Report Overview

Fiber Film Market - Highlights

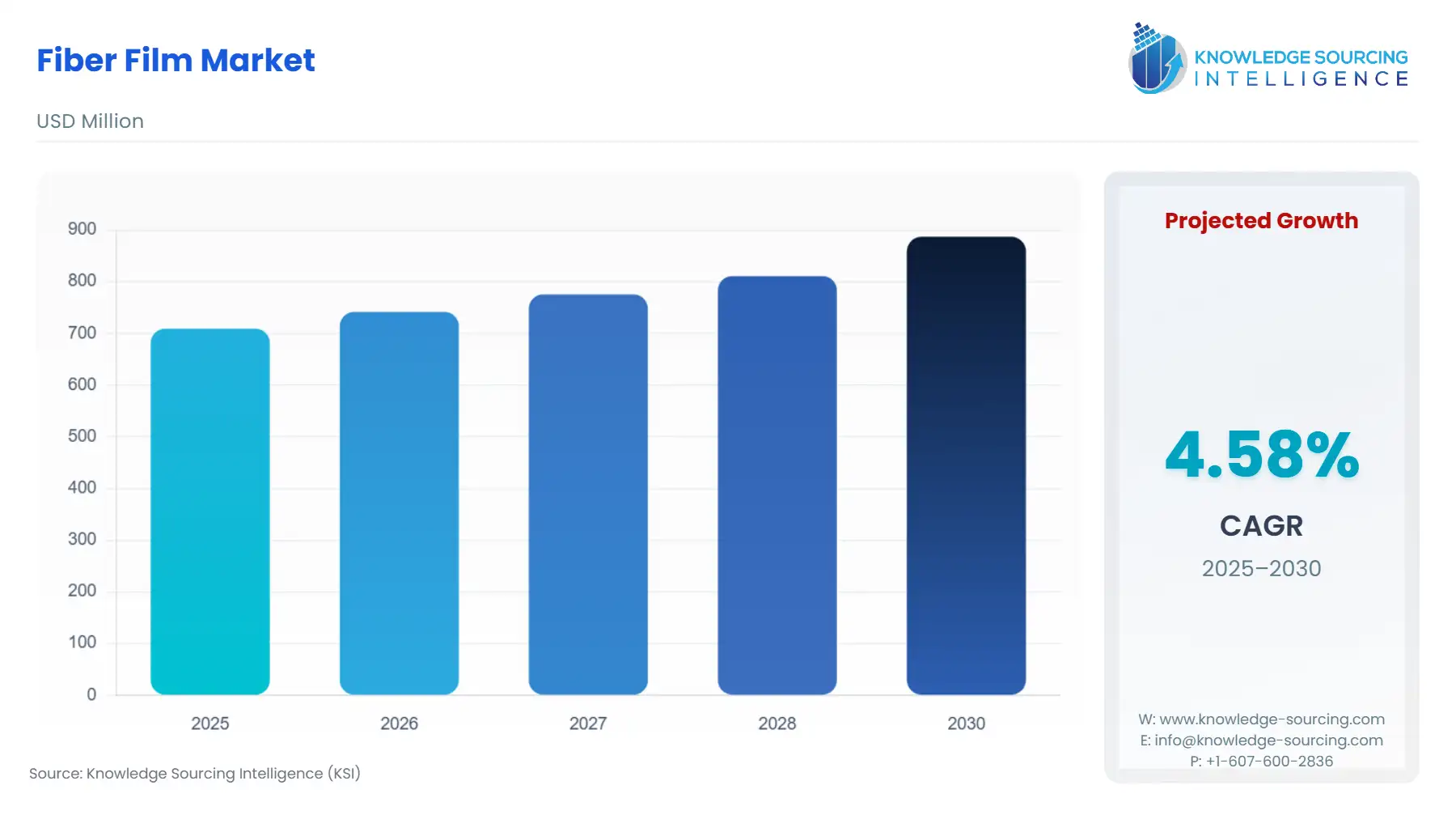

Fiber Film Market Size:

Fiber Film Market is set to rise at a 4.44% CAGR, reaching USD 920.713 million in 2031 from USD 709.346 million in 2025.

Fiber film is a thin and flexible sheet composed of various types of fibers, such as natural or synthetic polymers. These fibers are intricately woven or bonded together to create a cohesive and versatile material. Fiber films are valued for their lightweight, durable, and often transparent characteristics, making them suitable for applications in packaging, textiles, electronics, medical devices, and more, where their unique combination of properties serves functional and aesthetic purposes.

Fiber Film Market Trends:

The fiber film market refers to the industry segment that involves the production, distribution, and utilization of thin, flexible sheets or films made from various types of fibers, such as natural or synthetic polymers. These films find applications in diverse sectors, including packaging, textiles, electronics, medical devices, and more, due to their lightweight, durable, and often transparent properties. The market encompasses a wide range of materials, technologies, and end-user applications, catering to the growing demand for innovative and sustainable solutions across multiple industries. This industry finds applications across sectors such as packaging, textiles, electronics, and medical devices due to its lightweight, durable, and often transparent properties. Key market drivers include the growing demand for sustainable and eco-friendly materials, advancements in fiber technology enabling enhanced functionality, and the expanding e-commerce sector necessitating innovative packaging solutions. Additionally, the drive towards lightweight and efficient materials in automotive and aerospace industries further propels the market's growth.

Fiber Film Market Growth Drivers:

Sustainability and Eco-Friendly Demand: As environmental concerns rise, there's a strong push for sustainable materials. Fiber films, often derived from biodegradable sources or recyclable polymers, align with this demand, as they offer reduced environmental impact compared to traditional plastics.

Advancements in Fiber Technology: Ongoing research and development in fiber science have led to innovations like nano-fibers and composite fibers. These developments enhance the mechanical, barrier, and functional properties of fiber films, opening new applications and markets.

E-Commerce and Packaging Needs: With the surge in online shopping, there's a heightened demand for protective and appealing packaging. Fiber films, offering cushioning, moisture resistance, and branding possibilities, are becoming go-to choices for sustainable packaging solutions.

Rise of Bioplastics: The shift towards bioplastics, which are derived from renewable resources, is driving the adoption of fiber films. These materials present an eco-friendly alternative to conventional plastics, addressing both resource scarcity and waste concerns.

Stringent Regulatory Landscape: Increasing regulations on single-use plastics and non-biodegradable materials prompt industries to seek compliant alternatives. Fiber films, meeting these regulations, gain favor as versatile and compliant materials.

Health and Hygiene Applications: Fiber films find use in medical textiles, wound dressings, and hygiene products due to their biocompatibility, breathability, and moisture management properties. The growing healthcare sector thus bolsters the demand for fiber-based solutions.

Textile Industry Evolution: Fiber films have entered the textile sector as innovative materials for lightweight and breathable clothing, sportswear, and technical textiles. Their ability to combine comfort, performance, and aesthetics drives their adoption in this industry.

Consumer Preference for Natural Materials: Increasing consumer awareness and preference for natural and organic products extend to packaging and everyday items. Fiber films, often derived from natural fibers, resonate with this preference, elevating their market demand.

Reduced Carbon Footprint: Fiber films are produced using energy-efficient processes and materials, leading to a lower carbon footprint compared to some traditional plastics. As industries strive for sustainable practices, this aspect contributes to fiber films' popularity.

Automotive and Aerospace Applications: In transportation industries, weight reduction is crucial for fuel efficiency. Fiber films, being lightweight yet strong, find applications in interior components, upholstery, and non-structural parts, aligning with the drive for efficiency and performance.

List of Top Fiber Film Companies:

Amcor launched its Plant-Based Monolaminate film that is made from plant-based materials, such as sugarcane and wood pulp, and is designed to be compostable in home compost within 12 weeks. Plant-Based Monolaminate is used in a variety of applications, including food packaging, coffee cups, and straws.

Jindal Films launched its Bio-Flex film that is made from renewable resources, such as wood pulp and corn starch, and is designed to be compostable in industrial composting facilities within 180 days. Bio-Flex is used in a variety of applications, including food packaging, agricultural films, and personal care products.

Taghleef Industries launched its NatureFlex film that is made from wood pulp and is designed to be compostable in home compost within 12 weeks. NatureFlex is used in a variety of applications, including food packaging, coffee cups, and straws.

Toray Industries launched its Eco-Lite that is made from recycled PET and is designed to be lighter and stronger than traditional plastic films. Eco-Lite is used in a variety of applications, including food packaging, retail bags, and industrial films.

Fiber Film Market Segment Analysis:

Prominent growth in the automatic Wrapping segment within the Fiber Film Market Growth:

The "Automatic Wrapping" segment within the fiber film market is undergoing substantial growth. This can be attributed to the increased demand for efficient and streamlined packaging processes across various industries. Automatic wrapping technology offers enhanced productivity, reduced labor costs, and consistent wrapping quality, making it a preferred choice for businesses seeking operational efficiency. In particular, the food and beverages sector benefits from automated wrapping to meet high production demands, while the pharmaceutical industry values the precision and hygiene it provides. This surge in demand for seamless packaging solutions has driven the significant growth observed in the automatic wrapping segment of the fiber film market.

Fiber Film Market Geographical Outlook:

The fiber film market is expected to witness a substantial presence in the Asia-Pacific:

The Asia-Pacific region is anticipated to hold a significant portion of the fiber film market share due to several contributing factors. These include the presence of densely populated economies with rising levels of disposable income, resulting in heightened consumption of packaged products, textiles, and electronics. Moreover, the region's emphasis on sustainable alternatives, along with strong manufacturing capacities, positions it as a central hub for producing and advancing fiber films. Its advantageous geographical location for trade and business additionally reinforces its leadership in serving both local and global markets, thereby fostering substantial expansion within the market.

Fiber Film Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Fiber Film Market Size in 2025 | USD 709.346 million |

Fiber Film Market Size in 2030 | USD 887.230 million |

Growth Rate | CAGR of 4.58% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Fiber Film Market |

|

Customization Scope | Free report customization with purchase |

Fiber Film Market Segmentation

By Wrapping Technology

Automatic Wrapping

Handheld

By Thickness

Below 10 Microns

Between 10 & 50 Microns

50 Microns & Above

By End-User

Food & Beverages

Home & Personal Care

Pharmaceuticals

Chemical & Fertilizers

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others