Report Overview

Bio PET Film Market Highlights

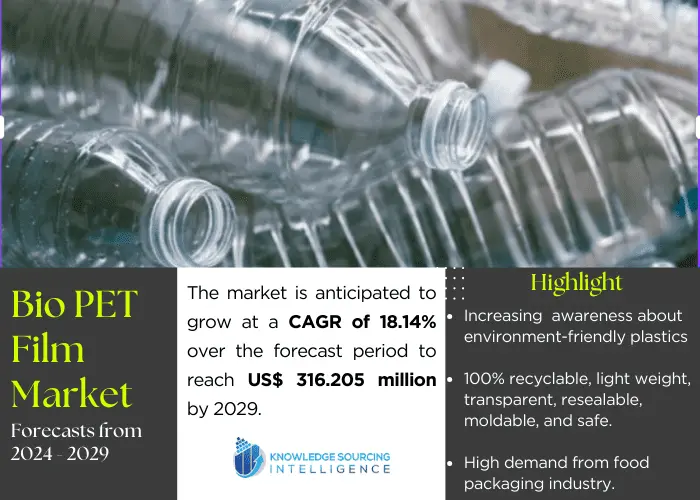

The bio pet film market is expected to grow at a CAGR of 18.14% reaching a market size of US$316.205 million in 2029 from US$98.442 million in 2022.

Polyethylene terephthalate, or bio-PET, is a polyester film that serves as PET's substitute. It may be used in a variety of settings, including car interiors, packaging, wrapping sheets, and electrical insulation. Thirty percent of the ingredients are plant-derived, while the remaining portion is made from sustainable resources. When compared to traditional PET packaging, bio-PET offers packaging that is both transparent and more affordable.

In addition to providing high tensile strength, dimensional stability, scent barrier, electrical insulation, and environmental protection, it is less expensive than petroleum-derived alternatives. The market for bio-PET film is expected to be driven by the trend toward bioplastics, governmental regulations, and the growing use of bio-PET film in packaging, cosmetics, pharmaceuticals, and other industries.

The growing sustainability and environmental concerns among individuals all around the world are driving up market demand. The growing public awareness of environmental concerns, notably plastic pollution and climate change has increased demand for environmentally acceptable alternatives to standard plastics. Bio-PET films are used in a variety of industries, including packaging, labels and decals, solar panels, electrical insulation, tape backing, graphic arts, laminates, photographic films, screen protectors, flexible electronics, and decorative films. PET films are widely utilized in label and decal applications.

- An increase in awareness for environment-friendly plastics and government policies

The market for bio-PET film has expanded as a result of growing awareness of the production and application of bio-based PET. The European Bioplastics (Association of Bioplastics) projects that by 2025, the production of bioplastics will reach 2.8 million metric tons.

In an effort to address the waste of marine plastic, the Japanese government has also implemented policies to promote plant-based plastics. Policies are developed by the Japan Clean Ocean Material Alliance, or CLOMA, to promote the use of recycled or biodegradable plastics. As a result, there is a growing market for bio-PET products, which encourages more end users to use bio-based PET and offers a better market demand

- A shift in bioplastics and bio-PET by large companies

The market for bioplastics and bio-PET film has increased as a result of major corporations like Coca-Cola moving more and more toward plant- or bio-based plastics. Coca-Cola began using bio-PET on its bottles and packaging in partnership with Ford, Nike, Heinz, and Procter & Gamble. Because of the trend toward green plastics, the decrease in greenhouse gas emissions, and technological advancements, the use of bio-polyethylene terephthalate for bio-based and 100% plant-based bottle manufacturing and packaging, including food and non-food, cosmetics, automotive, medical packaging, fibers, printing, and others, has improved the growth prospects for bioplastics. As a result, the market share of bio-PET film is expected to rise in the upcoming years, providing a more favorable outlook for the bio-PET film industry.

- High use in bottle application

Bio-PET finds extensive application in bottling processes. Globally, there is a sharp rise in demand for these as businesses look to wean themselves off of fossil fuel-derived goods. Furthermore, there is a growing consumer demand for products made from biobased materials.

With the help of bio-PET packaging, the beverage industry has advanced and clean drinking water is now accessible to billions of people. In addition to being 100% recyclable, lightweight, transparent, resealable, moldable, and safe, the material has great mechanical and barrier qualities.

Bio-PET has been on the market for a long time. 30% renewable raw materials and 70% petroleum-based raw materials are used to make the plastic. Because bio-PET has mechanical and thermal characteristics that are comparable to those of other oil-based PET products, it is a perfect substitute for virgin PET.

- High demand from food packaging industry

With its superior dimensional stability, optical clarity, moisture barrier, and tensile strength, bio-based PET or polyester film performs well in a range of applications. The Indian Institute of Packaging (IIP) reports that in just ten years, the country's packaging consumption has increased by over 200%, from 4.3 kg per person annually to approximately 8.7 kg per person annually. The purpose of food and beverage packaging is to protect food from deterioration, moisture, and chemicals. Because bio-PET film has excellent mechanical, transparency, and physical properties, its use has increased for pre-cooked meals, nuts, sweets, confectionaries, spreads, and ice cream.

Asia Pacific is witnessing exponential growth during the forecast period

Asia Pacific is expected to play a prominent role in the growth of bio-PET usage, as it massively helps the wide-scale acceptance of bio-PET in multiple applications, like textile, packaging, etc. The high cost of bio-PET is a deterrent to its wide acceptance in this region due to the cost-conscious nature of the consumer. Major manufacturers are focusing on lowering the price of bio-PET, and the success in lowering the prices massively affects the market shift toward bio-PET.

In Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income of people, the increasing number of working professionals, and the growing preference for fast food. Consumers prefer ready-to-consume foods because they require considerably less time for cooking, are fresh, and include attractive and sturdy packaging, supporting the demand for the market.

Product Offerings

Market key launches

- In September 2023, LOTTE Chemical unveiled "ECOSEED," a brand-new line of eco-friendly materials. Physically and chemically recycled materials, such as post-consumer recycled materials and bioplastics like Bio-PET, are included in ECOSEED. It is projected that this strategic initiative will help the company meet its 2030 target of supplying one million tons of "ECOSEED," a resource circulation material.

- In June 2023, a non-binding Memorandum of Understanding (MOU) was signed to establish a joint venture between Carbios, a biotech company focused on developing biological solutions for plastic and textile recycling, and Indorama Ventures Public Company Limited, a leading global producer of sustainable chemicals. The establishment of the first PET recycling facility in the world is the goal of this collaboration in France. The building of this cutting-edge facility is expected to require a capital investment of about USD 245.7 million.

Bio PET Film Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2022 | US$98.442 million |

| Market Size Value in 2029 | US$316.205 million |

| Growth Rate | CAGR of 18.14% from 2022 to 2029 |

| Study Period: |

2019 to 2029 |

| Historical Data: |

2019 to 2022 |

| Base Year | 2023 |

| Forecast Period | 2024 – 2029 |

| Forecast Unit (Value) | USD Million |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Film Type

- Lamination Film

- Insulation Film

- Others

- By Application

- Packaging

- Printing

- Decoration

- Others

- By End-User

- Food and Beverage

- Personal Care and Cosmetics

- Pharmaceuticals

- Electrical and Electronics

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America