Report Overview

Cloud Kitchen Market - Highlights

Cloud Kitchen Market Size:

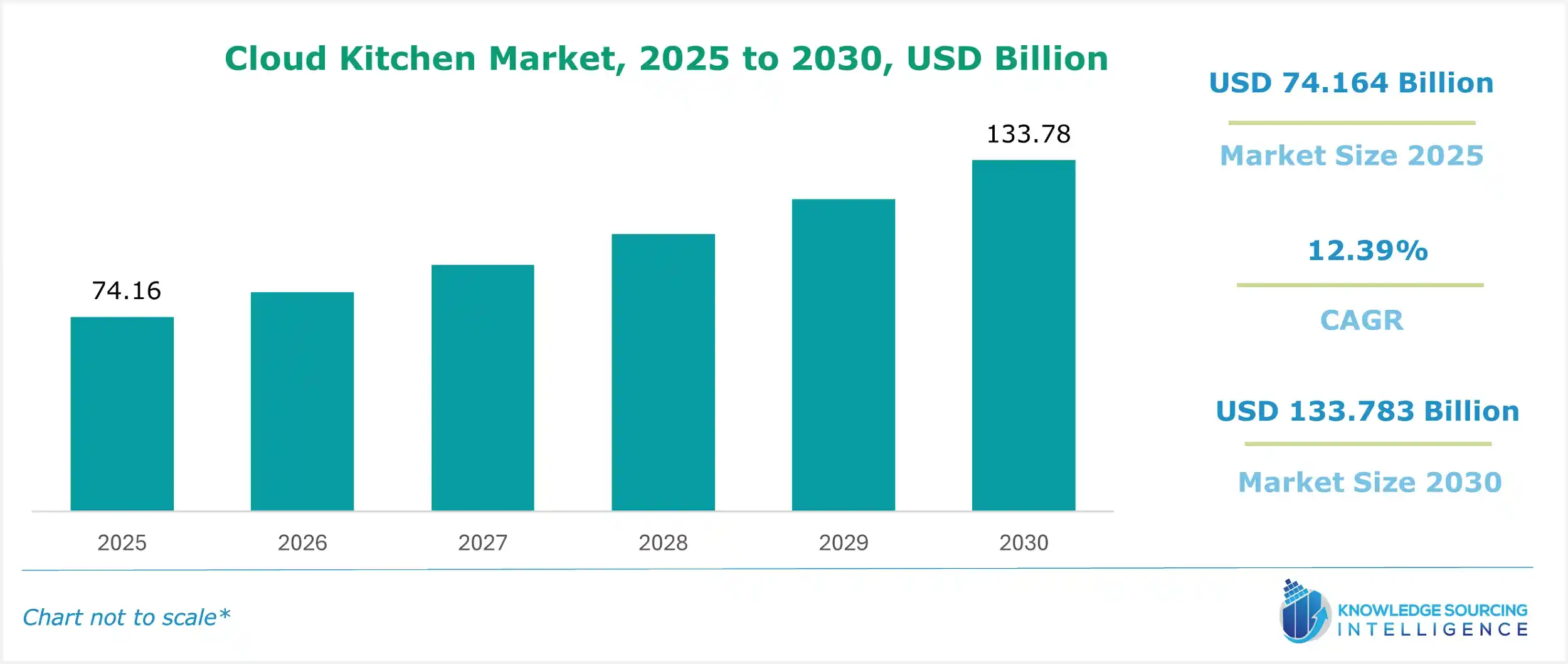

The cloud kitchen market is expected to grow at a CAGR of 12.39%, reaching a market size of USD 133.783 billion in 2030 from USD 74.164 billion in 2025.

Cloud Kitchen Market Trends:

Cloud kitchens are defined as ghost kitchens belonging to a particular entity or a third party that works with several entities established for the provision of food delivery services. In addition, cloud kitchen concepts allow the brands to operate virtually as well as in physical locations. Using technology and data analytics, these kitchens reduce costs and increase the productivity of operations by streamlining elements of the entire process.

The market has a very high growth rate primarily because of increased digital ordering, online food delivery services and convenience, and consumers’ inclination towards contactless and easy dining. The expansion is also evident in the market, which can be attributed primarily to the growing demand from customers for quicker and more efficient food delivery services and the efficient operational model of cloud kitchens.

Cloud Kitchen Market Growth Drivers:

- Changing consumer behavior and demand for convenience is contributing to the Cloud kitchen market growth

Changing consumer behavior, particularly in urban areas, is one of the key factors driving the cloud kitchen market’s growth. Customers are increasingly willing to take advantage of the contactless dining experience offered by cloud kitchens. The growing, fast-paced world has prompted the burgeoning demand for various types of food, which, thanks to technology, can be brought to people’s doors in a matter of minutes. This evolving mentality has brought with it the rise of cloud kitchens, which are delivery-centric and agile by nature. Urban areas have witnessed a rise in the use of cloud kitchen services because of busy schedules, which leave little or no time for conventional eating out.

Moreover, cloud kitchens are gaining popularity since customers are now able to sample a wide range of culinary fare available without leaving the house. This transformation in food consumer behavior is reshaping the food sector and shows clearly that today’s foodies will need flexibility and convenient services to meet their requirements. In this way, cloud kitchens are rapidly gaining acceptance as a practical response to consumers' changing demands and help keep the market active and alive.

- Rising demand for cost efficiency and scalability is contributing to the cloud kitchen market growth

Unlike the traditional kitchens fitted in restaurants, cloud kitchens operate on a reduced-cost model due to minimal overheads, cheaper rental spaces, and optimized labor costs. Considerable expenses are minimized by taking away such aspects as eating out, end-of-location rental, and expensive décor. Due to their low-cost structures, cloud kitchens are enabling even the fastest-growing restaurant chains, at least through young food businesses, to expand their geographical markets. It does not need a massive physical setup, and the huge costs it brings allow them to better market, menu developments, and even improved delivery systems.

The other key advantage of cloud kitchens is that they easily scale up and down, owing to changing customer dynamics and market changes such as seasonality. This makes it possible for food businesses to grow the existing virtual brands and try out new concepts with minimal risk. Hence, it is needless to say that the expansion of cloud kitchens globally is largely attributed to cost-performance benefits and the geographical reach that such kitchens deliver.

- Increased demand for online food delivery is contributing to the cloud kitchen market growth

The rise of food delivery apps has also boosted the cloud kitchen market’s expansion. This segment has been driven by the deep penetration of well-known franchises, especially in developing economies. Furthermore, the franchisor also gives the franchisee such things as marketing and training support, which motivates the franchise to be opened in different locations and, in turn, facilitates its growth globally.

Cloud Kitchen Market Restraints:

- High initial cost and high competition are anticipated to hamper the market growth

Establishing, renovating, and equipping a cloud kitchen with high technology, infrastructure, and cooking ware may require considering large financial outlays initially. Given the financial barriers, this can deter some potential entrants from the Cloud Kitchen market.

Moreover, buying or renting a commercial kitchen area, which is one of the major infrastructural investments, is also proportional to the cost of outfitting the kitchen with additional elements, including décor, appliance ventilation, and safety installation. Other factors of consideration are increased inventory turnover, low price control, poor working environment conditions, default trust, and dealing with more than one brand with more than one problem.

Still, many end-users prefer fast food because of its taste, variety of products, and available distribution. However, these products are unhealthy if taken regularly. For instance, almost all fast food, including drinks and sides, is high in carbohydrates and low in fiber content. This can hinder the market as more people are becoming more health-conscious and avoiding such fast foods.

Cloud Kitchen Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period

More than half of the global population lives in the Asia Pacific region, and therefore, a huge consumer base exists here. Some of the significant macroeconomic trends driving the cloud kitchen market growth in the Asia Pacific region are fast urbanization, increased disposable income, fast-paced lifestyles, increased internet connectivity, and rising smartphone usage. On top of that, the presence of a youthful population combined with an increasing appetite for food is aiding in the market's growth. With the strong GDP growth of such countries, regions like China and India are offering market players positive growth scenarios.

The Asia-Pacific cloud kitchen market is also growing with the rise in the popularity of Indian food and an increase in the tendency to order food rather than eat in restaurants. It is also believed that the outlook for this market in the Asia Pacific region will be the highest among all regions in terms of growth.

Cloud Kitchen Market Key Launches:

- In October 2024, Karigari opened Noida's first cloud kitchen. As a component of its larger expansion strategy, the cloud kitchen model enables Karigari to test operational effectiveness and guarantee seamless procedures before entering new markets.

- In January 2024, ITC planned to expand in Chennai and grow its cloud kitchen business. In Bengaluru, the company that uses food delivery apps to sell North Indian lunch and dinner items and bakery goods has been testing the market. With three of its brands, Master Chef Creations for North Indian cuisines, ITC ventured into the cloud kitchen space, which consists of a central kitchen and multiple satellite kitchens in the cities where it operates.

List of Top Cloud Kitchen Companies:

- KLC Virtual Restaurants

- The Food Corridor (Fort Collins, CO)

- Kitopi

- CloudKitchens

- Ghost Kitchen India

Cloud Kitchen Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cloud Kitchen Market Size in 2025 | USD 74.164 billion |

| Cloud Kitchen Market Size in 2030 | USD 133.783 billion |

| Growth Rate | CAGR of 12.39% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cloud Kitchen Market |

|

| Customization Scope | Free report customization with purchase |

The Cloud Kitchen Market is segmented and analyzed as follows:

- By Business Model

- Standalone Cloud Kitchen

- Multi-brand Cloud Kitchen

- Commissary (Aggregator) Kitchen

- Outsourced Cloud Kitchen

- Co-Working Cloud Kitchen

- By Order Source

- Customer call-in

- Delivery App

- Firm’s App

- Aggregate App

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Cloud Kitchen Market Size:

- Cloud Kitchen Market Highlights:

- Cloud Kitchen Market Trends:

- Cloud Kitchen Market Growth Drivers:

- Cloud Kitchen Market Restraints:

- Cloud Kitchen Market Geographical Outlook:

- Cloud Kitchen Market Key Launches:

- List of Top Cloud Kitchen Companies:

- Cloud Kitchen Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 25, 2025