Report Overview

Central Processing Unit (CPU) Highlights

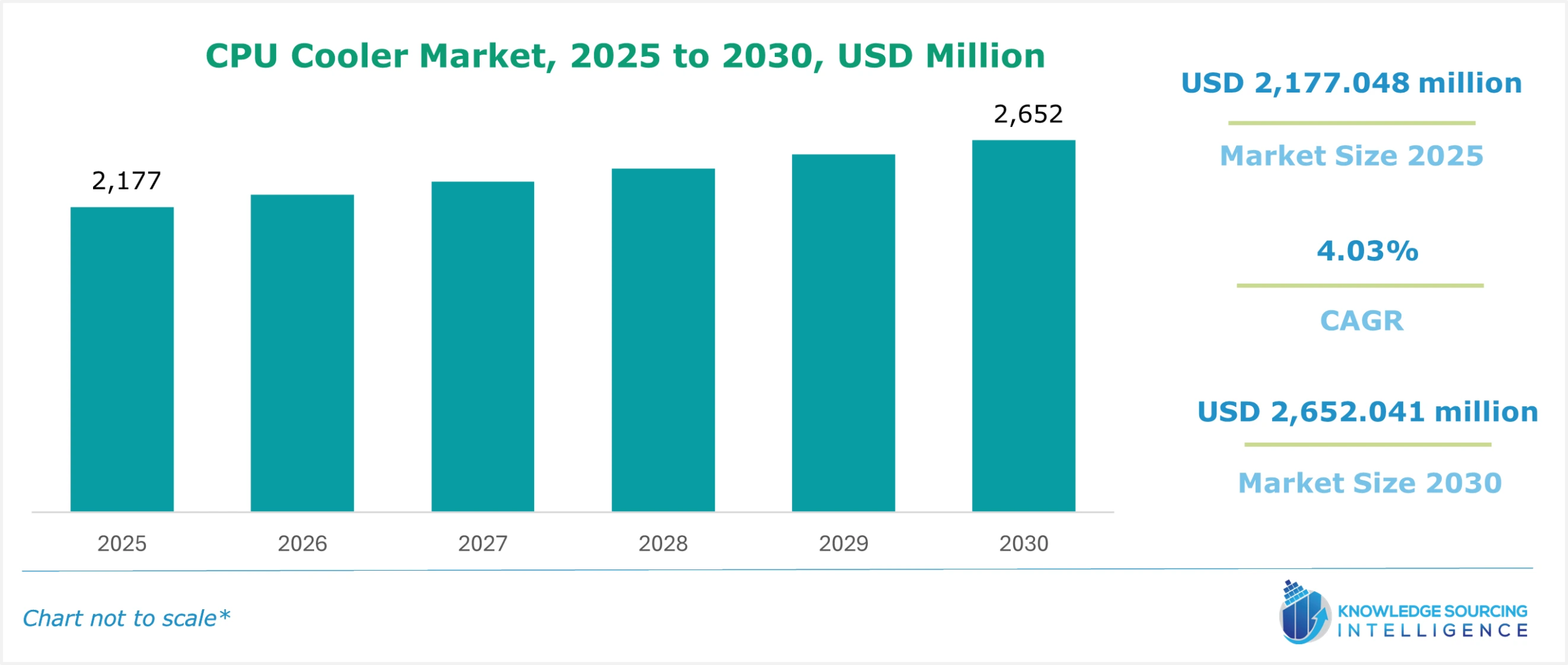

The CPU cooler market is expected to grow at a CAGR of 4.03%, reaching a market size of US$2,652.041 million in 2030 from US$2,177.048 million in 2025.

A CPU cooler is a type of external component that is applied to the central processing units (CPUs) of a computer to maintain its optimum temperature. A CPU cooler helps in keeping the temperature of the CPUs low, increasing their efficiency. The CPU coolers help to absorb the heat from CPUs and redistribute it, which enhances the performance and stability of the CPUs.

A key factor that is forecasted to propel the global CPU cooler market growth is the booming global data center ecosystem where the CPU is among the most important components, which enables an efficient and stable data transfer, maintains the optimum temperature of the CPUs, which in turn can boost the performance of the data centers.

What are the CPU Cooler Market Drivers?

- Bolstering growth in consumer electronics is expected to bolster the market expansion.

A CPU is among the most common and critical components of consumer electronics products, like smartphones, laptops, and PCs since it maintains their performance temperature without compromising the overall functioning and power consumption. The growing demand for such products is estimated to grow the demand for CPU coolers, to enhance the performance of these devices.

Rapid urbanization followed by improvement in living standards has positively impacted the demand and consumption of consumer electronics with major firms witnessing a bolstering growth in their sales revenue. For instance, Apple Inc. in the fiscal quarter that ended in December 2023, registered a total sale of US$69,702 million for its iPhone, whereas the total sales of Mac and iPad in the same period were recorded at US$7,780 million and US$7,023 million respectively. The company's sales increased from the fiscal quarter ending in December of 2022, when the iPhone category witnessed total sales of US$65,775 million, whereas the Mac and iPad recorded total sales of about US$7,735 million and US$9,396 million respectively.

- The establishment of data centers is propelling the market expansion.

The ongoing global digitization and investment to bolster digital automation in the corporate sector has bolstered the need for required infrastructure that can process and manage complex data. Hence, such desire has accelerated establishment and data center facilitates in major economies namely the United States, and European Unions, with international conglomerates such as Google, Amazon, and Microsoft investing in their facilities expansion.

Such expansion is set to stimulate the demand for effective data server cooling solutions thereby simultaneously driving the market demand and usage of CPU coolers in such regions. The Global Data Center Outlook report, published by JLL Inc., stated that the USA is among the biggest markets in the global data center capacity, followed by APAC, and Europe. The report stated that the hyperscale data center capacity of the USA was recorded at 53%, whereas the hyperscale capacity of APAC and Europe region was recorded at 26% and 16% respectively.

The CPU Cooler Market Restraints:

- High costs associated with product development can hamper the market growth.

CPU cooler offers high-performance benefits to minimizing server heating owing to which they constitute an integral part of the electronics system. However, the booming technological innovation has increased the level of technical requirements to be met by the electronic items which is demanding constant change in technical infrastructure. To cope with the dynamic preference of customers, high R&D cost for CPU cooler development is a must which will act as an obstacle to market expansion.

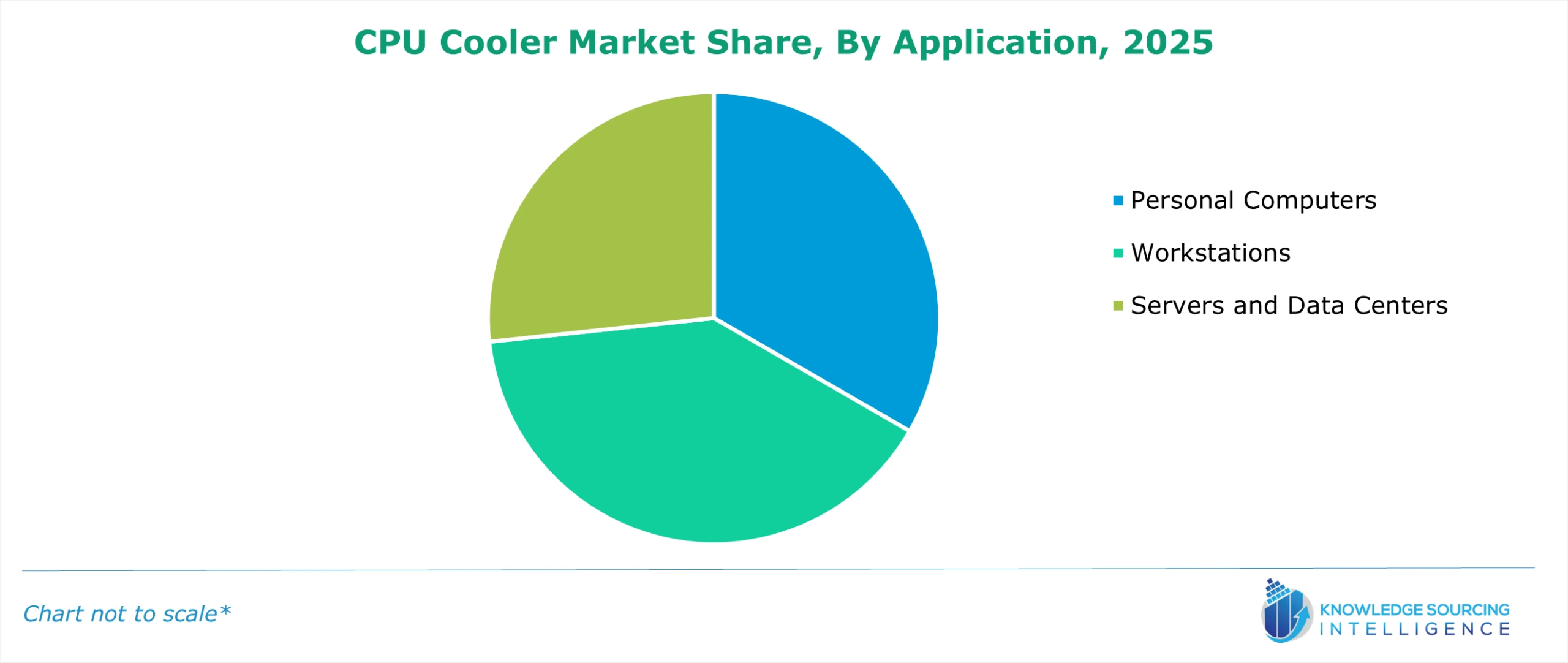

- The servers and data center segment based on the application will account for a considerable market share.

Based on application, the servers and data centers are estimated to constitute a considerable share of the market fueled by the rising cloud service usage and establishment of cloud service centers followed by enhanced internet connectivity. In a recent report by the United Nations specialized agency in Information Technology and Communication (ITU), it was highlighted that the number of persons not connected to the World Wide Web plummeted to approximately 2.6 billion people in 2023.

In the year 2022, there were 2.7 billion offline, thus 33% were unconnected worldwide, however, 5.4 billion people are now reported to be on the internet meaning there is evolution in a connected population across the globe in 2023. Managed data centers have been adopted by both medium and large enterprises on the increase chiefly due to their advantages such as cost-effectiveness, improved management efficiency, and operational flexibility. Data centers rank as some of the most energy-consuming technologies worldwide. Moreover, there is a rise in enterprises buying cloud computing services from 2021 to 2023 as per Eurostat data reported below, which will contribute to increasing CPU cooler demand for data centers.

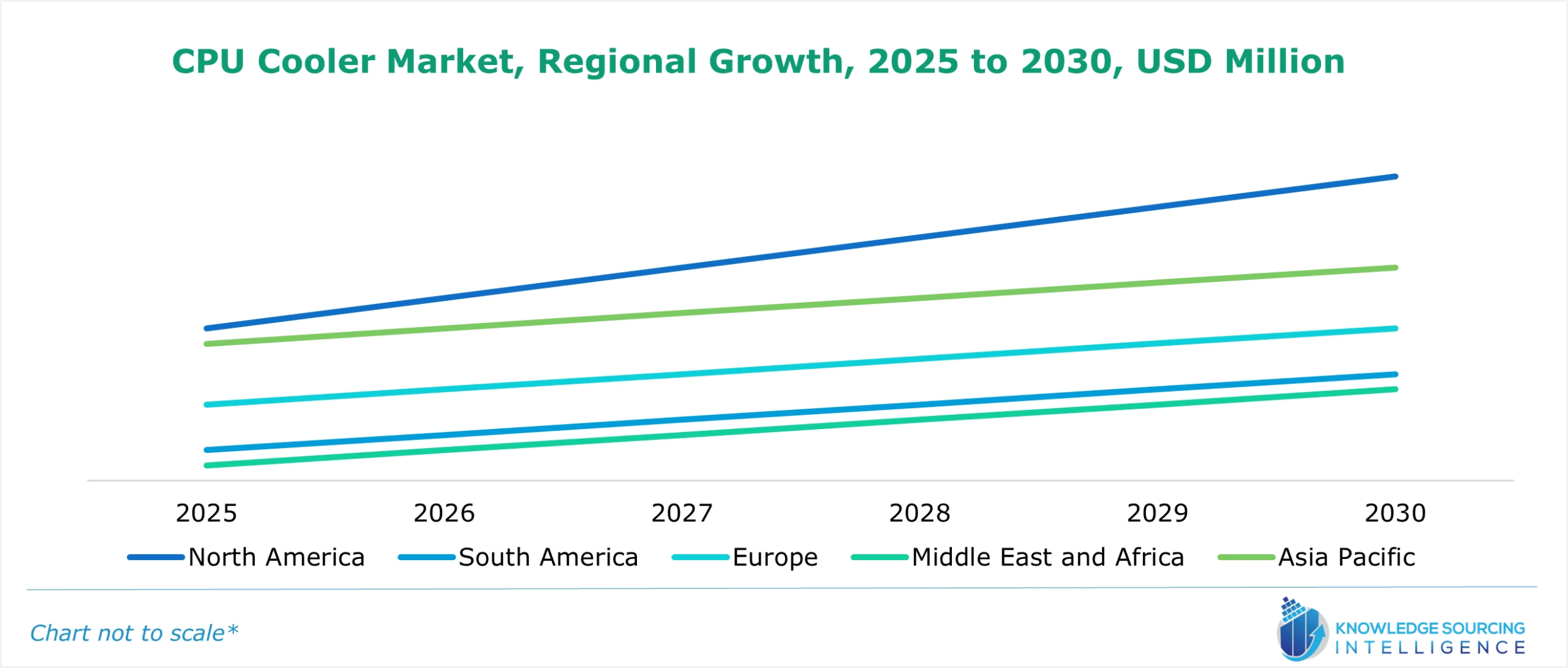

What are the key geographical trends shaping the CPU Cooler Market:

- North America is expected to account for a significant share of the market during the forecast period.

Geographically, the global seed market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

During the forecast period, the North American region is poised for positive growth fueled by favorable investment in data centers, digital infrastructure, and networking technology in major regional nations namely the United States and Canada. Furthermore, the adoption of technology across numerous sectors has increased the adoption of personal computers and working at workstations, creating notable demand for CPU coolers.

The launch of 5G technology and robust data flow has surged the requirement for data centers. For instance- in 2024, as per Blackstone, the capital expenditures in the United States for the construction of new data centers over the next five years will be around US$ 1 trillion. Further, rising initiatives related to data center investment are expected to provide robust growth opportunities for CPU coolers. For instance,- in 2024, Microsoft came into partnership with BlackRock and others to launch the AI Data Center Investment Fund worth US$30 billion.

Moreover, in May 2024, the US government also announced around US$3.3 billion investment by Microsoft to build an AI data center in the country. Additionally, as per Dgtl Infra, among the United States, in 2024, the largest number of data centers were reported in Northern Virginia followed by states such as Phoenix, Dallas, and Chicago among others.

Recent Development in the CPU Cooler Market:

- In October 2024: CORSAIR launched its “NAUTILUS RS ARGB” and “CORSAIR NAUTILUS RS” family of CPU coolers which showcases outstanding compatibility with modern CPU sockets. The new addition features offer easy installation and are available with or without lightning, with a low-noise pump and integrated heat spreader.

- In October 2024: Hewlett Packard Enterprise introduced the first fanless liquid cooling system for GPU and CPU architecture for enhancing large-scale AI deployment energy & cost efficiency. The direct liquid cooling system features a high-quality system design and next-generation accelerators that optimize power consumption.

Central Processing Unit (CPU) Cooler Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Central Processing Unit (CPU) Cooler Market Size in 2025 | US$2,177.048 million |

| Central Processing Unit (CPU) Cooler Market Size in 2030 | US$2,652.041 million |

| Growth Rate | CAGR of 4.03% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Central Processing Unit (CPU) Cooler Market | |

| Customization Scope | Free report customization with purchase |

CPU Cooler Market is analyzed into the following segments:

- By Product Type

- Air CPU Cooler

- Liquid CPU Cooler

- By Application

- Personal Computers

- Workstations

- Servers and Data Centers

- By End-User

- Residential

- Commercial

- Government

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- Others

- North America