Report Overview

Blue Hydrogen Market - Highlights

Blue Hydrogen Market Size:

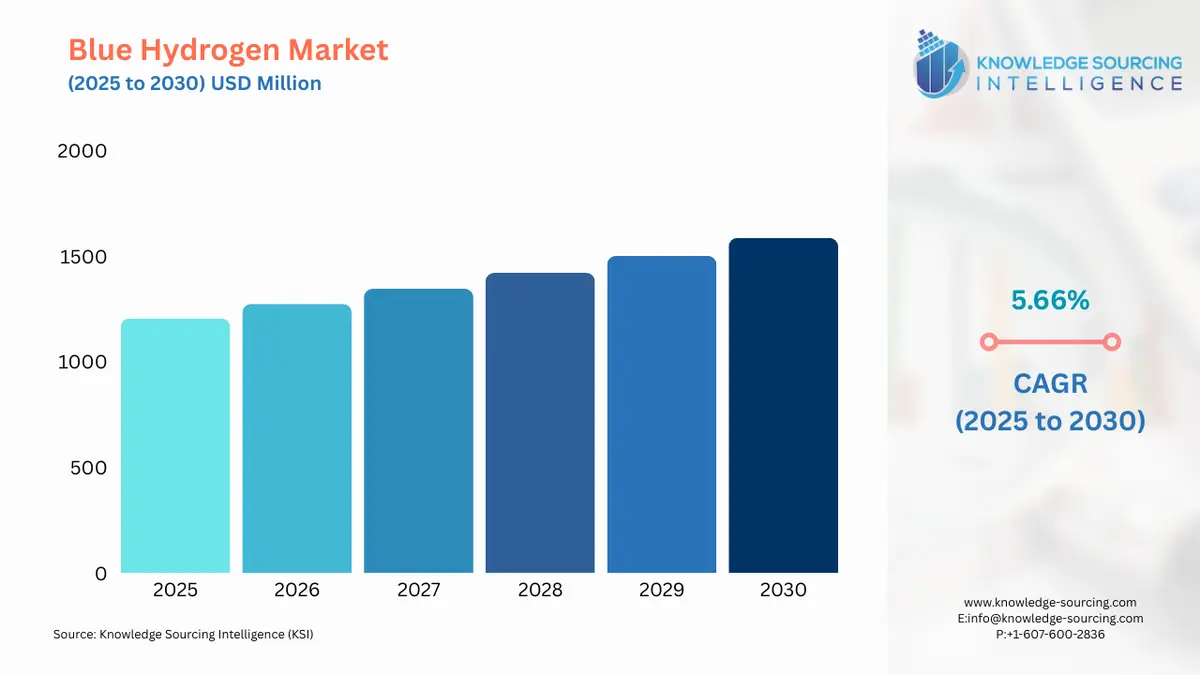

The blue hydrogen market is expected to grow at a CAGR of 5.66%, reaching a market size of US$1,586.122 million in 2030 from US$1,204.410 million in 2025.

Growing concerns about climate change and pollution have prompted decarbonization projects in a variety of businesses. Blue hydrogen is being used in the production of chemicals, refinement, and heavy industrial operations as a result of a considerable shift away from conventional fuels and towards carbon-neutral alternatives. Moreover, the rapid rise in fuel prices, the rising pollution caused by the burning of fossil fuels, the rising investment in the research and development of cleaner energy alternatives, and the growing number of government initiatives to switch to clean energy sources are all expected to contribute to the increase in the blue hydrogen market size.

Some of the key players in the blue hydrogen market include Alfa Laval, ExxonMobil Corporation, Air Products and Chemicals Inc., Aramco, Aker Solutions, Dastur Energy, Topsoe, Shell Plc, Lindle Plc, Petrofac Limited, Technip Energies N.V., Johnson Matthey, and Thyssenkrupp AG, among others.

Blue Hydrogen Market Trends

- Technological and Sustainability Advancements

The trend in the blue hydrogen market is the increasing emphasis on technological advancement in carbon capture storage techniques, which innovates the development and improvement of lower-cost storage solutions along with efficient capture systems, which will provide blue hydrogen with more visibility. Along with this, the increasing trend for low-carbon fuels to reach global decarbonization goals and net zero targets is also offering opportunities in the increasing demand for blue hydrogen in applications such as chemicals, power generation, and refining.

Blue Hydrogen Market Dynamics

Market Drivers:

- The use of hydrogen in fuel cell electric cars (FCEVs) is expanding: Hydrogen has long been recognized as a potential low-carbon transportation fuel, but adding it into the mix of fuels for transport has proven difficult. Compared to fossil fuels, which are running out and getting more expensive by the day, it has an edge. For usage in rockets and fuel cell electric vehicles, hydrogen is in high demand in the aerospace sector. Lowering the supply price of hydrogen is a primary issue for truck manufacturers, but fuel cell costs and refuelling stations determine how competitive hydrogen fuel cell autos are in the transportation sector. Since there aren't many low-carbon fuel alternatives for ships and aircraft, hydrogen-based fuels have a chance.

- Increased emphasis on satisfying the net-zero emission goal by 2050: In the scenario of net-zero emissions, hydrogen manufacturing undergoes a revolution never before seen. 70% of the world's H2 production in 2030, when it reaches 200 Mt, will come from low-carbon technology. By 2050, 500 Mt H2 will be produced; this rise is mostly attributable to low-carbon technologies. The energy system will need to be upgraded by using multiple technologies to achieve net-zero emissions by 2050. Energy efficiency, electricity, clean energy, carbon capture, utilization, and storage (CCUS), and hydrogen are anticipated to be the key pillars for the rise in the blue hydrogen market.

- Rising demand for power generation: The International Energy Agency (IEA) estimates that reforming, which involves mixing fossil fuels with steam and heating them to a temperature of around 800 °C, is how 96% of the world's hydrogen is created. Further, by employing and mixing hydrogen and oxygen atoms, blue hydrogen fuel cells can generate power, water, and a tiny amount of heat. Hydrogen combines with oxygen during this electrochemical reaction, similar to that of a battery, which increases the blue hydrogen market share during the forecast period.

- Increasing government initiatives: To ensure zero emissions, the governments of many nations in the region are putting up efforts and investing in blue hydrogen generation. For instance, the Saudi Arabian government declared in October 2021 that it will employ one of the largest natural gas projects in the world to produce blue hydrogen, and exporting it will help with the transition to renewable energy. Additionally, it is anticipated that a sizable amount of the gas from the USD 110.0 billion Jafurah development will be utilised to create blue hydrogen. Additionally, ADQ and Mubadala Investment Co. have partnered with ADQ to generate and export blue and green hydrogen. Abu Dhabi National Oil Co., a government-run oil corporation, has also teamed up with two of its sovereign wealth funds.

- Rising use of steam methane technology: The steam methane reforming category held a sizeable market share in 2021 and is likely to expand significantly throughout the foreseeable future. The technique of in-house pressure swing absorption purification, which can be used to efficiently produce high levels of pure hydrogen and increase hydrogen output, is one of the main drivers propelling the expansion of the category market. This procedure, which involves heating gases like methane in the presence of steam and a catalyst, has grown immensely popular as one of the most affordable sources of industrial hydrogen, which is expected to increase the blue hydrogen market share during the forecast period.

Market Restraints:

- High Cost of Production and Carbon Footprint Concerns: The production of blue hydrogen directly depends on natural gas and LNG with carbon capture and storage, which is expensive for the infrastructure cost, which includes the transport, capture, and storage of these gases. Additionally, the blue hydrogen release residue carbon footprint is even after the use of CCS, since not all the carbon dioxide is captured through blue hydrogen production. This leads to making blue hydrogen costlier than traditional fossil fuels, while not eliminating carbon dioxide completely, making it less appealing in comparison to green hydrogen, which could hamper the market expansion.

Blue Hydrogen Market Segmentation Analysis

- By End Use: Power Generation is dominating due to its growing demand for net-zero emissions and decarbonization of energy systems.

Based on end use, the market is categorized into refining, chemicals, iron and steel, power generation, transportation, and others. The power generation continues to dominate in the blue hydrogen market as its emission decarbonization is achieved by electricity production, from energy systems, by way of meeting the global net-zero emission targets.

In addition, this domain continues to be the largest end-use market for blue hydrogen, as cleaner alternative energies are sought globally and carbon emissions must lessen in electricity production as per governments' initiatives and regulatory bodies' mandates. Blue hydrogen from natural gas and carbon capture and storage, on the other hand, increasingly serve as fuel for gas turbines and power plants that run partly on natural gas, thereby reducing the carbon footprints of these power plants. The dominance of power generation lies in its scalability and the urgent demand for switching a fossil fuel-based power system into a low-carbon counterpart, especially in locations characterised by stringent environmental regulations, like North America, Europe, and the Asia-Pacific.

Moreover, the growth is driven by power generation for several other factors, like hydrogen fuel cells, which combine hydrogen and oxygen to produce electricity, are a zero-emission solution at the point of use, making it attractive for power plants and large-scale applications. Also, blue hydrogen is attractive to utilities, as it can utilize existing natural gas infrastructure, with the utilization of CCS in combination could lead to a decrease in emissions without the need for a new system, which makes it a cost-effective fuel for the industry.

Blue Hydrogen Market Regional Analysis

- North America: North America is expected to lead in global blue hydrogen due to the growing usage of blue hydrogen in the transportation, oil refining, and power-generating industries. North America is one of the biggest consumers of blue hydrogen. Moreover, the chemical sector is a crucial sector for creating cutting-edge solutions to make the transition to sustainability and net zero possible. Energy efficiency, bio-based feedstock, and shutting material loops can help us reach net-zero ambitions, but the chemical sector also needs other technologies like hydrogen, carbon capture, and electrification.

- Europe: Europe is gradually adopting blue hydrogen, especially in the United Kingdom and Germany, which are increasingly investing in fuels and projects to achieve the climate goals. The growing energy requirement in the region, with supportive policies and subsidies in the development of hydrogen infrastructure, will also fuel the blue hydrogen market in the years to come. For instance, Air Products formed a long-term agreement with ExxonMobil for the establishment of Europe's largest blue hydrogen production plant in Rotterdam in November 2023. It is expected to start operating by 2026.

- Asia-Pacific: Asia Pacific is holding a significant pace in the blue hydrogen market due to countries like Japan and South Korea, which are increasingly investing in the hydrogen fuel cells for diverse applications, while in China, Malaysia, and India are scaling up of blue hydrogen production and the utilization of hydrogen for chemicals and refining is increasing, which will contribute to an increase in the regional market of blue hydrogen. For instance, in November 2024, Malaysia’s Ministry of Science, Technology, and Innovation (MOSTI) announced a plan as part of their Economy and Technology Roadmap (HETR) for scaling up the blue hydrogen production to a target of 2 million tonnes by 2030 and further to 16 million tonnes by 2050.

- South America: The South American blue hydrogen market is the fastest-growing region, driven by a rise in investment in emerging CCS infrastructure, along with promoting low-carbon energy, especially in Brazil, which is exploring fuels like Blue Hydrogen for the decarbonization of industry.

- The Middle East and Africa: The Middle East and Africa are the dominating regions in the blue hydrogen market due to the significant presence of natural gas reserves, along with strong exports in other regions. This is coupled with an increase in investment in CCS infrastructure and the production of blue hydrogen by regional countries like Saudi Arabia and the UAE.

Blue Hydrogen Market Competitive Landscape

Key Industry Players:

The competitive landscape in the blue hydrogen market is fast developing, with energy companies, industrial gas providers, and governments ramping up efforts to decarbonize heavy industries and energy systems. Big oil and gas players like Aramco, ExxonMobil, and Shell currently invest heavily in the large-scale blue hydrogen projects, tapping into their existing natural gas infrastructure and CCS expertise. Industrial gas players like Air Products and Chemicals Inc., and Linde Inc., are carving out strong positions by developing integrated blue hydrogen plants and entering into long-term supply agreements for refineries, chemical producers, and transport sectors. Competition also arises from regional policy frameworks, where subsidies, carbon pricing, and clean energy roadmaps influence project economics. The market is also reshaped by technical expertise and infrastructure accelerating through collaborative ventures, such as the one between Aramco and Air Products Qudra in March 2025 for promoting blue hydrogen production. So, all in all, the competition remains based on scale, costs, integration with CCS, and long-term offtake environment benefits.

List of Key Company Profiles:

- Alfa Laval

- Aramco

- ExxonMobil Corporation

- Air Products and Chemicals Inc.

- Dastur Energy

- Topsoe

- Shell Plc

- Lindle Plc

- Other

Blue Hydrogen Market Key Developments

- Acquisition: In March 2025, Aramco announced the acquisition of a 50 percent stake in Blue Hydrogen Industrial Gases (BHIG) Company. It is a Jubail-based company involved in blue hydrogen industrial gases in a joint venture with Air Products Qudra focuses on the supply of hydrogen which including blue hydrogen, in the Jubail region. The Aramco carbon capture and storage (CCS) structure in Jubail will be coordinated with BHIG for the production of blue hydrogen with usage of natural gas with CCS. This collaboration is in line with the Saudi Arabia Vision 2030, which targets a decrease in carbon dioxide and advancement in the hydrogen network while also supporting domestic production and growth.

- Project Commencement: In December 2024, the INPEX Corporation started front-end engineering and design (FEED) development and preparations for the production plant of blue hydrogen in Niigata Prefecture. The company is focusing on the objective of producing a capacity of about 100,000 tons annually. The projects will utilize LNG from the Noetsu terminal along with natural gas produced from INPEX’s Minami-Nagaoka gas field.

- Partnership: In October 2024, Double Zero Holdings and SJ Environmental partnered in a joint effort to convert stranded natural gas to blue hydrogen. The partnership is focused on addressing the challenge of unused natural gas, particularly methane, through the utilization of advanced technology to transform this into a cleaner source of fuel. The process captures 100% of CO2 emissions at the well site, thus creating an atmosphere that supports sustainability as part of the transition toward low-carbon energy. This initiative is also likely to play a leading role in reducing greenhouse gas emissions and enhancing energy efficiency within different industries.

- Project Agreement: In August 2024, Linde signed a long-term agreement to supply Dow's Path2Zero project in Fort Saskatchewan, Canada, with clean hydrogen. Linde invested more than $2 billion to build and operate a state-of-the-art clean hydrogen production facility, which will be the largest of its kind in Canada when it is completed in 2028. The facility will use autothermal reforming and Linde's proprietary carbon capture technology to produce clean hydrogen while capturing more than two million metric tons of CO2 annually, supporting Dow's net-zero emissions goals.

Blue Hydrogen Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Blue Hydrogen Market Size in 2025 | US$1,204.410 million |

| Blue Hydrogen Market Size in 2030 | US$1,586.122 million |

| Growth Rate | CAGR of 12.58% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Blue Hydrogen Market |

|

| Customization Scope | Free report customization with purchase |

The Blue Hydrogen Market is analyzed into the following segments:

- By Technology

- Steam Methane Reforming

- Gas Partial Oxidation

- Auto Thermal Reforming

- By End-Use

- Refining

- Chemicals

- Iron and Steel

- Transportation

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Blue Hydrogen Market Size:

- Blue Hydrogen Market Highlights:

- Blue Hydrogen Market Trends

- Blue Hydrogen Market Dynamics

- Blue Hydrogen Market Segmentation Analysis

- Blue Hydrogen Market Regional Analysis

- Blue Hydrogen Market Competitive Landscape

- Blue Hydrogen Market Key Developments

- Blue Hydrogen Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025