Report Overview

Bottled Water Packaging Market Highlights

Bottled Water Packaging Market Size:

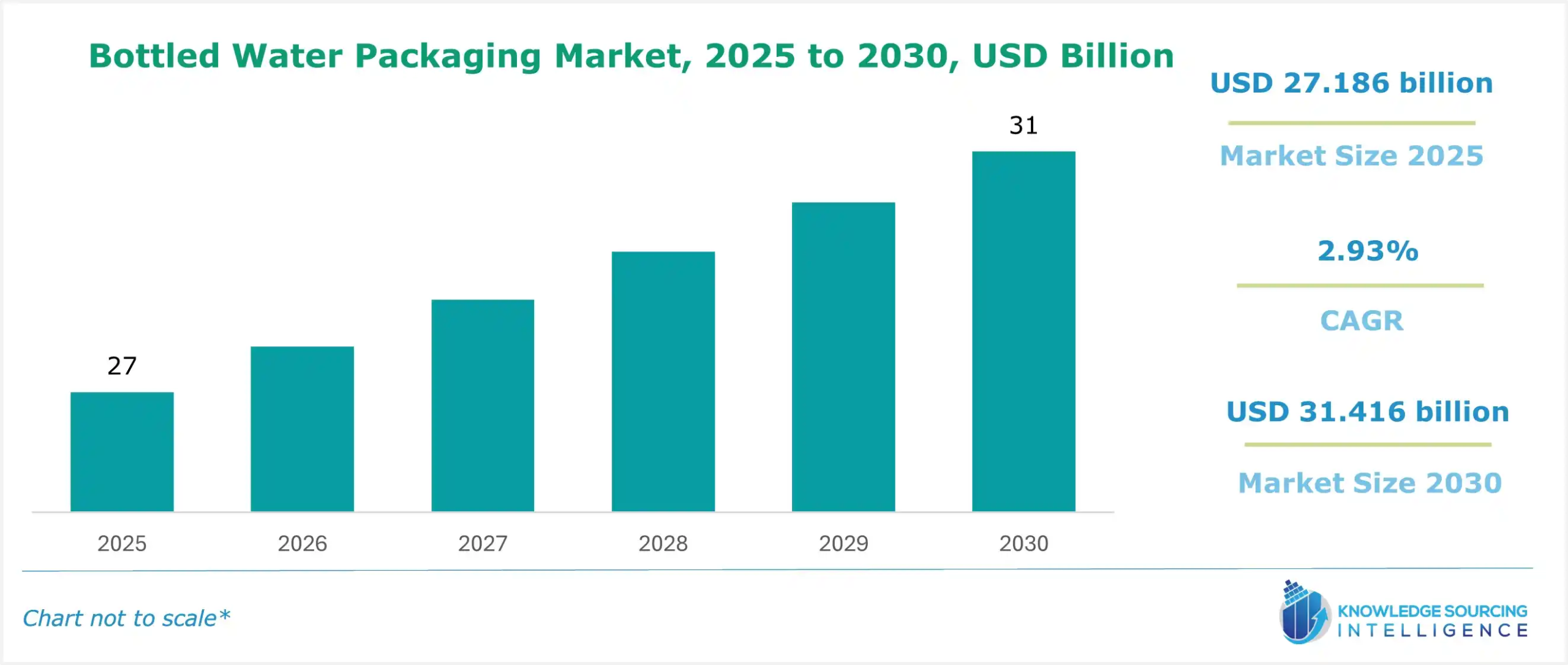

The bottled water packaging market is projected to grow at a CAGR of 2.93% over the forecast period, from US$27.186 billion in 2025 to US$31.416 billion by 2030.

Bottled Water Packaging Market Key Highlights:

- The bottled water packaging market is experiencing steady growth, driven by rising consumer demand.

- Manufacturers are increasingly adopting sustainable materials like recycled PET for eco-friendly packaging solutions.

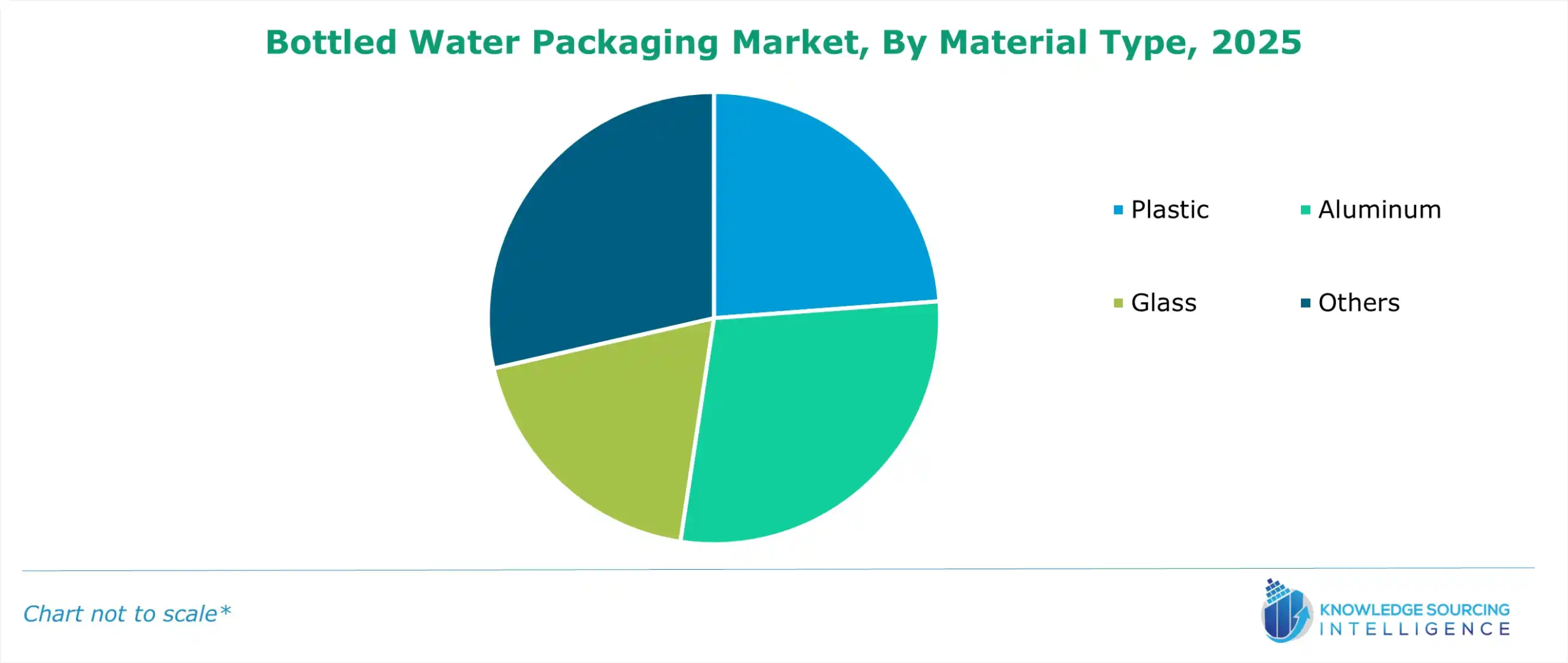

- Plastic bottles, particularly PET, are dominating due to cost-effectiveness and lightweight properties.

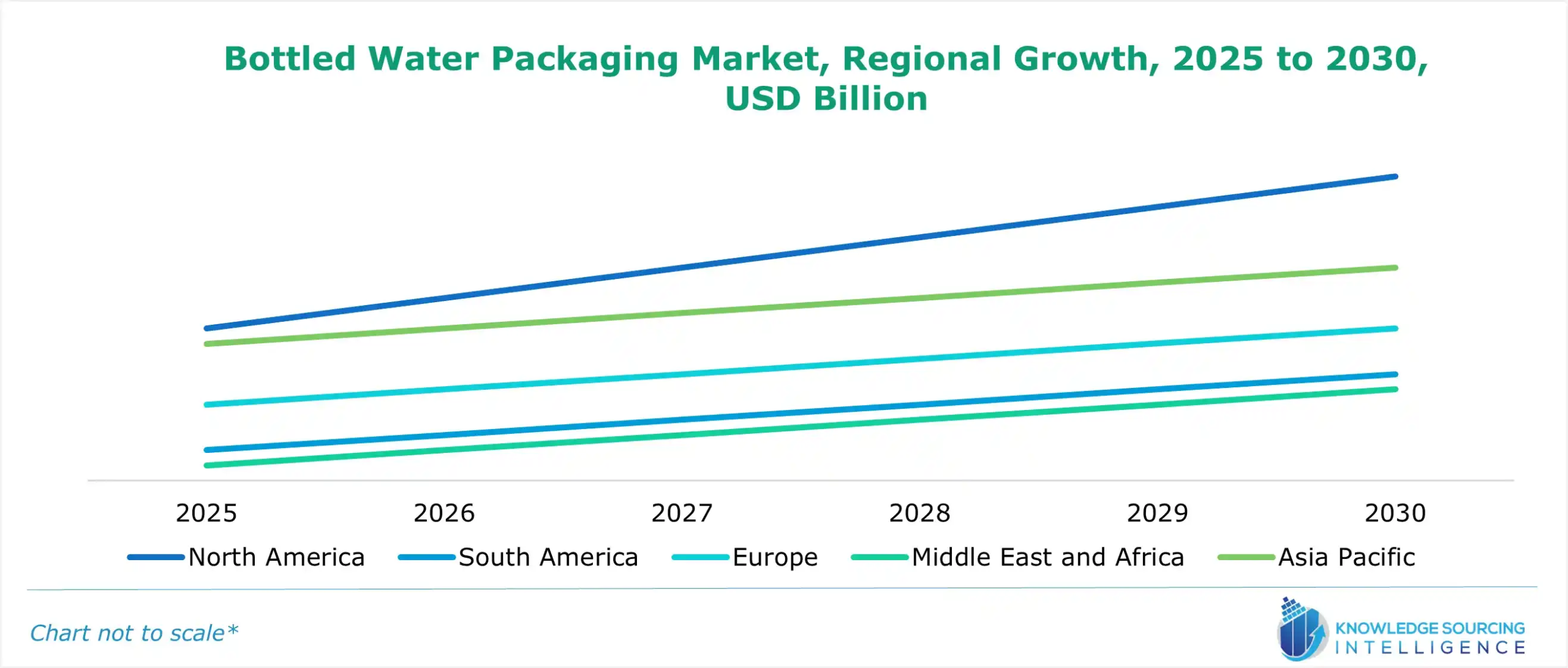

- North America is maintaining the largest market share, fueled by health-conscious consumer trends.

Bottled water is a form of drinking water that is processed, distilled, and packed in different types of bottles for consumption. The bottled water packaging solution includes packaging bottled water in different kinds of bottles, which make use of various types of materials, like aluminum, plastics, and glass.

Bottled Water Packaging Market Trends:

The increasing consumer preference towards a safer and hygienic drinking water solution is among the key factors propelling the bottled water packaging market forward. Consumption of unsafe water can cause multiple diseases and infections, like cholera, diarrhea, dysentery, and polio, among many others. With the rising cases of such diseases, the demand for packed bottled water will increase significantly, boosting the bottled water packaging market forward. For Instance, the European Centre for Disease Prevention and Control (ECDC), in its global cholera report, stated that between August 31, 2024, and October 23, 2024, about 83,982 new cases of cholera were recorded globally, which caused about 900 new deaths. The agency further stated that in the global new cases of cholera, Afghanistan and Sudan reported the highest number of cases, with about 24,151 new cases in the former and about 23,590 new cases in the latter. In Pakistan and Nigeria, 12,954 and 4,886 new cholera cases were recorded, respectively.

The bottled water packaging market includes designing, producing, and distributing packaging solutions for bottled water. The market includes the materials used for packaging water for consumption, such as polyethylene terephthalate, recycled PET, aluminum, glass, and paper-based solutions such as paper bottles. This market also includes different packaging types, such as single-serve bottles, bulk containers, pouches, and cartons. The market includes packaging solutions for various applications, such as packing still water, carbonated water, flavored water, and functional water.

Bottled Water Packaging Market Growth Drivers:

- Rising demand for bottled water

A major factor propelling the global bottled water packaging market is the increasing demand and production of bottled water worldwide. With the rising preferences of global consumers towards safer and hygienic drinking water, the demand for packaged water bottles has witnessed a massive increase.

The International Bottled Water Association, or IBWA, in its bottled water report, stated that the per capita consumption of water increased in the USA. The agency stated that in 2023, bottled water's total per capita consumption was recorded at 46.4 gallons annually, compared to about 34.4 gallons of soft drinks consumed. The agency further stated that bottled water production in the USA also observed constant growth over the past few years. According to the agency, in 2021, the total production of bottled water in the USA was recorded at 15,702.6 million gallons, which surged to 15,880.9 million gallons in 2022. In 2023, 15,951.6 million gallons of bottled water were produced nationwide, observing an increase of about 0.4% from the previous year.

Bottled Water Packaging Market Segment Analysis:

- Plastic-based bottles will continue growing in the forecast period

Water bottles come in various types of materials; however, the use of plastics is quite prevalent. The aforementioned materials, including plastic, are economical, lightweight, and long-lasting in making these structures. The most common plastic is polyethylene terephthalate (PET), which is also reused as it is biodegradable.

New techniques regarding packaging have also brought about the production of slim and strong water bottles, which propels the market. Green materials and low-carbon content packages will aid in the global bottled water packaging market growth.

The factors that enable the market to grow at an accelerating rate include the increasing improvement in the manufacturing know-how, the decreasing operational costs, the resins, and the expendable packaging. This is mainly because plastic bottle packaging is relatively inexpensive because of the low price of resin.

Additionally, brand owners are enhancing the design of plastic bottling systems, which are more efficient than any other packaging options, resulting in savings in production and transport weight. This is one of the factors aiding the market growth of bottled water in plastic containers. For instance, in June 2023, the new rPET bottle was introduced for the packaged drinking water brand Kinley and is now available in one-liter bottles. Their complete use of recycled food-grade plastic marks a major turning point in ALPLA and Coca-Cola's collaborative efforts to establish a circular economy in India.

Moreover, PET has many applications in plastic bottles, including everyday consumption beverage containers and other similar products. The growing demand for PET signifies growth in the ability to manufacture plastic bottles. Given this increase in demand, plastic bottle manufacturers will spend money on production expansion, resulting in an enhanced supply of plastic bottles for household bottled water and other uses. Thus, all these factors align with the North American market, and it will continue to hold the largest market share in the coming years.

Bottled Water Packaging Market Restraints:

- Raw material availability poses a major challenge, leading to supply chain issue

The growing environmental concerns over plastic pollution and the increasing sustainability issue pose a serious threat to the bottled water packaging market. The health and safety associated risk is a key market restraint. The growing government regulations and the pressing need for sustainable alternatives for packing water are posing a significant challenge for traditional plastic packaging. According to research done worldwide, it is found out that a liter of bottled water includes about 240,000 tiny pieces of plastic, including nano plastics, that pose serious health risks such as carcinogenic risk and bioaccumulation, leading to chronic diseases, respiratory issues, digestive issues, etc. Thus, the rising environmental consciousness over bottled water packaging will negatively impact the market during the forecast period.

Bottled Water Packaging Market Geographical Analysis:

- North America will hold the largest market share during the forecast period

Geography-wise, the Bottled water packaging market is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. North America will continue to have the largest bottled water packaging market share.

Various factors, including the number and variety of available bottled water products and lifestyle choices favoring health and hydration, play a role in the region's consumption. Additionally, the marketing strategy has been driven by the availability of on-the-go and safe drinking water for active consumers. Moreover, to meet consumers' increasing demand for bottled water, many companies have raised their budgets while simultaneously improving the quality of the products and their delivery systems. In April 2023, Premium Waters, Inc. – a bottled water manufacturing company based in Minneapolis – unveiled plans for a new bottling plant in Seguin City, Texas. The plant is projected to be constructed on 27 acres of land for USD 80 million and operational in 2024.

Additionally, a survey found that 86% of Americans occasionally drink bottled water when traveling, 84% drink it at work, 81% drink it at home, and 77% drink it at social gatherings where other drinks are served. Furthermore, 67% of people drink bottled water at the gym or while working out, 74% do so while shopping and on the go, and 73% do so at sporting events and entertainment venues.

Bottled Water Packaging Market Key Developments:

- In November 2024, Amcor announced a strategic collaboration with Kolon Industries Inc., a leading South Korean Chemical materials manufacturer, to develop sustainable polyester materials and focus on technological exploration of chemically recycled PET and PEF materials.

- In March 2024, Poboco, the paper bottle company, announced the Next Gen Paper Bottle in the market, launching full-scale production and producing 20 million bottles by the end of 2025.

List of Top Bottled Water Packaging Companies:

Bottled Water Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Bottled Water Packaging Market Size in 2025 | US$27.186 billion |

| Bottled Water Packaging Market Size in 2030 | US$31.416 billion |

| Growth Rate | CAGR of 2.93% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Bottled Water Packaging Market |

|

| Customization Scope | Free report customization with purchase |

The Bottled Water Packaging Market is analyzed into the following segments:

- By Material Type

- Plastic

- Aluminum

- Glass

- Others

- By Application

- Still Bottled Water

- Carbonated Bottled Water

- Flavored Bottled Water

- Functional Bottled Water

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Bottled Water Packaging Market Size:

- Bottled Water Packaging Market Key Highlights:

- Bottled Water Packaging Market Trends:

- Bottled Water Packaging Market Growth Drivers:

- Bottled Water Packaging Market Segment Analysis:

- Bottled Water Packaging Market Restraints:

- Bottled Water Packaging Market Geographical Analysis:

- Bottled Water Packaging Market Key Developments:

- List of Top Bottled Water Packaging Companies:

- Bottled Water Packaging Market Scope:

- Our Best-Performing Industry Reports: