Report Overview

Canada Home Fragrance Market Highlights

Canada Home Fragrance Market Size:

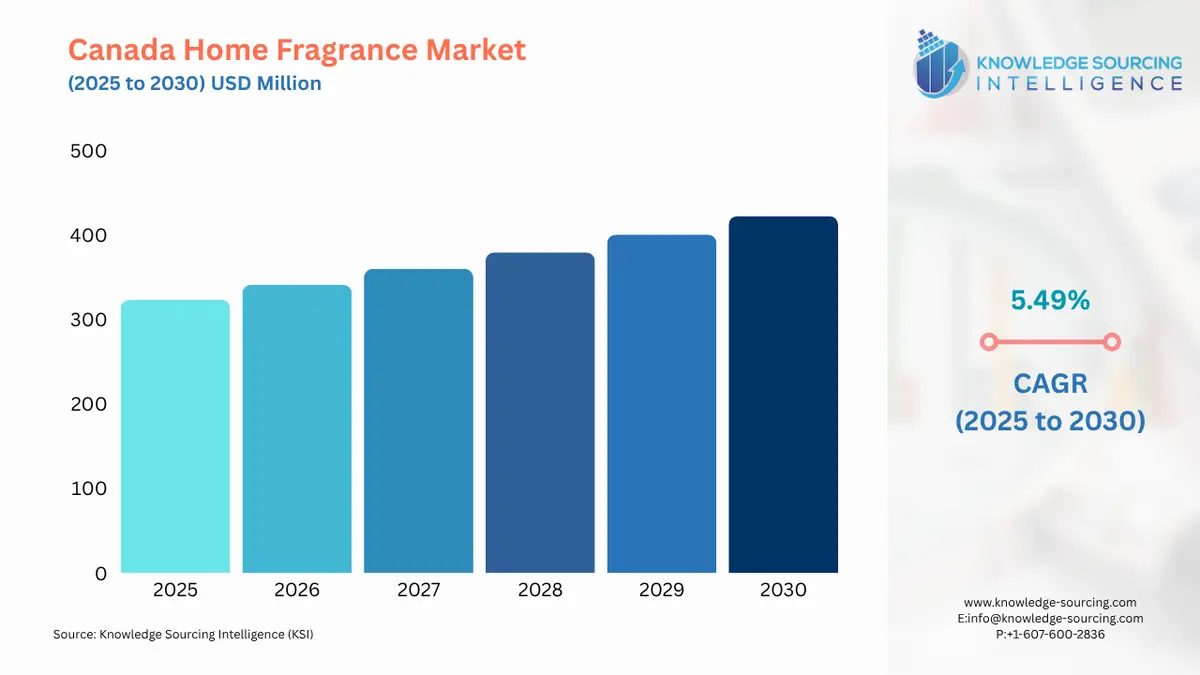

The Canada Home Fragrance Market is projected to expand at a CAGR of 5.49%, moving from USD 323.292 million in 2025 to USD 422.330 million in 2030.

Growing customer preferences and rising disposable income are the driving forces behind the fragrance market in Canada. Premium and luxury scents have become increasingly popular as consumers place a greater emphasis on personal hygiene and other cosmetic treatments. This change is further fueled by the ease with which consumers may now create their own scents in the contemporary fragrance market, allowing them to create a variety of aromas that are exclusively their own. Customers are also eager to buy fragrances linked to their favorite celebrities or influencers, demonstrating the continued relevance of social variables like social media and endorsements in the market.

Canada Home Fragrance Market Overview & Scope:

The Canadian home fragrance market is segmented by:

- Fragrance: Fresh and citrus products are expected to lead the Canadian home fragrance industry. The main reason for this is that these scents are so popular and freely available. Fresh and zesty fragrances are produced from essential oils derived from the peels and fruits of several citrus trees, including colorful limes, tart lemons, sweet oranges, sour grapefruits, and aromatic bergamot. In addition to their energizing qualities, these scents are well-liked for their many additional benefits, such as mood enhancement, aromatherapy applications, smell blending, and other uses that enhance overall wellbeing.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The market for home fragrances is anticipated to be led by the Diffusers category. The market for aroma diffusers is expanding significantly due to rising consumer interest in personal care, home décor, and wellbeing. The popularity of aromatherapy and the desire to create welcoming, comfortable spaces are driving this increase. The market is divided into two segments, conventional reed diffusers and cutting-edge electric diffusers. Both are seeing growth in demand.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their requirements.

Top Trends Shaping the Canada Home Fragrance Market:

- Smokeless & Waterless Diffusion Technology: Home fragrance distribution systems are evolving due to health and environmental concerns. Concerns about indoor air quality and respiratory health are causing consumers to move away from paraffin candles and incense. Solid fragrance cubes and nebulizers, which are waterless diffusers, are becoming more and more popular due to their longer-lasting and cleaner effects. Scent diffusers that can be recharged via USB are popular among hybrid and digital nomad workers.

- Fragrance Manufacturing Principles: The socially sensitive customer base in Canada has made purchasing perfume a moral act. The sourcing of ingredients, carbon impact, cruelty-free methods, and community assistance programs are now all expected to be disclosed on labels. Using the scent platform as a vehicle for activism, several firms contribute to Indigenous communities or mental health problems. Videos showing the production process are accessed by QR codes on packaging, highlighting ethics and traceability.

Canada Home Fragrance Market Growth Drivers vs. Challenges:

- Opportunities:

- Growing Usage Per Household Due to Cold Winters: The long, dark winters in Canada, in contrast to many other countries, make house scent a seasonal necessity. The five-month-long winter season is when consumers spend more time indoors and look for perfumed comfort. Sales of fragrances increase during the fall and winter seasons as people get their houses ready for hibernation and nesting. Fragrance characteristics are also influenced by this, in the winter, Canadians like warm, spicy, resinous aromas (including clove, birch tar, pine, and cedarwood).

- Innovation in E-Commerce and Digital Fragrance Exploration: Even though scent is a tangible experience, Canadian fragrance companies are experimenting with web technology. Customers can locate scents that correspond with their horoscopes, music preferences, or moods with the aid of AI-powered tools. Immersion AR/VR "scent experiences" are being tested online by a few luxury firms to mimic scent storytelling. Scent storytelling and ASMR unwrapping are two ways that Canadian micro-influencers promote on sites like YouTube and TikTok.

- Challenges:

- Geographical Restrictions on Logistics in Canada: Significant operating challenges are brought about by Canada's large, inhabited terrain. Access to premium or niche products may be limited by unreasonably high or delayed shipping costs to rural or remote areas (such as the Yukon or Northern Territories). Delicate scent items, such as soy candles or essential oil mixes, may melt, freeze, or leak while being transported because of Canada's extreme climatic variations. Major retailers or specialist shops carrying high-end scent lines are frequently inaccessible to smaller towns and Indigenous communities.

Canada Home Fragrance Market Competitive Landscape:

- The market is moderately fragmented, with many key players including New Directions Aromatics, Canwax Inc, Voyageur Soap & Candle, Stephenson Group, and Milk Jar Candle Co.

- Product Innovation: In June 2024, Leading personal care and home fragrance retailer Bath & Body Works, Canada Inc. is working with Accenture to update, revamp, and streamline its main digital and technological platforms. This multi-year initiative is a component of Bath & Body Works plan to improve the brand and use the newest digital, MarTech, AI, and generative AI (gen AI) technologies to spur expansion.

Canada Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 323.292 million |

| Total Market Size in 2031 | USD 422.330 million |

| Growth Rate | 5.49% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Geography |

| Geographical Segmentation | Ontario, Quebec, British Columbia, Alberta, Manitoba, Others |

| Companies |

|

Canada Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- Ontario

- Quebec

- British Columbia

- Alberta

- Manitoba

- Others