Report Overview

Blueberry Extract Market - Highlights

Blueberry Extract Market Size:

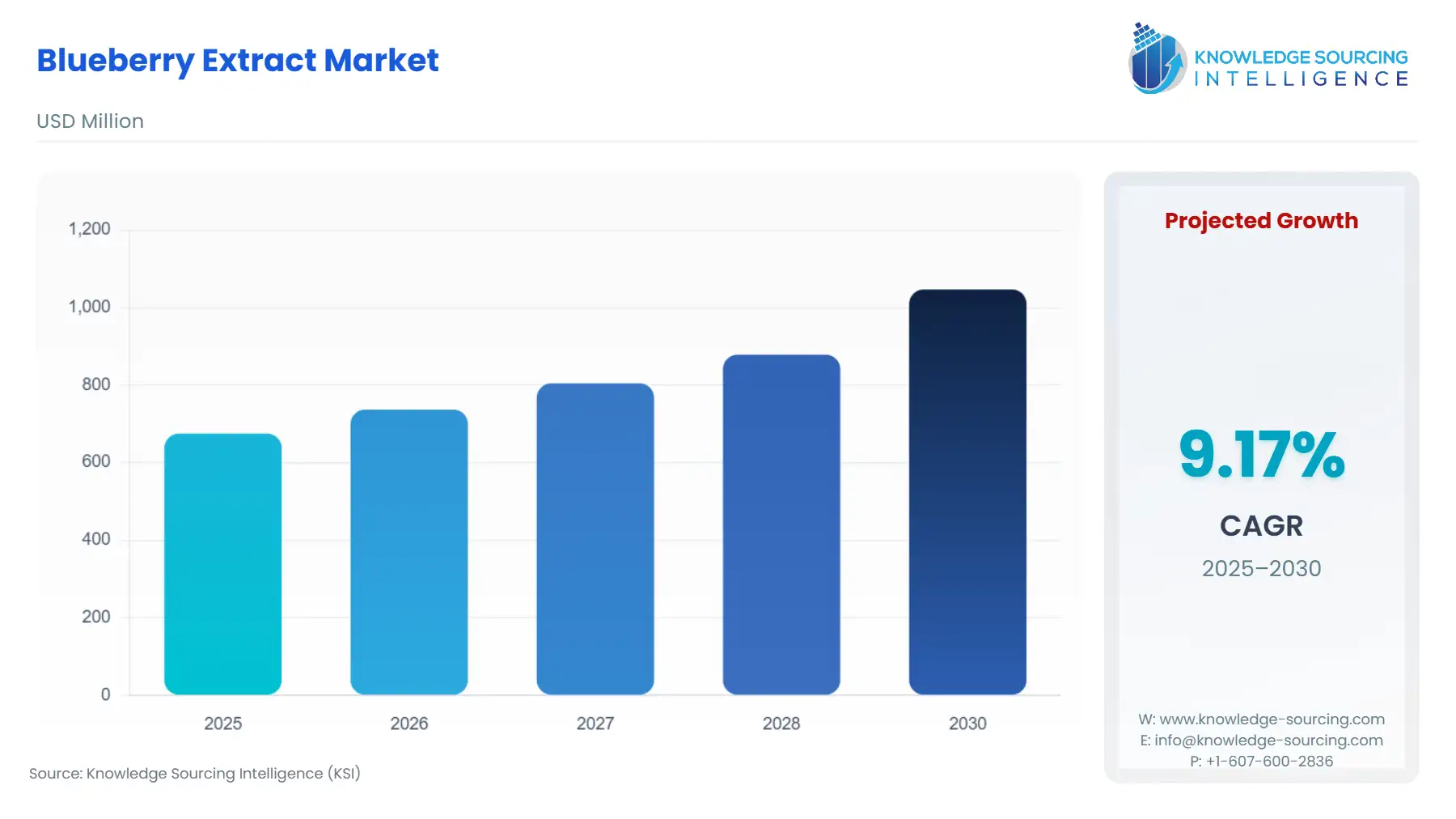

Blueberry Extract Market, with a 9.17% CAGR, is projected to increase from USD 675.175 million in 2025 to USD 1,047.105 million in 2030.

The Blueberry extract market centers on the fruit's potent concentration of polyphenols, primarily anthocyanins, which confer a high-value status as a functional food ingredient and nutraceutical active. This structural attribute—being a source of stable, scientifically-validated bioactives—positions the extract as an essential raw material for brands capitalizing on the global shift toward preventive self-care. The extract's utility spans beyond traditional dietary supplements into modern food science, where its pigment content offers a clean-label solution for color and flavor fortification. This dual-market function underpins the current demand landscape, necessitating a specialized analysis of both the botanical supply chain and the highly regulated application environments.

Blueberry Extract Market Analysis

- Growth Drivers

The market growth is primarily propelled by the verified cardiometabolic and neuroprotective benefits of the extract's high anthocyanin content. Academic studies consistently link consumption to positive outcomes in cardiovascular health and cognitive function, creating a strong consumer pull for dietary supplements. This scientific validation is the core demand driver for the nutraceutical and pharmaceutical segments, as it enables manufacturers to leverage permissible structure/function claims on finished products. Concurrently, the burgeoning global "Clean Label" movement propels industrial demand in the food sector. As regulatory bodies and consumers pressure manufacturers to eliminate synthetic ingredients, Blueberry extract is procured as a natural coloring and stabilizing agent, directly replacing artificial dyes and driving large-volume demand from Food & Beverage formulators.

- Challenges and Opportunities

The primary challenge constraining market fluidity is the inherent volatility in raw material supply. Blueberry cultivation is susceptible to regional climate shifts and seasonal cycles, creating an unpredictable cost and volume dynamic for extractors. This instability elevates the cost of goods sold, hindering high-volume, low-margin applications. Conversely, this volatility creates an opportunity for varietal innovation and global sourcing expansion. Companies that invest in counter-seasonal supply chains, utilizing production from regions like Peru and Chile, can stabilize their input costs, thereby strengthening their competitive position. Furthermore, the regulatory complexity around health claims in developed markets presents an opportunity for science-backed players to differentiate themselves through rigorous, proprietary clinical evidence that substantiates premium pricing.

- Raw Material and Pricing Analysis

The supply chain begins with the cultivation of lowbush (wild) and highbush (cultivated) blueberries. Pricing is fundamentally affected by the seasonal yields in major growing regions, notably the United States (Michigan, Washington, Oregon) and Canada. For instance, reports indicate a production decline in some traditional US states, forcing extract manufacturers to increase procurement from emerging global hubs like Morocco, China, and Southern Hemisphere suppliers. This shift stabilizes volume but introduces logistical complexity and greater price fluctuations tied to currency and shipping costs.

- Supply Chain Analysis

The global supply chain is characterized by a high degree of vertical integration among key extractors who manage the journey from harvest to final powdered ingredient. Primary production hubs are concentrated in North America, with counter-seasonal supply originating from South America (Chile, Peru) to guarantee year-round feedstock. The most critical stage is the extraction process, which must occur rapidly after harvest due to the fruit's high perishability. Logistical complexities stem from transporting fresh or frozen berries across long distances without compromising the anthocyanin content, necessitating specialized cold-chain infrastructure.

Blueberry Extract Market Segment Analysis

- By Application: Pharmaceuticals

The Pharmaceuticals segment represents a high-value anchor for the Blueberry extract market, driven by the clear, scientifically-supported role of anthocyanins in disease risk reduction. Demand here is not predicated on general wellness but on outcomes from rigorous clinical trials demonstrating effects on oxidative stress markers, vascular function, and neuroprotection. This segment specifically procures high-potency, standardized powder extracts to ensure a precise, repeatable dosage form. The demand driver is the ability of a manufacturer to obtain regulatory clearance for explicit health claims—such as the extract's role in maintaining healthy blood flow or supporting visual acuity—which compels formulation with the highest-grade, clinically-validated materials. The subsequent demand translates into a preference for powder extracts over less controllable forms like liquids, due to the imperative for accurate dosage control in pills and capsules.

- By Product Type: Powder

The Powder segment dominates the market due to its versatility, stability, and formulation efficiency, directly amplifying its demand from both the Food & Beverage and Pharmaceuticals sectors. As a dry, free-flowing format, the powdered extract offers superior shelf stability for the sensitive anthocyanin compounds compared to liquid formats, directly addressing one of the industry's major logistical challenges. Critically, it is the only viable format for creating accurately-dosed capsules, tablets, and customizable dry-blend supplements, supporting the rapid growth of personalized nutrition. Furthermore, the F&B industry drives high-volume powder demand because it easily disperses in dry mixes, baked goods, and functional beverages, functioning as both a highly stable natural colorant (a clean label imperative) and a functional ingredient without adding unwanted volume or moisture.

Blueberry Extract Market Geographical Analysis

- US Market Analysis (North America)

The US market for Blueberry extract is strongly driven by the culture of proactive self-care and high consumer adoption of dietary supplements. This demand is further amplified by the regulatory environment under DSHEA, which fosters rapid innovation and product launches centered on health benefits like cardiovascular and cognitive support. Specifically, the strong and growing demand for botanical supplements is directly linked to an aging population seeking preventive health solutions and younger, wellness-conscious consumers prioritizing mental health and anti-aging benefits. The prevalence of e-commerce channels facilitates direct-to-consumer sales, making it easy for high-quality, specialized extracts to reach a national audience.

- Brazil Market Analysis (South America)

Demand in Brazil is primarily fueled by a powerful, localized Clean Label trend within the Food & Beverage industry, where consumers actively reject synthetic additives. Brazilian manufacturers seek Blueberry extract as an approved, natural colorant to replace artificial red and blue dyes in confectionery and beverages. Furthermore, the country's rising middle class and increasing focus on functional foods propel demand in the nutraceutical space, as consumers view natural fruit extracts as superior, premium ingredients for fortified beverages and immunity-boosting supplements, providing a clear demand advantage over commodity-grade ingredients.

- Germany Market Analysis (Europe)

The German market is defined by a strict regulatory framework and a high consumer expectation for scientific rigor, which places unique demands on the extract market. The European Food Safety Authority's (EFSA) rigorous health claim substantiation and the Novel Foods Regulation restrict the speed and volume of product launches compared to the US. This creates demand for clinically-backed extracts only, compelling suppliers to provide proprietary, human clinical data to justify claims, resulting in a market that prioritizes high-quality, high-cost, and scientifically verifiable extracts suitable for premium positioning over unverified commodity products.

- UAE Market Analysis (Middle East & Africa)

The UAE's demand for Blueberry extract is tightly correlated with the rapid growth of the nutraceutical and functional food sector, reflecting high discretionary income and Westernized consumer preferences. A key driver is the regional focus on addressing lifestyle diseases, creating specific demand for antioxidant-rich supplements marketed for cardiometabolic health. Furthermore, the UAE functions as a key trade and re-export hub for the broader Middle East and Africa region, meaning local demand is amplified by the need for bulk, stable, and high-quality extracts required for local packaging and subsequent distribution across the MEA supply chain.

- China Market Analysis (Asia-Pacific)

The demand in China is overwhelmingly driven by the convergence of a rapidly aging population and a cultural predisposition toward Traditional Chinese Medicine (TCM) and herbal remedies. Blueberry extract is sought after for its functional benefits related to vision health and anti-aging applications. As a major global fruit producer, China also drives domestic demand for processing as a production hub. The fastest-growing segment is powdered dietary supplements, with local consumers favoring customized and easily absorbable forms, creating high demand for fine-grade extract powders suitable for encapsulation and blending.

Blueberry Extract Market Competitive Environment and Analysis

The Blueberry extract competitive landscape is fragmented yet led by a few global specialty ingredient manufacturers with deep vertical integration and proprietary extraction technologies. Competition focuses on the standardization of the active ingredient (anthocyanin concentration), supply chain transparency, and the deployment of proprietary clinical data to justify premium pricing. Differentiation is achieved through investment in next-generation extraction methods that maximize yield and stability, which directly supports the required efficacy for high-end nutraceutical formulation.

- VDF FutureCeuticals, Inc.

VDF FutureCeuticals, Inc. is strategically positioned as a science-driven functional ingredient supplier, focusing on clinically backed, patented components. The company's strategy revolves around proprietary research to create ingredients with documented efficacy, moving them beyond commodity status. They leverage their internal scientific teams to develop and market extracts for high-growth segments such as healthy aging, sports performance, and joint health. Their key positioning is providing differentiated ingredients that enable their customers (brand owners) to make stronger, evidence-based marketing claims, thereby increasing the extract's value in the supply chain.

- Symrise

Symrise, with its integrated Taste, Nutrition & Health segment, competes by offering comprehensive solutions rather than just raw materials. Their strategy is rooted in leveraging advanced consumer insights (e.g., Symvision AI) and technical application expertise to formulate the extract into final products for their clients. This approach is critical in the Food & Beverage sector, where the extract is demanded not only for its health benefits but also for its performance as a natural color, flavor, and preservative. Symrise’s positioning is as a formulation partner that ensures the stability and taste profile of the final product, directly capturing demand from complex F&B applications.

Blueberry Extract Market Developments

- October 2025: Symrise

Symrise announced the expansion of its Scent & Care Creative and Commercial Center in Mumbai, India. This strategic capacity addition in a high-growth Asia-Pacific market allows the company to rapidly tailor its extract-containing solutions—including functional and clean-label prototypes—to meet the specific taste and ingredient preferences of local and regional brand manufacturers, accelerating time-to-market in a critical emerging hub.

- March 2025: Symrise

Symrise launched the Mindera® platform, a new offering in its Diana Food division. While focused on plant-based protection, this product launch demonstrates the company's continuous innovation in natural, functional bioactives. This strategy is essential for the Blueberry extract market as it provides an alternative for manufacturers seeking highly stable, naturally-derived preservatives and colorants for their food and supplement matrices, thereby bolstering the demand for sophisticated extract technology.

- November 2024: VDF FutureCeuticals, Inc.

VDF FutureCeuticals, Inc. finalized a strategic global sales and manufacturing partnership with Global Calcium Pvt., Ltd. for its FruiteX-B® calcium borate complex. This collaboration, while focused on a different product, signifies VDF's aggressive strategy to enter and expand its distribution network for functional ingredients, including its berry extracts, into major emerging markets like India, the Middle East, and Southeast Asia.

Blueberry Extract Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 675.175 million |

| Total Market Size in 2031 | USD 1,047.105 million |

| Growth Rate | 9.17% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Distribution Channel, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Blueberry Extract Market Segmentation:

- BLUEBERRY EXTRACT MARKET BY PRODUCT TYPE

- Liquid

- Powder

- Pills & Capsules

- BLUEBERRY EXTRACT MARKET BY DISTRIBUTION CHANNEL

- Online

- Offline

- Supermarket/ Hypermarket

- Convenience Stores

- Pharmacies

- BLUEBERRY EXTRACT MARKET BY APPLICATION

- Food & Beverage

- Pharmaceuticals

- Others

- BLUEBERRY EXTRACT MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America