Report Overview

Automotive Digital Cockpit Market Highlights

Automotive Digital Cockpit Market Size:

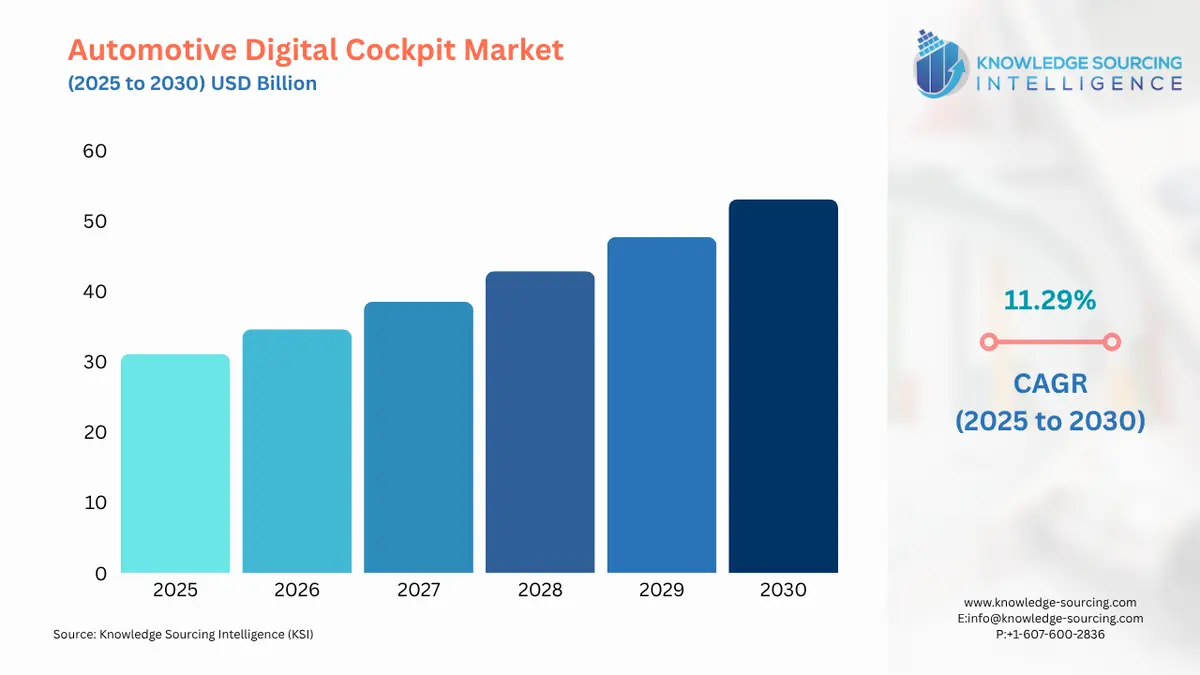

The Automotive Digital Cockpit Market is expected to grow at a CAGR of 11.29%, reaching USD 53.098 billion in 2030 from USD 31.102 billion in 2025.

The automotive digital cockpit market is experiencing a fundamental transformation, driven by the convergence of consumer electronics, software-defined vehicles, and advanced safety systems. Once a collection of disparate displays and controls, the vehicle cockpit is now a unified, intelligent, and highly connected digital hub. This evolution moves beyond simple digitization to the creation of immersive, multi-display interfaces that manage a vehicle's core functions, from vehicle status and navigation to entertainment and driver assistance. This paradigm shift directly impacts the demand for sophisticated hardware components, complex software platforms, and the specialized services required for their integration.

Automotive Digital Cockpit Market Analysis:

- Growth Drivers

The primary catalyst for demand in the automotive digital cockpit market is the consumer's increasing expectation for a technology-rich, user-centric vehicle experience. This growth is not confined to luxury segments but is now a standard feature in mid-range and even entry-level vehicles. The integration of high-resolution displays, such as liquid-crystal displays (LCD) and organic light-emitting diode (OLED) screens, directly addresses this demand by providing a more intuitive and visually appealing interface for accessing information. The transition to digital instrument clusters, for instance, allows for customizable layouts that can prioritize navigation data, media information, or ADAS alerts, giving the driver a personalized experience and reducing information clutter.

Another significant driver is the proliferation of Advanced Driver-Assistance Systems (ADAS). Digital cockpits serve as the primary interface for a vehicle's ADAS features, such as lane-keeping assistance, adaptive cruise control, and real-time alerts. The necessity for these safety and convenience features is increasing globally, and the digital cockpit is the mechanism through which they are effectively communicated to the driver. Head-up displays (HUDs) are a clear example of this dynamic, as they project critical data directly onto the windshield, allowing drivers to process information without taking their eyes off the road. The rise of electric vehicles (EVs) further amplifies demand. EVs require a new set of data to be presented to the driver, including battery state of charge, estimated range, and energy flow. The digital cockpit is the ideal platform for this, offering a real-time, dynamic display of information that is crucial for managing range anxiety and optimizing vehicle performance.

- Challenges and Opportunities

The automotive digital cockpit market is not without its significant challenges, which create both constraints and new opportunities. A primary challenge is the immense complexity of integrating multiple hardware and software systems from various suppliers into a single, cohesive cockpit platform. This complexity can lead to integration hurdles, extended development timelines, and increased costs for original equipment manufacturers (OEMs). The high cost of advanced components, such as high-resolution displays and powerful processors, can also increase the final price of the vehicle, which may serve as a restraint on demand in price-sensitive markets. Furthermore, the increasing connectivity of these systems makes them vulnerable to cybersecurity threats, creating an imperative for robust security protocols and software-over-the-air (SOTA) update capabilities to protect vehicle and user data.

These challenges, however, present key opportunities for market growth and differentiation. The need for seamless integration has driven the development of centralized cockpit domain controllers (CDCs), which consolidate the functions of multiple electronic control units (ECUs) into a single, powerful unit. This architectural shift streamlines the supply chain, reduces component count, and facilitates faster integration of new features. The cybersecurity imperative has created a new segment of demand for specialized software and security services. Companies that can provide secure, certified, and updatable platforms gain a significant competitive advantage. The high cost of traditional components is also an opportunity for innovation in display technology, with manufacturers exploring new materials and manufacturing processes to reduce costs while maintaining performance. Finally, the move towards a software-defined vehicle architecture allows for the monetization of new features through subscription services and in-app purchases, creating new revenue streams for OEMs and their suppliers and further incentivizing the development of advanced digital cockpits.

- Supply Chain Analysis

The supply chain for the automotive digital cockpit market is a complex, multi-tiered ecosystem. It begins with Tier-2 and Tier-3 suppliers of foundational components, such as semiconductor manufacturers (e.g., NVIDIA, Qualcomm), display panel makers (e.g., LG Display, BOE Technology), and specialized sensor companies. These components are then supplied to Tier-1 companies that design, integrate, and manufacture the complete digital cockpit systems. Key production hubs for these systems are concentrated in the Asia-Pacific, particularly in China, South Korea, and Taiwan, which have a strong presence in semiconductor and display manufacturing.

Logistical complexities include the management of a high number of interconnected components, a high degree of technological dependencies, and the need for just-in-time delivery to automotive assembly lines. The supply chain is highly sensitive to disruptions, as seen during the global semiconductor shortages that significantly impacted vehicle production. The dependence on a limited number of high-end semiconductor manufacturers for powerful processors is a key vulnerability. The integration of advanced features like artificial intelligence (AI) and machine learning requires close collaboration between hardware and software providers, making the supply chain highly interdependent. The growing trend of vertical integration by some OEMs, who are now developing their own software and even silicon, is beginning to reshape these traditional supply chain dynamics.

- Government Regulations

Government regulations on vehicle safety and driver distraction are a critical force shaping the automotive digital cockpit market. While not always directly mandating digital cockpits, these regulations indirectly increase their demand by requiring the integration of features that are best managed through a digital interface. The focus on reducing driver distraction, for instance, has led to regulations that govern the placement and functionality of in-vehicle displays. This compels manufacturers to design user interfaces that are intuitive and can be operated with minimal attention.

- United States: National Highway Traffic Safety Administration (NHTSA) Driver Distraction Guidelines

NHTSA guidelines encourage automakers to design in-vehicle electronic devices that are easy and safe to use. While voluntary, these guidelines influence OEM design choices, leading to an increased demand for integrated and intuitive digital cockpits that can reduce the risk of driver distraction, particularly through features like voice-activated controls and consolidated display layouts. - European Union: General Safety Regulation (GSR) and Euro NCAP ratings

The EU's General Safety Regulation mandates certain safety features in new vehicles, which often rely on a digital cockpit for effective operation. Additionally, Euro NCAP's vehicle safety rating system places a growing emphasis on features like driver monitoring systems (DMS). This directly increases demand for digital cockpits that integrate DMS to enhance driver alertness and safety, thereby improving a vehicle's safety rating and marketability. - China: National standards for intelligent connected vehicles (ICV)

China's regulatory push for intelligent connected vehicles (ICVs) is a major catalyst for the automotive digital cockpit market. These standards promote the integration of advanced features such as automated driving functions and vehicle-to-everything (V2X) communication, which are managed and displayed through the digital cockpit. This policy environment creates a robust and rapidly growing domestic market for advanced digital cockpit technologies.

Automotive Digital Cockpit Market Segment Analysis:

- By Technology: Head-up Display (HUD)

The head-up display (HUD) segment is a powerful demand driver in the automotive digital cockpit market, as it addresses the critical imperative of driver safety by minimizing distraction. A HUD projects vital information, such as vehicle speed, navigation directions, and ADAS warnings, directly onto the driver's windshield or a small, transparent screen. This allows the driver to maintain focus on the road ahead rather than diverting their gaze to a dashboard or center stack display. The necessity for HUD technology is directly propelled by its ability to enhance situational awareness. As ADAS features become more complex and standard, the need to communicate real-time alerts without overwhelming the driver is paramount. HUDs solve this challenge by providing a clear, contextual, and unobtrusive presentation of information. The technology is also a significant selling point for OEMs, who position it as a premium safety and convenience feature. The necessity is increasing from both luxury and mid-segment vehicles, reflecting a broader consumer trend toward advanced safety technologies.

- By Vehicle Type: Commercial Vehicle

The commercial vehicle segment is an emerging and high-growth area for the automotive digital cockpit market. While historically lagging behind passenger cars in adopting advanced in-cabin technology, commercial vehicles are now a key source of demand, driven by a different set of imperatives. For fleet operators, the digital cockpit is a tool for operational efficiency and safety management. It integrates telematics, navigation, fleet management software, and driver monitoring systems (DMS) into a single interface. This consolidation enables real-time tracking of vehicle performance, route optimization, and driver behavior analysis, directly leading to lower fuel consumption and improved safety records. The market growth is further propelled by regulatory requirements for Electronic Logging Devices (ELDs) and other safety and compliance systems. The digital cockpit serves as the ideal platform for these functions, simplifying the driver's interface and ensuring regulatory adherence. The segment's growth is focused on rugged, reliable, and highly functional systems that can withstand the demands of professional use while providing a clear return on investment through enhanced fleet management capabilities.

Automotive Digital Cockpit Market Geographical Analysis:

- US Market Analysis: The US automotive digital cockpit market is a mature and competitive landscape, with demand driven by consumer preference for large, high-resolution displays and seamless smartphone integration. The market's growth is fueled by the rapid adoption of new vehicle technologies, including ADAS and electric vehicles (EVs). US consumers view digital cockpits as a key differentiator and a measure of a vehicle's modernity. The need for infotainment features, such as music streaming, in-car gaming, and video conferencing, is a unique characteristic of the US market. The regulatory environment, particularly with respect to driver distraction guidelines from the NHTSA, influences design choices, compelling OEMs to prioritize intuitive interfaces. The presence of major technology players and a strong ecosystem of Tier-1 suppliers makes the US a significant hub for both innovation and consumption.

- Brazil Market Analysis: Brazil's automotive digital cockpit market is in an earlier phase of adoption compared to more developed economies. The market expansion is primarily concentrated in the premium and luxury segments of the market. The country's economic volatility and price-sensitive consumer base are key factors influencing the market's trajectory. However, the automotive industry in Brazil is undergoing modernization, with OEMs increasingly offering digital instrument clusters and advanced infotainment systems in new vehicle models. The desire for connectivity and safety features further fuels the market expansion. As vehicle production in the country continues to recover and consumer incomes rise, the demand for digital cockpits is expected to expand into the mid-range vehicle segments. Local manufacturing and sourcing are key competitive factors, with companies that can provide cost-effective solutions for the domestic market gaining a significant advantage.

- Germany Market Analysis: Germany is a global leader in the development and manufacturing of premium automobiles and, consequently, a critical market for digital cockpits. The German market is a function of a strong focus on engineering excellence, safety, and a premium user experience. German OEMs are at the forefront of integrating highly complex, multi-display digital cockpits that manage a vast array of vehicle functions. This growth is driven by a culture of technological innovation and a strong emphasis on performance and luxury. The German market is a key proving ground for new technologies like augmented reality (AR) HUDs and gesture controls. Regulatory pressures, particularly from Euro NCAP, directly incentivize the integration of advanced safety features, such as DMS, which increases demand for sophisticated digital cockpits that can seamlessly integrate these functions.

- Saudi Arabia Market Analysis: The automotive digital cockpit market in Saudi Arabia is a nascent but rapidly growing sector, with demand driven by a young, tech-savvy population and a preference for luxury and high-performance vehicles. The country's economic strength, fueled by its energy sector, allows consumers to afford vehicles with advanced technology features. The government's Vision 2030 initiative, which promotes economic diversification and technological advancement, is also a catalyst for demand. The demand for digital cockpits is concentrated in the premium vehicle segment, with a focus on connectivity, infotainment, and personalized user experiences. The market's future growth is tied to the expansion of domestic vehicle ownership and the continued import of technology-rich vehicles from global manufacturers.

- Japan Market Analysis: Japan's automotive digital cockpit market is a mature and highly innovative landscape. A dual focus on safety and technological sophistication drives the market. Japanese OEMs are known for their meticulous engineering and their ability to integrate advanced features that are both reliable and intuitive. The necessity is not just for cutting-edge technology but for a seamless and integrated user experience. The market is a key hub for the development of new display technologies and human-machine interfaces (HMIs), including sophisticated voice recognition and gesture controls. The country's aging population and focus on driver assistance systems for elderly drivers also contribute to the demand for digital cockpits that can enhance safety and ease of use. The market's competitive environment is shaped by the strong presence of major domestic Tier-1 suppliers, who are at the forefront of developing new solutions.

Automotive Digital Cockpit Market Competitive Analysis:

The automotive digital cockpit market is highly competitive, dominated by a few major Tier-1 suppliers that provide comprehensive hardware and software solutions to global OEMs. Competition is based on technological innovation, scale, and the ability to integrate complex systems. The market is also seeing new entrants from the consumer electronics and software industries, which are bringing new expertise and challenging the traditional automotive supply chain.

- Visteon Corporation: Visteon has strategically positioned itself as a pure-play automotive cockpit electronics supplier. The company's competitive edge is its deep expertise in developing and integrating a full range of digital cockpit products, from digital instrument clusters and center stack displays to HUDs. A key element of its strategy is the development of SmartCore™, a domain controller that consolidates multiple cockpit functions onto a single system-on-a-chip (SoC). This approach directly addresses the OEM's need for reduced complexity and cost, driving demand for Visteon's integrated solutions. The company's focus on software-defined cockpits allows it to offer a flexible and scalable platform that can be tailored to various vehicle models and features.

- Continental AG: Continental is a global leader in automotive technology, with a strong position in the digital cockpit market. The company’s competitive strategy is centered on its comprehensive portfolio that spans from foundational hardware to advanced software and services. Continental's Cockpit High-Performance Computer (HPC) is a prime example of its technological leadership, integrating infotainment, instrument cluster, and ADAS functions into a single unit. This solution drives demand by providing OEMs with a powerful, pre-integrated platform that accelerates the development cycle. Continental's acquisition of Elektrobit further strengthens its software capabilities, allowing it to offer end-to-end solutions that are crucial for success in the software-defined vehicle era.

- NVIDIA Corporation: While not a traditional Tier-1 supplier, NVIDIA has emerged as a formidable force in the automotive digital cockpit market. The company's strategic positioning is focused on providing powerful, AI-enabled computing platforms for in-vehicle systems. Its DRIVE platform is used by a growing number of automakers to power infotainment and digital cockpit systems. NVIDIA's competitive advantage lies in its leadership in GPU technology and AI, which allows it to provide the high-performance computing necessary for complex graphics, in-car gaming, and advanced driver assistance. The demand for NVIDIA's solutions is driven by OEMs who are seeking to create an immersive, software-defined vehicle experience that rivals consumer electronics. The company's partnerships with major automakers demonstrate its growing influence on the future of vehicle architecture.

Automotive Digital Cockpit Market Developments:

- August 2025: Continental announced the sale of its Original Equipment Solutions business area, demonstrating a strategic move to streamline its portfolio and focus on core technologies. This divestiture allows the company to reallocate resources to high-growth areas such as digital cockpits, autonomous driving, and software development, which will be central to its future growth strategy.

- June 2025: Visteon announced a new high-resolution camera and backlight unit manufacturing facility in India, expanding its capacity for key components of the digital cockpit. This capacity addition is a direct response to the increasing demand for advanced displays and safety features in a rapidly growing regional market.

- April 2025: Visteon and Qualcomm Technologies announced a collaboration to redefine the next-generation, AI-based intelligent cockpit experience. This partnership leverages Qualcomm's Snapdragon Digital Cockpit platforms and Visteon's SmartCore™ to create a unified and scalable cockpit solution, directly impacting demand by offering OEMs an integrated, high-performance platform for future vehicle models.

Automotive Digital Cockpit Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Digital Cockpit Market Size in 2025 | USD 31.102 billion |

| Automotive Digital Cockpit Market Size in 2030 | USD 53.098 billion |

| Growth Rate | 11.29% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive Digital Cockpit Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Digital Cockpit Market Segmentation:

- By Technology

- Digital Instrument Cluster

- Head-up Display (HUD)

- Center Stack Display

- Driver Monitoring System (DMS)

- Others

- By Vehicle Type

- Passenger Car

- Commercial Vehicle

- By Application

- Infotainment

- Navigation

- Safety & Security

- Others

- By Component

- Hardware

- Software

- Services

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa