Report Overview

Spain AI in Finance Highlights

Spain AI in Finance Market Size:

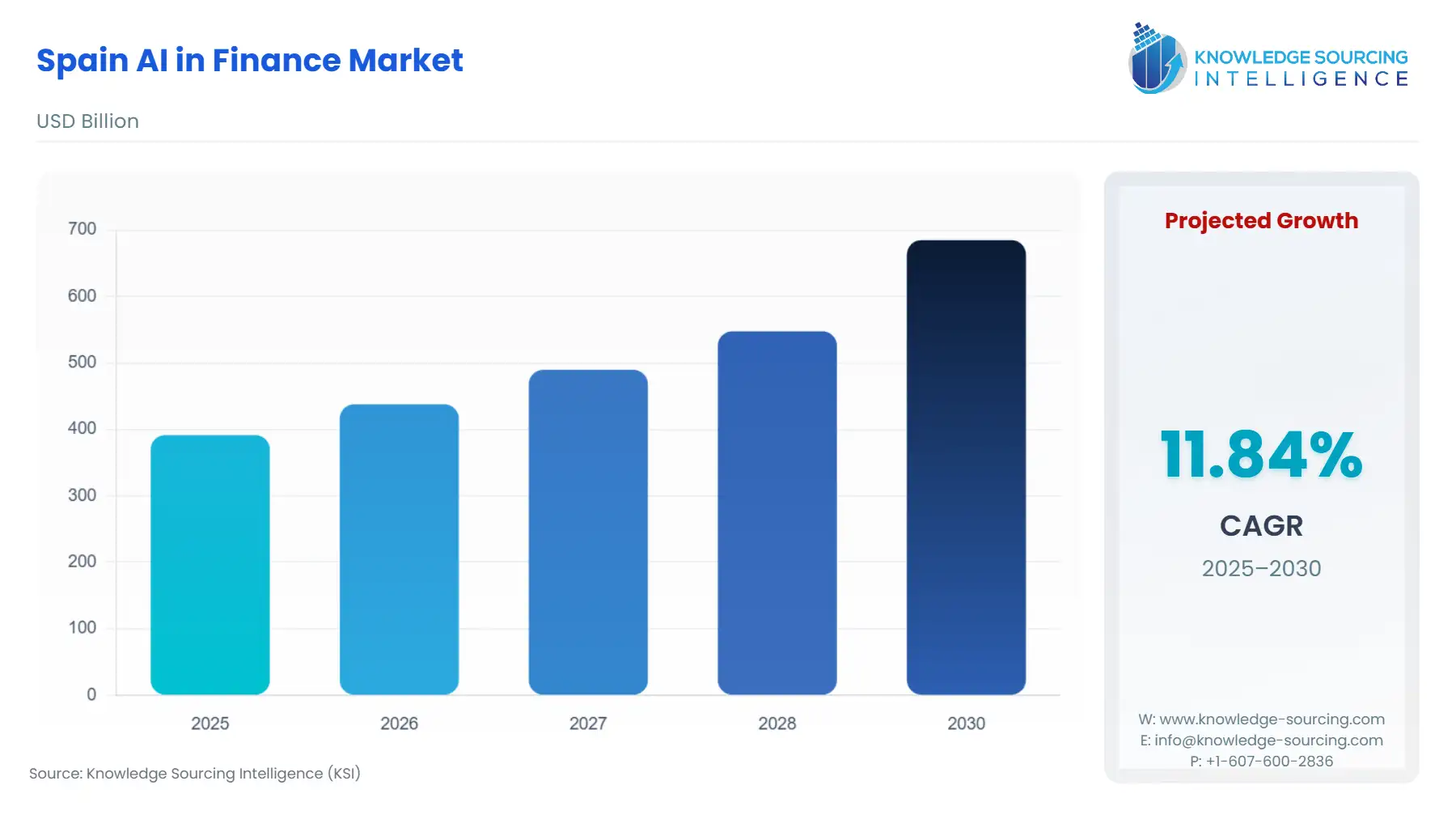

The Spain AI in Finance Market is expected to grow at a CAGR of 11.84%, rising from USD 391.531 billion in 2025 to USD 685.179 billion by 2030.

The Spanish AI in Finance market is experiencing a structural transformation, moving from early-stage experimentation to a regulatory-driven phase of mandatory, scalable integration. This shift is characterized by leading financial institutions pivoting to a "data and AI-first" strategy, recognizing the technology as an operational imperative rather than a mere efficiency tool. The market is undergoing a significant growth wave as banks and other financial institutions are doubling down on their digital transformation efforts and adopting emerging technologies to achieve greater operational efficiency, innovate, and remain competitive. A revival of the economy, increasing customer deposits, and a regulatory environment full of energy and readiness for AI are the main factors in market evolution.

The??? increase in assets under management (AUM) and client deposits at top banks, together with the expansion of digital banking channels, has resulted in large data ecosystems that are the basis for AI model training and deployment. Furthermore, public policies like the National Artificial Intelligence Strategy (ENIA) and the Spain Digital 2026 Plan are facilitating the implementation of a morally correct AI, ensuring the participation of all in the digital world, and supporting the research through which Spain is positioning itself as a technological leader in the financial ???sector.

________________________________________

Spain AI in Finance Market Overview

The??? Spanish Artificial Intelligence (AI) in Finance Market is undergoing significant growth, which is largely influenced by the fast digital transformation that is happening in the banking, insurance, and investment sectors. Spain's banks and other financial institutions are turning to AI solutions across a wide range of areas, such as streamlining operations, automating risk assessments, improving security, and offering better customer experiences through predictive analytics and tailoring financial services to individual ???customers.

The??? expansion of AI in finance in Spain is mainly powered by the government's up-to-date structures and the country-wide plans that encourage digital innovation and the responsible use of AI. Among the main points are the National Artificial Intelligence Strategy (ENIA), which is Spain's guide to the use of AI in a fair way in all sectors, and the Spain Digital 2026 Plan, which is about the digital transformation through the investment in the data-related infrastructure, cloud technologies, and AI research. Moreover, Spain's conformity with the European Union's AI Act and strict observance of the General Data Protection Regulation (GDPR) ensure transparency, accountability, and data security in AI applications in finance, thus creating trust among consumers and ???regulators.

The??? growth of managed funds in the Spanish banking sector is highly dependent on the AI-in-finance market trend. Customer deposits of BBVA for Q3 2024 have increased by 9.1% year-on-year as of the end of August 2024, mainly due to a 4.0% increase in demand deposits and a 48.7% increase in time deposits. This increase in customer funds is important for the AI-in-finance market, as larger volumes of deposits and investment instruments result in more data flows, provide scale for analytics, and create pressure for the optimisation of operational efficiency and risk ???management.

?Despite obstacles such as outdated infrastructure, expensive implementation, and data silos, the Spanish financial sector is progressively shifting towards an AI maturity level with a clear focus on explainability, adherence to regulations, and cross-border data interoperability. The future of the market remains bright, as it is financed by the growing expenditures in cloud computing, big data analytics, and AI talent development, making Spain an emerging hub for smart financial technologies within the European ???Union.

Spain's??? AI in finance landscape comprises a lively mix of the country's top banks and a trailblazing fintech company named ID Finance, along with a long list of other organizations such as CaixaBank, Newton Fintech, Multiverse Computing, Sherpa.ai, Kantox, Bnext, Fintonic, EVO Banco, Micappital, and Aplazame. The mainstay institutions of the financial sector, combined with startup ventures, through AI-enabled technology, are giving a new shape to the digital transformation of the Spanish banking industry. By using AI to automate data analytics, customer personalization, risk management, and credit, the traditional banking players are also competing with fintech firms. It seems that CaixaBank and EVO Banco are turning to AI to make their core banking operations more efficient and to gain predictive insights, while companies like Multiverse Computing and Sherpa.ai want to be the first to use quantum AI for financial modeling and ethical AI for ???compliance.

Spain AI in Finance Market Analysis

- Growth Drivers

The imperative for operational cost-efficiency and enhanced risk management creates a direct and immediate demand for AI solutions. Competitive pressures compel financial institutions to automate repetitive back-office tasks, such as loan processing and compliance reporting, where AI can achieve substantial cost reduction, thereby increasing demand for Machine Learning and Natural Language Processing (NLP) tools. Furthermore, escalating fraud rates in the financial sector accelerate demand for AI-driven fraud detection systems and predictive analytics. The regulatory environment acts as a catalyst; specifically, the EU's Digital Operational Resilience Act (DORA) mandates robust digital security and resilience, necessitating investment in AI-powered tools for continuous threat monitoring and immediate breach analysis, directly pulling demand for specialized AI infrastructure services.

- Strong Government and Regulatory Push for AI Integration

One??? of the most significant factors leading to the Spanish AI in the Finance Market’s growth is the strong government and regulatory push for AI integration. Spain's government has been very active in planning and outlining a clear path for the use of artificial intelligence in different sectors of the economy, including finance, through the Spanish National Artificial Intelligence Strategy (Estrategia Nacional de Inteligencia Artificial - ENIA). This policy framework, in harmony with the EU Digital Europe Programme and the European Artificial Intelligence Act, is intended to position Spain as a regional leader regarding responsible AI innovations. The government has invested heavily in various digital transformation projects through the ENIA program. As a result, it has provided several types of support, such as grants for AI research, cloud infrastructure modernization, and fintech acceleration, among ???others.

Since??? 2020, AI-related investments in Spain have been worth more than 2 billion euros. With this amount, Spain ranks as the 5th country in Europe with the highest volume of AI investments. In 2024 alone, money raised for AI projects went beyond the 300 million euros ???mark.

- Challenges and Opportunities

The primary market challenge is the significant digital skills gap, which constrains the ability of Spanish financial firms to internally develop and deploy complex AI models, particularly generative AI, thereby limiting the pace of full-scale adoption. Furthermore, the high upfront costs associated with AI infrastructure and specialized talent pose a prohibitive constraint for smaller financial entities and regional banks, concentrating market expansion among the largest institutions. This constraint, however, simultaneously creates an immense opportunity for Cloud-based, 'AI-as-a-Service' models from global providers and specialized Spanish FinTechs, which lower the entry barrier. The uncertainty surrounding the final compliance requirements of the EU AI Act presents an opportunity, driving anticipatory demand for consulting and technical compliance solutions that specialize in auditing and stress-testing AI models for fairness, transparency, and high-risk classification adherence.

- Supply Chain Analysis

The 'supply chain' for AI in Finance, being a service, centers on three critical non-physical assets: proprietary financial data, cloud computing infrastructure, and specialized talent. The scarcity of high-quality, normalized, and securely governed proprietary financial data is the primary limiting factor, as model training relies heavily on clean, internal datasets. The foundational computing infrastructure is overwhelmingly dependent on hyperscale cloud providers (e.g., AWS, Microsoft Azure, Google Cloud), which serve as the indispensable production hubs for Large Language Models (LLMs) and advanced Machine Learning operations. This external dependency creates logistical complexities around data sovereignty, cross-border data transfer, and vendor lock-in, which DORA seeks to mitigate. Finally, the supply of domestic AI engineering and data science talent constitutes a major dependency, with Spanish universities and specialized training programs struggling to meet the escalating demand from the incumbent banking sector.

Spain AI in Finance Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union (EU) |

Digital Operational Resilience Act (DORA) |

Reinforces demand for AI-driven risk management and cybersecurity platforms. Mandates that financial entities manage ICT-related risks from third parties (Cloud/AI providers), leading to a demand for advanced vendor risk management solutions. |

|

European Union (EU) |

EU AI Act (Forthcoming) |

Creates immediate, high-assurance demand for high-risk AI governance tools. Systems used in credit scoring or risk assessment will face stringent transparency, robustness, and human oversight requirements, compelling financial firms to invest in AI Model Auditing and Explainable AI (XAI) technologies. |

|

Spain |

Agencia Española de Supervisión de la Inteligencia Artificial (AESIA) |

Serves as the national supervisory authority, setting a precedent for 'good practices' and trust in AI. This role is expected to generate demand for local conformity assessment bodies and national Sandboxes, providing a controlled environment for FinTechs to test high-risk applications before full deployment. |

________________________________________

Spain AI in Finance Market Segment Analysis

- By Type: Natural Language Processing (NLP)

The NLP segment in the Spanish AI in Finance market is primarily driven by the critical need to process unstructured data and enhance direct customer interaction efficiency. Financial institutions face an overwhelming volume of text-based data—from internal compliance documents, complex legal contracts, and external market news, to millions of customer emails and chat transcripts. NLP technologies, including classification and named entity recognition, are in demand because they can automate the extraction of key terms, sentiment analysis, and contractual obligations from these sources, directly addressing the operational constraint of manual data review. In the Front Office, the use of conversational AI (chatbots and voice assistants) built on NLP reduces the burden on human customer service agents, enabling 24/7 service and improving customer experience, a key performance indicator for Spanish banks seeking to maintain digital service leadership. This technology directly satisfies the demand for immediate, personalized communication at scale.

- By Application: Back Office

The Back Office segment is a primary growth center for AI in the Spanish financial system, driven by the structural requirement for precise, high-volume process automation in compliance and risk functions. The regulatory environment, specifically the continuous legislative load stemming from Brussels (e.g., MiFID II, Anti-Money Laundering directives), forces banks to dedicate substantial resources to regulatory adherence. AI in the Back Office addresses this by automating Know Your Customer (KYC) processes, transaction monitoring for Anti-Money Laundering (AML), and regulatory reporting through advanced anomaly detection and Robotic Process Automation (RPA) integrated with Machine Learning. The explicit requirement is for tools that not only increase speed but also guarantee auditability and precision, directly mitigating the financial and reputational risks of non-compliance. This segment's growth is therefore directly correlated with the increasing regulatory complexity and the executive mandate for cost-efficient compliance operations.

- By Deployment Model: Cloud

The Spanish AI in Finance Market is segmented by deployment model into on-premise and cloud. The Spanish AI in Finance market cloud deployment is experiencing significant growth as it allows financial organizations to apply AI technologies, such as machine learning, natural language processing, and predictive analytics, without the burden of on-premises hardware expenditure. This shift is particularly evident in banking areas of fraud detection, risk management, personalized banking, and algorithmic trading, which require instant data processing. This trend aligns with the country’s digital agenda supported by the EU's AI regulations and national strategies like the Digital Spain 2026 plan.

Moreover, major cloud companies and specialized cloud players are investing heavily in Spain, enabling banks to access GPU clusters and automated AI services quickly and affordably. This investment fosters the development of user-friendly generative models for the finance sector, real-time risk scoring, and large-scale analytics. For instance, in June 2024, Oracle made an announcement that it is investing more than $1 billion to set up a third Oracle Cloud region in collaboration with Telefónica España in Madrid. This facility is designed to provide Spanish companies with secure, low-latency access to Oracle Cloud Infrastructure, facilitating compliance with EU digital and financial regulations. The range of applications includes OCI Generative AI, Autonomous Database, and MySQL HeatWave. Oracle plans to invest another $1 billion over the next decade, with the project expected to attract €6 billion in cloud industry investment in the country.

Furthermore, the cloud infrastructure enables finance departments like banks to quickly generate AI setups, conduct tests, and transfer models to production. This accelarates the commercialization of personalization, fraud detection, AML, chatbots, and other applications of AI technologies. For example, in July 2025, leveraging Google Cloud AI, CaixaBank, a Spanish finance group, unveiled a generative AI agent within its mobile banking application that allowed customers to interact through conversation to see, compare, and request products.

- By User: Corporate Finance

Based on the type, the Spanish AI in the finance market is segmented into personal finance, consumer finance, and corporate finance. The technological advancements in Spain, followed by ongoing efforts to promote digital automation, have transformed the corporate environment in the country. The emphasis to bolster “Industry 4.0” has led to the establishment of national strategies, culminating in approval of the “Artificial Intelligence (AI) Strategy 2024” by the Spanish government in May 2024. This framework aims to facilitate the AI adoption across various corporate activities, including finance, where it assists in fraud detection and risk management.

The growing transition towards task automation, aimed at optimizing productivity and reducing costs, has further accelerated the preference for next-generation concepts such as Artificial Intelligence (AI). According to the data provided by Eurostat, in 2024, the percentage of Spanish firms using Artificial Intelligence (AI) technologies reached 11.31%, reflecting a 2.13% growth over the percentage share recorded in 2023.

According to the Bank of Spain’s November 2024 research study “Adoption of Artificial Intelligence in Spanish Firms” it was stated that from the 6,300 firms surveyed, nearly 20% were using Artificial Intelligence (AI) in their various operations. This rise in AI adoption among Spanish firms provides new growth prospect for its usage in financial operations, enabling better tracking of transactions.

Additionally, the Spanish firms are actively enhancing their digital infrastructure with various talent and skill development programs aimed at upskilling their working. Moreover, major tech-giants are investing in Spanish market to establish their AI centres. For instance, in June 2024, Oracle Corporation announced investment of USD 1 billion to establish third cloud region in Madrid that will enable Spanish firms, including those in the financial sector to migrate their workload to OCI (Oracle Cloud Infrastructure), thereby modernizing their applications via AI and data analytics.

________________________________________

Spain AI in Finance Market Competitive Environment and Analysis

The Spanish AI in Finance competitive landscape is dominated by the incumbent banking giants, which possess the requisite capital and proprietary data sets for large-scale AI deployment. Their strategy is a mix of massive internal development and high-profile external partnerships. FinTechs and AI pure-plays focus on niche applications (e.g., wealth management, specific fraud tools) or enabling technologies (e.g., specialized NLP or model governance).

- Banco Santander

Banco Santander has cemented its strategic positioning by adopting an aggressive "data & AI-first" global strategy, focusing on integrating AI across its entire value chain. A core element of this strategy is a landmark agreement signed with OpenAI (August 2025), which aims to accelerate the entity's transformation into an "AI-native bank." The collaboration focuses on embedding Generative AI across all business areas, including product management, credit risk evaluation, and marketing. This move is designed to enhance internal productivity and create a competitive edge in personalized product offerings by leveraging LLMs to analyze customer data and market trends more effectively than competitors.

- BBVA

BBVA's strategic positioning centres on leveraging its in-house technological prowess to automate operations and radically transform the customer experience across its global footprint. The bank has pursued a dual strategy of construction and enablement, empowering its employees with AI tools. As of 2024, BBVA reported significant internal adoption, with almost 90% of licensed personnel using AI tools weekly and the creation of approximately 3,500 internal chatbots, focusing on topics like data protection and mortgage concession. This internal, bottom-up approach to AI adoption, coupled with the launch of a new strategic cycle in 2025 focusing on generative AI for customer service transformation (e.g., eliminating IVR complexity), demonstrates a drive for maximum operational efficiency and radical client experience improvement.

________________________________________

Spain AI in Finance Market Developments

- August 2025: Banco Santander signed a strategic agreement with OpenAI, publicly stating the goal of becoming an "AI-native bank." The partnership is designed to integrate generative AI across all core business lines, including risk management and customer relationship platforms, with a focus on accelerating internal productivity gains and delivering highly personalized services. The official announcement underscores the bank's commitment to training its entire workforce in AI fundamentals, ensuring a group-wide capability shift.

- February 2025: The Banco de España and the Barcelona Supercomputing Center (BSC) signed a collaboration agreement to jointly advance the application of Artificial Intelligence within the financial system. This institutional cooperation aims to explore high-performance computing capabilities to support financial stability, systemic risk modeling, and supervisory tasks, establishing a public-sector foundation for responsible and powerful AI development in the Spanish financial domain.

- 2025: CaixaBank launched a generative AI agent based on Google Cloud technology into its mobile banking app. The agent allows customers to ask questions, compare products, and receive personalized suggestions, specifically launched for card products, to approximately 200,000 customers.

________________________________________

Spain AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 391.531 billion |

| Total Market Size in 2031 | USD 685.179 billion |

| Growth Rate | 11.84% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

Spain AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office