Report Overview

UAE AI in Finance Highlights

UAE AI in Finance Market Size:

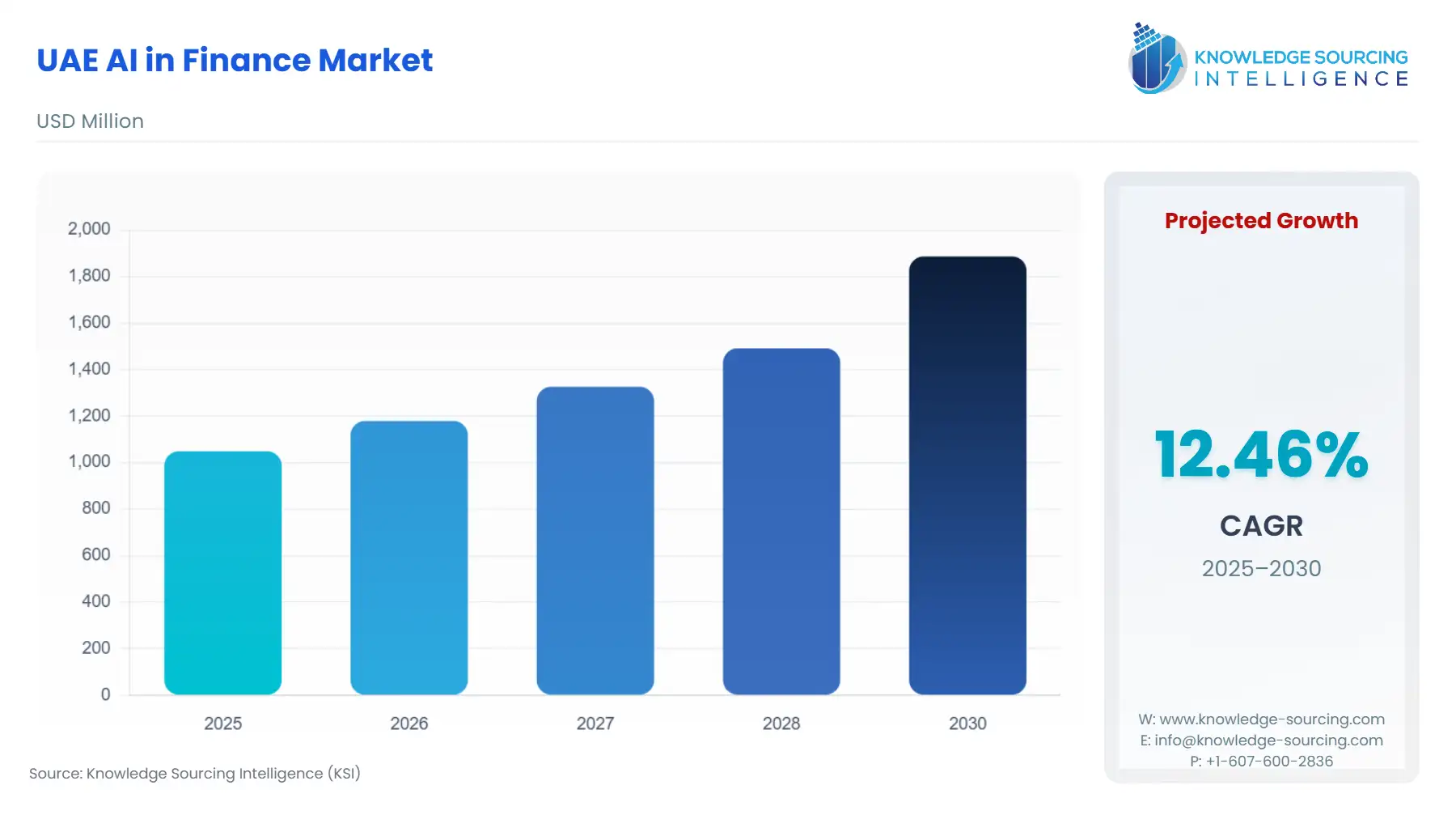

The UAE AI in Finance Market is expected to grow at a CAGR of 12.47%, rising from USD 1.049 billion in 2025 to USD 1.887 billion by 2030.

The United Arab Emirates is rapidly establishing itself as a regional and global epicenter for the integration of Artificial Intelligence within its financial services sector. This strategic pivot is not merely a technological upgrade but a fundamental component of the nation's economic diversification and digital transformation agendas.

The market's trajectory is directly shaped by high-level government mandates, which view AI as a critical enabler for efficiency, enhanced service quality, and risk mitigation across the entire financial ecosystem, from central banking functions to private wealth management.

________________________________________

UAE AI in Finance Market Analysis:

Growth Drivers

- Government support through the UAE National AI Strategy 2031 acts as a primary catalyst, directly increasing institutional demand for AI in finance solutions by mandating their adoption across federal and commercial sectors. This strategic imperative focuses on leveraging AI to streamline operations, such as enhancing fraud detection capabilities within the Central Bank of the UAE's Financial Infrastructure Transformation Programme.

- Financial institutions actively seek AI-powered automation to process large transaction volumes, improving operational efficiency and reducing human error, which directly increases demand for solutions like Robotic Process Automation and machine learning platforms.

- The rising sophistication of cyber threats elevates demand for real-time, AI-driven fraud detection systems and behavioral analytics, essential for mitigating security risks across the banking landscape.

Challenges and Opportunities

- The primary challenge constraining market growth is the high initial implementation cost, with average expenditure for AI integration in UAE banks projected at a significant financial burden that can impede adoption by smaller institutions.

- Another key constraint is the necessity for compliance with stringent data protection laws, such as the UAE's Federal Data Protection Law and DIFC's Regulation 10, creating demand for specialized RegTech and AI governance solutions.

- Opportunities for market expansion exist in the growing need for personalized financial services, which drives institutions to invest in AI-powered customization, including virtual assistants and smart credit scoring.

- The integration of ESG data into financial decision-making, as promoted by the UAE Sustainable Finance Working Group, presents a new opportunity that accelerates the demand for GenAI models capable of evaluating sustainability-linked products and carbon transition risks.

Supply Chain Analysis

The supply chain for the UAE AI in Finance market is primarily intellectual and logistical, centered on three core elements: Global Technology Providers, Local Financial Institutions, and Data Sourcing. Global technology firms (e.g., those providing Large Language Models and cloud services) represent the key production hubs for foundational AI components, creating a dependency on international intellectual property and secure cross-border data transfer protocols. Local financial institutions serve as the final deployment hubs and customizers, requiring a stable pipeline of specialized AI talent. The most critical logistical complexity lies in data security and compliance, specifically the secure, ethical, and legal transfer and processing of large, sensitive financial datasets, which dictates a high dependency on specialized, compliant cloud infrastructure and regulatory technology partners.

Government Regulations

The regulatory environment in the UAE is proactively structured to foster AI innovation while maintaining rigorous compliance and ethical standards, particularly within its financial free zones.

Jurisdiction / Key Regulation / Agency / Market Impact Analysis

Dubai International Financial Centre (DIFC) / DIFC Data Protection Regulation 10 (Autonomous and Semi-autonomous Systems) / Mandates the appointment of an Autonomous Systems Officer and requires explicit notice and a Data Protection Impact Assessment (DPIA) for AI systems processing personal data. This creates immediate demand for governance, certification, and RegTech solutions that ensure ethical, transparent, and accountable AI deployment.

UAE Federal / UAE Central Bank Financial Infrastructure Transformation Programme / Directly influences the adoption of AI for financial stability and integrity. It drives institutional demand for AI-driven fraud detection, risk management, and advanced anti-money laundering (AML) processes to enhance overall systemic security and compliance.

UAE Federal / UAE National Strategy for AI 2031 / This policy establishes a long-term national imperative for AI adoption, positioning AI in finance as a priority sector. It ensures continued government investment in digital infrastructure and skills, sustaining the market's long-term growth and demand for high-performance computing necessary for AI.

UAE AI in Finance Market Segment Analysis:

By Application: Front Office

The Front Office segment captures direct client-facing AI applications, which drives intense demand for solutions focused on customer experience and revenue generation. The primary growth driver is the imperative for personalized financial services, driven by high digital adoption rates among UAE consumers, with 89% now utilizing digital-first bank accounts. Financial institutions are therefore prioritizing investment in Natural Language Processing (NLP)-powered virtual assistants (chatbots) and conversational AI to provide 24/7 customer support and instant query resolution. Furthermore, AI-driven advisory tools, such as robo-advisors and personalized product recommendation engines, are in high demand to offer tailored investment solutions and enhance customer lifetime value. This segment is characterized by a "speed-to-market" demand profile, where institutions seek rapidly deployable, scalable solutions to gain a competitive advantage in customer engagement and digital service delivery. The efficacy of these solutions in the multilingual UAE market also increases the demand for sophisticated NLP models capable of accurately processing both English and Arabic.

By User: Corporate Finance

The Corporate Finance segment drives demand for AI solutions focused on high-stakes, large-scale financial processes, particularly risk mitigation and process automation. The core growth driver is the regulatory pressure on banks to manage and report on large credit portfolios and complex cross-border transactions efficiently. This increases demand for AI-powered risk management solutions that provide real-time data visibility and automate complex tasks such as credit scoring, debt management, and regulatory reporting. For instance, the successful implementation of advanced AI-powered debt management solutions in major UAE banks, which automates collection strategies and links multiple subsystems, exemplifies this demand. Corporate entities also seek AI for enhanced financial forecasting and predictive analytics to inform strategic decision-making, driving the adoption of sophisticated machine learning algorithms capable of analyzing macroeconomic indicators and financial statements to predict corporate credit risk and market liquidity. The complexity and volume of corporate financial data ensure sustained, high-value demand for robust, on-premise or secure private cloud AI deployments.

UAE AI in Finance Market Competitive Environment and Analysis:

The competitive landscape of the UAE AI in Finance market is a duality: major local banks are simultaneously the primary end-users, significant internal innovators, and incubators for FinTech partnerships. Competition focuses on proprietary AI application development and strategic alliances with global technology providers. The market is not characterized by a single monopolistic vendor but by an internal digital arms race among the largest financial institutions.

Emirates NBD

Emirates NBD maintains a strategic positioning as a leader in digital innovation and FinTech enablement within the MENAT region, underscored by its role as a Premium Banking Partner at major industry events. The bank's strategy centers on deep integration of Generative AI (GenAI) across its operations to drive efficiency and elevate customer experience. A key product initiative involves the deployment of GenAI-powered banking solutions across over 11 use cases spanning experience, efficiency, and insights, demonstrating a commitment to large-scale operational transformation. Verifiable public details confirm that Emirates NBD empowers its IT teams by leveraging GitHub Copilot X to boost coding proficiency and software development speed. Furthermore, the bank has piloted the usage of Microsoft 365 Copilot to automate repetitive tasks and enhance decision-making across the organization, directly supporting its efficiency mandate. The bank's Digital Asset Lab also collaborates with external technology providers, such as Chainalysis, to enhance compliance and security in the digital asset space, reflecting a commitment to innovation beyond traditional banking.

First Abu Dhabi Bank (FAB)

First Abu Dhabi Bank (FAB) is strategically positioned as the UAE's global bank, focusing its AI initiatives on large-scale digital transformation to enhance operational efficiency and customer experience in lending and wealth management. FAB's key verified product is the successful implementation of Intellect's Consumer Banking Debt Management solution, a component of the eMACH.ai Lending platform. This initiative automates various processes and links over ten subsystems, providing real-time data visibility of the credit portfolio and streamlining the collection process to reduce recovery costs. This focus on backend automation in a critical banking function showcases a drive toward foundational digital robustness. FAB also consistently engages in thought leadership, producing reports that incorporate data-driven analysis of AI trends and their impact on global markets, demonstrating its influence on the wider financial ecosystem's understanding and adoption of AI technologies.

UAE AI in Finance Market Recent Developments:

- September 2024: FAB successfully piloted Programmable Payments through Onyx by J.P. Morgan. This development focuses on the technological underpinnings of future financial transactions, leveraging distributed ledger technology alongside modern payment infrastructure to explore new efficiencies in corporate and institutional payments.

- September 2024: FAB Asset Management successfully raised close to USD 200 million through the launch of a fixed maturity portfolio. This capacity addition in the asset management space signals a continued focus on large-scale investment products, which inherently increases the demand for AI-driven quantitative analysis and risk modeling tools to manage and optimize such substantial portfolios.

- January 2024: The UAE Ministry of Finance, in partnership with the Office of the Minister of State for Artificial Intelligence, conducted a workshop titled 'Guidelines for Artificial Intelligence Procurements in the Digital Procurement Procedures Manual'. This event represented a regulatory/procurement development that formally introduced criteria and a step-by-step manual for federal government bodies procuring AI solutions, establishing a clear pathway for verified, ethical AI adoption in public finance functions.

UAE AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.049 billion |

| Total Market Size in 2031 | USD 1.887 billion |

| Growth Rate | 12.47% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

UAE AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office