Report Overview

Blockchain in Healthcare Market Highlights

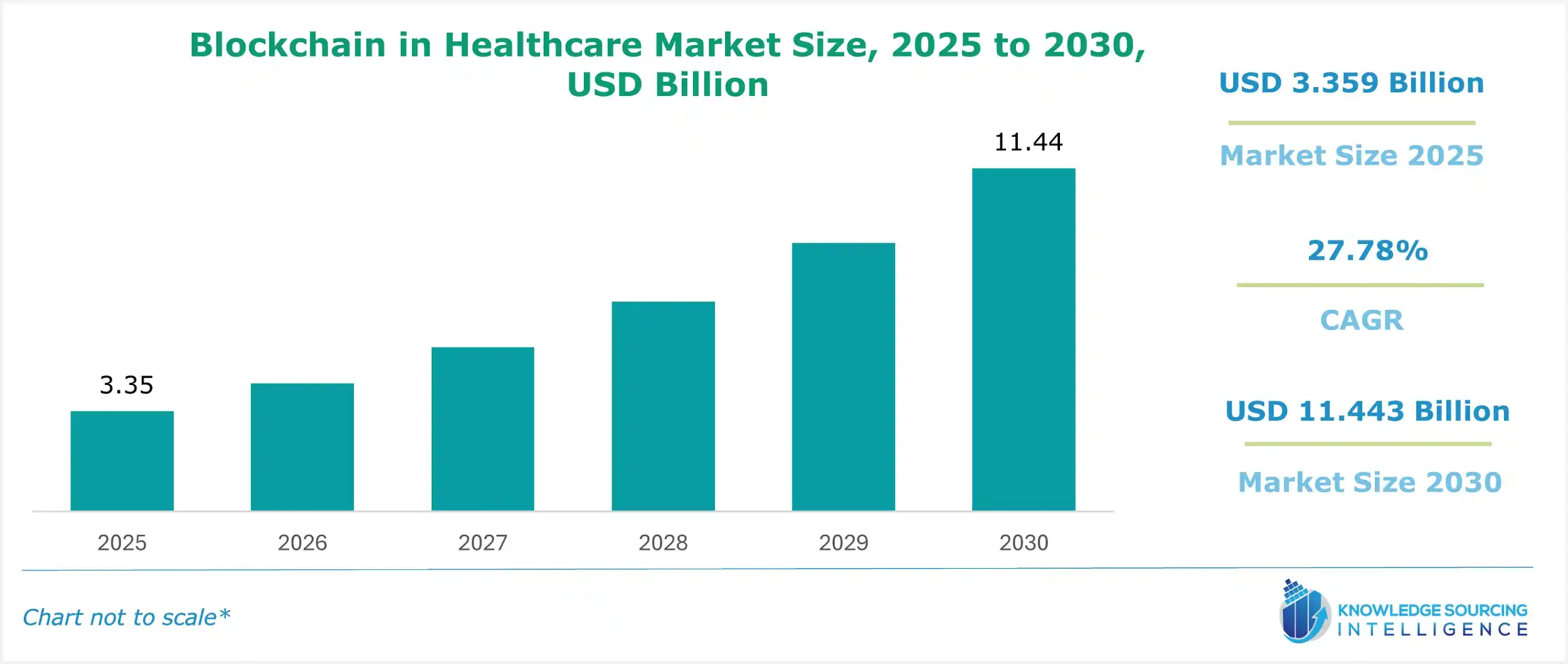

Blockchain in Healthcare Market Size:

Blockchain In Healthcare Market, at a 26.95% CAGR, is expected to reach USD 14.058 billion in 2031, starting from USD 3.359 billion in 2025.

Blockchain in Healthcare Market Overview:

Blockchain technology is being used in a wide range of industries and has gained a lot of traction. Banking, supply chain management, and healthcare all benefit from the secure and transparent record-keeping and transactional capabilities offered by blockchain. It reduces the need for middlemen thanks to its decentralized structure, resulting in increased productivity and decreased costs. The rising demand for decentralized solutions and enhanced data security is propelling the blockchain market's growth. The complexity, scalability, and personalization of a blockchain solution all influence the price. It is best to hire blockchain service providers for precise pricing tailored to your specific requirements.

Blockchain in healthcare is transforming data management through decentralized ledger technology (DLT), enabling immutable health records that ensure data integrity. Patient data security blockchain solutions leverage cryptographic encryption to protect sensitive medical information, reducing breach risks. Healthcare data interoperability is enhanced by standardized, secure data exchange across disparate systems, improving care coordination. Smart contracts in healthcare automate processes like consent management and claims processing, ensuring compliance and efficiency. These advancements empower industry experts to build trust, streamline operations, and enhance patient outcomes in clinical trials, supply chain management, and electronic health record (EHR) systems.

Blockchain is one of the emerging technologies that have the potential to transform the healthcare sector, which is constantly evolving. Blockchain technology, which gained prominence as the technology that served as the foundation for cryptocurrencies like Bitcoin, is now utilized in numerous fields, including healthcare. The blockchain in the healthcare market size has adopted and utilized blockchain technology in the healthcare sector. It involves putting blockchain-based solutions into action to address issues and enhance the efficiency, transparency, security, and interoperability of the healthcare system.

The market is made up of several different segments, including Drug Supply Chain Management, Claims Adjudication and Billing Management, Clinical Data Exchange and Interoperability, etc.

Blockchain In Healthcare Market Trends:

Blockchain in the healthcare market is driven by digital health transformation, integrating decentralized ledger systems to enhance data integrity and streamline operations. Healthcare cybersecurity trends prioritize immutable ledgers to combat data breaches, ensuring robust patient data protection. Patient empowerment in healthcare is rising, with blockchain enabling self-sovereign identity and control over medical records. Emerging decentralized finance (DeFi) in healthcare is gaining traction, facilitating secure, transparent payment systems and claims processing. These trends address interoperability challenges, reduce administrative costs, and foster patient-centric care models in increasingly digitized and secure healthcare ecosystems.

Blockchain In Healthcare Market Key Companies:

IBM: The IBM Blockchain platform, which enables healthcare networks to be dependable and interoperable, is offered by IBM, a global technology leader.

Microsoft: The Azure Blockchain Service, offered by Microsoft, another significant participant, enables developers to develop scalable and integrated blockchain applications.

Change Healthcare: It is a service provider for managing the revenue cycle and handling claims that use blockchain to cut down on administrative tasks and improve the quality of data.

Guardtime: The KSI Blockchain, which guarantees impermeable record-keeping for the integrity of data and supply chain management, is offered by Guardtime, a cybersecurity company.

Hashed Health: With the intention of fostering interoperability and managing the revenue cycle, Hashed Health creates consortium networking and collaborative platforms for stakeholders in the healthcare industry.

Blockchain In Healthcare Market Growth Drivers:

Increasing adoption of Electronic Health Records (EHR):

Security, confidentiality, and interoperability are enhanced when blockchain is incorporated into EHR systems. It provides tamper-proof records, restricted access, and expedited data transmission to meet the growing demand for safe and effective healthcare solutions.

Growing concerns regarding Data privacy and security:

Data privacy and security are important considerations in healthcare because of the high number of security incidents and consumer complaints. Blockchain technology addresses these issues by ensuring patient privacy, consent, and data integrity while facilitating safe storage, administration, and exchange of healthcare information through decentralization and immutability.

Demand for effective Supply Chain Management in Healthcare:

In the healthcare industry, the timely delivery of essential goods necessitates efficient supply chain management. Transparency, traceability, and verification are enhanced by blockchain technology, thereby resolving issues like interruptions and counterfeit pharmaceuticals. The use of blockchain-based solutions is being driven by the demand for efficient healthcare supply chain management in the industry.

Regulatory support and initiatives for Blockchain adoption:

To progress blockchain utilization in medical services, administrative action and support are essential. Blockchain's goals of increasing data security, privacy, and interoperability in EHR systems are aligned with the HITECH Act in the United States. The European Commission's Blockchain Observatory and Forum fosters cooperation and favorable regulatory conditions. Healthcare organizations may utilize blockchain technology to enhance their offerings with government support.

Technological Advancements in Blockchain Solutions:

Protocols for interoperability between blockchains make it possible for healthcare systems to exchange data and communicate effectively. Safe AI algorithm control, IoT data authentication, and data integrity in healthcare applications are all made possible by integration with AI and IoT. These advancements support innovative and secure blockchain-based healthcare solutions by enhancing scalability, privacy, and interaction with other technologies.

The healthcare blockchain market is set to grow at a constant rate in the forecast period.

The market for healthcare blockchain is segmented by application, end-user, type, deployment, and geography. Deployment is further segmented into teleconsultation, on-premises, and cloud-based. The type is further segmented into public blockchain, private blockchain, and consortium blockchain.

Blockchain in Healthcare Market Geographical Outlook:

The United States holds a significant market share in the global healthcare blockchain industry.

The healthcare blockchain market share is dominated by North America, particularly the United States, due to its strong infrastructure, legislation, and focus on digital health. Blockchain's capabilities are in line with the region's emphasis on information security. Among the obstacles are interoperability, standardization, and intricate legislation. For the integration of blockchain technology into various healthcare systems, stakeholders must work together. Laying out legitimate systems, settling security issues, and growing clear norms need close coordination with innovation organizations, healthcare associations, and administrative bodies. The adoption of blockchain technology in healthcare will increase if these obstacles are overcome.

Blockchain in Healthcare Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Blockchain In Healthcare Market Size in 2025 | USD 3.359 billion |

Blockchain In Healthcare Market Size in 2030 | USD 11.443 billion |

Growth Rate | CAGR of 27.78% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Blockchain In Healthcare Market |

|

Customization Scope | Free report customization with purchase |

Blockchain in the Healthcare Market Segmentation:

BY APPLICATION

Clinical Data Exchange and Interoperability

Claims Adjudication and Billing Management

Drug Supply Chain Management

Clinical Trials and Research Studies

Medical Records Management

Others

BY END-USER

Healthcare Providers

Pharmaceutical Companies

Healthcare Payers

Patients

Others

BY TYPE

Public Blockchain

Private Blockchain

Consortium Blockchain

BY DEPLOYMENT

On-Premises

Cloud-Based

BY GEOGRAPHY

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation

Page last updated on: September 12, 2025