Report Overview

Charcoal Market - Strategic Highlights

Charcoal Market Size:

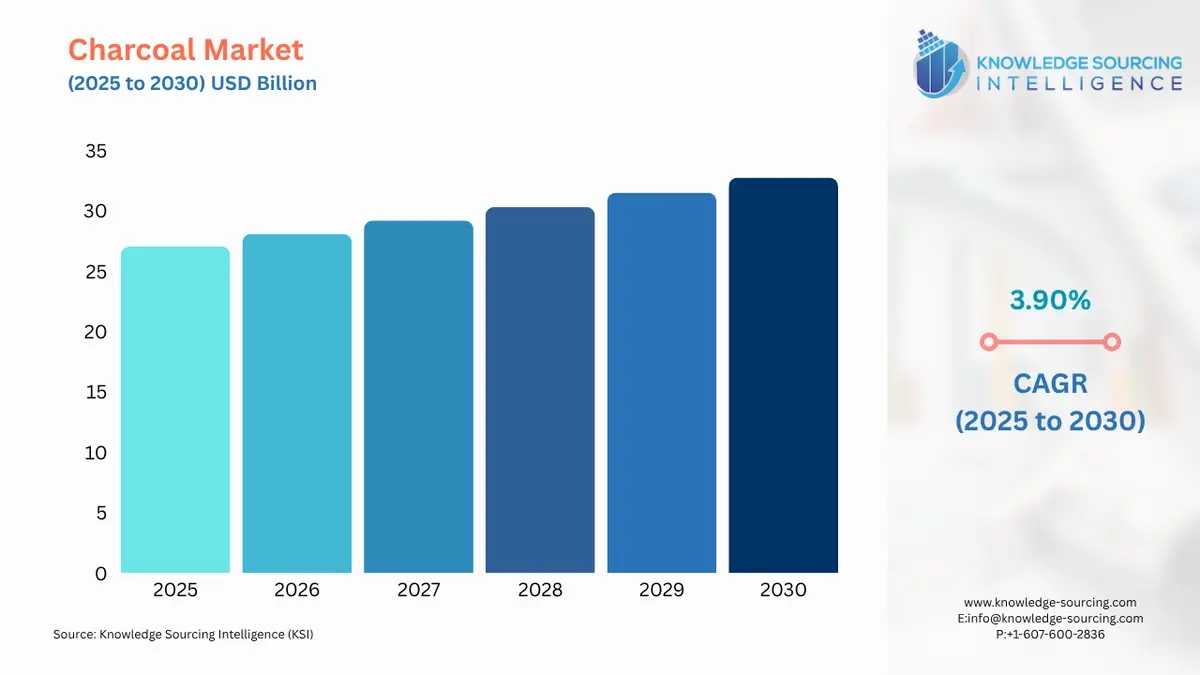

The global charcoal market is projected to grow at a CAGR of 3.90% over the forecast period, increasing from US$27.045 billion in 2025 to US$32.746 billion by 2030.

Charcoal Market Introduction:

The main factor driving the charcoal market is its application in medical applications such as assisting kidney function by filtering out undigested toxins and drugs, helping in intestinal gas, natural water filtration, teeth whitening, oral health, skin infections, etc. Products such as Activated Charcoal 200mg Tablet 50s by Glovida-Rx (GRx), a generic medicine used for detoxification, digestive comfort, and emergency toxin removal, are one of the major charcoal medicinal tablets for healthcare.

- Charcoal is one of the major inputs for smelters that process precious metal ores. It is mainly used in metal production in many parts of the world. The demand for iron and steel production and consumption in various places caused an upsurge in demand for charcoal in the market.

- Charcoal is used in the production of silicon, a major semiconductor used in industry. With the growing application of semiconductors in various devices and industries, there will be an increased demand for charcoal in the manufacturing industry.

- Charcoal is a useful material for cosmetic use, pyrotechnics, purification and filtration, art, and decorations, among others. Charcoal is used for the filtration of both liquid and gaseous forms. It is very useful in removing organic compounds and extracting chlorine from water, thereby making water suitable for both drinking and industrial usage purposes.

- Further, Charcoal can be used to remove chloramine, pesticides, nitrates, and hydrogen sulfide from the water. Gaseous purification can be made from the charcoal by removing oil vapors, odor, and other hydrocarbons from the air. Additionally, activated charcoal can be used for organic farming as well.

Charcoal Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

One of the main factors propelling the global charcoal market is the increase in industrial wastewater, which in turn is driving up the need for significant charcoal for water purification. Moreover, the popularity of barbecuing in recreational cooking drives the market for charcoal. Additionally, the market's growth has been slowed by the government's initiative to control and monitor deforestation.

Moreover, an enhanced requirement for charcoal may ultimately affect silicon requirements owing to its role in manufacturing processes, specifically in the production of silicon metal, which is utilized broadly across numerous industries, including electronics, solar power generation, and metallurgy. For instance, the silicon production in China was 6,000 tons (in 1000 tons), followed by Russia at 580 tons.

Further, grilled food is experiencing an increase in demand, due to demands by lifestyles and new cooking methods, and a significant movement in the charcoal industry. The rise in popularity of barbecued food cooked on-site can be credited to good ambience, big buffets, and nice music. Thus, this has led to the rapid growth of such restaurants in some developing countries like China and India, where grilled food is becoming common among people.

Charcoal Market Drivers:

- Rising use in the cooking fuel industry

The cooking fuel industry uses a lot of charcoal because it has many advantages, like easy lighting, smokeless fires, and no ash or dust production. There are additional advantages to using charcoal as cooking fuel, such as its higher calorific value, longer burning hours, and even heat distribution.

The charcoal industry is predicted to be driven by rising urbanization, easy access to charcoal in urban areas, and quick technological advancements. In addition, the cooking industry's need for charcoal will increase due to its reduced cost, lightweight nature, and accessibility.

Further, the charcoal market will be influenced by the changing lifestyles and newer methods of cooking that have sparked an increase in demand for barbecued food. More people are now eating grilled or barbecued dishes due to improved awareness of healthy living. This has impacted the increasing use of charcoal as a cooking fuel.

Moreover, clean metallurgical fuel is increasingly needed by the iron and steel industry, which further supports charcoal market growth. The charcoal market is anticipated to be driven by the rising use of charcoal stoves in developing nations due to their dependability, low carbon monoxide emissions, and ability to reuse radiated heat. This has also increased coal production, for instance, India produced 893.190 MT of raw coal overall in 2022–2023 compared to 778.210 MT in 2021–2022, a 14.77% increase from the year before. Production of lignite was 44.990 MT in 2022–2023 compared to 47.492 MT in 2021–2022, indicating a 5.27% decrease in growth from 2021–2022.

Charcoal Market Segmentation Analysis:

- The activated charcoal segment is likely to be the fastest-growing type during the projected period

Activated charcoal is produced by superheating natural sources of carbon, such as wood, peat, coconut shells, or sawdust. The major application of activated charcoal is in the healthcare industry. Activated charcoal for medical uses comes in different forms, like tablets, capsules, liquid, suspension, and pellets for intake as a medicine. Charcoal is a main component of the smelting industry, being an important reducing agent; it has relatively high mechanical strength, good conductive properties, and high carbon content.

The demand for metals like iron and steel is a major driving factor in the demand for charcoal. The world produced 1,892,036 thousand tonnes of crude steel in 2023, 1,884,011 thousand tonnes in 2022, and is a major consumer of charcoal in industrial usage. The demand for metals across various purposes like infrastructure, automotive, real estate, machinery, etc., would generate the demand for charcoal in metallurgical applications.

- Growing demand from the iron and steel industry

Steel is a critical material in the industry worldwide, and steel products are a heavily traded commodity. Global use of finished products made of steel has shown a significant demand. The steel demand is significant from the infrastructure developments around the world to medical equipment for saving lives, as well as war machinery around the world. Steel has become indispensable.

Countries around the world have constant demand and supply for steel. The United States has the imports for the steel mill product for domestic consumption to be 29.6 metric tons in 2021, 28 metric tons in 2022, and 25.6 metric tons in 2023. The usage of steel in various industries would correspondingly increase the demand for charcoal in the market.

- The growing application of activated charcoal in the pharmaceutical and food industries

Charcoal is a versatile porous material with increasing applications across various fields. The materials offer pores that can trap chemicals; it is used to clear toxins and drugs that include NSAIDs and other OTC anti-inflammatories, sedatives, calcium channel blockers, dapsone, carbamazepine, malaria medications, and methylxanthines. Charcoal is also used in barbeque, grilling, heating, etc., in the food industry. Charcoal is a part of traditional cooking; different types of charcoal are used for different cooking styles, such as coconut shell charcoal, used for grilling food. Hardwood briquettes are used for grilling and burning, containing moisture levels averaging less than 10%.

Charcoals are used in the production of fireworks. In the cosmetic industry, they are used as an active ingredient in face washes, face masks, moisturizers, and body wash. For detoxification, it uses the natural adsorption qualities of activated charcoal to help remove toxins and substances from the gastrointestinal tract, alleviates uncomfortable bloating and gas, and, in acute situations, it is used in healthcare settings to get rid of unwanted substances.

- The use of charcoal is expected to grow in the water treatment sector

Charcoal, in particular the activated type, has been widely used in the treatment of water because of its highly porous structure and large surface area through which impurities, chemicals, or contaminants in water are adsorbed. Activated charcoal removes organic compounds, chlorine, and even some heavy metals, and thus enhances both the taste and safety of drinking water. Its use in water filtration systems is fairly common at industrial as well as household application sites because it can filter out pollutants without re-introducing harmful substances back into the water. Thus, activated charcoal forms an essential component in water purification technologies and contributes to the clean and safe supply of water.

The increasing number of waterborne diseases is anticipated to fuel the market for charcoal in the projected period. Some of the most common water-borne diseases are Typhoid, Cholera, diarrhea, and Malaria. For instance, according to the World Health Organization (WHO), global cholera cases doubled from 2021 to 2022, and the number of cases was expected to climb further in 2023. The reported cholera cases in 2022 were 4,72,697, up from 2,23,370 in 2021. The number of countries reporting cholera increased from 35 to 41. Additionally, there was a cholera outbreak in 2022 that was larger and more frequent in seven countries, namely Cameroon, Afghanistan, the Democratic Republic of the Congo, Somalia, Nigeria, Malawi, and Syria, reporting an outbreak of more than 10,000 people.

Moreover, the increasing urbanization and rapidly growing population are expected to increase the demand for charcoal for treating water in the coming years. For instance, according to the Food and Agriculture Organization (FAO), the world population is expected to grow by over a third, or 2.3 billion, between 2009 and 2050, making a total of 9.1 billion people in 2050. Hence, in the projected period, an increase in urban population and an increasing number of waterborne diseases are anticipated to propel the market for charcoal in the coming years.

Charcoal Market Geographical Outlook:

- Asia-Pacific region is expected to dominate the charcoal market during the forecast period

The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as the ASEAN countries. India and China are the two largest producers of crude steel in the world. China produced 1,019,080 thousand tonnes and India produced 140,706 thousand tonnes of crude steel, the first and second largest producers of crude steel, respectively, in 2023. Iron ore produced in India was 2,04,035 thousand tonnes in 2021-22. The number gave the significance of charcoal in industrial uses. Another major economy in the region, Japan, produced 83,186.5 thousand tonnes in 2020 and jumped to 86,998.8 thousand tonnes in 2023.

The increasing demand for charcoal in China is anticipated to grow, owing to the fast-growing economy, coupled with increased production of crude steel in the country. According to the World Steel Association, the production of crude steel in China in September 2021 was 73.9 metric tons (MT), which increased by 17% and reached 87 Mt in 2022. Similarly, in 202,3 the world crude steel production was 18,92,562 thousand tonnes of which China’s crude steel production was 10,19,080 thousand tonnes, which indicates that China produced more the half of the world’s crude steel. Hence, the increased production of crude steel is anticipated to propel the market growth in the coming years.

Additionally, the increasing demand for clean metallurgical fuel from the steel and iron industries, coupled with the government’s policies for clean fuel, is expected to propel the market for charcoal in the country. For instance, China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) aim, by 2027, the Chinese government aims to promote low-carbon projects and reduce operating costs while halving the average CO2 emission levels from 2023.

Companies see huge potential in the Chinese charcoal market and are trying to increase their penetration by all means to meet the customer demands in the country. For instance, in July 2022, Birla Carbon announced the launch of birlacarbon.com.cn, which is an exclusive website for Chinese customers. The aim of launching this website was to give digital access to the company’s extensive portfolio of products and solutions offered by the company through informative content and enhanced functional features in Mandarin.

Moreover, the production of charcoal is anticipated to increase in the coming years, as China is one of the biggest exporters of wood charcoal. According to the Organization of Economic Complexity, in 2022, China was the second-largest producer of wood charcoal. China exported wood charcoal worth US$175 million. The top places where China exported from China were Japan, Saudi Arabia, Iraq, the United Arab Emirates, and South Korea.

The other major industrial uses for charcoal are the production of aluminum, boron, etc., the production of pure silicon (a major raw material for semiconductors), the production of glass, crystal, paints, electrodes, plastics, as an insulating material in construction, etc. All these applications are anticipated to grow during the forecasted period with the economic growth and urbanization in the region.

Charcoal Market Challenges:

- Environmental concerns are a major factor in the charcoal market growth. Charcoal is the major cause of deforestation in many regions around the world.

- In April 2023 European Parliament adopted a new law for companies to ensure products sold in Europe do not lead to deforestation and forest degradation. Charcoal is covered by the new rules.

Global Charcoal Market Key Developments:

- In May 2024, Sun24, an American NGO, introduced a new method of making charcoal in Africa. It is the top-down burn method of making char from crop waste. Now, the process for the best quality briquettes can be made by any farmer at a lower price than charcoal. It is a simple method for making char. 62 percent of global charcoal is produced in Africa, and mostly it comes from forests. A very small amount of charcoal is produced sustainably, but it is the main driver of deforestation in Africa. Charcoal production in Africa is growing because of increasing urban populations; this method is easily sustainable for the farmers.

- In December 2023, ArcelorMittal started converting waste wood into bio-coal to reduce fossil coal consumption for the first time in the European steel industry. It had been commissioned in Belgium's Torero plant. It can convert waste wood into bio-coal for use in the blast furnace at its Gent steelmaking site. This could reduce the annual carbon emissions by 112,500 tonnes by reducing the use of fossil coal. It can convert 88,000 tonnes of waste wood into 37,500 tonnes of bio-coal annually. It secured a €35 million investment in a plant in Gent. ArcelorMittal Europe has the vision to reduce CO2 emissions by 35% by 2030.

- In June 2023, Aperam expanded its strategy of investment in sustainable new business models and concluded a joint venture for the expansion of charcoal production with Ferbasa, one of the world’s leading producers of ferroalloys.

Charcoal Companies:

- Birla Carbon

- Aperam

- Australian charcoal company

- Koko Coal India

- Sagar Charcoal And Firewood Depot

Charcoal Market Scope:

| Report Metric | Details |

| Charcoal Market Size in 2025 | US$27.045 billion |

| Charcoal Market Size in 2030 | US$32.746 billion |

| Growth Rate | CAGR of 3.90% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Charcoal Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Product Type

- Activated charcoal

- Lump charcoal

- Japanese charcoal

- Other types

- By End-User Industry

- Water Treatment

- Food industry

- Steel and Iron Industry

- Cosmetics and personal care

- Healthcare

- Other End-user Industries

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of Middle East and Africa

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

- Carbon Capture, Utilization And Storage Market

- Advanced Carbon Materials Market

- Global Hydrocarbon Market

Navigation

- Charcoal Market Size:

- Charcoal Market Highlights:

- Charcoal Market Introduction:

- Charcoal Market Overview:

- Charcoal Market Drivers:

- Charcoal Market Segmentation Analysis:

- Charcoal Market Geographical Outlook:

- Charcoal Market Challenges:

- Global Charcoal Market Key Developments:

- Charcoal Companies:

- Charcoal Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 26, 2025