Report Overview

Organic Baby Food Market Highlights

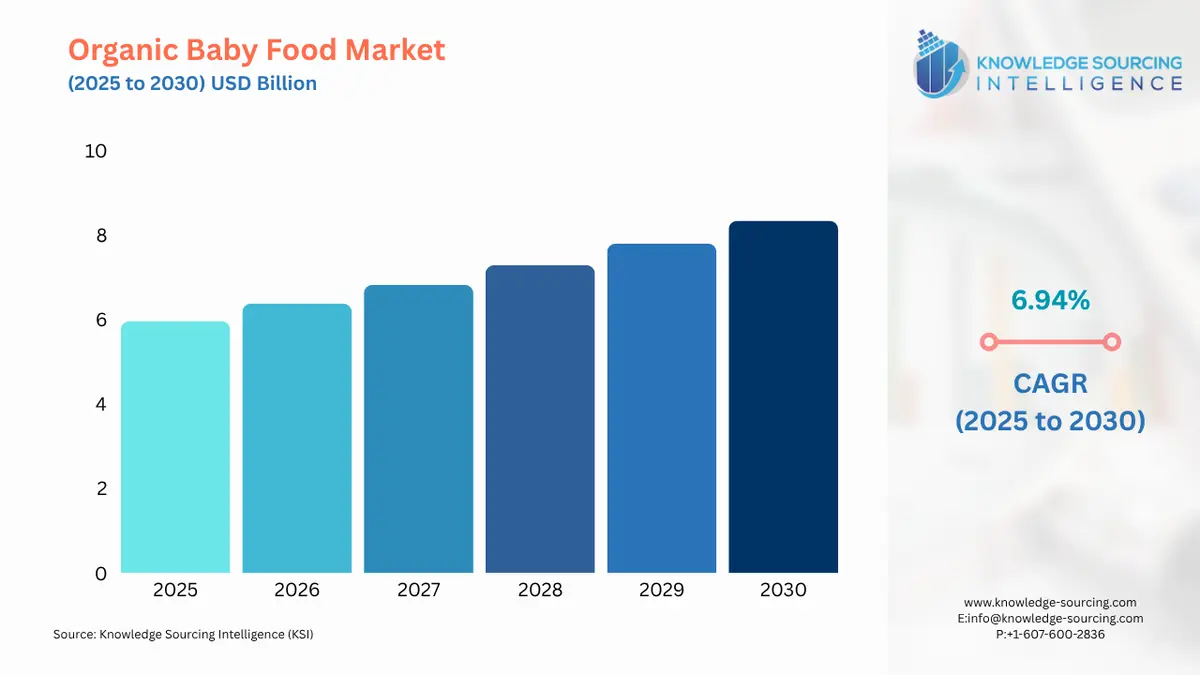

Organic Baby Food Market Size:

The Organic Baby Food Market is expected to grow at a CAGR of 6.94%, reaching USD 8.341 billion in 2030 from USD 5.964 billion in 2025.

The global organic baby food market is experiencing a significant and sustained period of growth, reflecting a fundamental shift in consumer preferences toward products perceived as safer and more natural for infant nutrition. This trend is not a singular phenomenon but rather the convergence of several socioeconomic factors, including rising health awareness among parents, increasing disposable incomes, and a general consumer trend toward "clean label" products. The market has moved beyond a niche segment to a mainstream category within the broader food industry. While this growth trajectory is compelling, the market is also subject to distinct challenges, including complex regulatory landscapes, supply chain complexities, and the inherent price premium of organic products.

Organic Baby Food Market Analysis:

- Growth Drivers

Parental concerns and a heightened focus on infant health and wellness fundamentally drive this market. A primary catalyst is the increasing consumer awareness of the potential adverse effects of pesticides, synthetic fertilizers, and genetically modified organisms (GMOs), often associated with conventional agriculture. Parents actively seek products that are free from these substances, creating a direct and measurable increase in demand for certified organic alternatives. This shift is not merely a preference but a health imperative for many parents who believe organic food provides a safer and more wholesome start for their children.

Another significant driver is the growing number of working women globally, which has catalyzed demand for convenient, pre-prepared, and nutritionally balanced food solutions. Organic baby food, available in formats like pouches and jars, directly addresses this need by providing a time-saving option without compromising on perceived quality or safety. The convenience factor is a key determinant of purchasing decisions for busy parents. Furthermore, the expansion of e-commerce platforms and specialized D2C subscription services has made organic baby food more accessible than ever before. These channels provide a direct pathway for brands to reach health-conscious parents, offer personalized product recommendations, and build brand loyalty through subscription models, all of which directly stimulate market growth. The premiumization trend in infant nutrition, where parents are willing to allocate a larger portion of their budget to perceived higher-quality products, further underpins the market's expansion.

- Challenges and Opportunities

The organic baby food market faces several significant challenges that can act as headwinds to its growth. The most prominent constraint is the high production cost associated with certified organic ingredients. The strict standards for organic farming—such as prohibitions on synthetic pesticides and fertilizers—often result in lower yields and more complex cultivation processes, which directly translate into a higher price for the final product. This price premium can limit market penetration, particularly in price-sensitive developing economies, thereby restricting the total addressable market. Another challenge is the relatively shorter shelf-life of many organic baby food products, particularly fresh or cold-pressed options. This logistical constraint complicates distribution, increases food waste, and can be a deterrent for retailers and consumers alike.

Despite these challenges, the market is rich with opportunities. The demand for transparency and "clean label" products presents a significant opportunity for brands to differentiate themselves. Companies that go beyond basic organic certification and provide detailed sourcing information or publicly disclose heavy metal test results, for instance, can build immense consumer trust and capture market share. This necessity for transparency creates a competitive advantage for brands willing to invest in robust testing protocols and communicate results openly. Furthermore, there is a substantial opportunity to innovate in product diversification. The need for organic baby food is evolving beyond traditional purees to include healthy snacks, cereals, and meals for toddlers. Brands that can develop and introduce new product formats, textures, and flavors that cater to different developmental stages can unlock new segments of demand and secure a loyal customer base. The expansion of e-commerce and subscription services also represents a continuous opportunity to scale operations and optimize the supply chain, bypassing some of the traditional retail constraints.

- Raw Material and Pricing Analysis

The organic baby food market's supply chain begins with the sourcing of certified organic raw materials, which are the primary cost driver for manufacturers. These raw materials—including fruits, vegetables, grains, and dairy—must be grown in compliance with strict organic standards, such as those set by the U.S. Department of Agriculture (USDA) or the European Union. This stringent requirement limits the pool of available suppliers and can make the supply chain susceptible to climate-related disruptions and seasonality. The scarcity of certain organic ingredients, particularly specialty fruits or grains, can lead to price volatility, directly impacting the final cost of the baby food products.

The pricing dynamics are characterized by a premium over conventional baby food. This premium is justified by the higher costs of organic farming, certification, and processing. Manufacturers must carefully manage their pricing strategy to reflect these costs while remaining competitive and accessible to their target demographic. For example, a company sourcing organic carrots from a certified farm faces higher input costs than a company sourcing conventional carrots. This cost differential is then passed on to the consumer. The premium on organic baby food is a direct result of the meticulous and resource-intensive process required to maintain organic integrity from farm to shelf.

- Supply Chain Analysis

The global organic baby food supply chain is a multi-stage process that prioritizes traceability and quality control. It begins with the sourcing of certified organic raw materials from a global network of farms. These raw materials are then transported to processing facilities where they are prepared, blended, and packaged into various product formats, such as purees in pouches, dried cereals, or milk formulas. A key logistical complexity is maintaining the organic integrity of the ingredients throughout the entire chain, from cultivation and harvesting to processing and packaging, to prevent cross-contamination.

Key production hubs are often located in regions with established organic agriculture sectors, such as Europe and North America. However, as demand in the Asia-Pacific grows, local production is increasing. Distribution channels include traditional retail—supermarkets and hypermarkets—as well as the rapidly expanding e-commerce and specialty retail segments. The supply chain's efficiency is a critical dependency, as any disruption in the supply of a core ingredient can impact production and inventory levels. For example, a bad harvest of a specific organic fruit could lead to a temporary shortage of products containing that ingredient. This is a perpetual challenge for the industry, which must secure reliable long-term contracts with organic farmers to ensure a consistent supply.

- Government Regulations

Government regulations and certification bodies play a fundamental role in shaping the organic baby food market. These regulations are not just compliance requirements but are also a direct driver of consumer trust and, by extension, demand. A key example is the USDA Organic certification in the United States, which mandates that products are grown and processed according to specific federal standards. This seal provides a clear, verifiable signal to consumers that the product meets a high standard of quality, which is crucial for a category as sensitive as infant nutrition.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis

- United States: USDA National Organic Program (NOP). The NOP establishes strict standards for producing, handling, and labeling organic products. This regulation directly increases demand by providing a federally backed guarantee of the product's organic integrity. This certification is a primary trust signal for parents and a significant market entry barrier for new producers.

- European Union: EU Organic Regulation (EU) 2018/848. This regulation sets the legal framework for organic production and labeling in the EU. It is a key factor driving consumer demand by providing a harmonized standard across member states. The EU's regulation on baby food, which sets limits on heavy metals and other contaminants, further reinforces consumer confidence in the safety of the products.

- China: National Organic Standard (GB/T 19630). China's national organic standard and its associated certification process create a regulated domestic market for organic products. The standard's strict requirements and a mandatory certification mark provide a basis for consumer trust, directly stimulating demand for organic baby food as parents seek perceived safer alternatives in the wake of past food safety concerns.

Organic Baby Food Market Segment Analysis:

- By Product Type: Prepared Baby Food

The prepared baby food segment, encompassing purees, mashes, and other ready-to-eat products, is a cornerstone of the organic baby food market. This segment’s growth is a direct result of parental desire for convenience and nutritional quality. Prepared baby food offers a time-saving solution for parents who are unable or unwilling to prepare homemade meals from scratch. The demand for organic prepared baby food is a specific subset of this trend, driven by the belief that a pre-packaged product can still meet the highest standards of safety and purity. The shift toward pouches as a primary packaging format has been a key driver, as they are portable, resealable, and reduce mess, which is a major convenience factor for on-the-go parents. The availability of a wide variety of flavors and ingredients, from single-fruit purees to complex vegetable and protein blends, allows parents to introduce their infants to a diverse palate, a factor that directly contributes to sustained demand for this segment.

- By Category: Infant Milk Formula

The infant milk formula segment is the largest and most critical component of the organic baby food market. The need for organic infant formula is driven by a complex set of factors, including the need for a safe and reliable alternative or supplement to breastfeeding. For parents who cannot or choose not to breastfeed, organic formula represents a high-quality option that aligns with their health and wellness values. The market is also a function of strict regulatory standards that govern the nutritional composition and safety of infant formula, which further builds consumer confidence. The market for organic infant formula is particularly robust in regions where there is a strong cultural preference for it or where parents are highly concerned about the quality and source of ingredients. The necessity for organic infant formula is not only about purity but also about the perception of superior nutritional quality, with many organic brands fortifying their products with key nutrients like DHA and prebiotics, which directly influences parental purchasing decisions.

Organic Baby Food Market Geographical Analysis:

- US Market Analysis

The US organic baby food market is a major force globally, characterized by a well-established consumer base and a strong preference for health and wellness products. The market is driven by a high level of consumer awareness and a robust regulatory framework under the USDA National Organic Program. Parents in the US often prioritize organic products as a means of avoiding pesticides and other unwanted chemicals. The market is highly competitive, with a mix of large, established companies and innovative startups. E-commerce and specialty natural food stores play a significant role in distribution, making organic options widely accessible. The market is also a hub for product innovation, with new brands consistently introducing creative product formats and flavors to capture a share of the high-value consumer segment.

- Brazil Market Analysis

The organic baby food market in Brazil is in a nascent but growing phase, primarily driven by a rising middle class and increasing health consciousness in urban centers. The market growth is a reflection of a growing preference for products perceived as natural and safe. While the market for organic products is not as mature as in North America or Europe, a shift is observable. The government’s initiatives to promote organic agriculture are an enabling factor. The high price premium of organic products, however, remains a key constraint on demand, particularly in a market with a diverse range of income levels. The market expansion is therefore highly dependent on economic stability and a continued increase in consumer purchasing power.

- Germany Market Analysis

Germany is a European leader in the organic baby food market, with a deeply ingrained culture of environmental consciousness and a strong regulatory environment. The market expansion is robust and driven by high consumer trust in the country's strict organic standards, such as those upheld by Bio-Siegel and Demeter. The market is dominated by well-known brands that have a long history of producing high-quality organic products. The necessity is not just for organic but for locally sourced and sustainably produced ingredients. German consumers are highly informed and place a premium on transparency and brand integrity. The country's efficient retail and e-commerce networks ensure that these products are widely available to a discerning consumer base.

- United Arab Emirates Market Analysis

The organic baby food market in the United Arab Emirates (UAE) is expanding, fueled by a high-income demographic and a large expatriate population that brings with it a strong demand for Western health and wellness products. The market growth is primarily concentrated in major urban centers like Dubai and Abu Dhabi. While local production is limited, the market is supplied by a mix of international brands. This market is driven by a combination of status-seeking and genuine health concerns, with parents willing to pay a premium for certified organic products. The market's growth is tied to the country's economic stability and its role as a regional trade hub, which facilitates the import of international organic brands.

- China Market Analysis

China’s organic baby food market is one of the most dynamic and fastest-growing in the world. Its growth is a direct response to a series of past food safety scandals that have eroded consumer trust in domestic conventional products. This has created a powerful and persistent demand for imported and domestically certified organic brands, which are perceived as safer and more reliable. The rising disposable income of the Chinese middle class and the country's high birth rate are fundamental economic drivers. The government's push for stricter food safety regulations and the establishment of its own national organic standard further bolsters consumer confidence and fuels market growth. The market is highly competitive, with both international giants and local players vying for market share. E-commerce and cross-border platforms are particularly crucial distribution channels for this market.

Organic Baby Food Market Competitive Analysis:

The global organic baby food market is characterized by a mix of large, multinational corporations and smaller, specialized organic brands. The competitive landscape is defined by brand reputation, product innovation, and the ability to maintain a transparent and trustworthy supply chain.

- Danone S.A.: As a global food and beverage giant, Danone has a significant presence in the organic baby food market through its Happy Family Organics and Nutricia brands. The company's strategic positioning is to leverage its extensive global distribution network and R&D capabilities to offer a wide range of organic baby food products. Danone has focused on acquiring and developing brands that resonate with health-conscious consumers, and its recent focus has been on product innovation and expanding its portfolio of organic, plant-based, and science-backed formulas and purees.

- Hain Celestial Group (Plum Organics): Plum Organics operates under the Hain Celestial Group and has established itself as a leading brand in the US organic baby food market. Its strategy centers on offering a wide range of organic pouches and snacks for infants and toddlers. The brand differentiates itself through a commitment to transparency, as evidenced by its public disclosure of heavy metals testing data. This proactive approach directly addresses a major consumer concern and has helped build a strong reputation for the brand.

- HiPP GmbH & Co. Vertrieb KG: HiPP is a dominant player in the European organic baby food market, with a long history and strong brand loyalty. The company’s strategic positioning is rooted in its commitment to sustainable organic farming and a wide product range that covers everything from infant formula to purees and meals. HiPP has built its reputation on strict quality control and a farm-to-shelf philosophy that is highly valued by European consumers. Its product portfolio is extensive, catering to various stages of infant development and dietary needs.

Organic Baby Food Market Developments:

- January 2025: Gerber Products Company initiated a recall and discontinuation of all batches of its Gerber® Soothe N Chew® Teething Sticks due to a potential choking hazard. This action, while related to a specific product, highlights the stringent safety standards and the immediate responsiveness required of companies in the baby food market, which can impact consumer confidence.

- June 2024: Gerber announced that it was awarded Clean Label Project certifications for more than 80 of its products, the most of any baby food brand. This third-party validation directly addresses consumer demand for transparency and product purity, reinforcing Gerber's brand reputation and providing a competitive advantage in the market.

Organic Baby Food Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Organic Baby Food Market Size in 2025 | USD 5.964 billion |

| Organic Baby Food Market Size in 2030 | USD 8.341 billion |

| Growth Rate | 6.94% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Organic Baby Food Market |

|

| Customization Scope | Free report customization with purchase |

Organic Baby Food Market Segmentation

- By Product Type

- Milk Formula

- Prepared Baby Food

- Dried Baby Food

- Others

- By Category

- Infant Milk Formula

- Infant Cereals

- Prepared Baby Meals

- Snacks

- Others

- By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Specialty Stores

- Others

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa