Report Overview

Big Data in ESG Highlights

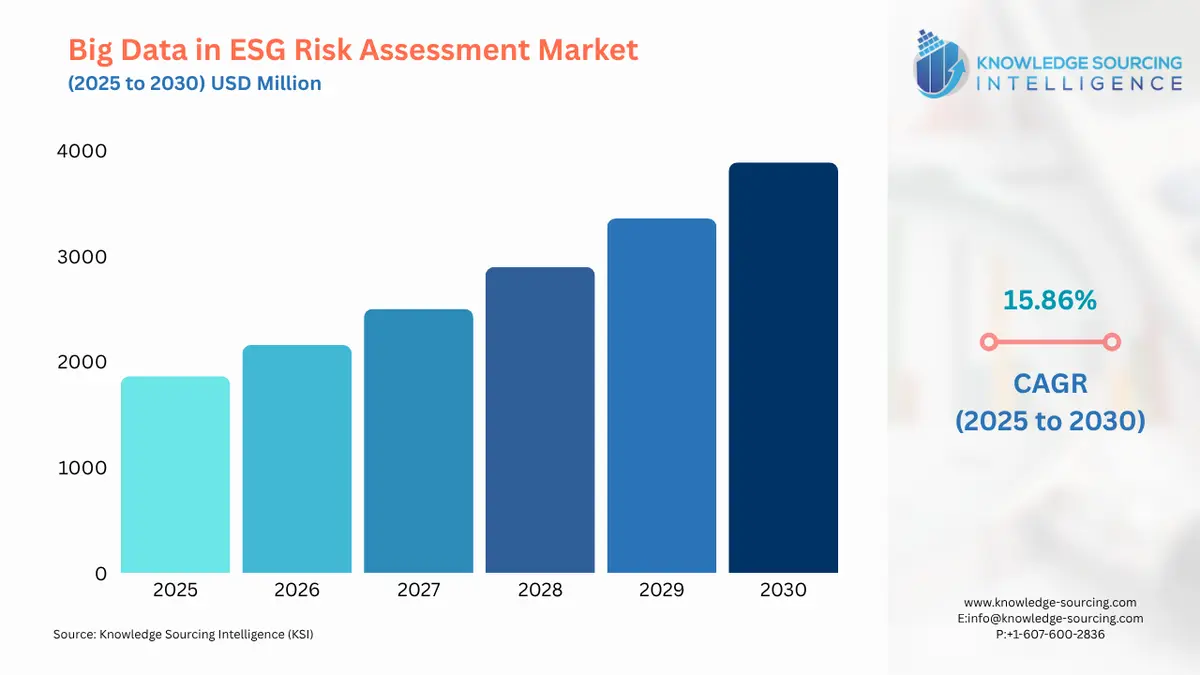

Big Data in ESG Risk Assessment Market Size:

The Big Data in ESG Risk Assessment Market is projected to grow at a CAGR of 15.86%, expanding to USD 3,888.301 million in 2030 from USD 1,862.817 million in 2025.

Big Data in ESG Risk Assessment Market Key Highlights:

- Regulatory pressure (CSRD, ISSB, SEC climate rules, SFDR) is making robust, verified, real-time ESG data management essential. Increasingly, ESG disclosures are being considered non-financial but pre-financial and investment-grade and are thus being elevated beyond mere non-financial reports to important risk management instruments.

- Due to shareholder demands and oversight by the board of directors, the metrics needed to be forward-looking (i.e., transcending present actions and inquiries), scenario-based, and highly granular in terms of the volume and openness of data.

Big Data in ESG Risk Assessment in 2025 is the most innovative sector of the business ecosystem in sustainability and corporate risk management, as ESG is becoming more integrated with advanced analytics, artificial intelligence, and cloud characteristics. Big data solutions can help organizations aggregate and analyze large volumes of ESG-related data, including supply chains, operational and regulatory reports, and are able to generate meaningful insights that can be used to mitigate risks proactively, in a compliant and investment-worthwhile approach.

Big Data in ESG Risk Assessment Market Overview & Scope:

The Big Data in ESG Risk Assessment market is segmented by:

- Offering: The market is sub-categorized into software, services, and hardware. This segment is led by software, as software enables scalable ESG risk assessment by using AI/ML-driven analytics, automation of compliance processes, and real-time reporting usage across industries. Value-added services, such as consulting, implementation, and auditing, are essential to organizations that require ESG expertise in their organization, but are generally add-ons to software, rather than stand-alone. Less than highly adopted are hardware, i.e., IoT sensors and monitoring products, as their application is narrower in scope to industries like energy and manufacturing that necessitate observing the environment in real-time.

- Application: Application-wise, the market comprises environmental performance management, governance, and compliance management, social responsibility tracking, supply chain ESG data management, investor and stakeholder reporting, as well as risk assessment and mitigation. Among them, environmental performance management is the most promising application because of the worldwide effort of achieving carbon neutrality, monitoring of emissions, and resource optimization. Although governance and social tracking are gaining wider attention, they are secondary to the purpose of transparency to multinational operations, since managing the supply chain and reporting to investors are very critical. The size of risk assessment is smaller now, but is expected to increase as predictive ESG analytics take off.

- Deployment Mode: The different modes of deployment are cloud-based, hybrid, and on-premises solutions. Cloud-based deployment is prevalent, as organizations are shifting towards flexible, cost-efficient, and scalable ESG solutions that can aid real-time collaboration and data combination across geographies. Hybrid deployments tend to be favoured by highly regulated industries, as they provide flexible scalability without compromising on data security, whereas on-premises systems are becoming unused due to both high cost and lack of scalability, especially where strict data sovereignty or control is strongly desired.

- Organization Size: The market is targeting large undertakings as well as SMEs. Very large enterprises dominate this segment, as they have far-flung operations, more complicated ESG compliance requirements, and more resources to deploy on sophisticated ESG analytics solutions. SMEs are increasingly embracing the use of ESG tools, especially their cloud-based, cost-effective models, but they are far behind big companies that face more regulatory pressure and have enough technical skills and budget to deploy them.

- End-User Industry: The end-user companies are financial services, manufacturing, energy and utilities, retail, technology, healthcare, real estate, and transportation & logistics. Financial services are the most popular in this segment, as banks, asset managers, and investment companies are incorporating ESG risk analytics into lending, portfolio management, and compliance activities under intense global reporting regulations. There is high adoption in manufacturing and energy sectors, associated with emissions monitoring and supply chain sustainability, and the retail and logistics sectors are migrating towards good sourcing and transparency.

- Region: The Big Data in ESG Risk Assessment market is classified into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific. The Asia-Pacific region is expected to have the highest and fastest-growing market size due to sound investments in artificial intelligence, and AI-enhanced robotics, healthcare, smart infrastructure, and a quickly digitizing population.

Top Trends Shaping the Big Data in ESG Risk Assessment Market:

- Real-Time and Multimodal ESG Data Collection

The market leaders' trend is that the periodic and static ESG reporting is being replaced with constant and real-time monitoring on the basis of multimodal analytics. The latter implies the use of AI models to collect and combine data streams of IoT sensors, satellite images, social media feeds, weather databases, and financial transactions either jointly or by themselves. Multimodal data fusion offers more realistic, contextual information about the sustainability and ethical performance, and it picks up the details that are overlooked in one-dimensional reporting. To illustrate, businesses will be able to track real-time carbon emissions per facility, quickly identify supply chain labor violations, and predict breaches of regulations based on up-to-date external data. - Predictive ESG Risk Assessment

The other fundamental trend is the use of more sophisticated predictive analytics engines that evaluate the future ESG risks before they occur. AI platforms now utilize historical and real-time data to simulate climate scenarios, predict regulatory exposure, forecast supply chain disruptions, and model the likely impact of policy or market changes on sustainability goals. This allows businesses to move from reactive compliance to preventive action, mitigating carbon risk, anticipating loss events, identifying potential greenwashing, and fine-tuning resource allocations with far greater strategic foresight.

Big Data in ESG Risk Assessment Market Growth Drivers vs. Challenges:

Drivers:

- Rising Demand for Data-driven Sustainability: There is overwhelming corporate, investor, and regulatory interest in data-supported ESG data. With ESG taking centre stage as reputation, investment decisions, and regulatory compliance in both the UK and across the world, companies require assurance of credible and accurate granular comparative analytics commonly reported through manual reports. AI-driven capabilities combine massive volumes of disparate sustainability and governance data (including layer-deep operational sensors, supply chain files, social media data, and regulatory feeds) to extract, validate, and normalize metrics with unparalleled accuracy. This helps organizations to shift anecdotal sustainability reporting to evidence-driven disclosures that fuel more intelligent investment, operational, and strategic judgments. Real-time benchmarking and forecasting of ESG risks and opportunities are rapidly becoming recognized as a key driver of long-term business value and stakeholder confidence.

- Global Regulatory Push: Increased and evolving regulation is putting pressure on ESG analytics to implement a standardized framework and rigorous reporting. Governments and other supranational authorities are introducing disclosure requirements, such as the EU SFDR, that require granular, auditable data, real-time validation, and consistency with different standards. This pressure is prompting organizations to automate ESG reporting processes; manual and spreadsheet-based approaches are inadequate to match the speed, scale, and cross-jurisdiction complexity of reporting. With the scope of ESG regulations expanding but also becoming more comprehensive in their requirements, platforms powered by AI-based analytics are being selected due to their flexibility, error handling, and ability to ensure regulatory changes are realized in short periods. The globalization of the ESG and sustainability regulations ensures that market profit growth is high among the AI analytics vendors capable of providing ready compliance solutions.

Challenges:

- Data Quality, Availability & Consistency: A prevailing challenge facing the market is the persistent fragmentation and inconsistency of ESG data. Sustainability information sources can be all over legacy systems, third-party suppliers, manual spreadsheets, and a menagerie of third-party vendors, and thus, information gaps and mismatches, and incomplete information will arise. The lack of globally accepted standards for ESG metrics and reporting formats means harmonizing and validating data for analytics is labor-intensive and error-prone, impeding comparability and driving up costs. AI models, while powerful, depend on high-quality, complete datasets to generate trustworthy insights, so the problem of poor data hygiene remains a fundamental barrier to widespread adoption and accurate reporting.

Big Data in ESG Risk Assessment Market Regional Analysis:

- Asia-Pacific: Asia Pacific stands out as the fastest-growing region in the AI-driven ESG analytics space, driven by a confluence of factors. Governments across countries like China, Japan, South Korea, and Singapore are aggressively implementing policies to accelerate digital transformation, promote sustainable development, and foster innovation in artificial intelligence and robotics. These initiatives are accompanied by substantial public and private investment in AI infrastructure, smart urban planning, renewable energy integration, and sustainable manufacturing. Moreover, the region’s rapidly expanding economies, large industrial bases, and rising ESG awareness among businesses and consumers propel demand for advanced analytics solutions that can navigate complex environmental and social challenges. The growing emphasis on climate risk mitigation, supply chain transparency, and responsible resource management amid urbanization and industrial modernization further fuels adoption.

Big Data in ESG Risk Assessment Market Competitive Landscape:

The market is fragmented, with many notable players:

- Company Initiatives: In September 2024, Alternative data analytics specialist QuantCube Technology announced its Asset Mapping database, designed to fill the data gap facing banks, insurance companies, asset managers, and corporates as they seek to monitor the risk exposure of the physical assets they own and invest in. The solution enables firms to understand the exposure of their investment portfolios to environmental, social, and governance (ESG) risks at a granular level and to address the European Banking Authority’s Pillar 3 disclosures on ESG risk.

Big Data in ESG Risk Assessment Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1,862.817 million |

| Total Market Size in 2031 | USD 3,888.301 million |

| Growth Rate | 15.86% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Offering, Application, Deployment Mode, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Big Data in ESG Risk Assessment Market Segmentation:

- Offering

- Software

- Services

- Hardware

- Application

- Deployment Mode

- Cloud-Based

- Hybrid

- On-Premises

- Organization Size

- Large Enterprises

- SMEs

- End-User Industry

- Financial Services

- Manufacturing

- Energy and Utilities

- Retail

- Technology

- Healthcare

- Real Estate

- Transportation and Logistics

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America