Report Overview

South Korea AI in Highlights

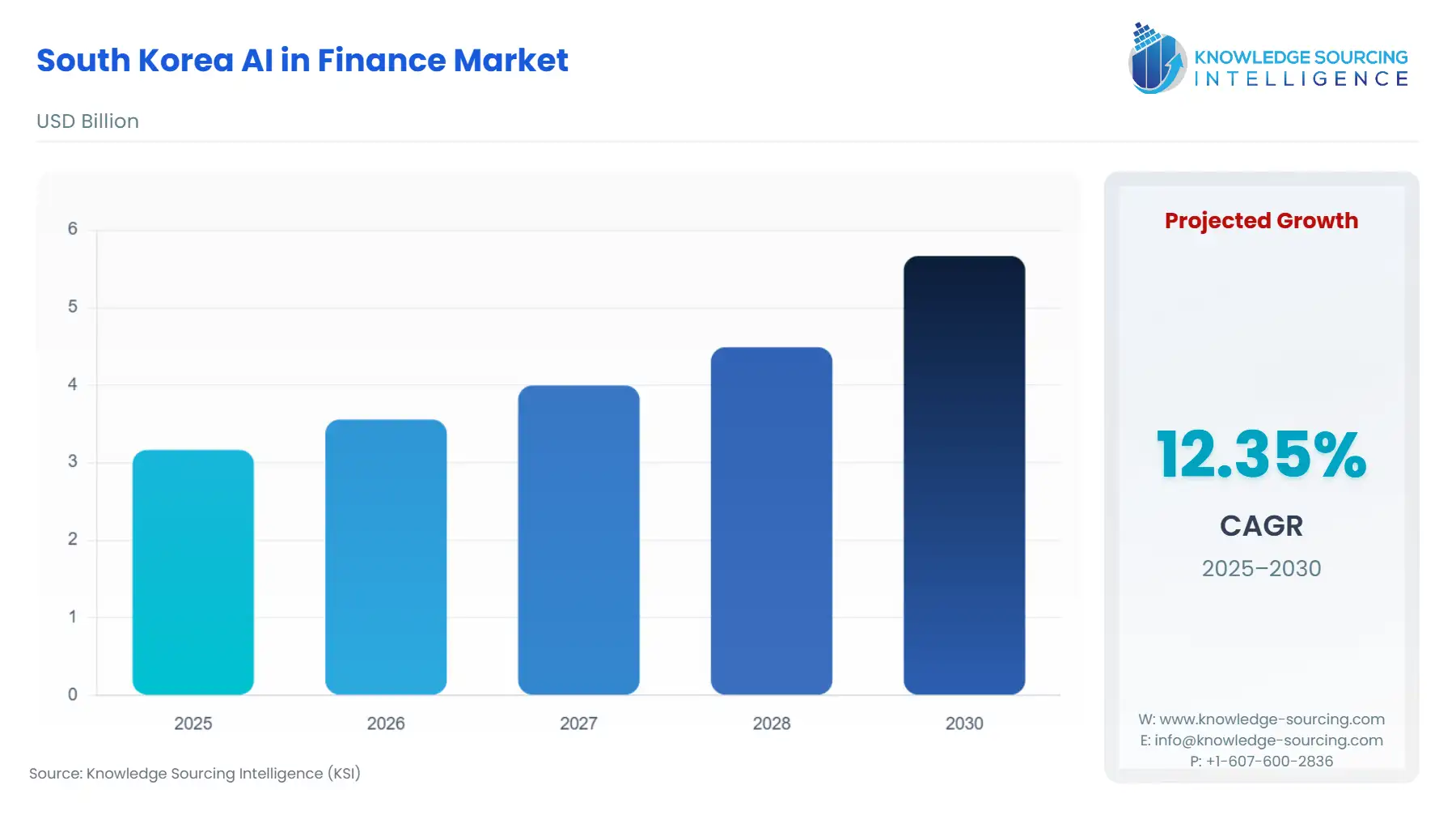

South Korea AI in Finance Market Size:

The South Korea AI in Finance Market is expected to grow at a CAGR of 12.35%, rising from USD 3.166 billion in 2025 to USD 5.667 billion by 2030.

The South Korean AI in Finance market is undergoing a significant, state-sponsored transformation, evolving from a market with stringent regulatory restrictions into an innovation-driven hub. This shift is deeply rooted in the national economic strategy, which views AI adoption as a crucial lever to mitigate the structural headwinds of an aging population and declining labor supply, as identified by the Bank of Korea.

Financial institutions are now positioned to leverage advancements in machine learning, Natural Language Processing (NLP), and Generative AI, moving beyond back-office operations to deploy sophisticated, customer-facing applications. The combined effect of proactive government funding for AI research and development, alongside targeted regulatory reform in the financial sector, has created an inflection point that mandates technology adoption for financial firms to maintain competitiveness and relevance.

________________________________________

South Korea AI in Finance Market Analysis:

Growth Drivers

The structural shift towards mitigating demographic risks acts as a primary catalyst, as AI-driven automation in financial processes, such as wealth management and credit scoring, directly increases labor productivity, thereby generating demand for AI solutions that offset a shrinking workforce. Secondly, the 2024 policy reform by the Financial Services Commission, which granted selective permission for financial firms to adopt generative AI and cloud computing, immediately propelled demand for cloud-based AI solutions across the financial spectrum. This regulatory alignment with global technology trends forces a mandatory investment cycle in cloud-compatible, high-compute AI infrastructure and services to unlock new product development. Finally, the country's high digital literacy and the existing competitive landscape among mobile-first players like KakaoBank and Toss create an imperative for AI-enhanced customer experiences, driving demand for advanced front-office AI applications like conversational AI and robo-advisory tools.

Challenges and Opportunities

A key constraint facing the market is the regulatory friction stemming from the delicate balance between innovation and data security, particularly concerning the existing Personal Information Protection Act (PIPA). This stringency imposes high compliance burdens on firms developing AI solutions, which can slow time-to-market for data-intensive models. Conversely, this constraint presents a unique opportunity in the demand for sophisticated, privacy-preserving AI models, specifically federated learning and secure multi-party computation technologies, which allow data analysis without exposing sensitive customer information. An additional opportunity lies in the government's sustained public-private investment focus, including plans for a National Growth Fund, which significantly reduces the capital expenditure risk for FinTech startups and traditional financial institutions embarking on large-scale AI deployment projects, stimulating demand for third-party AI consulting and integration services.

Supply Chain Analysis

The South Korean AI in Finance supply chain is primarily a service- and software-centric value chain, characterized by a dependence on external and co-developed foundational technology. The chain begins with a high reliance on global hyperscale cloud providers for Infrastructure-as-a-Service (IaaS) and specialized hardware, such as GPUs, to power large-scale model training. Key production hubs for the financial AI models themselves are concentrated within the local R&D centers of major financial holding groups and specialized domestic IT/tech subsidiaries, such as KakaoBank's dedicated AI data center, or Samsung SDS. Logistical complexity centers not on physical transport, but on the secure, compliant transmission and storage of sensitive financial data, necessitating advanced security and network protocols. The supply chain's primary dependency is on the availability and secure integration of advanced, large-scale language models (LLMs), often developed by global tech giants, which domestic firms then fine-tune for the Korean language and specific financial applications.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| South Korea | Act on the Development of Artificial Intelligence and Establishment of Trust (AI Basic Act, passed Dec 2024, effective Jan 2026) | Establishes a formal, risk-based governance framework for "high-impact" AI systems, creating a direct demand for compliance and risk-assessment solutions within financial institutions to meet future safety and transparency obligations. |

| South Korea | Financial Services Commission (FSC) Policy Update (Sept 2024) | Directly relaxes prior network separation rules, explicitly permitting financial companies to use generative AI and external cloud computing for core business functions, immediately stimulating demand for cloud-based AI platform services and external data migration support. |

| South Korea | Personal Information Protection Act (PIPA) | Mandates strict compliance for the collection and use of customer data, acting as a constraint on AI model training that relies on vast, unstructured personal data. This increases the demand for Privacy-Enhancing Technologies (PETs) and anonymization/synthetic data generation tools. |

________________________________________

South Korea AI in Finance Market Segment Analysis:

By Application: Front Office

The Front Office segment encompasses all AI applications directly impacting customer interaction, including conversational AI, personalized marketing, and robo-advisory services. The imperative among Korean financial institutions, particularly internet-only banks, to maintain their competitive edge through superior user experience and higher operational efficiency, drives this segment's growth. The strategic goal is to automate routine customer service tasks and offer hyper-personalized advice at scale, which directly lowers the customer acquisition and servicing cost base. KakaoBank's 2025 launch of its conversational AI Search service exemplifies this demand, utilizing generative AI to field natural language inquiries on financial products and provide immediate, relevant service links. This implementation satisfies the increasing consumer expectation for 24/7, seamless digital engagement, compelling traditional banks to invest in similar technologies to prevent customer attrition. The high penetration of mobile banking in South Korea reinforces the demand for AI to make complex financial products instantly accessible and comprehensible via a smartphone interface, making the Front Office a critical battleground for market share.

By Technology: Natural Language Processing (NLP)

The NLP technology is structurally tied to the high volume of unstructured data within the financial sector, including customer service transcripts, legal documents, market news feeds, and social media commentary. NLP is indispensable for translating this data into actionable intelligence across multiple financial functions. In the Middle Office, for instance, advanced NLP models are deployed for regulatory technology (RegTech) to automatically analyze new compliance mandates and identify gaps in internal documentation, thereby increasing demand for automated compliance monitoring systems. Furthermore, the need for enhanced anti-fraud measures drives NLP demand in the analysis of call center data, as seen with Shinhan Bank's August 2024 deployment of an AI-powered sentiment analysis system. This system uses NLP and voice analysis to detect signs of anxiety or suspicious keywords in real-time customer conversations, automatically escalating potential voice phishing attempts. This application demonstrates a direct demand for NLP as a specialized tool for both risk mitigation and operational excellence in high-stakes financial crime prevention.

________________________________________

South Korea AI in Finance Market Competitive Environment and Analysis:

The South Korean AI in Finance competitive landscape is characterized by a high-stakes rivalry between established financial holding groups and nimble, technology-first players (FinTech and Internet Banks). Competition focuses less on technology ownership and more on the speed and efficacy of deploying AI models that yield demonstrable customer experience improvements or operational efficiencies.

KakaoBank

KakaoBank, an internet-only bank, is strategically positioned as a disruptive, AI-native leader by prioritizing customer-centric innovation and leveraging the vast user base of the KakaoTalk ecosystem. The company focuses its AI efforts on mass-market digital service penetration and personalization. Its establishment of a dedicated AI data center in January 2024 and the subsequent rollout of the Azure OpenAI-powered conversational AI Search and AI Financial Calculator in mid-2025 highlight its core strategy: rapid, cloud-based deployment of generative AI for superior customer interaction and self-service. This approach aims to minimize the operational costs associated with traditional banking infrastructure while maximizing digital engagement.

Shinhan Bank

Shinhan Bank, a major traditional financial institution, adopts a strategic positioning focused on integrating AI into core operational processes for risk mitigation and customer service quality control, often partnering with specialized domestic technology firms. Its strategic focus on AI deployment is two-fold: enhancing internal resilience and modernizing the multi-channel customer experience. A key verifiable product is its AI-powered sentiment analysis system, deployed in August 2024 in collaboration with KT, which analyzes customer voice interactions in real-time to detect potential fraud and ensure service quality. This reflects a measured, risk-aware strategy that emphasizes incremental, high-impact AI deployment in compliance-sensitive areas.

________________________________________

South Korea AI in Finance Market Recent Developments:

- June 2025: KakaoBank announced the launch of its AI Financial Calculator service, built on Azure OpenAI's generative AI, within its mobile application. This service enables customers to calculate interest on deposits, estimate loan parameters, and check exchange rates through conversational interaction, representing a direct application of generative AI to simplify complex financial planning for mass-market mobile users.

- May 2025: KakaoBank rolled out its Azure OpenAI-powered AI Search service, which allows customers to ask natural language questions about bank services or general financial knowledge and receive AI-generated, synthesized answers with embedded links to related services. This product, developed under the Financial Services Commission's Innovative Financial Services designation, marks a significant milestone in using generative AI for high-accuracy, personalized in-app assistance.

- August 2024: Shinhan Bank adopted an AI-powered sentiment analysis system to bolster its defense against financial fraud and enhance customer service. The system analyzes customer voices for stress levels and specific keywords during interactions, allowing for the immediate escalation of suspected voice phishing attempts to a dedicated fraud response team.

________________________________________

South Korea AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.166 billion |

| Total Market Size in 2031 | USD 5.667 billion |

| Growth Rate | 12.35% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

South Korea AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office