Report Overview

Automotive Imaging Sensors Market Highlights

Automotive Imaging Sensors Market Size:

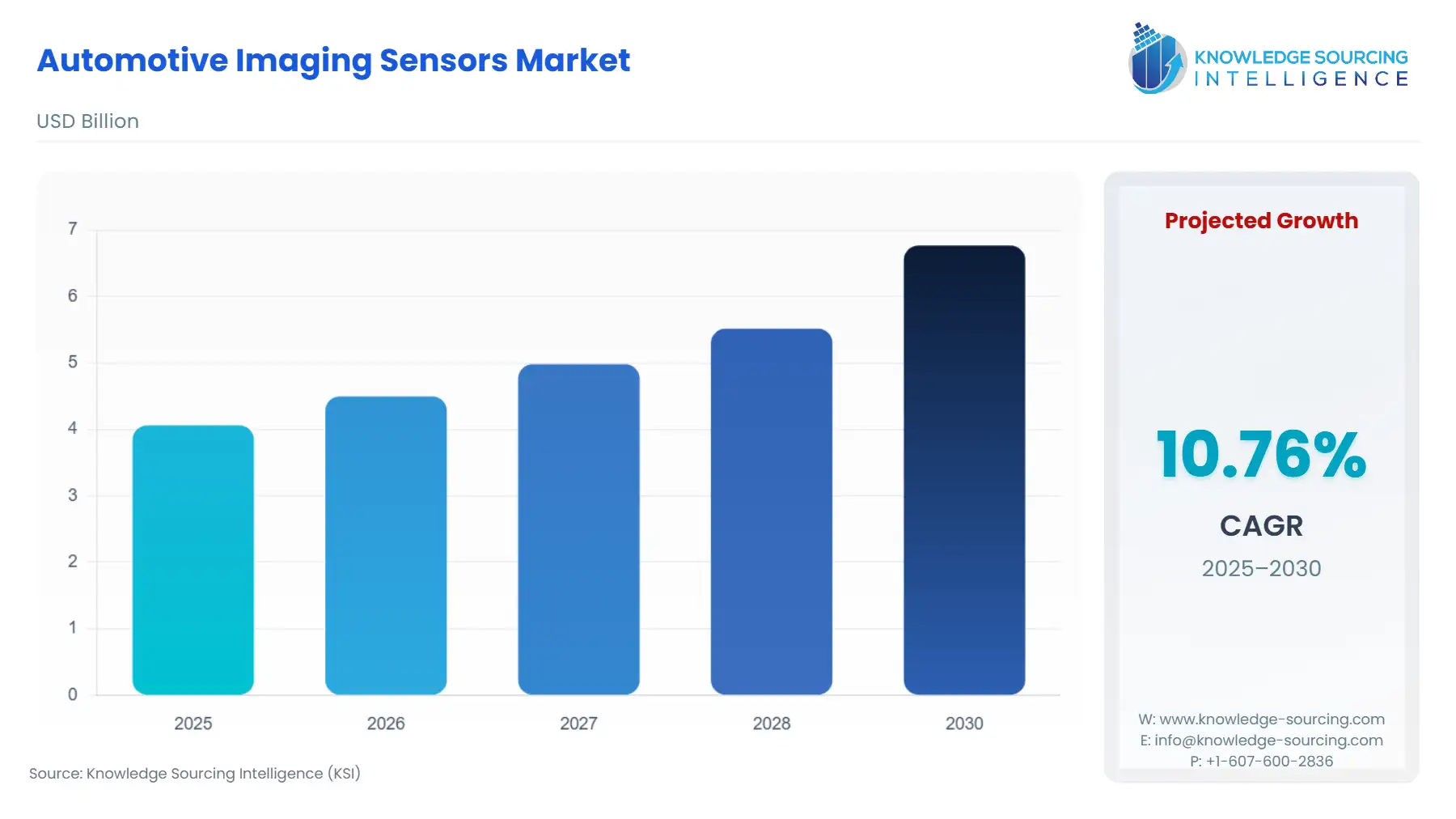

The automotive imaging sensors market is expected to grow from USD 4.061 billion in 2025 to USD 6.769 billion in 2030, at a CAGR of 10.76%.

The Global Automotive Imaging Sensors Market serves as a foundational component in the automotive industry's irreversible shift toward software-defined and automated mobility. These highly specialised electronic components, predominantly based on Complementary Metal-Oxide-Semiconductor (CMOS) technology, capture visual data for interpretation by on-board Electronic Control Units (ECUs) and Artificial Intelligence (AI) algorithms. Their function extends across a spectrum of applications, ranging from basic rear-view cameras to the complex, high-reliability perception stacks required for Level 3 and Level 4 autonomous driving functions.

The market dynamics are not merely evolutionary but are being fundamentally redefined by a combination of stringent global safety legislation, rapid technological convergence, and significant geopolitical factors affecting the semiconductor supply chain. This confluence of forces elevates the imaging sensor from a mere component to a critical safety and functional imperative, necessitating robust, verifiable, and scalable supply mechanisms. The subsequent analysis dissects these core drivers, challenges, and regional variations impacting the trajectory of market demand.

Automotive Imaging Sensors Market Analysis

- Growth Drivers

Regulatory compulsion and sensor fusion architectures propel demand. The EU’s General Safety Regulation (GSR) mandates multiple driver assistance features for all new vehicle types, directly requiring a minimum number of camera-based systems for compliance, thereby creating an immediate, non-discretionary demand floor. Furthermore, the increasing adoption of L2+ and L3 autonomous systems necessitates dense sensor stacks where cameras provide the highest fidelity and most context-rich data for object classification, pushing average sensor content per vehicle higher. The threat of proposed US tariffs on Chinese-made electronic components, including up to 100% on certain imported auto parts, is now a global factor. Automakers are reacting by accelerating the certification and design-in of sensors from manufacturers with geographically diversified production, creating a demand shift toward suppliers with US or European fabrication capacity to mitigate the impending cost risk and ensure supply stability against escalating trade frictions.

- Challenges and Opportunities

The primary challenge is the capital intensity and time required for high-volume, automotive-grade sensor fabrication and qualification. The high barrier to entry and the lengthy, multi-year design-in cycles constrain the ability of smaller, innovative players to penetrate the established Tier 1 supply base, potentially slowing down the adoption of newer technologies like event-based vision. Simultaneously, this environment creates a substantial opportunity for incumbent manufacturers to capture immense long-term demand. The mandated integration of Driver Monitoring Systems (DMS) represents a new, high-growth segment. As governments enforce stricter rules on distracted driving, manufacturers with proven near-infrared (NIR) CMOS technology, optimized for in-cabin reliability under varying light conditions, can secure high-volume design wins in a segment with lower resolution demands but higher spectral complexity requirements than exterior cameras.

- Raw Material and Pricing Analysis

Automotive imaging sensors are physical electronic components built upon a highly complex semiconductor supply chain. The core raw material is silicon—specifically, large-diameter, high-purity silicon wafers. The production process also relies heavily on specialized optical glass and polymers for lenses and packaging materials, and trace elements like gallium and germanium are essential for certain semiconductor devices and are subject to export controls, particularly from China. This geopolitical material constraint can directly influence input costs. Pricing for the final sensor is governed by resolution and automotive safety integrity level (ASIL) qualification; higher ASIL-D-rated, 8 MP+ sensors command a premium due to rigorous validation costs and specialized manufacturing processes, making the market highly tiered. Fluctuations in the global silicon wafer market and the concentrated nature of wafer fabrication create persistent pricing volatility and supply risk for all sensor manufacturers.

- Supply Chain Analysis

The global supply chain for automotive imaging sensors is characterized by significant concentration and complexity. Production hubs are predominantly located in Asia-Pacific, particularly Japan, South Korea, Taiwan, and increasingly China, where the high-purity wafer fabrication (Front-End) occurs. The logistical complexity involves transporting sensitive, partially fabricated wafers and dies for back-end processing (assembly, testing, and packaging, or ATMP), which is often near automotive manufacturing centers in places like Malaysia, the Philippines, and Mexico. The entire chain exhibits a critical dependency on a few foundries (fabs) capable of producing automotive-grade CMOS Image Sensor (CIS) wafers and specialized optical module integrators (Tier 2/3). This vertical dependency means that a disruption at any single, specialized fabrication facility can trigger immediate, global supply shortages for the entire automotive sector, compelling Original Equipment Manufacturers (OEMs) to demand dual-sourcing arrangements.

Automotive Imaging Sensors Market Government Regulations

Governmental and regional regulatory mandates are the most powerful exogenous force driving mandatory demand for automotive imaging sensors. These regulations shift the procurement of these sensors from an optional, consumer-driven feature to a non-negotiable certification requirement for new vehicle production.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

General Safety Regulation (GSR) (Effective July 2024 for all new vehicles) |

The GSR mandates the inclusion of Reverse Detection Systems (RDS), Automated Emergency Braking (AEB), and Intelligent Speed Assistance (ISA). RDS and AEB systems fundamentally require camera input for object detection, directly increasing the minimum sensor count per new vehicle sold in the EU and creating substantial, immediate demand across all passenger and commercial vehicle segments. |

|

United States |

National Highway Traffic Safety Administration (NHTSA) / FMVSS 111 (Rear Visibility) |

FMVSS 111 requires all new vehicles under 10,000 pounds to have rear visibility technology. This mandate solidified the foundational demand for low-resolution imaging sensors (rear-view cameras) in the North American market and established an essential product category that suppliers must meet for vehicle certification. |

|

India |

AIS-145 (Safety Features) / AIS-191 (Reverse Park Alert Systems) |

These regulations enforce higher safety standards, with AIS-191 specifically requiring Reverse Park Alert Systems (RPAS), which are predominantly camera-based for light-duty vehicles. This policy directly stimulates the domestic production and import of cost-optimized imaging sensor modules to satisfy mandatory requirements in a rapidly growing, price-sensitive regional market. |

|

China |

National Strategy on Automated Driving / Public Road Test Regulations |

China's regulatory environment focuses on accelerating Level 3 and Level 4 autonomous driving pilots and subsequent commercial deployment. The government's strategic promotion of autonomous mobility, evidenced by the rollout of public road test permits, drives massive, specialized demand for high-resolution, long-range imaging sensors (8 MP+) and associated data processing hardware in the commercial logistics and Robotaxi sectors. |

Automotive Imaging Sensors Market Segment Analysis

- By Technology: CMOS Sensors

The CMOS (Complementary Metal-Oxide-Semiconductor) sensor segment overwhelmingly dominates the automotive imaging market, driven by its superior performance characteristics and cost-effective scalability compared to older CCD (Charge-Coupled Device) technology. CMOS sensors inherently offer higher frame rates, lower power consumption, and enable the integration of processing logic directly onto the chip (System-on-Chip, or SoC functionality). This direct integration significantly reduces system complexity and physical footprint—a critical advantage in space-constrained automotive applications. Demand is fundamentally driven by the need for speed and computational efficiency. ADAS and autonomous stacks must process millions of frames per second to ensure real-time object identification and decision-making. High-speed, high-fidelity CMOS sensors, particularly those employing advanced pixel architectures like Global Shutter (GS) for distortion-free capture of fast-moving objects, are non-negotiable components. The rapid evolution of CMOS technology—specifically the shift to Stacked CMOS architectures—directly increases demand by enabling higher resolutions (e.g., 8 MP to 12 MP) while maintaining a small optical format, simultaneously satisfying the automaker's cost targets and the regulatory imperative for superior perception capability. This makes the CMOS sensor the default and mandatory technology for nearly all modern automotive vision applications, from basic reversing to complex automated lane-centering.

- By Application: Advanced Driver Assistance System (ADAS)

The Advanced Driver Assistance System (ADAS) segment is the single largest consumer and most aggressive demand generator for automotive imaging sensors. The demand for ADAS is fundamentally non-discretionary, mandated by global safety regulations and consumer-driven safety rating systems. High-resolution sensors are a primary input for forward-facing perception systems that power functions such as Automatic Emergency Braking (AEB), Adaptive Cruise Control (ACC), and Automated Lane Keeping Systems (ALKS). These systems rely on imaging data for object detection, distance estimation, and classification of vulnerable road users (pedestrians, cyclists). For a Level 2+ system to reliably operate at highway speeds, it requires forward-facing cameras with resolutions of 5 MP and above to accurately detect and classify objects hundreds of meters away, a demand that continuously pulls the market toward higher-specification components. Furthermore, the proliferation of surround-view systems (often four to five cameras per vehicle) for parking and low-speed maneuvers, while technically ADAS, contributes immense volume. The increasing sophistication of ADAS, moving from simple alerting to active intervention, translates directly into a compounding demand factor: more features require more sensors, and more advanced features require higher-performance sensors.

Automotive Imaging Sensors Market Geographical Analysis

- US Market Analysis

The US market for automotive imaging sensors is defined by a mature regulatory environment and a fierce consumer-driven competition for advanced features. The foundational demand was established by the Federal Motor Vehicle Safety Standard (FMVSS) No. 111, which made rearview cameras mandatory for light vehicles, guaranteeing a high-volume demand floor for basic sensors. Current demand dynamics are primarily fueled by a two-pronged approach: the pursuit of high-level ADAS functionality and the reaction to geopolitical supply chain risk. Automakers focus heavily on systems that achieve high scores in the Insurance Institute for Highway Safety (IIHS) ratings, which drives the integration of high-fidelity camera systems for forward collision warning and AEB. The most significant regional demand-shaping factor is the ongoing geopolitical tension and the potential for increased US tariffs on electronic and semiconductor components. This threat accelerates demand for sensors and modules sourced from manufacturers with verified domestic US or allied-country fabrication and packaging facilities, promoting regional investment but simultaneously adding complexity and potential cost increases to the supply base.

- German Market Analysis

Germany, as the largest automotive manufacturing economy in Europe and a global leader in premium vehicle production, exhibits a demand profile centered on performance, reliability, and regulatory leadership. The local market is characterized by a high volume of vehicles certified to the EU’s General Safety Regulation (GSR) 2024 standards, which mandates multiple camera-dependent safety features. Germany’s national strategy to become a lead market for autonomous driving, backed by legal frameworks for SAE Level 4 operation, is the critical demand catalyst. This focus on L4 autonomy—especially in logistics and designated shuttle operations—creates an immense, specialized demand for high-redundancy, ASIL-D certified imaging sensor stacks that must operate reliably under all environmental conditions. German OEMs demand sensor solutions with demonstrated high-speed data transmission capabilities and robust functional safety features. This focus pushes demand not just for volume, but for the most technologically advanced and rigorously tested camera solutions available in the global market, prioritizing quality and functional safety compliance over marginal cost savings.

- Chinese Market Analysis

The Chinese market is the most dynamic global epicenter for automotive imaging sensor demand, characterized by unprecedented scale, government-led innovation, and rapid technology adoption. The government’s strategic push toward new energy vehicles (NEVs) and intelligent connected vehicles (ICVs) is the foremost demand driver, compelling domestic OEMs to embed advanced ADAS functionality, often at lower price points than in Western markets. The key differentiator is the rapid, aggressive deployment of high-level ADAS (L2+ and L3) as a standard feature, not a premium option. This strategy is fueled by domestic sensor providers who can quickly iterate on CMOS designs and a dense domestic Tier 2/3 supplier ecosystem. The resulting demand is enormous, centered on high-volume procurement of 8 MP-plus imaging sensors for use in highway navigation assistance and city-level pilot programs. Furthermore, the rapid growth of ride-hailing and logistics fleets adopting robotaxi and automated truck technology creates a dedicated, high-volume demand stream for perception systems that rely fundamentally on a high number of high-resolution cameras.

- Brazilian Market Analysis

The Brazilian market presents a demand profile heavily influenced by economic factors, a focus on new vehicle sales growth, and a rising but nascent regulatory environment for advanced safety. While the overall vehicle market is large, the penetration of high-end ADAS remains lower than in North America or Europe, concentrating current sensor demand in foundational, cost-optimized camera systems. The primary demand driver for imaging sensors is the growth in new vehicle sales, which has shown robust recovery, and the entry of new global players (particularly from Asia) who are standardizing features like rear-view cameras and entry-level parking assist systems across their model lineups. Governmental initiatives, such as the Programa de Mobilidade Verde e Inovação (Mover Programme), prioritize energy efficiency and general safety improvements, indirectly accelerating the adoption of electronic systems, including cameras. Future demand growth will hinge on evolving consumer awareness of crash safety ratings and eventual national regulatory mandates for mid-level ADAS features, which are expected to gradually lift the overall sensor content per vehicle.

- South African Market Analysis

The South African market’s demand for automotive imaging sensors is primarily driven by the import dynamics of major global OEMs and a localized focus on basic safety features and fleet management systems. There is a relative absence of domestic, technology-specific regulatory mandates for advanced ADAS, meaning that the current volume of sensor demand is directly inherited from the international specifications of imported vehicles, such as those meeting the UN's global standards for basic stability and braking systems. The key localized demand vector comes from the high-volume commercial vehicle and logistics sector. Fleet operators are increasingly adopting camera-based telematics and driver monitoring systems (DMS) to enhance safety, reduce insurance premiums, and enforce best driving practices. This specialized demand stream prioritizes ruggedized, cost-effective camera solutions that are often integrated with third-party telematics platforms, rather than the high-resolution, complex units required for L3 autonomy in the passenger vehicle segment. Any future increase in high-end ADAS demand will be directly correlated with the ratification and local application of more stringent UN-ECE safety regulations.

Automotive Imaging Sensors Market Competitive Environment and Analysis

The Automotive Imaging Sensors Market is highly concentrated, with a small group of semiconductor and Tier 1 companies dominating the provision of mission-critical sensor and module technology. Competitive advantage is derived from intellectual property in pixel design (e.g., low-light performance, High Dynamic Range (HDR)), scale of manufacturing (foundry access), and the deep, long-standing qualification relationships with major automotive OEMs and Tier 1 suppliers. The market structure involves silicon sensor specialists (Tier 2) selling to integrated Tier 1 systems providers and module makers, who in turn supply the OEMs.

- Onsemi

Onsemi is strategically positioned as a pure-play, high-reliability semiconductor provider specializing in automotive and industrial markets, making it a critical Tier 2 supplier in the imaging sensor value chain. Its competitive advantage rests on a legacy of developing advanced CMOS image sensor technology tailored for rugged automotive environments, with a strong focus on high-fidelity, high-speed applications. The company's strategy focuses on delivering functional safety and high-resolution imaging for the most demanding ADAS and autonomous driving systems. A key offering is the AR0830 and the newer Hyperlux SG image sensor family, designed for L2+ and L3 autonomy, which provides a high level of functional safety compliance (e.g., ASIL-C and ASIL-D capabilities). Onsemi leverages its vertical integration, controlling aspects of its manufacturing, which provides better quality control and supply assurance—a critical factor in mitigating supply chain risk for major Tier 1 and OEM customers.

- Sony Corporation

Sony Corporation, operating primarily through its Semiconductor Solutions Group, is the dominant global leader in CMOS image sensor technology, leveraging its immense scale and technological superiority from the consumer electronics segment into the automotive space. Sony's strategic positioning is focused on high-performance, high-resolution sensors, particularly its STARVIS technology which offers exceptional sensitivity in low-light conditions—a crucial requirement for night-driving ADAS. The company is actively driving innovation in system integration; for instance, the launch of the IMX828, the industry's first sensor with a built-in MIPI A-PHY interface, directly reduces system complexity and cost for Tier 1s by eliminating an external component. Sony's core strength is its unparalleled intellectual property in pixel architecture and fabrication scale, enabling it to deliver the high-quality, 8 MP+ sensors demanded by premium and autonomous vehicle platforms globally.

- Continental AG

Continental AG operates as a Tier 1 integrated systems provider rather than a pure sensor manufacturer. Its strategic positioning is to integrate imaging sensors (sourced from companies like Onsemi and Sony) with radar, LiDAR, and high-performance ECUs to deliver complete, validated ADAS and autonomous driving systems. Continental's strength lies in its deep system-level expertise, software integration, and longstanding, trust-based relationships with virtually all global OEMs. The company’s core business model is to sell the complete Surround View System or Forward Camera Module solution, where the imaging sensor is one component within a complex, highly regulated electronic assembly. This approach provides a competitive moat by shifting the focus from component price to system performance, functional safety verification, and software support, making them the primary gatekeeper for sensor technologies entering the final vehicle architecture.

Automotive Imaging Sensors Market Developments

Recent verifiable actions in the market demonstrate a continuous push toward higher integration, increased performance, and strategic capacity alignment to meet escalating automotive demand.

- Onsemi Introduces Hyperlux SG Image Sensor Family (January 2025)

In January 2025, Onsemi announced the release of its new Hyperlux SG image sensor family, including the ARX383, AR0145, and AR0235. This launch represents a significant product introduction centered on performance for advanced ADAS. The family's sensors are engineered to deliver high-resolution imaging combined with advanced features such as low-power consumption and superior High Dynamic Range (HDR) capability. The stated intent behind this product line is to enable next-generation forward-facing and side-view cameras for Level 2+ and Level 3 automation, directly addressing the automotive industry’s requirement for sensors capable of clear, reliable image capture under rapidly changing, high-contrast lighting conditions. This product launch solidifies the company’s focus on the premium segment of the ADAS imaging market.

- Sony Releases IMX828 CMOS Sensor with Integrated MIPI A-PHY (October 2025)

Sony Semiconductor Solutions Group (SSS) announced in October 2025 the development of the IMX828, an automotive CMOS image sensor that is the first in the industry to feature a built-in MIPI A-PHY interface. This development is a key step in simplifying the in-vehicle data transmission architecture. By integrating the physical layer of the communication interface directly onto the sensor chip, Sony effectively eliminates the need for a separate, external serializer chip, reducing both the component count and the complexity of the sensor module. This move is a strategic capacity addition in terms of system-level intellectual property, significantly lowering the bill of materials and design effort for Tier 1 suppliers developing surround-view and long-range camera modules, thereby accelerating the deployment of camera clusters in vehicles.

Automotive Imaging Sensors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.061 billion |

| Total Market Size in 2031 | USD 6.769 billion |

| Growth Rate | 10.76% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Resolution, Vehicle Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Imaging Sensors Market Segmentations:

- By Type

- CMOS Sensors

- CCD Sensors

- Others

- By Resolution

- Up to 2 MP

- 2 to 5 MP

- 5 to 8 MP

- Greater than 8 MP

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Application

- Autonomous Driving

- Advanced Driver Assistance System (ADAS)

- Surround Monitoring

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America