Report Overview

Cannabidiol Market - Strategic Highlights

Cannabidiol Market Size:

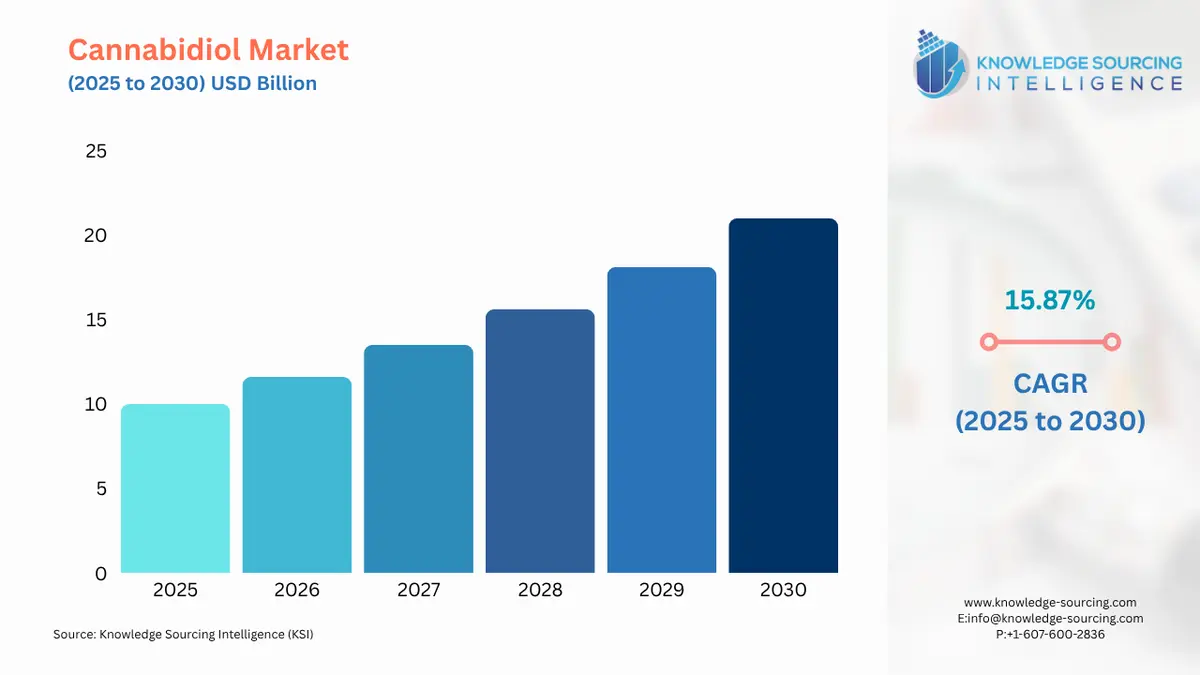

Cannabidiol Market, at a 15.39% CAGR, is projected to increase from USD 10.035 billion in 2025 to USD 23.693 billion in 2031.

Cannabidiol Market Trends:

Hemp is typically used because of its naturally high cannabidiol (CBD) content. While CBD is a crucial component of medicinal marijuana, it is either produced in a lab or is taken straight from the hemp plant, a relative of the marijuana plant. Cannabidiol is the cannabinoid that is most frequently utilized for medicinal purposes due to its absence of psychotropic effects. Cannabidiol oil for instance is utilised in various medical procedures, including the treatment of anxiety and depression, the reduction of stress, the prevention of diabetes, the reduction of pain and inflammation, and the treatment of cancer symptoms.

Cannabidiol Market Growth Drivers:

Growth drivers for the cannabidiol market

Increased funding for research and development to better understand cannabidiol's effects and create new products is the result of rising interest in the substance's potential health benefits. The cannabidiol market is anticipated to expand as hemp-based goods become permitted. To satisfy customer demand, businesses are creating a range of cannabidiol products, including candies, topicals, and drinks. Businesses can reach a larger audience and boost sales through online channels due to the growth of e-commerce.

Cannabidiol Market Segmentation Analysis:

Increase in patients suffering from chronic illness

In both industrialized and emerging nations, the frequency of chronic illness is increasing, which has increased the incidence of several neurological diseases including Parkinson's and Alzheimer's and this is impacting the cannabidiol market growth. According to a WHO estimate, more than 55 million individuals worldwide had dementia in 2017. Additionally, an Alzheimer's Association analysis estimates that by 2021, dementia would affect nearly 6 million elderly Americans. Additionally, there is a huge surge in people suffering from cancer and diabetes worldwide further propelling the cannabidiol market.

Government approvals for CBD products

Government restrictions are stringent, and CBD-based goods needed permits before they could be sold and supplied on the domestic and foreign markets. However, as marijuana and products derived from it have become more and more legal for a variety of uses, regulations have been loosened, and refined CBD products are becoming more and more popular. This is anticipated to fuel the cannabidiol market expansion and demand.

Additionally, there are significant producers of CBD products all over the world, which has led the government and other regulatory bodies, including the European Union in Europe and the United States, to relax their regulations on CBD and CBD-based products.

Increasing clinical trials and product utilization in the pharmaceutical industry

The cannabidiol market share is projected to increase over the projected period as a result of the rising number of research trials examining the benefits of CBD on various health issues. Additionally, a lot of businesses buy CBD oil in bulk and create CBD-infused goods that are extensively utilized by customers as an alternative to managing stress and discomfort.

As a result, the cannabidiol market for these items is probably in a growing phase. Over the projection period, the pharmaceutical industry is anticipated to grow at the quickest rate. Cannabidiol's transition from natural treatments to prescription medications is probably what will spur the cannabidiol market growth. The pharmaceutical industry's demand for these products is also anticipated to increase as more people become aware of cannabidiol's medicinal potential.

Growing demand in end-user industries

It is anticipated that growing demand for cannabidiol from a variety of end-user sectors, including food and beverage, personal care and cosmetics, and pharmaceuticals, would provide the cannabidiol market tremendous potential prospects. The need for cannabidiol products that are chemically and minimally prepared has also created a lucrative potential to grow the industry. With the commercialization of several products using cannabidiol in the production process, high levels of demand from hospitals are therefore anticipated to propel market expansion.

Growing demand for CBD products

The cannabidiol market is anticipated to rise due to the high demand for CBD products including oils, tinctures, concentrates, capsules, topical treatments like salves, lip balms, and lotions, as well as consumables like baked goods, coffee, chocolate, gum, and candies. Furthermore, hemp-derived CBD has a wide range of uses due to its antioxidant properties and capacity to combat aging and inflammation. CBD-infused products are being developed across a range of industries, including medicines, personal care, nutraceuticals, and food and beverage.

Cannabidiol Market Geographical Outlook:

The North American cannabidiol market is anticipated to grow significantly.

North American cannabidiol market is propelling due to a variety of reasons, including a sizable population of health-conscious people, increasing consumer acceptance of CBD products, the existence of major producers, and the ratification of the U.S. Farm Bill in 2020. With the most CBD firms and lax rules governing the use of CBD products, the region is regarded as the most advanced in cannabis and related products, including CBD.

Increasing investment and product innovation by key players

With an increase in the number of new businesses selling comparable items, the cannabidiol industry is becoming more competitive. Consumers have been compelled to buy these products, even though they are pricey, due to the rising understanding of the medicinal advantages of cannabidiol. Commercial shops are concentrating on marketing cannabis-based products because they offer a bigger profit margin. CBD-based products are now widely available at several health and wellness retailers. It is advertised for its alleged health advantages, which include easing pain and anxiety.

List of Top Cannabidiol Companies:

ENDOCA

Cannoid, LLC

Mayo Clinic

Folium Biosciences

Elixinol

Cannabidiol Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Cannabidiol Market Size in 2025 | USD 10.035 billion |

Cannabidiol Market Size in 2030 | USD 20.956 billion |

Growth Rate | CAGR of 15.87% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Cannabidiol Market |

|

Customization Scope | Free report customization with purchase |

Cannabidiol Market Segmentation:

By Source

Hemp

Marijuana

By Product Type

Oil

Tablets & Capsules

Gummies

Others

By Sales Type

B2B

B2C

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Food & Beverage

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others