Report Overview

Cocoa Butter Equivalent Market Highlights

Cocoa Butter Equivalent Market Size:

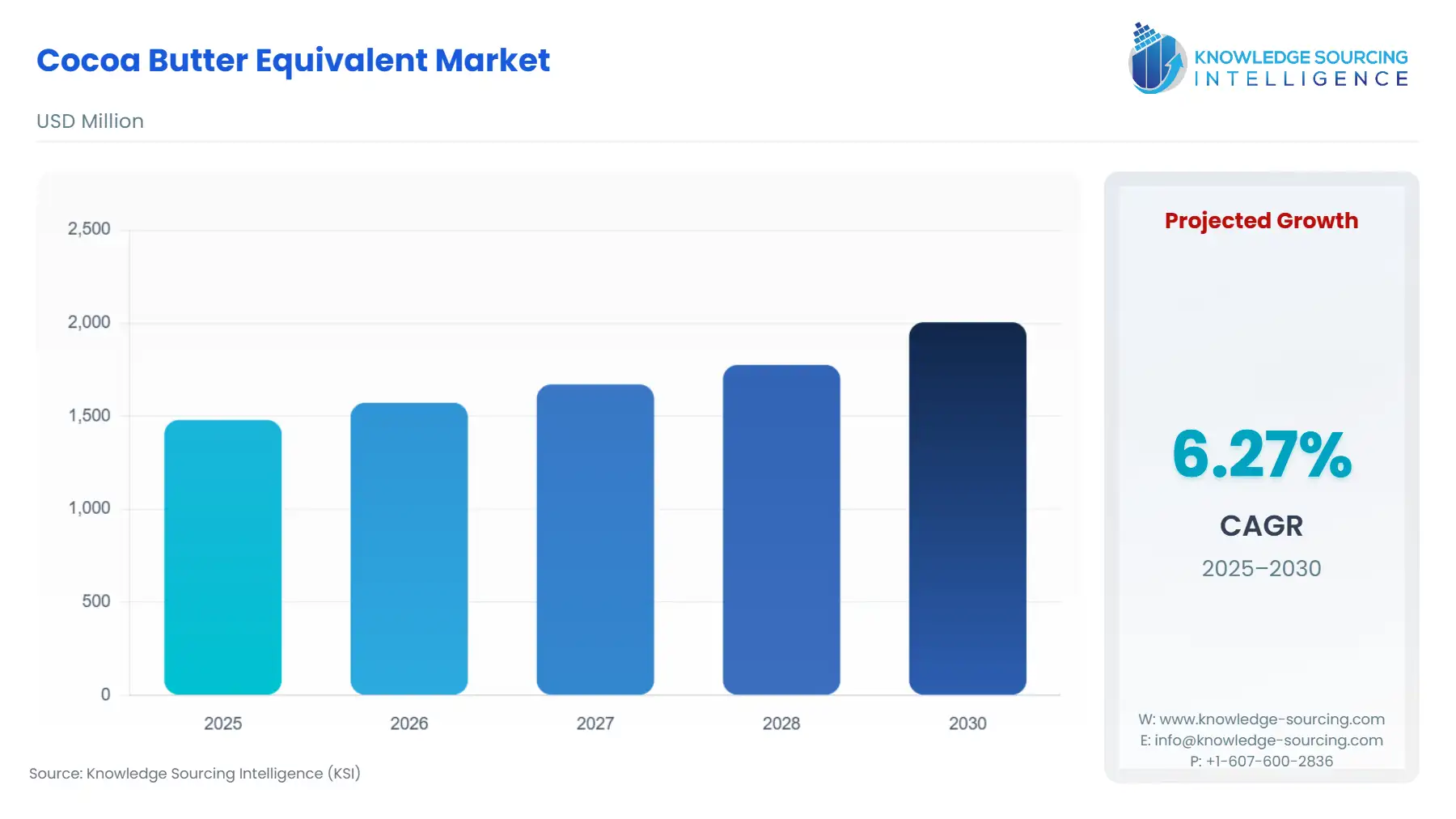

The cocoa butter equivalent market is estimated to attain a market size of US$2,004.872 million by 2030, growing at a 6.27% CAGR from a valuation of US$1,479.363 million in 2025.

The cocoa butter equivalent (CBE) market is experiencing robust growth, driven by the need for cost efficiency, rising sustainability expectations, and the functional advantages CBEs offer in product formulation. Companies that prioritize clean-label and sustainable CBEs and focus on expanding into emerging markets are well-positioned to lead the industry. Recent innovations in the sector include the development of CBEs using non-hydrogenated and fractionated plant-based fats.

These advancements have enabled manufacturers to create CBEs that closely replicate the physical and chemical properties of natural cocoa butter, all while minimizing the use of artificial processing or additives. Further, many countries only permit up to 5% vegetable fat replacement in products labelled as “chocolate.” For manufacturers seeking to comply with these standards, specialized CBE solutions like the CHOCOMATE and CHOCOMATE EZ series from Intercontinental Specialty Fats Sdn. Bhd. provide an effective alternative. These CBEs are designed to be easily incorporated into chocolate formulations without compromising the crystallization quality that consumers expect from premium chocolate.

Cocoa Butter Equivalent Market Overview & Scope:

The cocoa butter equivalent market is segmented by:

- Source: By type, the cocoa butter equivalent market is segmented into palm oil, coconut oil, shea butter, and others. Shea butter is gaining traction for its natural properties and ethical sourcing, especially in premium cosmetics and chocolates.

- Distribution Channel: By distribution channel, the cocoa butter equivalent market is segmented into online and offline. The offline channels dominate, particularly in bulk industrial sales to food and cosmetic manufacturers.

- Application: By application, the cocoa butter equivalent market is segmented into food and beverages, cosmetics, pharmaceuticals, and others. The food industry remains the major segment, driven by chocolate manufacturers seeking cost-efficient alternatives to cocoa butter.

- Region: Asia Pacific is poised to hold a prominent position in the cocoa butter equivalent market, particularly due to the increasing disposable income in the region. Further, the rapid expansion of the middle class in emerging markets across Asia-Pacific, Africa, and Latin America is driving a notable increase in chocolate consumption, as rising disposable incomes and changing consumer preferences make chocolate more accessible and desirable.

Cocoa Butter Equivalent Market Growth Drivers vs. Challenges:

Drivers:

Additionally, as per USDA data of February 2025, the United States reported a continuous decrease in imports of cocoa beans since 2021 due to a shrinking of cocoa crop harvest, leading to an increase in price of cocoa beans globally by 310 percent, which is $10,412 per metric ton in December 2024, which is a all time high. This provides an opportunity for the palm oil segment as it is similar in function to a lower alternative, which will promote its utilization in the production of diverse products.

Challenges:

- Quality concerns: Quality concerns, including perceived inferiority, authenticity debates, health issues, and sustainability challenges, significantly hinder the market’s growth, particularly in premium and health-conscious segments.

Cocoa Butter Equivalent Market Regional Analysis:

- North America: The United States is one of the major cocoa importers, and with the growing demand for confectionery products, the demand for cost-effective alternatives that provide the same taste & flavors and price utility is expected to show positive growth in the country. Moreover, the growing health consciousness and awareness regarding the usage of plant-based ingredients have furthered the overall market growth. According to the National Confectioners Association, the total confectionery sales in the country reached US$54 billion, which represented a 12.5% growth over the 2023 sales Figure. Moreover, the same source also specified that by 2029, the confectionery sales will reach up to US$70 billion. Chocolate sales accounted for a major share, with a sales volume of US$28.1 billion in the same year.

Cocoa Butter Equivalent Market Competitive Landscape:

The market is fragmented, with many notable players, including Cargill Incorporated, Usha Edible Oil, Wilmar International Ltd, Manorama Industries Limited, Makendi Worldwide, and Intercontinental Specialty Fats Sdn. Bhd., Olenex Sàrl, Fuji Oil Europe, Olam International, Bunge, Mallinath Group, Olenex Sàrl, and AAK AB, among others.

- Product Launch: In June 2024, Bloomer Chocolate Company launched “Elevate” confectionery products that are based on cocoa butter equivalent (CBE) technology that provides seamless integration of cocoa butter with its equivalent, thereby improving the overall visual appeal and shelf life of the product.

Cocoa Butter Equivalent Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cocoa Butter Equivalent Market Size in 2025 | US$1,479.363 million |

| Cocoa Butter Equivalent Market Size in 2030 | US$2,004.872 million |

| Growth Rate | CAGR of 6.27% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cocoa Butter Equivalent Market |

|

| Customization Scope | Free report customization with purchase |

The Cocoa Butter Equivalent Market is analyzed into the following segments:

By Source

- Palm Oil

- Coconut Oil

- Shea Butter

- Others

By Distribution Channel

- Online

- Offline

By Application

- Food and Beverages

- Cosmetics

- Pharmaceutical

- Others

By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others