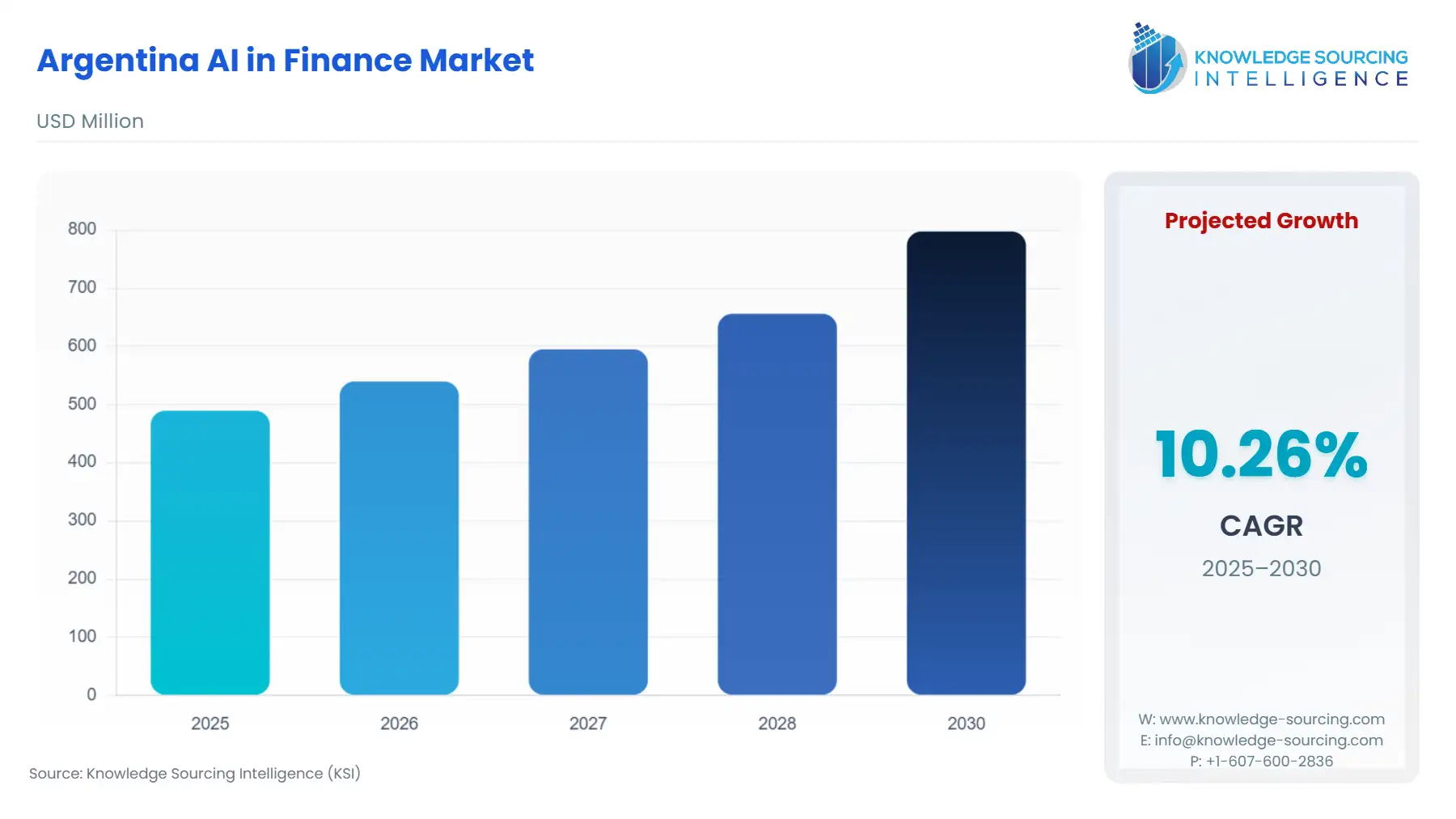

The Argentina AI in Finance Market is expected to grow at a CAGR of 10.26%, rising from USD 489.414 million in 2025 to USD 797.745 million by 2030.

The Argentine AI in Finance market is experiencing a structural transformation, shifting from pilot projects to core operational integration, primarily propelled by intense domestic competition and an evolving regulatory mandate for digitalization. Traditional financial entities and a rapidly expanding fintech sector are now competing directly on the quality, speed, and personalization of digital services.

This race for user acquisition and operational efficiency establishes AI—particularly in fraud prevention, customer interaction, and credit risk assessment—as an essential technological imperative. The market is defined by a dichotomy: high operational demand for AI juxtaposed against a need for highly specialized technical talent and robust local cloud infrastructure, shaping investment priorities and strategic partnerships.

Argentina AI in Finance Market Analysis:

Growth Drivers

Digital financial inclusion remains a core catalyst, with a significant percentage of the Argentine population adopting digital wallets and virtual accounts. This surge in digital transaction volume creates a critical demand for AI solutions, specifically in fraud detection and anti-money laundering (AML), as the scale of data surpasses human analysis capacity. Further, the ongoing high inflation and economic volatility compel institutions to optimize underwriting and credit scoring processes; AI-driven alternative data models are essential for accurately assessing risk for underserved segments, directly increasing the demand for automated Consumer Finance lending platforms. Major banks’ successful deployments, like Banco Galicia’s NLP platform, reducing corporate client onboarding time, demonstrably decrease operational costs, positioning AI as a direct driver of profitability and a necessary competitive response.

Challenges and Opportunities

- Challenges:

- The primary constraint facing the market is the scarcity of highly specialized data science and machine learning engineering talent within the country, raising salary costs and decelerating in-house development projects. This constraint forces institutions to increase their demand for fully managed, turnkey AI-as-a-Service (AIaaS) solutions from external vendors.

- Opportunities:

- Simultaneously, an opportunity emerges from the regulatory push for greater transparency and security. The BCRA's security communications create a mandatory demand for AI in regulatory reporting and model risk management (MRM). Moreover, the widespread use of digital assets and cryptocurrencies by Argentines presents a unique opportunity, compelling financial firms to deploy AI for real-time asset tracking and compliance to manage the novel risks associated with decentralized finance.

Supply Chain Analysis

The AI in Finance supply chain is inherently non-physical, centered on three core dependencies: proprietary algorithm development, cloud computing infrastructure, and specialized talent. Global AI development hubs in North America and Europe remain key intellectual property sources, with major international cloud providers like AWS and Microsoft (through services like GitHub Copilot, actively used by institutions like Banco Galicia and Naranja X) serving as essential logistical hubs. The local dependency is the Argentine talent pool; while highly capable, it is insufficient in volume, leading to high-wage competition and a reliance on remote global talent or external consulting firms for implementation expertise. The key logistical complexity involves data sovereignty and security, which mandates that institutions prioritize Cloud deployments that comply with local data protection laws, despite the international nature of the primary service providers.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Argentina | Banco Central de la República Argentina (BCRA) Communication “A” 7,777 (Technology & Information Security Risks) | Directly increases demand for AI-powered security software in core banking and back-office operations to meet minimum management and control requirements. |

| Argentina | BCRA Communication “A” 7,783 (Risk Control for Digital Financial Services) | Creates compulsory demand for AI solutions in fraud detection, biometric authentication (e.g., face recognition for remote onboarding), and continuous monitoring for Payment Services Providers (PSPs) and banks. |

| Argentina | Personal Data Protection Law No. 25,326 (PDPL) | Mandates the use of AI tools that ensure anonymization, data minimization, and secure processing, driving demand for explainable AI (XAI) to demonstrate compliance and transparency in algorithmic decision-making. |

Argentina AI in Finance Market Segment Analysis:

By Application: Back Office

The Back Office segment, which encompasses processes such as fraud detection, compliance, reconciliation, and Know Your Customer (KYC) verification, is a high-demand sector for AI deployment. The necessity is directly driven by twin pressures: the necessity to reduce operational expenditure in a high-inflation economy and the stringent regulatory mandate to mitigate financial crime. AI in this segment, specifically through machine learning models for anomaly detection, transforms the traditional rule-based fraud prevention systems. For instance, the deployment of NLP platforms by entities like Banco Galicia for the Official Acceptance of Credentials (OAC) process has proven its value by automating the analysis of unstructured legal and financial documentation, cutting processing time from 20 days to minutes. This efficiency gain directly correlates to reduced salary costs for manual review staff and accelerates revenue generation from new corporate clients, making AI an immediate financial imperative. The focus is on robust, auditable models that can provide transparency to regulatory bodies while managing high-volume, real-time transaction streams.

By User: Personal Finance

The Personal Finance segment, which serves individual consumers through digital wallets, micro-lending, and personal investment tools, exhibits strong demand for AI, fueled by intense market competition from fintechs. The growth of digital wallets and the adoption of retail investment instruments compel platforms to differentiate on user experience and accessibility. AI applications, such as sentiment analysis to inform retail investment decisions and Large Language Models (LLMs) for hyper-personalized financial advisory chatbots, are critical. The core driver is the need to efficiently manage and service a mass market of digitally-native users. For example, AI-driven churn prediction models analyze user behavior to proactively offer personalized promotions, directly increasing user retention in a market dominated by low-friction switching between service providers. Moreover, AI-based credit scoring, leveraging non-traditional data (like utility payments or mobile usage), is essential for extending services to Argentina’s significant underbanked population, translating financial inclusion into market expansion and revenue growth for digital financial providers.

Argentina AI in Finance Market Competitive Environment and Analysis:

The Argentine AI in Finance market competitive landscape is polarized, dominated by established commercial banks leveraging AI for legacy process modernization and dynamic, tech-native fintechs building AI into their core product from inception. Competition centers on AI-driven customer acquisition efficiency and operational cost reduction.

- Banco Galicia: A leading private-sector commercial bank, Banco Galicia’s strategic positioning is focused on integrating AI to optimize core banking workflows, showcasing a modernization imperative. The bank's key verifiable initiative is the implementation of an AI-based intelligent Natural Language Processing (NLP) platform, built on Red Hat OpenShift, designed to streamline the corporate client OAC process. This product successfully cut the manual verification time for corporate clients from approximately 20 days to minutes with 90% accuracy, demonstrating a clear focus on back-office efficiency and enhanced corporate client onboarding experience. This strategic move is a direct response to competitive pressure from agile digital players.

- Mercado Pago: As the payment and financial services arm of the regional e-commerce giant Mercado Libre, Mercado Pago is strategically positioned to leverage massive volumes of proprietary transaction data, a significant competitive advantage. Its AI use is fundamentally driven by the need to secure a vast, high-volume payment network. The company is a key player in the Front Office and Consumer Finance segments, using machine learning extensively for proprietary fraud prevention systems that reportedly block a high percentage of fraudulent listings and transactions. Its focus on its anti-fraud engine, embedded directly into the payment flow, underscores a data-centric strategy aimed at maintaining user trust and minimizing financial loss across its marketplace and wallet ecosystem.

- Ualá: This Argentine fintech operates as a mobile application offering a suite of financial services, including a prepaid debit card, and positions itself as a catalyst for financial inclusion. Its strategic focus centers on leveraging technology for alternative credit scoring and providing a seamless user experience. Ualá's operational model demands AI to efficiently assess creditworthiness for users with no traditional bank history, directly impacting the expansion of its Personal Finance and lending products. By integrating data analytics and machine learning into its core platform, Ualá addresses the structural issue of credit access for the underbanked, rapidly scaling its loan book while managing risk.

Argentina AI in Finance Market Recent Developments:

- June 2025: The global digital bank Revolut announced its intent to acquire the Argentine unit of BNP Paribas. This strategic acquisition facilitates Revolut's operational entry into Argentina, utilizing the existing local banking license. The move positions the fintech to integrate its AI-powered services, like multi-currency accounts and remittances, into the regulated Argentine financial system.

- June 2025: Revolut moved to acquire Banco Cetelem in Argentina, one of the country's smallest licensed lenders. The intent was to quickly secure a local banking license, bypassing a lengthy application process. This foundational step is key to launching Revolut's comprehensive digital banking and AI financial assistant platform in the Argentine market.

- January 2025: Salesforce, a major AI CRM provider, announced a $500 million investment in Argentina over five years. This initiative is aimed at fostering AI innovation, workforce development, and public sector digital transformation. The investment supports the use of its AI-driven Agentforce platform by local institutions like Banco Galicia and Telecom.

Argentina AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 489.414 million |

| Total Market Size in 2031 | USD 797.745 million |

| Growth Rate | 10.26% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

Argentina AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office