Report Overview

Automatic Mounter Wafer Equipment Highlights

Automatic Mounter Wafer Equipment Market Size:

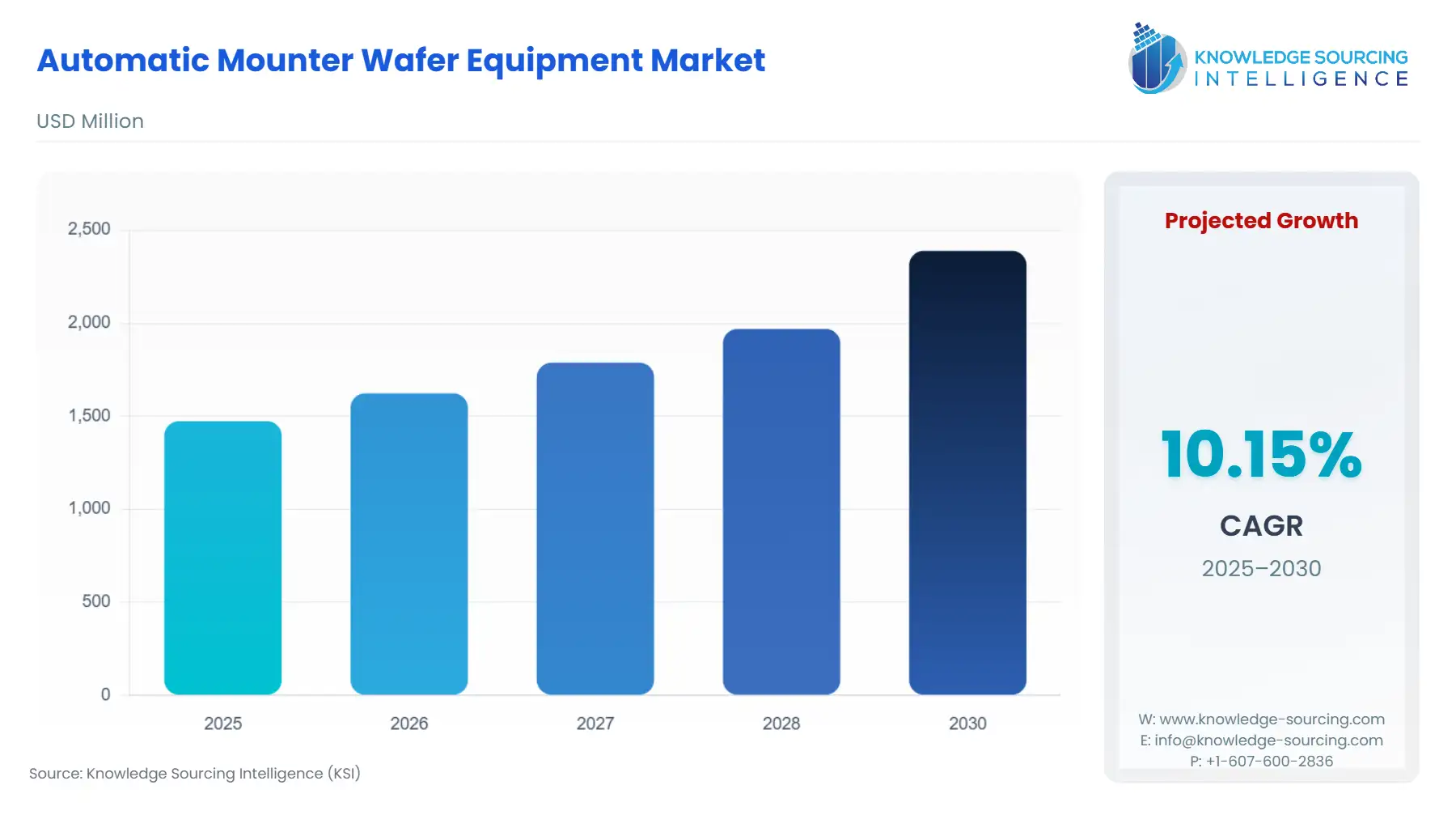

The automatic mounter wafer equipment market, growing at a 10.15% CAGR, is expected to grow to USD 2.389 billion in 2030 from USD 1.473 billion in 2025.

The automatic mounter wafer is a mounting device designed to automatically clip down wafers and guarantees extremely safe operation while performing thin die wafer fabrication processes in 3D IC and wafer-level packaging technologies. Bolstering growth in consumer electronics and the rapid spread of sophisticated electronic controls and semiconductor devices are driving the market growth for such equipment. The adoption of cutting-edge semiconductor devices created through automatic mounter wafer fabrication has increased significantly because of industry 4.0 growth, thereby simultaneously boosting the automatic mounter wafer equipment market growth during the forecasted period.

Automatic Mounter Wafer Equipment Market Drivers:

- The rising semiconductor industry will boost the market growth

The demand for faster, better, and more affordable electronic devices forces component manufacturers to upgrade their products constantly, which is increasing the demand for automatic mounter wafer equipment. The wafer mounting procedure is carried out as part of the fabrication of semiconductors during the die preparation of a wafer and there is an increasing tendency towards miniaturization in semiconductors, and as the demand for semiconductors increases, there will be a rise in market growth. According to World Semiconductor Trade Statistics, the global semiconductor sector sales were estimated to have reached USD 43.6 billion in May 2021, up from USD 41.9 billion in April 2021 respectively. As per the same source, it projects that the global semiconductor market will grow by 5.1% from 2022 to hit US$ 680 billion in 2023. As the sales and market of semiconductors grow the demand for fabrication by the mounter wafer equipment will also increase which will boost the automatic mounter wafer equipment market growth.

- The increase in IOT adoption will boost the automatic mounter wafer equipment market growth.

Semiconductor device makers prefer automatic wafer mounting equipment to meet the increasing demand for chips in new applications such as IoT emergence. Owing to the need for sensors, and microcontrollers that can help IOT applications retrieve real-time data and other components, the development of the Internet of things has resulted in the rise of silicon wafers and integrated circuits. The rising investment in smart city projects will increase the demand for IOT which will boost the automatic mounter wafer equipment market growth significantly. For instance, the Indian government is spending USD 1 billion to build 100 smart cities, which are anticipated to be a crucial factor in the spread of IoT in this area. In July 2021, Saudi Arabia started developing four major smart cities, NEOM, Qiddiya, the Red Sea Project, and Amaala, each with multibillion-dollar construction contracts, The largest of these developments, according to revealed designs, is NEOM, a planned USD 500 billion megacities that would include a zero-carbon hyper-connected metropolis. The government support for the proliferation of IoT in key sectors, combined with mass internet adoption, is driving IoT adoption, thereby increasing the growth of the automatic mounter wafer equipment market.

Automatic Mounter Wafer Equipment Market Geographical Outlook:

- During the forecast period, the Asia-Pacific region is expected to dominate the market

The two main factors propelling the growth of the automatic mounter wafer equipment market in the Asia-Pacific are the low cost of production and the rising number of production facilities in the electronics industry. For instance, the State Council of the People's Republic of China reports that in the two months from January to February 2022, the added value of the country's main electronics makers increased by 12.7% year over year, as opposed to 7.5% growth experienced by the entire industrial sector of the country. The Asia-Pacific region will continue to rule this market primarily due to its flourishing semiconductor manufacturing sector. According to PIB reports, in February 2022, the Indian semiconductors market was valued at USD 15 billion in 2020, and it is predicted to be around USD 63 billion by 2026. These developments in the semiconductors and electronics industry will boost the automatic mounter wafer equipment market growth in the Asia Pacific region during the forecasted period.

Automatic Mounter Wafer Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.473 billion |

| Total Market Size in 2031 | USD 2.389 billion |

| Growth Rate | 10.15% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Wafer Size, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automatic Mounter Wafer Equipment Market Segmentation:

- AUTOMATIC MOUNTER WAFER EQUIPMENT MARKET BY WAFER SIZE

- 150mm

- 200mm

- 300mm

- Others

- AUTOMATIC MOUNTER WAFER EQUIPMENT MARKET BY APPLICATION

- Dicing

- Protection

- Die Attach Films

- AUTOMATIC MOUNTER WAFER EQUIPMENT MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America