Report Overview

Brazil Home Fragrance Market Highlights

Brazil Home Fragrance Market Size:

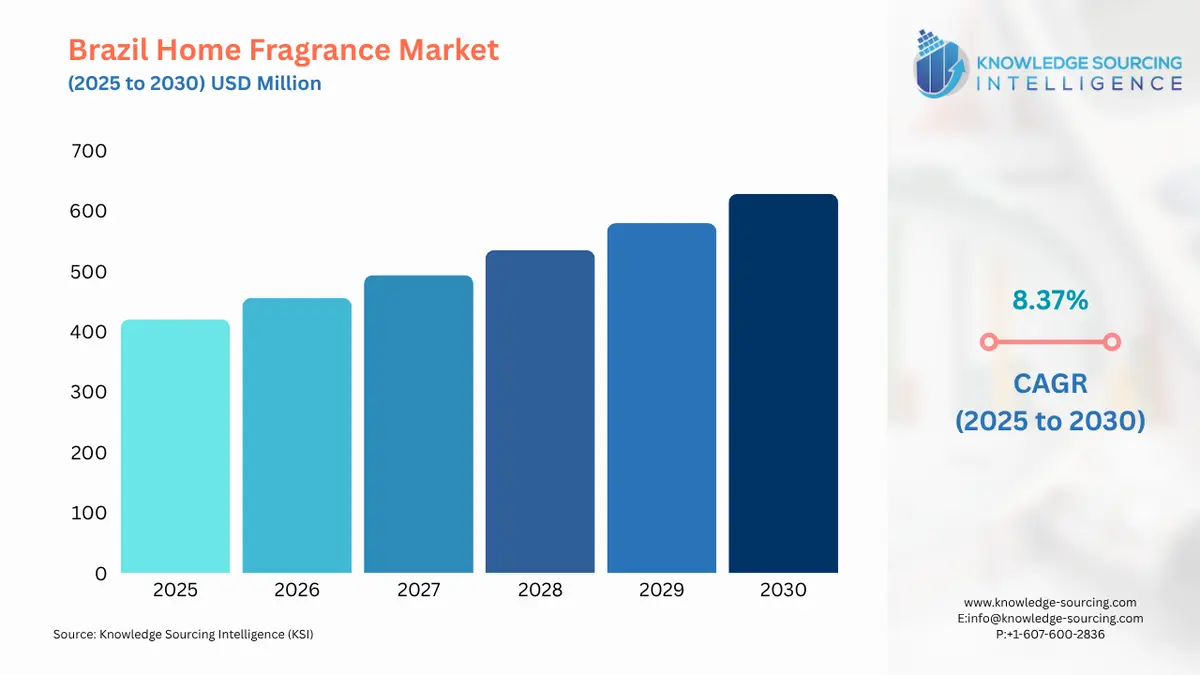

The Brazil Home Fragrance Market is anticipated to grow at a CAGR of 8.37%, increasing from USD 420.280 million in 2025 to USD 628.156 million by 2030.

The market for house fragrances in Brazil is expanding rapidly because of changing consumer habits, rising disposable incomes, and a greater emphasis on home atmosphere and wellbeing. Brazilians' deep cultural love for aroma is the main driver of this expansion. Customers are eager to spend money on products that provide comprehensive advantages and look for safe solutions for the environment and their health. The industry is now led by reed diffusers, although heat diffusers are the fastest-growing segment, indicating a move toward creative and effective aroma delivery techniques. The market is also distinguished by a mix of domestic and foreign brands, with a rising focus on ingredients that are produced locally and naturally. This trend is in line with consumers' growing desire for sustainable and eco-friendly items as they grow more ecologically conscious.

Brazil Home Fragrance Market Overview & Scope:

- Fragrance: The Brazilian home fragrance market is anticipated to be led by the floral sector. The market is led by floral scents because of its adaptability, appeal, and connection to positive feelings like femininity and beauty. Diverse tastes are catered to by the flower category's extensive selection of fragrances, which range from subtle floral notes to strong and vivid floral-based perfumes. The industry is also fueled by the popularity of aromatherapy and the need for fragrances with a wellness theme, which frequently include floral notes.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The market for home fragrances is anticipated to be led by the spray category. The growing use of the product to give living areas a pleasant scent is predicted to drive significant growth in the sprays segment over the next several years. Additionally, new items are being introduced by several well-known market participants.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their requirements.

Top Trends Shaping the Brazil Home Fragrance Market:

- Socioeconomic Inclusion Using Reusable Models: Many Brazilian companies are launching inexpensive refill programs in an effort to provide access to home fragrances, particularly in areas with lower incomes. Customers can utilize reusable containers to refill diffusers and sprays with these systems. It is a distinctive fusion of affordability, sustainability, and cultural usefulness that is becoming more and more well-liked in Brazil's suburbs and countryside.

- Decor with Heat-Activated Fragrances: The incorporation of fragrance into heat-sensitive household items, such as wooden or ceramic décor that emits smell when warmed by sunlight or a nearby bulb, is a distinctively Brazilian invention. These handcrafted items double as decorative highlights and fragrance dispensers; they are particularly well-liked in drier interior areas where passive diffusers might not work as well. This trend combines practical design with scent-based design and promotes small-scale artists.

Brazil Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

- Growing Significance of Indigenous and Afro-Brazilian Spirituality: In Brazil, ritualistic and spiritual applications of fragrance are a significant business driver. Natural scents like white sage, breu branco, arruda, and myrrh are used in purification, healing, and energy-cleaning ceremonies in Indigenous traditions and Afro-Brazilian religions like Candomblé and Umbanda. Demand for ritual-inspired home scent items that promote energy alignment, meditation, and ancestral reconnection is growing as millennials and Gen Z become more conscious of their spiritual well-being. This trend, in contrast to Western aromatherapy, has its roots in spiritual history rather than wellness promotion.

- The Merging of Personal and Professional Lives: The distinction between the home and the office has become hazier due to post-pandemic growth in remote work. Fragrances are being used more and more by Brazilian consumers to mark time and place in the house. While soothing lavender or sandalwood is sprayed in the evening, energizing citrus mixtures can be utilized throughout the workday. Scent has become a useful component of everyday productivity and relaxation because of this new routine-based usage pattern, which has increased per capita fragrance consumption.

Challenges:

- Import Tax Volatility and Bureaucratic Complexity: The Costs can be uncertain for firms that rely on foreign oils, perfumery ingredients, or designer packaging due to Brazil's unstable import tax system and administrative roadblocks. Businesses face logistical and financial hardship due to protracted customs procedures, fluctuating tax laws, and uneven enforcement. This hinders the capacity to remain competitive with global brands, discourages innovation, and restricts the range of products available.

Brazil Home Fragrance Market Competitive Landscape:

- The market is moderately fragmented, with many key players including Iberchem Brazil, O Boticário, Suave Fragrance Indústria e Comércio de Cosméticos Ltda, La Façon Fragrâncias, Seven Aromas, Capim Dourado Aromas, and Chantrêe Aromas.

- Acquisition: In March 2024, Prestige Cosméticos, a well-known distributor of high-end cosmetics and fragrances in Brazil with a developing following in North America, saw a substantial increase in ownership from Leste Group. The transaction's financial details were not made public.

Brazil Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 420.280 million |

| Total Market Size in 2031 | USD 628.156 million |

| Growth Rate | 8.37% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Geography |

| Geographical Segmentation | São Paulo, Minas Gerais, Rio de Janeiro, Bahia, Paraná, Others |

| Companies |

|

Brazil Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- São Paulo

- Minas Gerais

- Rio de Janeiro

- Bahia

- Paraná

- Others