Report Overview

Building and Construction Tapes Highlights

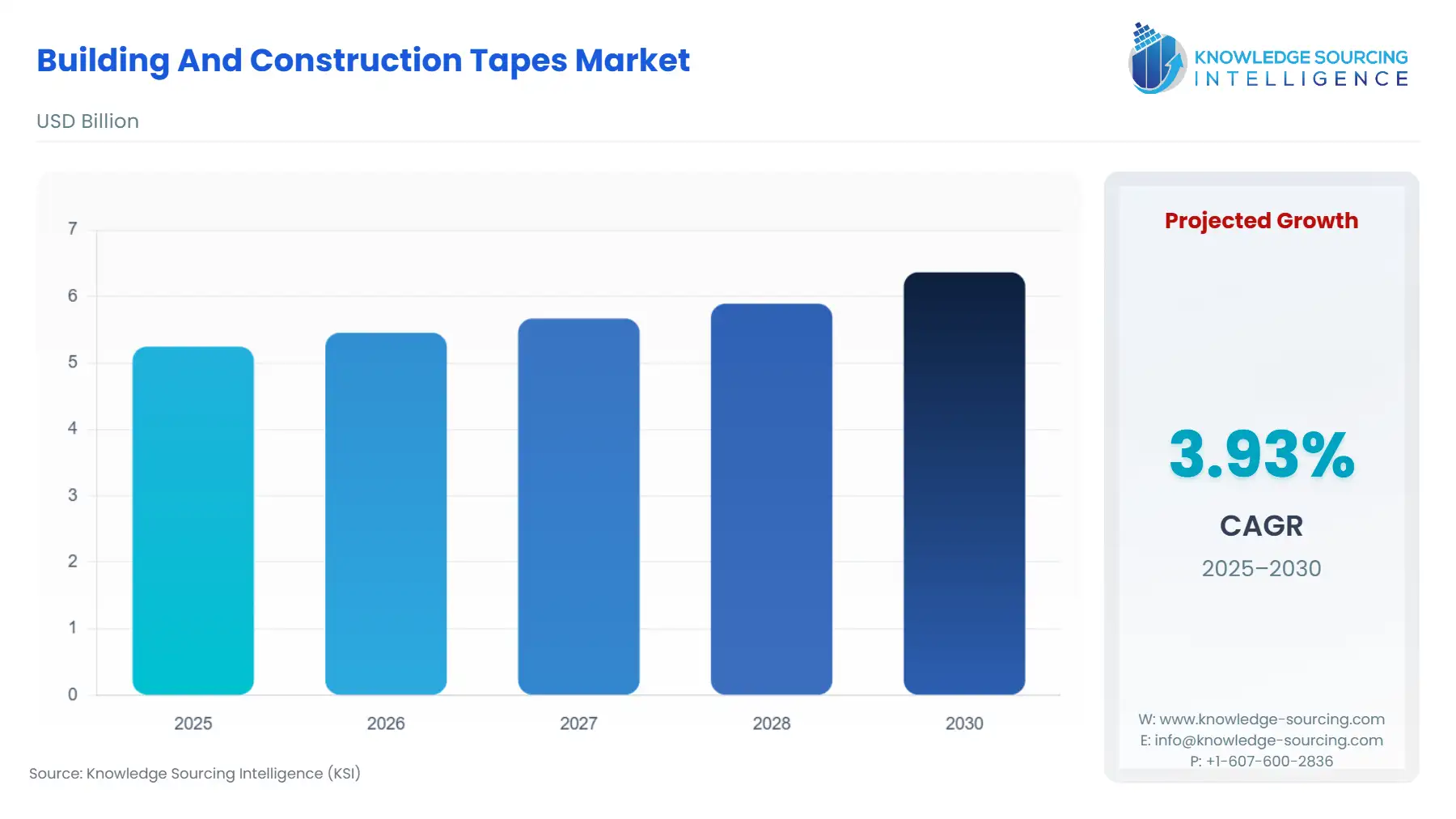

Building and Construction Tapes Market Size:

The building and construction tapes market is forecasted to grow at a 3.82% CAGR during the forecast period, attaining USD 6.574 billion in 2031 from USD 5.249 billion in 2025.

Building and construction tapes are adhesive materials specifically designed for use in the construction industry. These tapes come in various forms, such as duct tape, insulation tapes, sealing tape, and double-sided tape. They are used for various applications, including sealing joints and gaps, insulating electrical components, bonding different surfaces, and providing temporary or permanent fixtures. Building and construction tapes offer strong adhesion, weather resistance, and durability, making them essential tools for contractors, builders, and DIY enthusiasts in various construction and renovation projects.

Building and Construction Tapes Market Introduction:

These tapes cater to various applications, such as sealing, insulation, bonding, and mounting, providing essential solutions for construction, renovation, and repair projects. With increasing construction activities, the growing emphasis on energy-efficient building practices, and the need for reliable and durable bonding materials, the building and construction tapes market is witnessing steady growth as it continues to address the diverse needs of the construction industry. The construction industry's expansion, driven by urbanization and infrastructure development, has fueled the demand for adhesive tapes in various applications, including sealing, insulation, and bonding. Moreover, the increasing emphasis on sustainable and energy-efficient building practices has boosted the adoption of specialized tapes for weatherproofing and thermal insulation.

Building and Construction Tapes Market Drivers:

Growing Construction Industry: The building and construction industry's steady growth, fueled by population growth, urbanization, and infrastructure development, is a primary driver for building and construction tapes. As construction projects increase, so does the demand for tapes in various applications such as sealing, bonding, and insulation.

Energy-Efficient Building Practices: The rising awareness of energy efficiency and sustainability in construction has led to increased demand for tapes that provide weatherproofing and thermal insulation solutions. Building and construction tapes contribute to energy-efficient building practices by minimizing air leaks and maintaining stable indoor temperatures.

Sustainability and Eco-Friendly Solutions: Consumers and regulatory bodies are increasingly prioritizing sustainable building practices. As a result, manufacturers are developing eco-friendly and recyclable tapes to align with green building initiatives, enhancing the market's growth.

Ease of Use and Efficiency: Building and construction tapes offer a user-friendly alternative to traditional construction methods. Their ease of application and time-saving properties make them popular among contractors and DIY enthusiasts, contributing to improved project efficiency.

Advancements in Tape Technology: Manufacturers are continuously investing in research and development to enhance tape formulations. Improved adhesion, weather resistance, and durability make tapes more reliable and suitable for a wide range of construction applications, further driving their demand.

Rise in DIY Renovation Projects: The increasing trend of do-it-yourself (DIY) renovation and repair projects among homeowners has bolstered the demand for building and construction tapes. DIY enthusiasts seek user-friendly tapes that offer effective bonding and sealing solutions for their projects.

Strong Demand for Waterproofing Tapes: Waterproofing is a crucial aspect of construction to prevent water infiltration and moisture-related damage. Waterproofing tapes cater to this need, making them indispensable in both residential and commercial construction projects.

Infrastructure Development Initiatives: Government investments in infrastructure development projects worldwide create a steady demand for building and construction tapes. These tapes are essential for structural integrity, safety, and protection in large-scale construction initiatives.

Building Renovations and Retrofits: The need for renovation and retrofitting of existing structures drives the demand for tapes that provide effective solutions for repair and improvement works. Tapes play a vital role in enhancing the longevity and performance of renovated buildings.

Emphasis on Safety Measures: The construction industry places significant importance on safety measures. Building and construction tapes are used for floor marking, anti-slip applications, and hazard warnings, contributing to a safer working environment and promoting safety compliance.

Building and Construction Tapes Market Products Offered by Key Companies:

Shurtape Technologies launched a new line of scannable adhesive tapes that allow users to link digital information. The tapes can be scanned with a smartphone or tablet, and the information will be displayed on the device.

3M launched a new line of low-VOC adhesive tapes that are designed to reduce emissions. The tapes are made with a water-based adhesive, which produces fewer VOCs than traditional solvent-based adhesives.

Nitto Denko launched a new line of recyclable adhesive tapes. The tapes are made with a recyclable plastic film, and the adhesive is also recyclable.

Positive growth in the energy-efficient building solutions segment:

The segment of the building and construction tapes market that is experiencing significant growth is the energy-efficient building solutions segment. This growth can be attributed to increasing awareness of sustainable and eco-friendly building practices, along with stringent regulations focused on energy efficiency in construction. Energy-efficient building tapes, such as weatherproofing and thermal insulation tapes, are in high demand as they help improve a building's energy performance, reduce energy consumption, and contribute to green building certifications. Additionally, the rising emphasis on reducing carbon footprints and energy costs has further accelerated the adoption of energy-efficient tapes in construction projects worldwide.

Building and Construction Tapes Market Geographical Outlook:

The North American region is expected to hold a significant share:

North America is expected to dominate the building and construction tapes market share. This dominance can be attributed to several factors, including a robust construction industry, significant infrastructure development, and a strong focus on energy-efficient building practices in the region. Additionally, stringent building codes and regulations related to safety and sustainability drive the demand for high-quality tapes for sealing, insulation, and weatherproofing applications. North America's large-scale commercial and residential construction projects contribute to the region's prominence in the building and construction tapes market.

Building and Construction Tapes Market Key Developments:

In Nov 2022, Bostik, a global adhesive specialist, launched two new innovative products for the tape and label market in India. The first product, Bostik HM2060, serves as both an adhesive and label, making it ideal for high-speed label production in industries like FMCG and pharmaceuticals, where demand is increasing due to growing manufacturing in India.

In October 2022, Avery Dennison Performance Tapes unveiled a new portfolio of interior surface bonding solutions for the building and construction segment. The portfolio includes nine pressure-sensitive tape constructions with different adhesive technologies designed for bonding materials to commercial and residential interior surfaces. Pressure-sensitive adhesive tapes are widely used in both residential and commercial settings and have proven to be effective for this purpose.

List of Top Building and Construction Tapes Companies:

3M

Intertape Polymer Group (IPG)

DuPont

Shurtape Technologies, LLC

Berry Global Inc.

Building and Construction Tapes Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Building and Construction Tapes Market Size in 2025 | USD 5.249 billion |

Building and Construction Tapes Market Size in 2030 | USD 6.366 billion |

Growth Rate | CAGR of 3.94% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Building and Construction Tapes Market |

|

Customization Scope | Free report customization with purchase |

Building and Construction Tapes Market Segmentation

By Product Type

Adhesive Tapes

Double Sided

Single Sided

Duct Tapes

Masking Tapes

Others

By Functioning

Sealing & Bonding

Sound & Water Proofing

Insulation

Others

By Application

Flooring

Walls & Ceiling

Roofing

Others

By End-User

Residential

Commercial

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others