Report Overview

Global Cancer Diagnostics Market Highlights

Cancer Diagnostics Market Size:

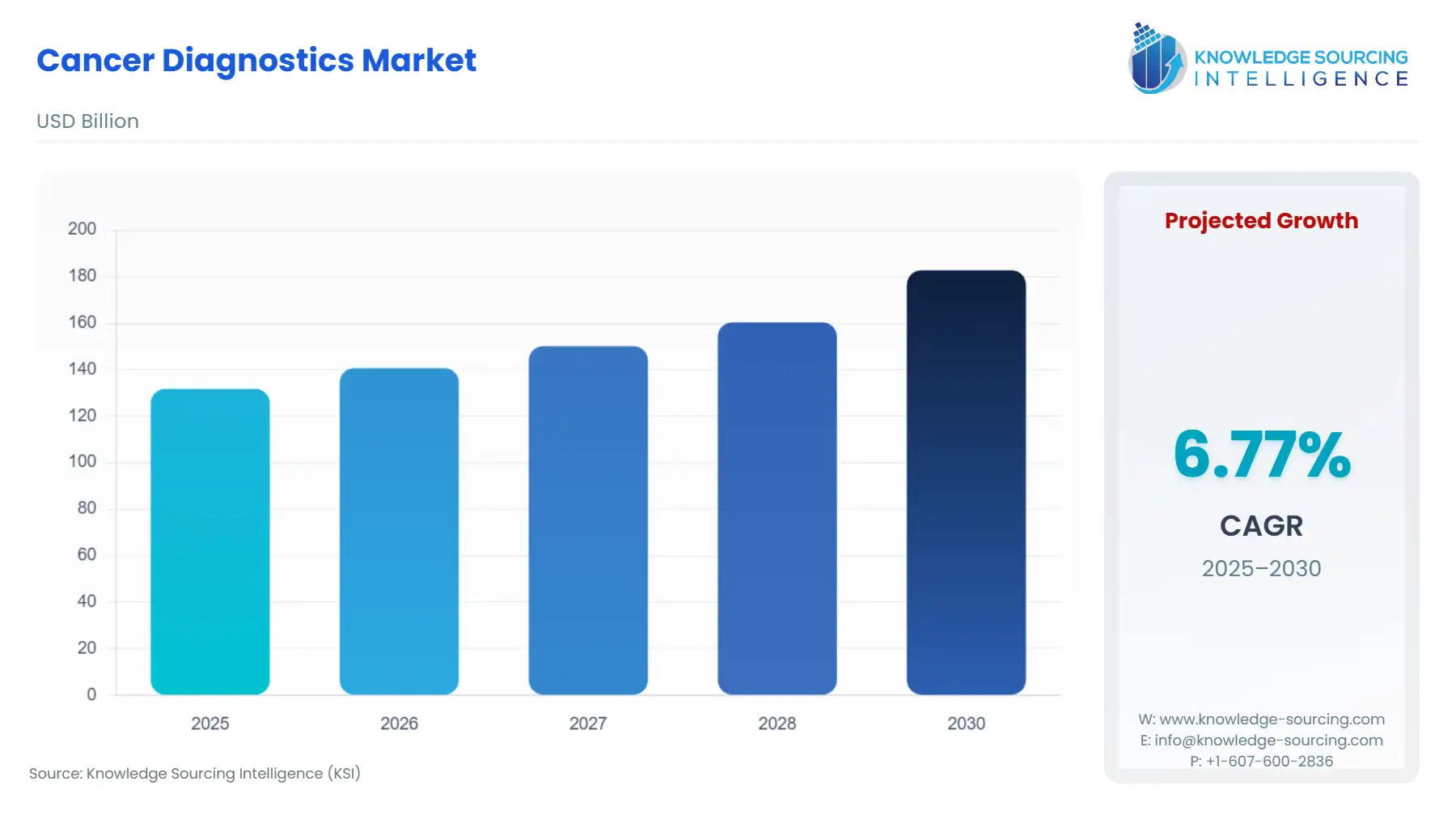

The global cancer diagnostics market is expected to grow from US$131.733 billion in 2025 to US$182.785 billion in 2030, at a CAGR of 6.77%.

Cancer Diagnostics Market Trends:

The cancer diagnostics market refers to the healthcare industry segment that deals with the development, production, and commercialization of tests and technologies used to diagnose cancer. This includes a wide range of diagnostic tools, including imaging tests (such as X-rays, CT scans, and MRI scans), blood tests, biopsies, and molecular diagnostic tests (such as genetic and tumor marker tests). The cancer diagnostics market is an important segment of the healthcare industry, as early and accurate cancer diagnosis is crucial for effective treatment and improved patient outcomes. Key players in the cancer diagnostics market include bioMérieux SA, F. Hoffmann-La Roche Ltd, Sienna Cancer Diagnostics, and Insight Medical Genetics. These companies are investing heavily in research and development to develop new technologies and solutions to meet the growing demand.

Cancer Diagnostics Market Growth Drivers:

- The rising incidences of cancer are a significant factor driving the demand for cancer diagnostics.

Cancer is a leading cause of death worldwide, and the incidence of the disease is increasing alarmingly. According to the World Health Organization (WHO), there were approximately 19.3 million new cancer cases and 10 million cancer-related deaths in 2020. Furthermore, it is estimated that the number of new cancer cases will increase by 47% in the next two decades, with over 28 million new cases expected by 2040. As the number of cancer cases continues to rise, there is a growing need for more effective and efficient diagnostic tools to detect and diagnose the disease at an early stage. Early cancer detection is crucial for improving patient outcomes as it enables earlier intervention and treatment, which can increase the chances of a positive outcome.

- Governments around the world are increasingly recognizing the potential of cancer diagnostics technologies.

For instance, in 2021, the US FDA granted a Breakthrough Device designation to Grail Inc.'s liquid biopsy test for early cancer detection. This designation is intended to expedite the development and review of new technologies that demonstrate the potential to provide more effective diagnosis, treatment, or prevention of life-threatening or irreversibly debilitating diseases.

Cancer Diagnostics Market Developments:

- In 2021, bioMérieux SA announced the acquisition of Bioinformatics Solutions Inc. (BSI), a Canadian company specializing in software solutions for proteomics and genomics analysis. This acquisition will enhance bioMérieux's capabilities in next-generation sequencing-based cancer diagnostics.

- In June 2021, Grail introduced its Galleri blood test, which uses fragments of tumor DNA in the bloodstream to identify almost 50 different cancers. The test is available in the United States with a prescription and is intended for screening individuals over 50 who have an increased risk of cancer. The launch established Grail as one of the leaders in developing blood-based screening tests for various types of cancer, competing with Guardant Health, Freenome, and Thrive Earlier Detection.

- In 2021, Thermo Fisher Scientific, a leading provider of diagnostic solutions, announced the launch of its new Oncomine Dx Target Test. This next-generation sequencing-based cancer diagnostic test can detect genetic mutations in various types of cancer. The test is highly accurate and can detect mutations in multiple genes, providing physicians with valuable information to guide treatment decisions.

Cancer Diagnostics Market Segment Analysis:

By diagnostic procedures, the global cancer diagnostics market mainly comprises laboratory tests, imaging procedures, and biopsies. During the forecast period, the laboratory test segment is expected to hold a considerable market share. The laboratory test diagnostic procedures segment is further categorized into blood, urine, and genetic tests.

- The breast cancer segment is expected to hold a sizeable share as one of the most common types of cancer in women worldwide.

In recent years, there has been a surge in investment in the development of diagnostic tools and technologies for breast cancer, which is expected to fuel further growth in the breast cancer diagnostics market. According to a report by the Department of Defense Breast Cancer Research Program, October 2021, as of 2020, female breast cancer has become the most diagnosed cancer globally, with an estimated 2.3 million new cases. In 2021, about 281,550 women and 2,650 males will be diagnosed with invasive breast cancer in the United States alone. As the number of breast cancer patients grows, there is a heightened demand for cancer diagnostic technologies and products to ensure early detection and prompt treatment.

Cancer Diagnostics Market Geographical Outlook:

- By geography, the global cancer diagnostics market has been analyzed into North America, South America, Europe, Asia Pacific, and the Middle East and Africa.

According to data from the Global Cancer Observatory (GCO), Asia, the most populated continent, accounted for the highest number of new cancer cases in 2020, with almost 9.5 million new cases. Meanwhile, North America and Europe combined for more than 6.5 million new cancer cases in the same year. The number of cancer cases has shown significant growth in the US owing to growing alcohol & tobacco consumption, sedentary lifestyles, unhealthy eating habits, and genetic factors. For instance, according to the data provided by the American Cancer Society, the estimated number of new cancer-diagnosed cases in the US stood at 1.9 million, which represented a 5.6% increase in newly diagnosed cases in comparison to 1.8 million new cases reported in 2020. Also, as per the same source, the estimated number of cancer deaths in 2021 stood at 6,08,570, signifying an increase of 2,050 in the number of deaths. Such an increase in cancer-diagnosed cases and the death rate will propel the demand for diagnostics and screening activities for early cancer detection, thereby boosting the market growth of cancer diagnostics in the United States.

Critical Care Diagnostics Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 131.733 billion |

| Total Market Size in 2031 | USD 182.785 billion |

| Growth Rate | 6.77% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Diagnostic Procedure, Cancer Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Critical Care Diagnostics Market Segmentation:

- By Diagnostic Procedure

- Laboratory Test

- Imaging Procedures

- Biopsy

- By Cancer Type

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Skin Cancer

- Stomach Cancer

- Others

- By End-User

- Hospitals

- Clinics

- Diagnostics Centers

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Indonesia

- Japan

- Others

- North America