Report Overview

Canada Advanced Battery Market Highlights

Canada Advanced Battery Market Size:

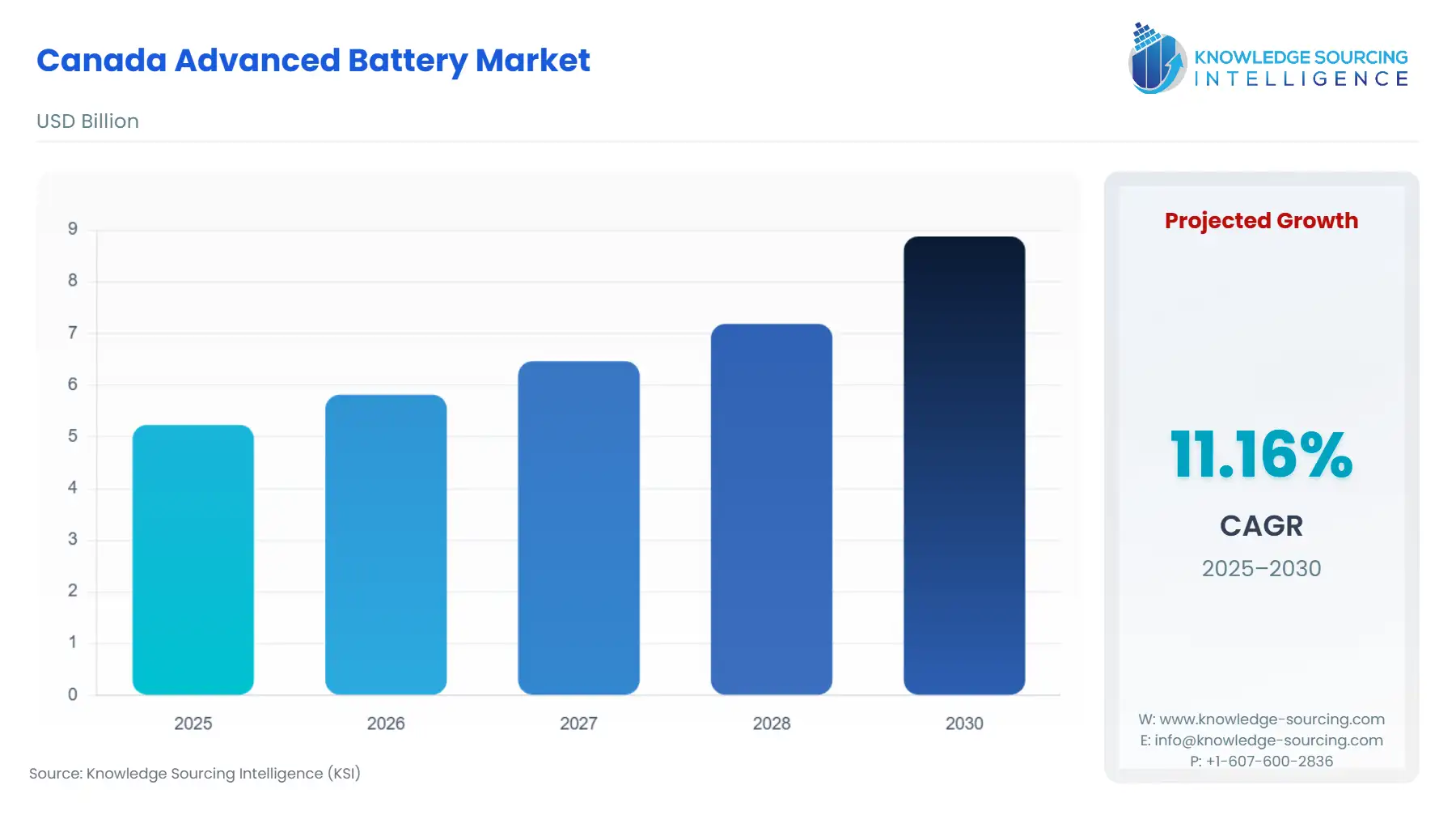

The Canada Advanced Battery Market is expected to grow at a CAGR of 11.16%, attaining USD 8.879 billion in 2030 from USD 5.232 billion in 2025.

The Canadian Advanced Battery Market is undergoing a rapid, policy-driven transformation, shifting its focus from being a raw materials exporter to establishing a fully integrated, domestic electric vehicle (EV) and energy storage supply chain. This strategic pivot is underpinned by significant government funding and regulatory levers, specifically targeting the midstream processing and downstream manufacturing segments to capture greater value. The market's competitive advantage is being engineered around access to ethically sourced critical minerals and Canada's abundance of low-carbon electricity, positioning it as a key component of the North American battery ecosystem amidst global supply chain diversification efforts.

Canada Advanced Battery Market Analysis:

- Growth Drivers:

The primary growth driver is the direct legislative action under the Electric Vehicle Availability Standard. By mandating that 20% of new light-duty vehicle sales be ZEVs by 2026, and progressively increasing to 100% by 2035, the government directly propels a guaranteed, escalating demand for high-performance lithium-ion battery packs, particularly the high-capacity variants (>200 Ah) required for Battery Electric Vehicles (BEVs). Concurrently, the Critical Minerals Strategy accelerates demand for domestic raw material processing. Public investment in midstream capacity, such as the support for nickel sulphate production, directly generates demand for battery-grade cathode and anode materials that feed the recently announced domestic cell production facilities.

- Challenges and Opportunities:

A key challenge is the midstream capacity gap. While Canada possesses abundant critical minerals, its existing refining and processing infrastructure has historically lagged behind the scale needed for battery-grade material production. This constraint creates an upstream supply dependency that limits the immediate demand for domestically mined raw materials from Canada's nascent cell manufacturers. The fundamental opportunity lies in vertical integration and battery circularity. Developing cost-competitive, environmentally sustainable processing technologies, such as those promoted through the National Research Council's Critical Battery Materials Initiative, creates an imperative to establish a secure, closed-loop supply, thereby stabilizing material costs and increasing the demand for battery recycling technologies.

- Raw Material and Pricing Analysis:

Advanced batteries, being physical products, are directly sensitive to raw material pricing and supply chain concentration. The cost of lithium, a key component in Lithium-ion batteries, has seen significant volatility, influencing battery pack pricing and, consequently, EV cost competitiveness. Canada, with its lithium and nickel reserves, is addressing supply stability. Projects in Quebec, like the North American Lithium operation, aim to integrate domestic production, which, when coupled with investments in nickel-rich and cobalt-free cathode technologies, can provide a more resilient and lower-carbon-footprint supply stream. This domestic material security directly buffers Canadian manufacturers against geopolitical risks and price instability from heavily concentrated foreign sources, enabling more predictable long-term supply contracts.

- Supply Chain Analysis:

The Canadian advanced battery supply chain is rapidly evolving toward a fully integrated North American model. It starts with upstream extraction in provinces like Quebec, Ontario, and Newfoundland & Labrador. The midstream, currently the focus of massive investment, is developing processing and Cathode Active Material (CAM) production hubs, notably in Bécancour, Quebec, and Kingston, Ontario. The downstream is anchored by new battery cell "gigafactories" in Southern Ontario. A key logistical complexity is the vast geographic separation between critical mineral mines and manufacturing clusters. The dependency is clear: the viability of the large-scale Ontario and Quebec cell plants is fundamentally reliant on the successful and timely scale-up of Canadian midstream material processing.

Canada Advanced Battery Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Federal (Canada) | Electric Vehicle Availability Standard (via Transport Canada) | Directly compels auto manufacturers to increase ZEV sales, thereby creating a guaranteed, structural increase in demand for automotive-grade Lithium-ion battery packs. |

| Federal (Canada) | Critical Minerals Strategy (via Natural Resources Canada) | Provides federal funding and tax incentives (e.g., Clean Technology Manufacturing Investment Tax Credit) to de-risk investment in mining, processing, and manufacturing, directly accelerating the establishment of domestic battery supply capacity. |

| Provincial (e.g., Ontario, Quebec) | Clean Energy / Decarbonization Mandates | Provincial electricity grid mandates for decarbonization and peak-shaving drive increased procurement of utility-scale energy storage systems (ESS), boosting demand for both Lithium-ion and Flow battery technologies in the >200 Ah category. |

Canada Advanced Battery Market Segment Analysis:

- By Technology – Lithium-ion Batteries: The Lithium-ion (Li-ion) battery segment serves as the central pillar of the Canadian advanced battery market, with its demand overwhelmingly concentrated in the electric mobility and utility-scale ESS applications. The core growth driver is the Li-ion battery's superior energy density, a non-negotiable requirement for achieving competitive EV range and for maximizing energy throughput in space-constrained urban and commercial ESS deployments. Government ZEV mandates create an unyielding demand floor for Li-ion for transportation. Furthermore, the commitment to renewable energy integration and grid modernization by Canadian provinces fuels demand for large-format Li-ion cells for peak shifting and frequency regulation. The market trend is currently shifting towards nickel-rich cathodes (NMC) for high-range automotive applications and Lithium Iron Phosphate (LFP) for grid storage, prioritizing longevity and cost over maximum energy density in stationary use cases. This dual-chemistry demand profile ensures Li-ion's continued market dominance.

- By Application – Automotive: The Automotive segment, specifically Electric Vehicles (EVs), is the most volatile and high-growth demand vector for advanced batteries in Canada. Three confluent factors influence this necessity: direct federal ZEV mandates, provincial consumer incentives (e.g., iZEV Program), and global automaker capital allocation. The mandates create a regulatory push, forcing OEMs to meet sales targets by supplying the Canadian market, thereby generating direct order volume for advanced battery packs. This structural requirement is further amplified by consumer-side incentives, which bridge the initial cost differential between ZEVs and internal combustion engine vehicles, accelerating the retail pull. This need is heavily skewed toward high-voltage, liquid-cooled battery packs that offer fast-charging capabilities and optimal performance across Canada’s varied climate zones, driving innovation in thermal management systems and battery management software.

Canada Advanced Battery Market Competitive Analysis:

The Canadian advanced battery competitive landscape is currently characterized by a transition from a raw materials extraction hub to a cell and component manufacturing cluster, heavily influenced by multi-billion-dollar foreign direct investment (FDI) in downstream manufacturing.

- PowerCo SE: The battery subsidiary of Volkswagen Group, PowerCo, is positioned as a market-defining entity. Its planned gigafactory in St. Thomas, Ontario, with a final capacity of up to 90 GWh, establishes it as a foundational player in Canadian battery cell production. Its strategic positioning leverages Canada's clean energy grid and critical minerals to supply its North American EV production with cutting-edge unified cells.

- Stellantis/LG Energy Solution (NextStar Energy): This joint venture is strategically positioned as a critical cell supplier for the established North American automotive manufacturing footprint. The Windsor, Ontario, plant represents a major commitment to local production of advanced Lithium-ion battery cells and modules, anchoring the supply chain for Stellantis’ future EV requirements across the region. Their positioning emphasizes proximity and integration with the major assembly plants.

- POSCO Chemical and General Motors (GM) (Ultium CAM): Focused exclusively on the midstream, this partnership is a critical piece of the Canadian value chain, producing Cathode Active Material (CAM) in Bécancour, Quebec. This company's strategic value lies in transforming raw Canadian minerals (nickel, cobalt, manganese) into high-value battery precursors, securing a domestic, vertically integrated supply of the most expensive component of the Li-ion cell.

Canada Advanced Battery Market Developments:

- September 2025: Hitachi Energy announced an additional $270 million CAD investment to expand its large power transformer manufacturing capacity in Varennes, Quebec. This expansion, building on a prior investment, nearly triples the site's annual production capacity, primarily to address the surging electricity demand from data centers, renewable energy integration, and the electrification of transportation, all of which require resilient grid infrastructure that relies on advanced ESS.

- August 2025: PowerCo, a subsidiary of Volkswagen Group, initiated a significant hiring campaign for its new electric vehicle battery gigafactory in St. Thomas, Ontario, aiming to fill hundreds of specialized positions in preparation for the start of production. This development is a clear precursor to large-scale capacity addition in the automotive battery cell manufacturing segment.

- March 2023: Volkswagen confirmed its subsidiary, PowerCo SE, would build its first overseas cell factory in St. Thomas, Ontario, with an investment of up to €4.8 billion / CAD$7 billion until 2030 and a planned capacity of up to 90 GWh in its final expansion phase. This capacity addition significantly increases the domestic manufacturing capability for advanced Li-ion batteries.

Canada Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.232 billion |

| Total Market Size in 2031 | USD 8.879 billion |

| Growth Rate | 11.16% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

Canada Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket