Report Overview

Automotive LED Lighting Market Highlights

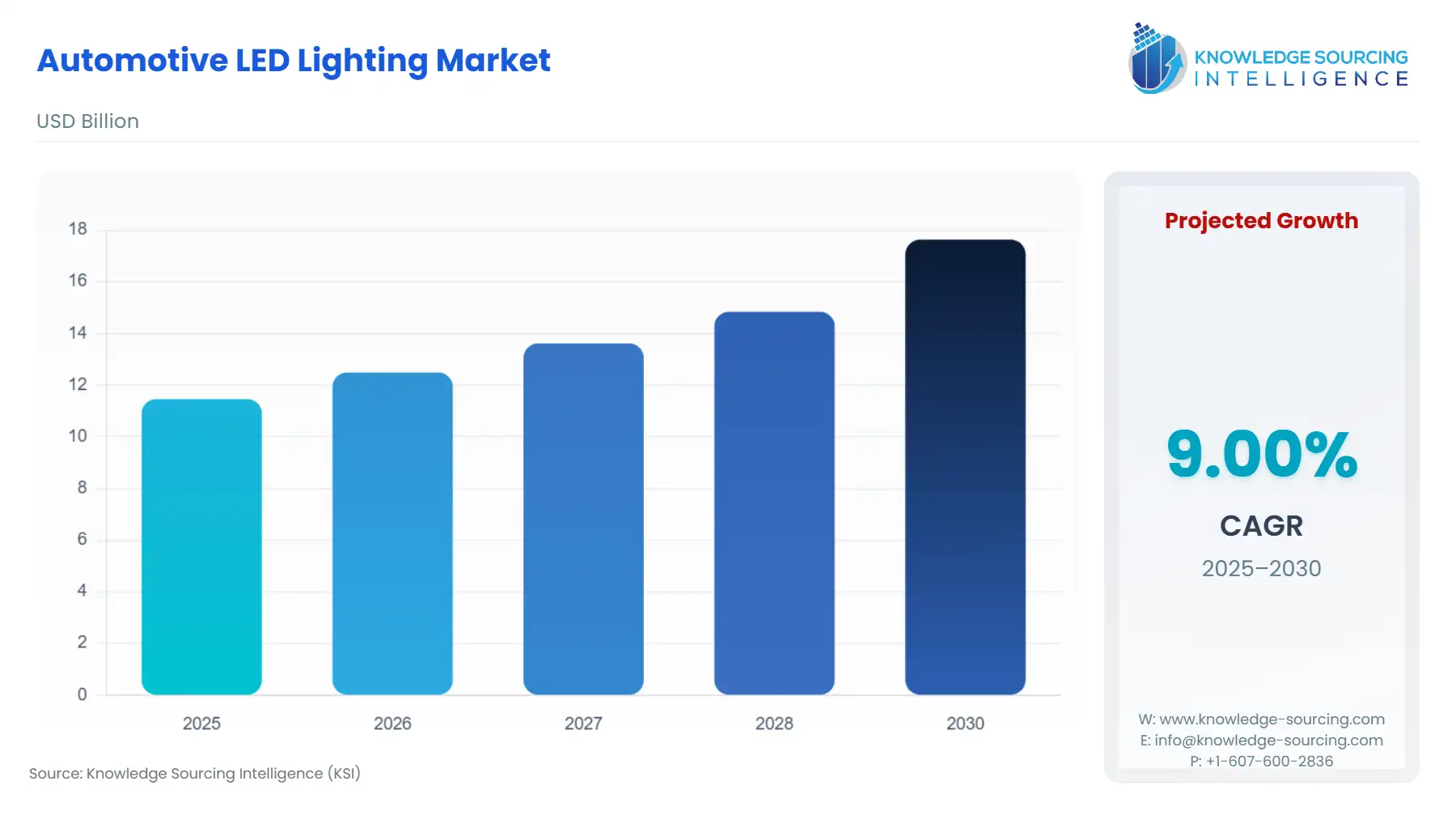

Automotive LED Lighting Market Size:

The automotive LED lighting market is expected to grow from USD 11.460 billion in 2025 to USD 17.630 billion in 2030, at a CAGR of 9.00%.

Automotive LED Lighting Market Overview:

LEDs are one of the most energy-effective automobile lighting currently available. As they convert more than 80% of the energy they consume into light and only 20% into waste heat, LED lights use a lot less energy than halogen lights do in a car. Since LED lights illuminate 0.2 seconds faster than incandescent lights, they are utilized as tail lamps. This benefits the driver who is following a car closely. This turns out to be a huge benefit, especially on roads when cars are moving at a fast rate of speed. The lifespan of LEDs is greater than that of incandescent lights. The lifespan of headlights, taillights, and other lights is 1,200 hours or more. Additionally, replacement is typically costly. The typical LED lasts 42 times longer than an incandescent. People may never need to replace a light source in their vehicle as it has a service life of more than 50,000 hours. They are completely water resistant. They do not allow even small quantities of water to get inside the internal bulbs of an LED headlamp. Additionally, they are equipped with the modern waterproof technical materials due to which the metallic components are not at risk of rusting, thus making LED lights in automotive more durable and enable them to function for a longer period of time.

The automotive LED lighting market is transforming vehicle design and safety through advanced V lighting solutions, enhancing automotive safety lighting with superior brightness and precision. ADAS integration lighting, including adaptive headlights, aligns with stringent lighting regulations to improve visibility and reduce accidents. Energy-efficient automotive lighting, driven by LED technology, minimizes power consumption, supporting electric vehicle range and sustainability goals. Vehicle aesthetics LED designs create distinctive brand signatures, elevating consumer appeal. The market thrives on innovation, regulatory compliance, and aesthetic differentiation across global automotive sectors.

Automotive LED Lighting Market Trends:

The automotive LED lighting market is advancing with adaptive driving beam (ADB) and matrix LED headlights, enhancing precision and safety through intelligent lighting systems. OLED automotive lighting and laser headlights offer compact, high-resolution illumination, while digital light projection enables dynamic road signaling. Ambient interior lighting and dynamic lighting elevate vehicle aesthetics and driver experience. Connected car lighting integrates with vehicle systems for real-time adaptability, and Li-Fi in automotive explores light-based data communication for enhanced connectivity. These trends reflect a shift toward smart, energy-efficient, and multifunctional lighting solutions, aligning with safety regulations and consumer demands for innovative, connected automotive experiences.

Automotive LED Lighting Market Growth Driver:

- Automotive LED Lighting Market growth has been aided by increased LED adoption because of environmental concerns, a focus on road safety, and strict lighting regulations.

Numerous complaints have been raised about poor visibility on the roadways, particularly at night when it is difficult to see other cars coming up from behind. Vehicle accidents that result in death happen almost primarily at night. Thus, LED lighting is used in automotives because of the greater visibility that is obtained from the LED lighting in the headlights, which makes it easier for consumers to travel by car in a safer manner. The market for automotive LED lighting is also being propelled by the affinities between modern driver assistance systems and their rising acceptance and prevalence among the middle-class population, as well as the exploding demand for LED lights in multiple vehicle applications. Additionally, the expansion of this market has been aided by funding and investments secured by important players and manufacturers in the automotive LED lighting sector. For instance, the Low Carbon Innovation Fund 2's fifth deal was successfully closed by the environment and energy efficiency-focused merchant bank Turquoise in November 2020. In this acquisition, which was a part of a £760,000 fundraising round, the organization supported by the European Regional Development Fund invested in Kubos Semiconductors, a manufacturer of LED lighting. According to Kubos Semiconductors, the key settings for its technology include general illumination, micro-LED displays, automobiles, street lighting, and digital signs.

Automotive LED Lighting Market Key Developments:

- The first system-on-chip (SoC) for external car illumination was unveiled in December 2022 by indie Semiconductor, a pioneer in Autotech solutions. The new iND83080 is a highly integrated LED matrix controller that lowers the price and simplifies the design of high-definition external lighting systems that use individual LEDs to provide pixel-level control.

- Oracle Lighting, a leader in the development of premium lighting goods and cutting-edge LED solutions for the automotive aftermarket, announced the successful release of its new 5900 Series Multifunction Reflector-Facing Technology LED Light Bars in December 2022. The new LED light bar system, which made its debut at the recent 2022 SEMA Show in Las Vegas, uses high-performance 8W LEDs and the most recent RFT (Reflector Facing Technology) optics, which use reflectors to increase light coverage and give an astonishing 95 percent light transmittance. Additionally, the 5900 Series' distinctive design includes integrated multifunction marker lights with programmable colors.

Automotive LED Lighting Market Geographical Outlook:

- A sizeable proportion of the market for automotive LED lighting is in the Asia Pacific area. While North America and Europe also hold comparable market shares of this industry.

The Asia-Pacific region controls a substantial portion of the market for automobile LED lighting. Luxury automobile sales, manufacturing, and demand are all on the rise in these locations, along with an increase in accidents, particularly at night. These are some of the main reasons influencing the market growth in these areas. Additionally, a rise in the demand for and sales of commercial vehicles due to the expansion of the logistics and construction sectors, as well as a rise in the purchases of economical vehicles due to an increase in middle-class consumers' disposable incomes, have all contributed to the market's expansion in this region. The automotive LED lighting market in North America and Europe is anticipated to expand significantly over the assessment period. The industry is expanding primarily as a result of rising auto production, strict government enforcement of lower CO2 emissions, and the widespread use of energy-efficient lighting technologies.

Automotive LED Lighting Market Segmentation Analysis:

- Position-wise, front LED lighting applications are anticipated to account for a sizeable portion of the vehicle LED lighting market.

Headlamps are one of the most widely used applications for LED lighting in the automotive industry. The primary reasons for this increased demand for LED versions of these lights are their improved visibility and lower energy usage, which reduces heat and harm to the environment, which is less as compared to other choices. Furthermore, LED lights are more resilient and long-lasting, which has increased demand for LED lighting in the vehicle sector for front applications.

Automotive LED Lighting Market Key Launches:

- In March 2025, Marelli introduced micro-LED headlamps for NIO ET9, offering high-resolution lighting and improved traffic safety for luxury EVs.

List of Top Automotive LED Lighting Companies:

- General Electric Company

- Hyundai Mobis Co Ltd

- Hella GmbH & Cp KGaA

- Valeo SA

- OSRAM Group

Automotive LED Lighting Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive LED Lighting Market Size in 2025 | USD 11.460 billion |

| Automotive LED Lighting Market Size in 2030 | USD 17.630 billion |

| Growth Rate | CAGR of 9.00% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Automotive LED Lighting Market |

|

| Customization Scope | Free report customization with purchase |

Automotive LED Lighting Market Segmentation:

- By Position

- Interior

- Exterior

- By Vehicle Type

- Passenger Cars

- Two-Wheelers

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- By Sales Channel

- OEM

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

- North America