Report Overview

Cancer Gene Therapy Market Highlights

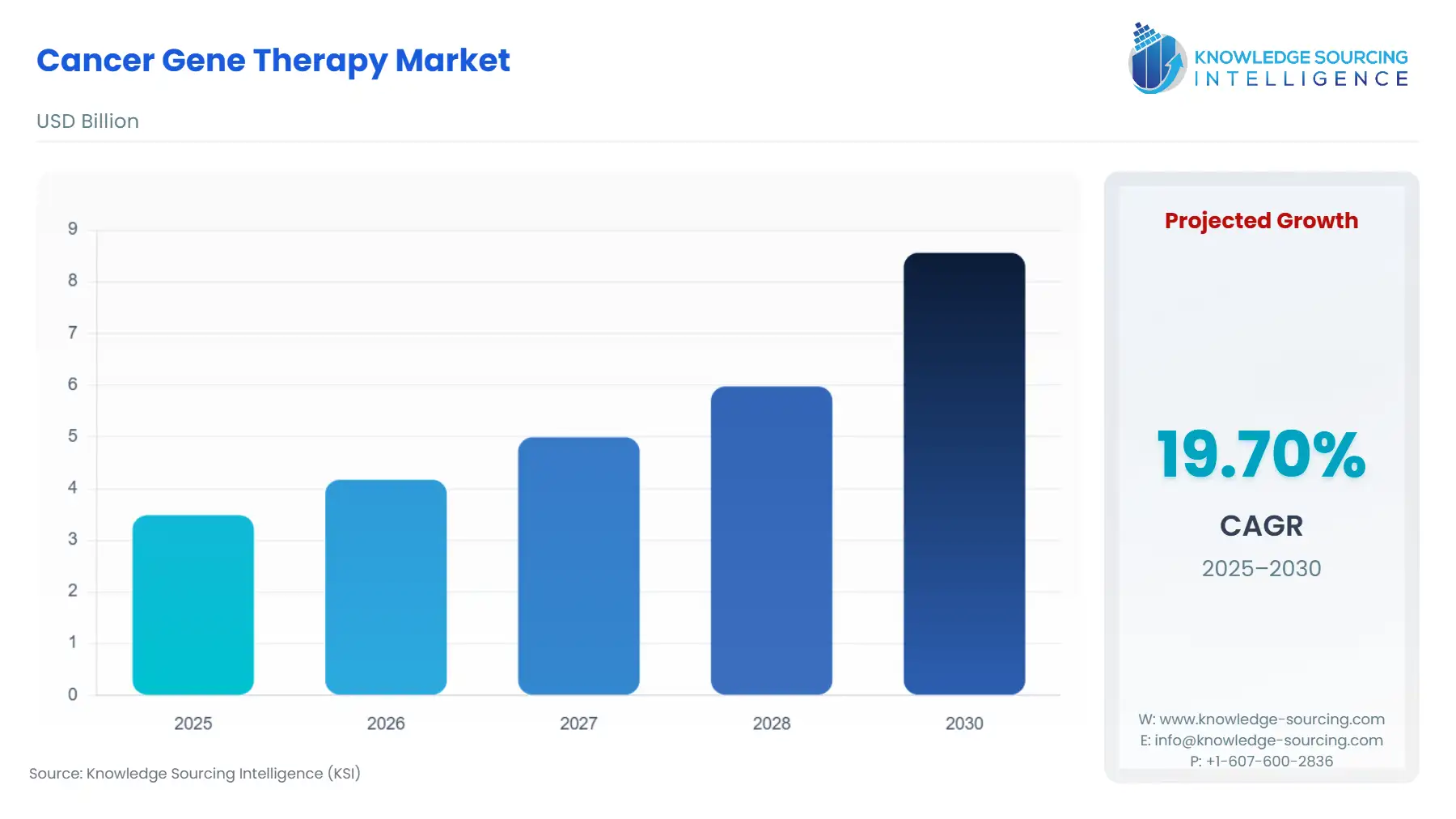

Cancer Gene Therapy Market Size:

The cancer gene therapy market is expected to grow from US$3.484 billion in 2025 to US$8.561 billion in 2030, at a CAGR of 19.70%.

The Cancer Gene Therapy Market is undergoing a rapid, technology-driven evolution, transitioning from an experimental approach to a cornerstone of oncology practice, particularly in relapsed or refractory disease settings. This complex biopharmaceutical sector is defined by high-value, curative-intent single-administration treatments utilizing a patient's own modified cells (autologous) or engineered viral vectors. The commercial viability of this modality is directly proportional to its demonstrated efficacy in patients who have exhausted standard-of-care options and the industry’s ability to scale highly personalized and technologically arduous manufacturing processes. The market's trajectory is currently being shaped by key regulatory precedents in both North America and Europe, which are gradually widening the therapeutic window and patient pool, moving gene therapies into earlier stages of cancer treatment.

Cancer Gene Therapy Market Analysis

-

Growth Drivers

The increasing adoption of gene therapy products is directly propelled by compelling clinical data demonstrating superior durable response rates compared to conventional late-line chemotherapy, particularly in hematologic malignancies. This clinical success fundamentally shifts demand by creating a new standard of care for refractory patient populations. Furthermore, the rising global incidence of cancer, coupled with the growing elderly population who often present with comorbidities limiting their tolerance for aggressive traditional treatment, amplifies the imperative for targeted, single-administration therapies, thus stimulating specific demand for less systemically toxic gene therapy options. Regulatory initiatives, such as the U.S. FDA’s Orphan Drug and Breakthrough Therapy designations, accelerate development timelines and market entry, swiftly converting pipeline innovation into commercially available treatments, which directly translates to new product demand.

-

Challenges and Opportunities

The primary constraint facing the market is the exorbitant cost of personalized gene therapies and the associated reimbursement complexity across various healthcare systems, which acts as a direct headwind to patient access and commercial demand. Furthermore, the critical need for specialized treatment centers equipped for apheresis, reinfusion, and sophisticated toxicity management (like Cytokine Release Syndrome) constrains the geographic accessibility, limiting the demand reach. The key opportunity lies in developing allogeneic (off-the-shelf) therapies, which promise to standardize the manufacturing process, dramatically reduce cost-of-goods, and simplify logistics. Success in allogeneic platforms would fundamentally democratize access and generate substantial new demand by making gene therapies feasible outside of major academic centers. Another major opportunity is the expansion into solid tumor indications—a much larger patient population—where approvals like Amtagvi (TIL therapy) are validating new therapeutic mechanisms, creating massive potential demand if efficacy can be broadly replicated.

-

Raw Material and Pricing Analysis

The Cancer Gene Therapy Market is an intangible therapeutic service (i.e., a personalized biological product manufactured from the patient's own cells) and is therefore not subject to a traditional raw material commodity analysis. However, the high price point of treatments, such as Tisagenlecleucel (Kymriah) or Axicabtagene Ciloleucel (Yescarta), is a direct function of the extremely high cost of manufacturing and quality control. This includes the procurement and processing of viral vectors (often Lentiviral or AAV) used to engineer the cells, the specialized cGMP-compliant manufacturing facility overhead, and the rigorous quality assurance/quality control required for a personalized, single-batch living drug product. The pricing mechanism is thus driven by the cost-of-therapy delivery and perceived long-term value (potential for cure) rather than raw material supply chain dynamics.

-

Supply Chain Analysis

The cancer gene therapy supply chain is an intricate, patient-centric "vein-to-vein" closed loop, characterized by extreme logistical complexity. Key production hubs are typically centralized, high-specification biomanufacturing facilities operated by the therapy sponsor (e.g., Novartis, Gilead/Kite, Bristol Myers Squibb) in North America and Europe. The critical logistical complexity stems from the need for Chain-of-Identity (CoI) and Chain-of-Custody (CoC), which ensures the patient’s starting material (apheresed cells) remains strictly linked to their final drug product. Furthermore, the final product often requires cryopreservation at ultra-cold temperatures (-150°C to -196°C) using specialized, continuously monitored dry shippers. This dependence on validated, time-sensitive cryogenic cold chain transportation and specialized third-party logistics (3PL) providers creates significant dependencies and is a major determinant of both cost and market reach.

-

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Food and Drug Administration (FDA) – Center for Biologics Evaluation and Research (CBER) |

CBER issues specialized guidance (e.g., Guidance for Industry on CAR T Cell Products), accelerating development. Its approval process for high-impact products (e.g., Priority Review, Accelerated Approval) acts is a significant growth catalyst, bringing life-saving therapies to market faster. |

|

European Union |

European Medicines Agency (EMA) – Committee for Advanced Therapies (CAT) |

The CAT's dedicated framework for Advanced Therapy Medicinal Products (ATMPs) provides a streamlined, albeit complex, pathway for market authorization, which is essential for opening up the high-demand European market. The national-level negotiation on pricing and reimbursement (e.g., Germany's G-BA, UK's NICE) creates significant downstream demand constraints. |

|

China |

National Medical Products Administration (NMPA) |

The NMPA has established specific fast-track approval policies for innovative therapies, notably leading to the early market entry of domestic CAR T-cell products. This regulatory support rapidly validates local technologies, dramatically increasing and localizing commercial demand within the APAC region. |

Cancer Gene Therapy Market Segment Analysis

-

By Technology: Immunotherapy (CAR T-Cell Therapy)

The Immunotherapy segment, specifically Chimeric Antigen Receptor (CAR) T-cell therapy, dominates the market due to its demonstrated profound and durable efficacy in hematological malignancies. The rate of failure of established first- and second-line treatments drives market growth. As chronic and relapsed cancer patients exhaust conventional chemotherapy, stem cell transplant, and antibody therapies, demand is funneled directly to the FDA- and EMA-approved CAR T-cell products. The recent expansion of regulatory approvals into earlier lines of therapy for certain non-Hodgkin lymphomas significantly broadens the addressable patient population. For instance, the approval of a CAR T-cell product for second-line treatment shifts the growth curve significantly upstream from the tertiary care setting. Furthermore, strong long-term follow-up data showing sustained complete remissions for years positions this one-time treatment as a curative-intent option, which is a powerful demand generator in discussions with both oncologists and payers, despite the high initial cost. Future requirement is inextricably linked to successful clinical trials targeting solid tumors, which remains the single largest opportunity for expansion.

-

By End-User: Hospitals & Clinics

The Hospitals & Clinics end-user segment commands the majority share of the commercial gene therapy market, primarily because of the specialized infrastructural and operational capabilities required to administer these complex treatments. The number of certified treatment centers capable of adhering to stringent accreditation and risk management protocols drives this growth. Autologous CAR T-cell therapy requires highly specialized logistical coordination, including patient conditioning (lymphodepleting chemotherapy), the infusion of the cell product, and critical post-infusion patient monitoring for severe adverse events like Cytokine Release Syndrome (CRS) and Immune Effector Cell-Associated Neurotoxicity Syndrome (ICANS). These procedures are almost exclusively performed in academic medical centers or large regional cancer hospitals with dedicated Intensive Care Units and specialized personnel. The high capital expenditure required for accreditation and the limited number of skilled clinical staff act as a powerful demand concentrator, channeling the vast majority of patient requirements directly toward these certified institutional settings. The diffusion of demand to smaller, non-academic clinics will only occur with the commercialization of less toxic or 'off-the-shelf' (allogeneic) alternatives.

Cancer Gene Therapy Market Geographical Analysis:

-

US Market Analysis (North America)

The US market is catalyzed by a strong biopharma innovation ecosystem and a relatively streamlined regulatory pathway (FDA CBER) that supports the commercialization of novel gene therapies. The Fee-for-Service model, coupled with comprehensive private and public insurance coverage (Medicare/Medicaid), facilitates high-value product adoption, even at premium price points. Local growth factors are heavily influenced by the concentration of leading academic medical centers, which serve as the primary Accredited Treatment Centers (ATCs). The requirement is further reinforced by robust patient advocacy groups and favorable reimbursement codes for autologous cellular therapies, which mitigate the direct financial burden on certified hospitals, making the treatment financially viable for the institutions that deliver the product.

-

Brazil Market Analysis (South America)

The market dynamic in Brazil is constrained by significant budget limitations within the public healthcare system (SUS) and a smaller, fragmented private healthcare sector. Its necessity is primarily impacted by the slow and complex process of Health Technology Assessment (HTA) and subsequent governmental pricing negotiations. While there is immense clinical demand from oncologists for curative-intent treatments, the effective commercial requirement is throttled by the need for regulatory approval from ANVISA and, crucially, a positive recommendation for reimbursement from CONITEC. Local manufacturing capacity is nascent, meaning the market is highly import-dependent, which subjects realized patient demand to complex currency fluctuations and international logistics.

-

Germany Market Analysis (Europe)

Germany represents a bellwether European market characterized by rapid access to innovative therapies due to its strong, decentralized healthcare system. The key growth factor is the early adoption of new therapies based on initial EMA approval, followed by price negotiation. Under the German AMNOG system, gene therapies can be commercially launched before the final price is negotiated, leading to faster initial patient access and higher early demand. However, the subsequent price negotiation by the G-BA (Federal Joint Committee) based on therapeutic benefit comparison to standard-of-care, imposes a long-term price constraint, which can then depress or stabilize the volume-driven demand from the supply side if the final negotiated price is significantly lower than the initial launch price.

-

Saudi Arabia Market Analysis (Middle East & Africa)

The need for cancer gene therapy in Saudi Arabia is highly concentrated within major metropolitan centers and is entirely driven by substantial public healthcare spending and a government mandate to establish advanced medical infrastructure. The government's Vision 2030 strategy includes significant investment in specialized oncology centers, which directly creates a demand for the latest high-tech therapies like CAR T-cells. Clinical necessity is primarily channeled through government-funded centers of excellence, meaning reimbursement is not a constraint for approved therapies, simplifying the demand equation for foreign manufacturers compared to market-based systems. However, the availability of specialized, highly trained clinical staff remains a powerful operational constraint on the system's ability to fulfill total clinical demand.

-

China Market Analysis (Asia-Pacific)

China is rapidly becoming a dual-structure market, supporting both imported global products and a thriving domestic industry. The rapid pace of domestic regulatory approvals (NMPA) for locally developed CAR T-cell products propels this demand. This domestic innovation, exemplified by companies like Shanghai Sunway Biotech and others, leverages the vast local patient pool for clinical trials and offers the promise of a more cost-effective alternative to expensive Western-developed therapies. The inclusion of therapies in Provincial Medical Insurance or supplementary commercial insurance programs (like Hui Min Bao) is the primary market access catalyst, directly converting high clinical need into funded, realized demand across major cancer centers.

Cancer Gene Therapy Market Competitive Environment and Analysis:

The cancer gene therapy competitive landscape is highly concentrated, dominated by a few multinational pharmaceutical companies with deep pockets for research, development, and complex manufacturing scale-up. Competition is primarily focused on broadening approved indications, improving cell engineering to reduce toxicity, and developing allogeneic platforms to overcome autologous manufacturing limitations. Strategic positioning involves securing proprietary vector technology, extensive intellectual property for Chimeric Antigen Receptor (CAR) constructs, and establishing a robust global network of accredited treatment centers and specialized supply chain partnerships.

-

Novartis

Novartis, a pioneer in the space, established its strategic position with the 2017 FDA approval of Kymriah (tisagenlecleucel), the first-ever CAR T-cell therapy. Kymriah is indicated for treating pediatric and young adult patients with relapsed/refractory B-cell acute lymphoblastic leukemia (ALL) and for adult patients with relapsed/refractory diffuse large B-cell lymphoma (DLBCL) and follicular lymphoma (FL). Novartis’s strategy focuses on geographic expansion and new indication approval, leveraging its early mover advantage and partnerships with academic institutions like the University of Pennsylvania. The company emphasizes continuous process improvements in manufacturing to enhance reliability and reduce turnaround time, which is critical for meeting clinical demand for a personalized medicine.

-

Gilead Sciences, Inc. (Kite)

Gilead Sciences, through its Kite Pharma subsidiary, is a dominant player in the autologous CAR T-cell market, centering its strategy on its flagship product, Yescarta (axicabtagene ciloleucel), approved for adult patients with relapsed or refractory large B-cell lymphoma (LBCL). Kite's strategic positioning is defined by an aggressive push into earlier lines of treatment, as demonstrated by the expanded FDA approval of Yescarta in the second-line setting for large B-cell lymphoma. This strategy directly opens a larger, more viable patient population, dramatically increasing the demand funnel for the product. The company has invested heavily in proprietary manufacturing facilities and a bespoke "vein-to-vein" supply chain to ensure reliable and rapid turnaround times for the patient-specific therapy.

-

Amgen Inc.

Amgen holds a unique position in the market with Imlygic (talimogene laherparepvec) (T-VEC), an oncolytic virus therapy approved for melanoma lesions that are unresectable and have recurred after initial surgery. Unlike the CAR T-cell therapies, Imlygic represents a different gene therapy modality—a modified herpes simplex virus designed to replicate in and lyse cancer cells while expressing a stimulating cytokine. Amgen’s strategic focus with Imlygic is the integration of oncolytic virotherapy into combination treatments, aiming to boost the efficacy of checkpoint inhibitors. This approach generates demand by positioning the product as a combination therapy backbone, thereby securing its relevance in a rapidly evolving immuno-oncology landscape.

Cancer Gene Therapy Market Developments

The following verifiable, non-speculative events from 2024-2025 demonstrate strategic capacity and market focus:

-

August 2025: Gilead's Kite Pharma unit announced its acquisition of Interius BioTherapeutics to advance its in vivo platform. This strategic move is focused on next-generation gene therapy technology, aiming to develop products that can be delivered directly into the body, which is a critical step toward overcoming the logistical constraints and high costs of ex vivo CAR T-cell manufacturing.

-

April 2025: Amgen announced a $900 million manufacturing expansion, creating 350 new jobs in Ohio. This significant capital investment directly addresses the industry-wide imperative for increased, reliable, and geographically dispersed manufacturing capacity for its complex biological products, which is essential to meet growing global demand.

-

November 2024: Novartis acquired Kate Therapeutics to further enhance and strengthen the company's ongoing efforts to advance gene therapies for patients, signaling a direct strategic investment to bolster its pipeline beyond its existing oncology portfolio into other disease areas.

Cancer Gene Therapy Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 3.484 billion |

| Total Market Size in 2030 | USD 8.561 billion |

| Forecast Unit | Billion |

| Growth Rate | 19.70% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cancer Gene Therapy Market Segmentation

-

By Therapy Type

-

Immunotherapy

-

Oncolytic Virotherapy

-

Gener Transfer

-

Others

-

-

By Vector Type

-

Viral

-

Non-Viral

-

-

By Cancer Type

-

Breast

-

Lungs

-

Pancreas

-

Prostate

-

Others

-

-

By End-User

-

Hospitals & Clinics

-

Diagnostic & Research Institutes

-

Others

-

-

By Geography

-

North America

-

United States

-

Canada

-

Mexico

-

-

South America

-

Brazil

-

Argentina

-

Others

-

-

Europe

-

United Kingdom

-

Germany

-

France

-

Spain

-

Others

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Others

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Indonesia

-

Thailand

-

Others

-

-