Report Overview

Biometric System Market - Highlights

Biometric System Market Size:

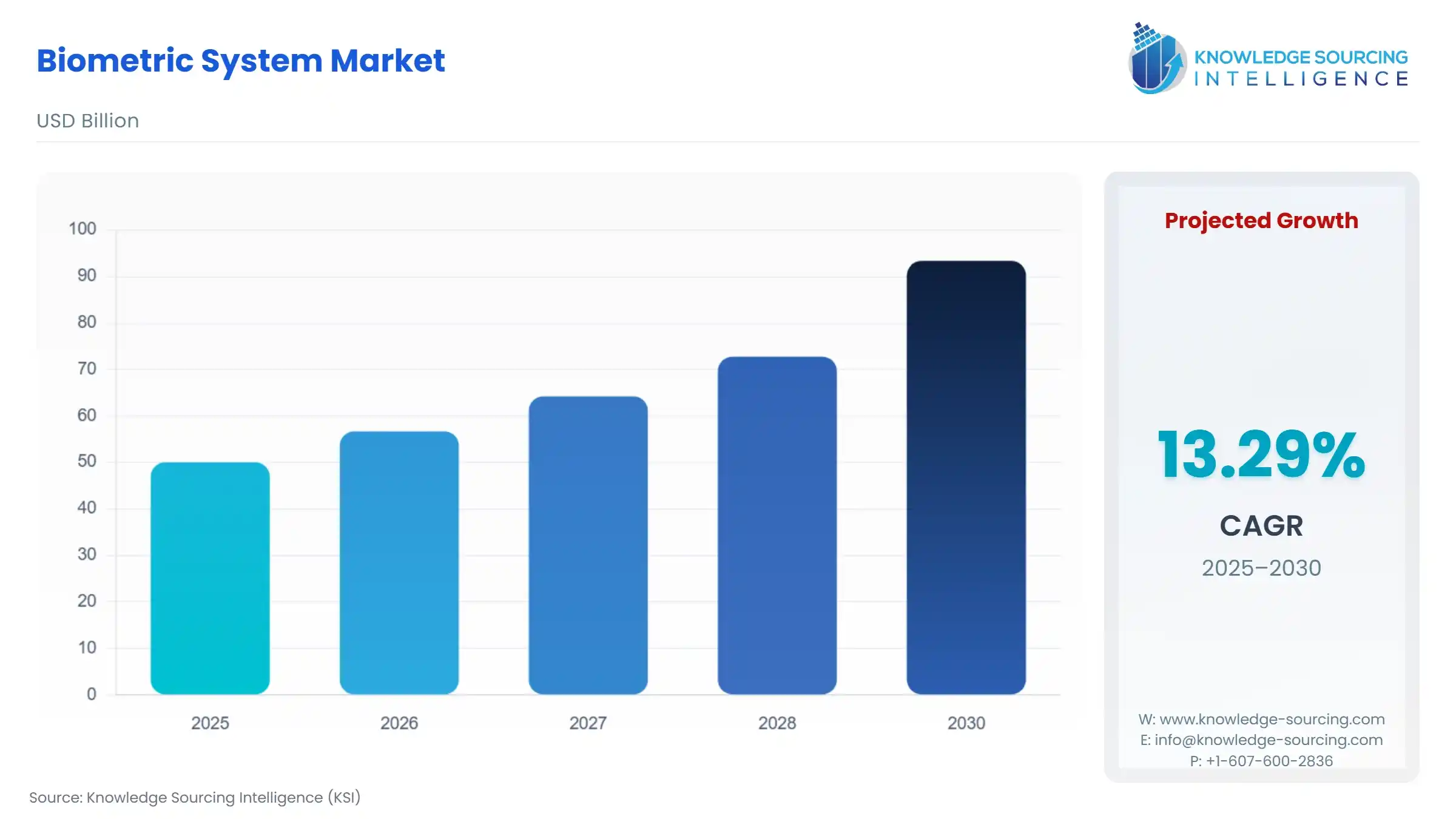

The Biometric System Market is expected to grow from US$50.040 billion in 2025 to US$93.369 billion in 2030, at a CAGR of 13.29%.

Biometric System Market Introduction:

The biometric system market is growing rapidly due to rising demand for better security solutions in government, commercial, and consumer sectors. Concerns about identity theft, cybercrime, and terrorism have led governments to implement stringent identification and verification systems at borders, airports, and public places. Programs such as e-passports, national ID initiatives, and biometric voter registration are now common in many countries. Law enforcement agencies are also using biometrics for identifying criminals and surveillance, which is driving consistent investment in biometric infrastructure.

In the business sector, using biometrics in smartphones, laptops, and access control systems has greatly increased market presence. According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, global smartphone shipments increased 2.4% year-over-year (YoY) to 331.7 million units in the fourth quarter of 2024 (4Q24). Among these, Samsung has the largest market share of 31.97%, followed by Apple with 23.18%.

Industries like banking, retail, and healthcare are using biometrics to improve customer verification, simplify operations, and eliminate fraud. Touchless technologies, including facial recognition, iris scanning, and voice recognition, are now a priority because of their convenience and accuracy. Multi-modal biometric systems are also becoming popular as they offer better security by combining methods like fingerprint, face, and voice recognition. Technological progress is another major factor for market growth. New developments in artificial intelligence (AI), machine learning, and deep learning have noticeably improved the accuracy, speed, and usability of biometrics. Edge computing and cloud integration enable real-time authentication with little delay, helping to expand biometric uses in areas like smart cities, surveillance, and digital health. As biometric solutions become cheaper and easier to scale, more companies are expected to adopt them in emerging markets, creating new opportunities for global suppliers and local businesses.

Biometric System Market Trends:

The biometric system market is expected to grow at a modest rate due to cohesive support by the governments worldwide, and favourable regulations are being carried out for triggering the promotion of the biometrics market. The main reason for the adoption of this technology is security. As in today’s era, theft and breach of security are easily possible, so taking into consideration security, this market is growing. Simultaneously, a growth in cyberattacks and crimes is pushing the demand for biometric security during the forecasted period.

By verticals, the biometric system market is segmented as BFSI, consumer electronics, automotive, government, and others. This market is growing in the automotive sector due to increasing vehicle thefts. Due to economic growth across the globe, demand for automotive is increasing at the ideal demographic trend, thus the growing automotive production is anticipated to push the demand for biometric systems. In the BSFI sector, the biometric market is boosting toward growth for justified reasons of uniqueness and security due to increased thefts and cybercrimes. The consumer electronics market will dominate this market as the manufacturers are investing heavily to make the devices more secure.

By geography, the biometric system market is segmented as the Americas, Europe, the Middle East & Africa, and the Asia Pacific. In the Americas, this market is expected to grow at a tremendous rate due to the security and scrutiny of employees. The Asia Pacific region is adopting the new technologies of biometrics for more security and efficiency. Now, the various governments are implementing various security policies, which show growth in this market in the forecasted period.

Major industry players profiled as a part of this report are NEC Corporation[1], Iris ID Systems Inc., Comfis S.R.O., Princeton Identity, BioRugged, Telepower Communication Co., Ltd, Jagstar, Crossmatch, Infinity Optics Solutions Pte Ltd, and Cognitec Systems GmbH.

Biometric System Market Drivers

- Growing use in various end-use industries

The biometric system market is experiencing strong growth, mainly due to the integration of biometric technologies into consumer electronics. Devices like smartphones, laptops, smartwatches, and tablets increasingly include fingerprint sensors, facial recognition systems, and iris scanners. Major brands such as Apple, Samsung, Huawei, Dell, and Lenovo have made biometric authentication a standard in their products. This ensures secure access, easy payments, and personalized use of devices. Features like Face ID, ultrasonic fingerprint sensors, and Windows Hello facial recognition have improved user experience and boosted data security, especially as people conduct sensitive tasks like online banking and e-commerce on personal devices.

According to Invest India, the global electronics manufacturing services market is expected to attain a value of $1145 billion by 2026, growing at a CAGR of 5.4% during the forecast period 2021-2026. From $ 9.8 billion in 2021, India's domestic demand for consumer electronics is growing exponentially and will reach $ 21.18 billion by the end of 2025. India is the second-largest market for smartphones worldwide, with over 1.3 billion mobile phone users in the country, further fueling the growth.

Beyond electronics, industries such as healthcare, automotive, education, retail, and manufacturing are integrating biometric systems for operational efficiency, compliance, and enhanced security. In healthcare, biometrics ensure accurate patient identification and secure access to electronic medical records, reducing fraud and administrative errors. The automotive sector is implementing facial and fingerprint recognition for driver authentication and personalization. In line with this, according to the IEA, in 2023, approximately 14 million electric cars were sold, of which ninety-five percent were purchased by consumers in Europe, China, and the United States. Compared to 2022, this figure showed a 35% increase, with 3.5 million more registered EVs. The IEA data further represented that the sale of electric cars rose from 13.7 million in 2023 to 16.6 million units in 2024.

Moreover, educational institutions are using biometrics for attendance and exam security, while retail and e-commerce leverage it for contactless payments and personalized customer service. In manufacturing and industrial environments, biometric time-tracking and access control systems help monitor workforce activity and improve safety.

The growing penetration of biometric systems across diverse verticals highlights a fundamental shift in how organizations manage identity, access, and security. Biometric technologies offer a powerful combination of convenience, speed, and data protection, making them increasingly indispensable in both public and private sectors. As industries adopt digitization, automation, and remote operations, the demand for reliable and frictionless authentication is only expected to rise.

Biometric System Market Segmentation Analysis:

- By Type, the Multi-Factor Authentication (MFA) segment is growing notably

Multi-Factor Authentication (MFA) is the predominant segment in the biometric system market by type, surpassing Single-Factor Authentication (SFA) due to its enhanced security capabilities. MFA combines two or more authentication methods, such as biometrics (e.g., fingerprint, facial recognition), passwords, or smart cards, to provide robust protection against cyber threats. Its widespread adoption is driven by the need for secure digital transactions and compliance with stringent regulations.

The surge in cyberattacks, including phishing and credential theft, has pushed organizations to adopt MFA. A 2024 report by Verizon noted that 74% of data breaches involved stolen credentials, underscoring the need for stronger authentication methods. MFA mitigates these risks by requiring multiple verification layers.

Global regulations, such as the European Union’s PSD2 (Payment Services Directive 2) and GDPR, mandate strong customer authentication for financial transactions. MFA aligns with these requirements, driving its adoption across industries.

Innovations in biometric modalities, such as behavioral biometrics and voice recognition, enhance MFA’s reliability and user experience. For instance, in 2024, Apple introduced passkeys leveraging facial recognition for seamless MFA on its devices.

The shift to cloud computing has accelerated MFA adoption, as organizations seek scalable, secure authentication for remote workforces. Microsoft reported in 2024 that MFA adoption on its Azure platform grew

- The BFSI sector is anticipated to lead the market expansion

The BFSI sector is the leading vertical in the biometric system market, driven by the need for secure transactions, fraud prevention, and regulatory compliance. Biometric systems, including fingerprint scanners, facial recognition, and iris authentication, are widely deployed in ATMs, online banking, and insurance claim verification.

The BFSI sector faces significant fraud risks, with global financial losses from payment fraud reaching USD 40 billion in 2024, per a Mastercard report. Biometric systems, particularly MFA, reduce unauthorized access and fraudulent transactions.

Consumers increasingly expect seamless yet secure banking experiences. Biometric authentication, such as facial recognition for mobile banking, balances security with user convenience. A 2024 survey by J.P. Morgan found that 68% of customers prefer biometric login over passwords.

The BFSI sector’s shift to digital platforms, including mobile apps and online services, necessitates robust authentication. Biometric systems enable secure onboarding and transaction verification, supporting digital growth.

National digital identity programs, such as India’s Aadhaar, integrate biometrics into financial services, boosting adoption in BFSI. In 2024, over 1.3 billion Aadhaar-based transactions were processed monthly in India.

Biometric System Market Geographical Analysis:

- The US market is expected to rise rapidly

Several factors are responsible for driving the growth of the United States in the biometric system market, such as the increasing security concerns, technological advancements, and the widespread adoption across diverse sectors. Key growth drivers include the rising need for secure authentication due to escalating cyber threats, with data breaches costing $4.88 million globally in 2024, which was a 10% increase from 2023, when the average cost was $4.45 million. According to the study published by Morgan Lewis, for the 14th year in a row, the United States led all countries and regions globally with an average cost per data breach of $9.36 million in 2024, representing a slight decrease from 2023 when the average cost of a breach was $9.48 million. The other four of the top five countries and regions globally experiencing the highest average costs of a data breach were the Middle East at $8.75 million, Benelux at $5.9 million, Germany at $5.31 million, and Italy at $4.73 million.

Top companies in the U.S. biometric market, including IDEMIA, NEC Corporation, Thales, BIO-key International, and Aware, Inc., are driving innovation through strategic collaborations, mergers, acquisitions, and product launches. In January 2024, IDEMIA launched VisionPass SP, a facial recognition access control solution with advanced AI algorithms for enhanced accuracy and security, targeting commercial and government applications. NEC Corporation, in the same year, collaborated with Japan’s Immigration Services Agency to deploy biometric kiosks at Haneda Airport, showcasing technology adaptable for U.S. border security. Thales partnered with SoyYo in October 2023 to integrate biometric payment solutions, a model expanding in the U.S. banking sector. BIO-key International formed a strategic partnership with Arrow ECS Iberia in April 2025 to distribute advanced identity and access management solutions, including phoneless and passwordless authentication, strengthening its U.S. market presence.

Biometric System Market Key Developments

- India’s e-Passport with Biometric Chip: In May 2025, the Government of India began issuing e-passports embedded with chips storing biometric data (fingerprints and photographs). This enhances security and enables automated immigration processing, boosting biometric use in government applications.

- Okta’s Adaptive MFA with Behavioral Biometrics: In June 2024, Okta released an adaptive MFA solution incorporating behavioral biometrics, such as typing patterns and mouse movements, to enhance enterprise security. This product reduces login friction while meeting compliance needs, driving MFA innovation in cybersecurity.

- Visa’s Global Biometric MFA Rollout: In 2024, Visa launched a global biometric-based Multi-Factor Authentication (MFA) solution for card-not-present transactions, integrating facial and fingerprint recognition. This aligns with PSD2 compliance and reduces fraud in digital payments, strengthening biometric adoption in the BFSI sector.

List of Top Biometric System Companies:

- NEC Corporation

- Iris ID Systems Inc.

- Comfis s.r.o.

- Princeton Identity

- BioRugged

Biometric System Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 50.040 billion |

| Total Market Size in 2031 | USD 93.369 billion |

| Growth Rate | 13.29% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Verticals, Component, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Biometric System Market Segmentation

-

By Type

-

Single Factor Authentication

-

Multi-Factor Authentication

-

-

By Verticals

-

BFSI

-

Consumer Electronics

-

Automotive

-

Government

-

Others

-

-

By Component

-

Hardware

-

Software

-

-

By Geography

-

North America

-

USA

-

Canada

-

Mexico

-

-

South America

-

Brazil

-

Argentina

-

Others

-

-

Europe

-

Germany

-

France

-

United Kingdom

-

Italy

-

Others

-

-

Middle East and Africa

-

Saudi Arabia

-

Israel

-

Others

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Others

-

-