Report Overview

Electrode Ionization System Market Highlights

Electrode Ionization System Market Size:

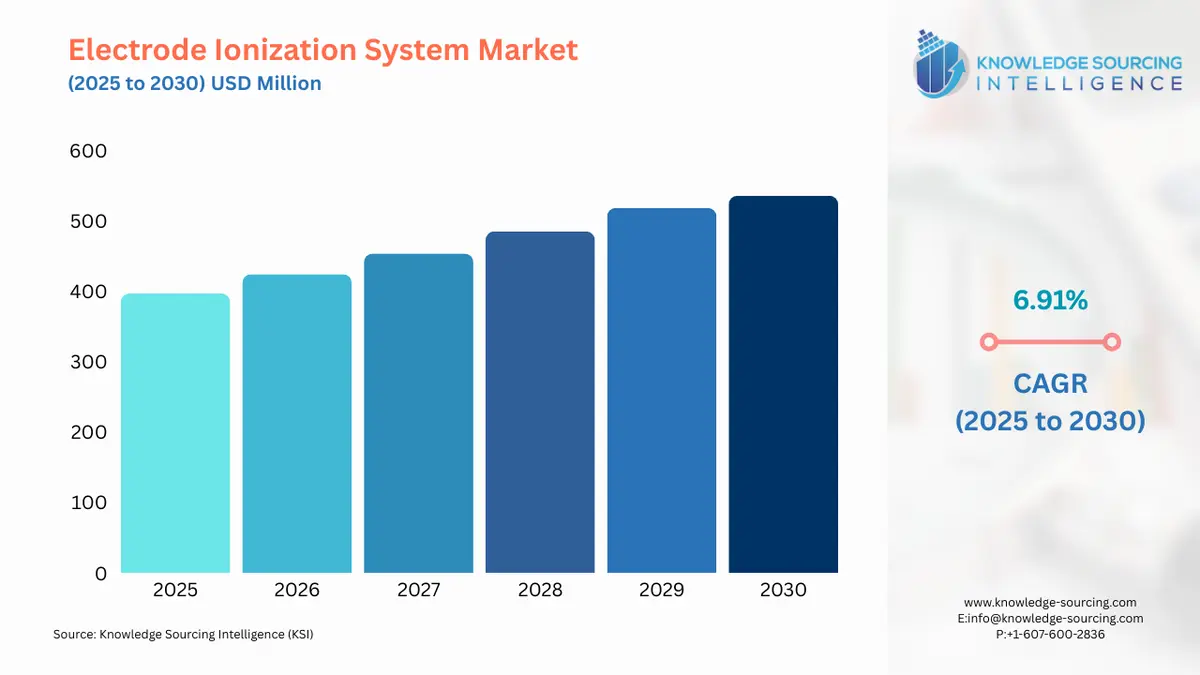

The global electrode ionization system market is projected to be valued at US$396.946 million in 2025, and it is forecasted to grow to US$535.911 million by 2030, at a CAGR of 6.91%.

Electrode Ionization System Market Introduction:

The electrodeionization (EDI) system market is a vital segment of the global water treatment industry, delivering ultra-pure water (UPW) for critical applications in semiconductors, pharmaceuticals, power generation, and other high-tech sectors. Electrodeionization (EDI) technology combines ion exchange resins, ion-selective membranes, and direct current (DC) electricity to achieve water demineralization without the need for chemical-free regeneration, offering a sustainable alternative to traditional ion exchange systems. Unlike conventional methods that rely on hazardous chemicals for resin regeneration, EDI systems use electricity to continuously purify water, making them environmentally friendly and cost-effective for industries requiring high-purity water. The market is driven by the increasing demand for UPW in semiconductor manufacturing, where even trace contaminants can disrupt production, and in pharmaceutical processes, where stringent water quality standards are mandatory.

South Korea, a global hub for semiconductor production, exemplifies the market’s growth, with companies like Samsung Electronics relying on EDI systems for reverse osmosis polishing to ensure UPW quality in chip fabrication. The continuous electrodeionization (CEDI) process, a cornerstone of modern EDI systems, enables uninterrupted operation, eliminating downtime associated with chemical regeneration. Recent industry developments, such as Veolia Water Technologies’ launch of the TERION S series, a compact CEDI unit for laboratory and industrial applications, highlight the market’s focus on efficiency and scalability. The market also benefits from global sustainability trends, with EDI systems reducing chemical waste and aligning with environmental regulations, as seen in Europe’s stringent water quality standards.

The electrodeionization system market is further propelled by advancements in Industry 4.0 automation, integrating IoT and real-time monitoring to enhance system performance. For instance, Evoqua Water Technologies’ introduction of IoT-enabled CEDI modules improved operational efficiency through predictive maintenance. The market’s growth is supported by government initiatives, such as Japan’s subsidies for water treatment technologies, fostering R&D in water demineralization systems. As industries prioritize sustainability and precision, the EDI system market is poised for significant expansion, particularly in the Asia-Pacific region, where rapid industrialization drives demand for UPW.

Various factors driving the market expansion:

Demand for Ultra-Pure Water: Growing needs in semiconductors and pharmaceuticals fuel EDI system adoption for UPW production.

Sustainability Regulations: Stringent environmental policies promote chemical-free regeneration in EDI systems.

Technological Advancements: IoT and automation enhance CEDI efficiency and scalability.

However, the market faces challenges, such as:

High Initial Costs: EDI systems require significant upfront investment for installation and infrastructure.

Technical Complexity: Operating CEDI systems demands skilled personnel, limiting adoption in smaller facilities.

How Electrodeionization Systems Work

An electrodeionization (EDI) system operates by integrating ion exchange, electrodialysis, and DC electricity to achieve water demineralization. Typically used for reverse osmosis polishing, EDI processes water post-reverse osmosis (RO) to remove residual ions and achieve ultra-pure water quality (up to 18.2 M?/cm). The system consists of chambers filled with ion exchange resins, separated by cation- and anion-selective membranes. When water enters, a DC electric field drives ions toward electrodes: cations to the cathode and anions to the anode. These ions pass through the resins, which maintain stable conductance, and are captured in concentrate chambers, leaving purified water in the dilute chamber. The chemical-free regeneration process occurs as H+ and OH- ions, generated by water splitting, continuously regenerate the resins, eliminating the need for chemical additives. Continuous electrodeionization (CEDI) ensures uninterrupted operation, with concentrate streams recycled or discharged, maintaining high efficiency.

Main Advantages of Electrodeionization Systems

Chemical-Free Regeneration: EDI systems eliminate hazardous chemicals, reducing environmental impact and operational costs.

Continuous Operation: CEDI enables non-stop water demineralization, minimizing downtime compared to traditional ion exchange systems.

High Purity Output: Produces UPW with low conductivity and silica levels, critical for semiconductors and pharmaceuticals.

Compact Design: EDI systems require less space, ideal for space-constrained facilities.

Sustainability: Reduces chemical waste and energy use, aligning with global sustainability goals.

Electrode Ionization System Market Overview:

An electrode ionization system is a type of water purification technology that separates ions in water by creating an electric field. The purified water is the output from the system, while the impurities are collected in the device.

The electrode ionization system market can be classified by type, design, end-user, and geographic region. The growing need for ultra-pure water in industries such as semiconductors, pharmaceuticals, and power generation is a major driver for the growth of the electrode ionization systems market.

The surge in industrialization, particularly in developing and underdeveloped nations, is driving the need for water treatment systems, boosting the market for electrode ionization systems. These systems effectively address water purification needs, and with increased industrial activity generating more wastewater, they are essential for treating ultrapure wastewater for reuse and protecting natural water bodies.

Rapid technological innovations are enhancing the features of electrode ionization systems, driving market growth. For example, in November 2023, QUA Group launched three advanced membrane technologies, including FEDI GIGA, a next-generation Fractional Electrodeionization (FEDI) solution for high-flow ultrapure water production. Such advancements, including chemical-free processes, are expected to increase the market value of electrode ionization systems during the forecast period.

The electrode ionization system market is divided into: the Americas, Europe, the Middle East and Africa, and Asia-Pacific. Asia-Pacific is a leading market and is expected to maintain dominance due to the expanding electronics sector, growing semiconductor demand in China and South Korea, and increased manufacturing and construction in countries like Japan and India. North America and Europe are projected to see steady growth, driven by mature markets with consistent demand for water purification in industries such as electronics, construction, and manufacturing. The presence of major water treatment solution providers in these regions will further support market expansion, meeting the needs of diverse sectors during the forecast period.

Some of the major players covered in this report include Veolia Environnement S.A., Newterra Ltd., Kurita Water Industries Ltd., Samco Technologies, Evoqua Water Technologies Corp., and Aquatech International LLC (QUA Group), among others.

Electrode Ionization System Market Trends:

The EDI system market is advancing rapidly, driven by innovations in smart water treatment and IoT water purification for ultra-pure water (UPW) production. Modular EDI systems are gaining traction for their scalability and compact design, with Veolia’s TERION S series offering flexible EDI stack configurations for semiconductor and pharmaceutical applications. Ion exchange resins and ion exchange membranes are critical to electrodialysis, enhancing ion removal efficiency, as seen in DuPont’s EDI modules with improved membrane durability. Smart water treatment, integrated with IoT water purification, enables real-time monitoring, as demonstrated by Evoqua’s IoT-enabled EDI systems, optimizing water demineralization through predictive maintenance. These systems support chemical-free regeneration, reducing environmental impact in industries like electronics, where UPW is critical. The push for sustainability and Industry 4.0 automation drives adoption, particularly in Asia-Pacific, where semiconductor manufacturing demands advanced modular EDI systems. These trends position the EDI system market for robust growth, emphasizing efficiency and eco-friendly solutions.

Electrode Ionization System Market Drivers:

Growing Demand for Ultra-Pure Water in High-Tech Industries

The electrodeionization (EDI) system market is propelled by the rising demand for ultra-pure water (UPW) in industries such as semiconductors, pharmaceuticals, and power generation. UPW is critical for semiconductor manufacturing, where trace impurities can disrupt chip production, as seen in Samsung Electronics’ reliance on EDI systems for its South Korean facilities. Continuous electrodeionization (CEDI) ensures consistent water demineralization, meeting stringent purity standards (up to 18.2 M?/cm). The pharmaceutical industry also requires UPW for drug formulation, driving adoption of chemical-free regeneration systems to comply with regulatory standards. Veolia’s TERION S series launch highlights the need for scalable EDI systems in these sectors. The global expansion of high-tech manufacturing, particularly in the Asia-Pacific, fuels market growth as EDI systems deliver reliable reverse osmosis polishing.

Stringent Environmental and Sustainability Regulations

Increasing global environmental regulations are a key driver of the electrodeionization system market, as chemical-free regeneration aligns with sustainability goals. Traditional ion exchange systems rely on hazardous chemicals for resin regeneration, generating waste that conflicts with regulations like the EU’s Water Framework Directive. EDI systems, using electrodialysis and ion exchange membranes, eliminate chemical use, reducing environmental impact. This is critical in industries like pharmaceuticals, where UPW production must meet both quality and eco-friendly standards. DuPont’s EDI modules emphasize sustainability with lower energy consumption for water demineralization. Government initiatives, such as Japan’s subsidies for green water treatment technologies, further encourage the adoption of CEDI systems, driving market growth in regions prioritizing environmental compliance.

Technological Advancements in Smart Water Treatment

Advancements in smart water treatment and IoT water purification significantly drive the electrodeionization system market, enhancing system efficiency and scalability. Modular EDI systems with EDI stack technology integrate IoT for real-time monitoring and predictive maintenance, reducing downtime in UPW production. Evoqua’s IoT-enabled CEDI systems optimize water demineralization for power generation and electronics, improving operational reliability. Ion exchange resins and ion exchange membranes have also improved, with innovations like DuPont’s durable membranes enhancing electrodialysis efficiency. These advancements align with Industry 4.0 automation, supporting reverse osmosis polishing in high-tech industries. The integration of smart water treatment ensures EDI systems meet the precision demands of semiconductor and pharmaceutical applications, driving market expansion.

Electrode Ionization System Market Restraints:

High Initial Investment and Installation Costs

The electrodeionization system market faces challenges due to the high initial costs of EDI systems, which require significant investment in the EDI stack, ion exchange resins, and ion exchange membranes. Installation also demands specialized infrastructure for reverse osmosis polishing, increasing expenses for industries like semiconductors. For instance, DuPont’s EDI modules involve costly setup for UPW production, limiting adoption by smaller facilities. The need for integration with existing reverse osmosis systems adds complexity and cost, as highlighted by ELGA LabWater’s implementation challenges. Despite long-term savings from chemical-free regeneration, the upfront financial barrier restricts market growth in cost-sensitive regions or industries, slowing the adoption of CEDI systems.

Technical Complexity and Skilled Personnel Shortage

The technical complexity of operating EDI systems is a significant restraint for the electrodeionization system market, requiring skilled personnel to manage electrodialysis, ion exchange membranes, and smart water treatment technologies. CEDI systems demand expertise in maintaining EDI stack integrity and optimizing IoT water purification, which can be challenging in smaller facilities or regions with limited technical resources. Evoqua notes that training for IoT-enabled EDI systems is critical to ensure reliability. The shortage of qualified technicians can lead to operational inefficiencies, hindering water demineralization processes in UPW applications. This complexity limits market scalability, particularly for industries new to reverse osmosis polishing or lacking infrastructure, slowing adoption despite the benefits of chemical-free regeneration.

Electrode Ionization System Market Segmentation Analysis:

By Type, Continuous Deionization (CDI) is gaining traction

Continuous Deionization (CDI), also referred to as continuous electrodeionization (CEDI), dominates the EDI system market due to its ability to provide uninterrupted water demineralization for ultra-pure water (UPW) production. Unlike fractional electrodeionization (EDI), which operates in batches, CDI ensures constant operation, eliminating downtime and enhancing efficiency in high-demand industries like semiconductors and pharmaceuticals. CDI systems leverage ion exchange resins and ion exchange membranes with electrodialysis to remove ions continuously, making them ideal for reverse osmosis polishing. Evoqua’s IoT-enabled CDI systems integrate smart water treatment, optimizing performance through real-time monitoring. The technology’s chemical-free regeneration reduces environmental impact, aligning with sustainability goals. South Korea’s semiconductor industry, led by Samsung, relies on CDI for UPW to support chip fabrication, driving its market leadership.

By Design, the Plate-and-Frame Construction segment is predicted to grow rapidly

Plate-and-Frame Construction leads the electrodeionization system market due to its efficiency, scalability, and ease of maintenance in producing ultra-pure water (UPW). This design uses stacked ion exchange membranes and ion exchange resins within a plate-and-frame structure, enabling robust electrodialysis for water demineralization. Its modular nature supports modular EDI systems, allowing customization for high-volume applications like semiconductor manufacturing. Veolia’s TERION S series, built on plate-and-frame construction, offers compact solutions for UPW in electronics and pharmaceuticals. The design’s high throughput and reliability make it preferred over spiral wound construction for large-scale reverse osmosis polishing, with DuPont emphasizing its durability in EDI modules. Plate-and-frame construction dominates due to its adaptability and alignment with Industry 4.0 automation.

The Electronics & Semiconductor sector is expected to be the leading end-user

The Electronics & Semiconductor segment is the largest end-user in the electrodeionization system market, driven by the critical need for ultra-pure water (UPW) in chip manufacturing. UPW ensures no contaminants disrupt semiconductor fabrication, with CDI systems and plate-and-frame construction providing precise water demineralization. Samsung Electronics’ reliance on EDI systems for its South Korean facilities underscores the segment’s dominance. Smart water treatment and IoT water purification, as seen in Evoqua’s CEDI advancements, enhance efficiency in semiconductor plants. Chemical-free regeneration supports sustainability, aligning with global environmental standards. The segment’s growth is fueled by Asia-Pacific’s semiconductor boom, supported by Japan’s subsidies for water treatment technologies, making Electronics & Semiconductor the leading end-user for EDI systems.

Electrode Ionization System Market Key Developments:

In May 2024, Veolia Water Technologies announced a strategic partnership with a leading semiconductor manufacturer to supply EDI systems for a new facility in China’s Changshu industrial zone. The collaboration focuses on delivering ultra-pure water (UPW) for chip production, incorporating modular EDI systems with IoT water purification for enhanced efficiency and reduced environmental impact. The new plant also serves as a maintenance hub for water demineralization solutions, strengthening Veolia’s presence in Asia-Pacific.

Global Electrode Ionization System Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 396.946 million |

| Total Market Size in 2031 | USD 535.911 million |

| Growth Rate | 6.91% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Design, End-User, Geography |

| Geographical Segmentation | Americas, Europe Middle East and Africa (EMEA), Asia Pacific |

| Companies |

|

The Global Electrode Ionization System Market is segmented and analyzed as follows:

By Type

Fractional Electrodeionization (EDI)

Continuous Deionization (CDI)

Other Advanced EDI Configurations

By Design

Plate-and-Frame Construction

Spiral Wound Construction

By End-User

Power Generation

Pharmaceuticals

Electronics & Semiconductor

Food & Beverage

Others

By Capacity

Low Capacity (<5 GPM)

Medium Capacity (5-50 GPM)

High Capacity (>50 GPM)

By Geography

Americas

Europe, the Middle East, and Africa

Asia Pacific