Report Overview

Solar Battery Market - Highlights

Solar Battery Market Size:

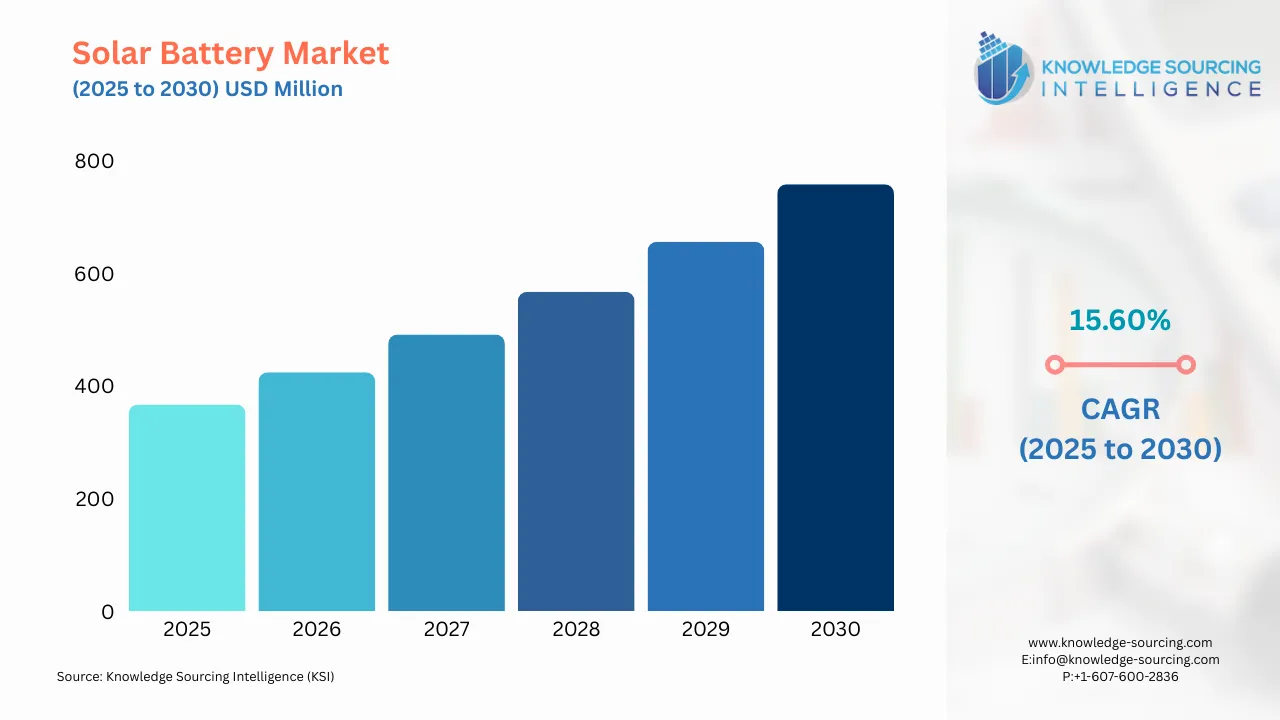

Solar Battery Market, sustaining a 15.60% CAGR, is anticipated to reach USD 757.777 million in 2030 from USD 367.130 million in 2025.

To store the extra electricity produced by the solar panels, there is a need to add a solar battery to a solar power system, so that on cloudy days, at night, and during power outages when the solar panels don't produce enough electricity, it then utilize that stored energy to power the home and industry places. As solar energy becomes more popular in home and industrial applications as an alternative to renewable energy, the market for solar batteries grows. For instance, according to the International Energy Association (IEA), renewable energy sources will have the fastest rise in the electrical industry, increasing from 24% in 2017 to roughly 30% in 2023, this is expected to grow a need for solar batteries which will boost the market growth year-on-year during the forecasted period.

Solar Battery Market Growth Drivers:

- The increasing urbanization and infrastructure investments will boost market growth.

The energy demand is expected to rise due to several important causes, including a growing population, with fast industrialization, urbanization, and increased infrastructure investments by market leaders will boost the solar battery market growth. In August 2019, around 110 million USD were committed to the development of a 150 MW floating solar power plant in Uttar Pradesh by Shapoorji Pallonji & Company Private Limited (India) and ReNewPower (India). In February 2022, Waaree Energies Ltd. announced the award of a new 180 MW DC solar project in Tamil Nadu, India, after the award of a 140 MW solar project in Gujarat. Rapid urbanization will also lead to energy demand which will boost the solar energy demand and thus the solar battery market. For instance, according to IEA, between 2019 and 2030, it is predicted that India's energy demand would rise by about 35%, and during the next 20 years, India's urban population is expected to grow by another 270 million people. According to the U.S Energy Information Administration (EIA), in 2021 the total primary energy used in the United States was equivalent to 97 quadrillion BTUs (British thermal units). This means that as energy consumption and urbanization increase, so will the demand for solar energy which will boost the solar battery market.

- The replacement of old fossil fuels with solar energy will boost the solar battery market

As the government is replacing fossil fuels like coal with solar power to generate electricity so that natural resources are being saved which will lead to an increase in the need for solar batteries and thus would increase the market growth. According to the US Energy Information Administration EIA, in 2022 the U.S. expect a 21.5 GW increase in U.S. utility-scale solar generating capacity. As the demand for solar energy had been used to generate more electricity for many years now there is a requirement to store that power and this will increase the demand for solar batteries. According to the US Energy Information Administration EIA, in 2023 developers intend to add 8.6 GW of battery storage power capacity to the grid, which will treble the nation's total battery power capacity as batteries can store electricity from solar energy sources for later use. Additionally, there is a definite need for new generating capacity all over the world to satisfy the rising demand for energy in many nations as well as to replace outdated fossil fuel units, particularly coal-fired ones that release a lot of carbon dioxide. Thus, this will increase the usage of solar power as a renewable and less harmful alternative which will help to boost the solar battery market.

Solar Battery Market Geographical Outlook:

- During the forecast period, North America will dominate the solar battery market

The market for solar batteries is predicted to be dominated by North America due to the region's rising environmental consciousness, government backing, and falling cost of solar panels. According to a new analysis from the National Renewable Energy Laboratory (NREL), utility-scale solar systems saw a 12.3% price fall between 2020 and 2021 in the U.S, and the installed cost of solar photovoltaic (PV) and battery storage systems also continued to reduce between 2020 and 2021. Due to the widespread use of sustainable energy sources to reduce the growing GHG emissions, North America is predicted to lead the solar thermal collector market. The EIA is collaborating with many federal states to install solar thermal collecting systems in homes and businesses to generate pollution-free energy.

The US Department of Energy claims that solar power is now more widely used, accessible, and inexpensive than ever before in the country, from a capacity of 0.34 GW in 2008, the U.S. estimated solar power capacity in 2021 is 97.2 gigawatts (GW) and there has been an increase in the percentage of generation of solar capacity in North America by 25.5% which is the highest rise in all renewable energies. As per the same source, the generation of solar in total North America has increased from 633.2 TWH in 2020 to 714.1 TWH in 2021 the highest in comparison to other renewable energy. This shows the growth of solar energy capacity is huge in the American market which is expected to boost the market of solar batteries in the North American region during the forecasted period.

List of Top Solar Battery Companies:

- Luminous (Schnieder Electric)

- Okaya Power Pvt. Ltd

- BYD Company Ltd.

- U.S Battery Mfg

- SunPower Corporation

Solar Battery Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Solar Battery Market Size in 2025 | USD 367.130 million |

| Solar Battery Market Size in 2030 | USD 757.777 million |

| Growth Rate | CAGR of 15.60% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Solar Battery Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation

- SOLAR BATTERY MARKET BY PHASE TYPE

- Lithium Ion Battery

- Lead Acid Battery

- Nickel-Cadmium Battery

- Flow Battery

- SOLAR BATTERY MARKET BY POWER OUTPUT

- Up to 3 kW

- 3 to 5 kW

- Greater than 5 kW

- SOLAR BATTERY MARKET BY END-USER

- Residential

- Commercial

- Industrial

- SOLAR BATTERY MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America