Report Overview

Global Connected Agriculture Market Highlights

Connected Agriculture Market Size:

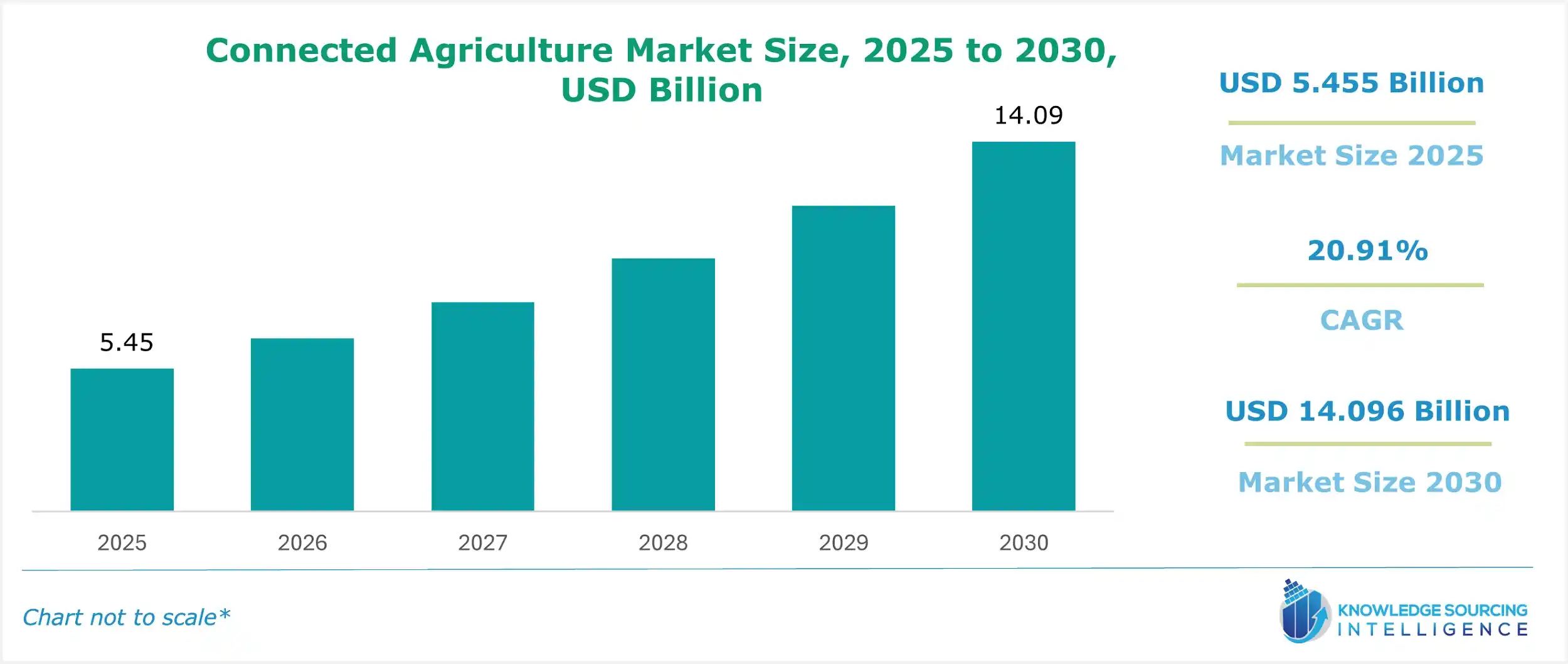

The connected agriculture market will grow at a CAGR of 20.91% to be valued at USD 14.096 billion in 2030 from USD 5.455 billion in 2025.

The connected agriculture market is a transformative force within the global agricultural sector, leveraging digital technologies to enhance productivity, sustainability, and market access for farmers worldwide. By integrating solutions such as the Internet of Things (IoT), artificial intelligence (AI), big data analytics, and mobile connectivity, connected agriculture enables farmers to optimize resource use, improve crop yields, and make data-driven decisions in real time.

The connected agriculture market is revolutionizing farming through the smart agriculture market and precision farming technology. Digital farming solutions, powered by IoT in agriculture, enable real-time data collection and analysis for optimized crop production. The AgTech sector integrates advanced sensors, drones, and farm management software to enhance efficiency, reduce resource waste, and improve yields. These technologies support data-driven decisions, from soil monitoring to predictive analytics, addressing challenges like climate variability and food security. As adoption grows, connected agriculture empowers farmers with scalable, innovative tools, transforming traditional practices into sustainable, technology-driven operations for market leaders.

Connected Agriculture Market Overview:

Connected agriculture refers to the application of networked digital technologies to streamline agricultural processes, from soil management and crop monitoring to market access and financial transactions. Unlike traditional farming, which relies on manual methods and localized knowledge, connected agriculture employs IoT sensors, cloud-based platforms, and mobile applications to deliver actionable insights. For instance, trading platforms connect farmers directly with buyers, while mobile payment systems facilitate seamless transactions in remote areas. The global agricultural technology (AgTech) market, which includes connected agriculture, was valued at approximately $273.8 billion in 2024, with connected solutions gaining traction due to their ability to address inefficiencies across the agricultural value chain.

The market is segmented by component into solution, hardware & devices, and services. The market is also segmented by technology type into IoT Devices & sensors, AI and Data Analytics, Robotics & Automation, and connectivity infrastructure. By application, the market caters to Precision Farming, Smart Greenhouses, livestock monitoring, fish farming, supply chain management, and field operations management. By farm size, it covers large, medium, and small farms.

Geographically, it spans North America (USA, Canada, Mexico), South America (Brazil, Argentina, others), Europe (UK, Germany, France, Spain, others), the Middle East and Africa (Saudi Arabia, South Africa, others), and Asia Pacific (Japan, China, India, South Korea, Thailand, Taiwan, Indonesia, others). Recent advancements, such as AI-driven analytics and IoT-enabled precision farming, are reshaping agriculture by enabling data-driven decisions and improving resource efficiency. The adoption of these technologies is critical in addressing global challenges like climate change, water scarcity, and food insecurity, making connected agriculture a cornerstone of modern farming.

Connected Agriculture Market Trends:

The connected agriculture market is advancing with sustainable agriculture tech and climate-smart farming, addressing environmental challenges. Regenerative agriculture solutions promote soil health and biodiversity, while food security technology enhances crop resilience. Resource efficiency farming, driven by IoT and data-driven farming, optimizes water and nutrient use. Labor shortage agriculture solutions utilize automation and robotics to streamline operations. Precision viticulture is gaining traction, using sensors and analytics for vineyard management. These trends, powered by AI and farm management software, enable scalable, efficient practices. Market players acknowledge connected agriculture as pivotal for sustainable, high-yield farming amid global challenges.

Connected Agriculture Market Growth Drivers vs. Challenges

Opportunities:

- Rising Global Food Demand: The United Nations forecasts a global population of 9.8 billion by 2050, which will require annual cereal production to rise to about 3 billion tonnes from 2.1 billion today. Connected agriculture technologies, such as precision farming and real-time monitoring, are essential for boosting yields and ensuring food security.

- Technological Advancements: Innovations in IoT, AI, and cloud computing enable real-time data collection and analysis. Rapid technological advancements are transforming the agricultural landscape by making connected farms smarter, more efficient, and more data-driven.

- Government Support and Policies: Governments worldwide are promoting smart agriculture through subsidies and initiatives. In 2023, the U.S. Department of Agriculture allocated $500 million to support precision agriculture technologies, driving the adoption of connected solutions. Also, for example, in August 2024, India launched the National Pest Surveillance System (NPSS), a mobile-based platform connecting farmers with experts for pest management. This system utilizes the latest digital technologies, such as Artificial Intelligence and Machine Learning (AI and ML), to provide quick and instant solutions regarding pest attacks, crop diseases, crop damages, etc., by issuing real-time crop protection advice to the farmers. It includes a user-friendly mobile app and a portal for the identification of pests and disease mitigation.

- Increasing Smartphone Penetration: With global smartphone subscriptions reaching 6.8 billion in 2024, mobile-based services like payments and information systems are transforming rural agriculture, particularly in regions with limited access to traditional infrastructure.

- Sustainability Imperatives: Climate change and resource scarcity are pushing farmers toward sustainable practices. Connected agriculture solutions, such as smart irrigation and soil sensors, optimize water and fertilizer use, aligning with global sustainability goals.

Challenges:

- High Initial Costs: Implementing IoT sensors, drones, and cloud platforms requires significant investment, which can be prohibitive for smallholder farmers, particularly in developing economies.

- Limited Digital Literacy: Many farmers, especially in rural areas, lack the technical expertise to operate advanced technologies, slowing adoption rates.

- Infrastructure Gaps: Inadequate internet connectivity and power supply in remote regions hinder the deployment of connected agriculture solutions, limiting market reach.

Connected Agriculture Market, By Technology Type, Segment Analysis:

- IoT Devices and Sensors: IoT Devices and Sensors are installed across the farm to collect real-time data on soil, crops, weather, livestock, and machinery. Some of the products are soil moisture and nutrient sensors, weather stations, and livestock wearables, among others. It has growing trajectories owing to the increasing demand for precision farming.

- AI and Data Analytics: AI and data analytics process large volumes of data (from sensors, drones, etc.) to uncover insights, make predictions, and automate decision-making. It uses technologies like machine learning, computer vision, and predictive analytics to optimize planting and harvesting time, predict livestock productivity, and others. It is forecasted to grow at a rapid rate due to rapid advancements in cloud computing and growing integration with farm management systems.

- Robotics and Automation: Robotics and automation are also expected to grow in the coming years. The market is driven by the high efficiency provided by these, and the growing labor shortages in agriculture are driving the market.

- Connectivity Infrastructure: These communication networks and protocols link all farm devices, systems, and platforms for seamless data transmission. The expansion of rural broadband and government funding for digital infrastructure.

Connected Agriculture Market Geographical Analysis:

- North America: North America is a leader in the connected agriculture market, driven by its advanced technological infrastructure and widespread adoption of precision agriculture. In 2024, the region generated substantial revenue, with the U.S. contributing the largest share due to its robust AgTech ecosystem. Companies like Deere & Company and Trimble Inc. are at the forefront, with innovations like AI-powered autonomous tractors introduced by Deere in 2023, and Precision Automatic Potato Planter, GreenSystem Compact Round Balers, and Precision Fertilizer Metering Solution, thus enhancing field management efficiency and also enhancing farming implements to optimize yields and efficiency.. Government support, such as the U.S. Department of Agriculture’s $500 million investment in precision agriculture in 2023, encourages adoption among small and large-scale farmers.

Canada and Mexico also contribute, with Canada focusing on smart irrigation and Mexico leveraging proximity to U.S. markets. The trading segment dominates in North America, as digital platforms connect farmers with buyers, streamlining supply chains and improving market access. The mobile information segment is also significant, with farmers using apps for real-time data on weather, soil conditions, and commodity prices, supported by widespread 5G connectivity and IoT infrastructure.

- Asia Pacific: The Asia Pacific region is the fastest-growing market for connected agriculture, driven by its vast agricultural base, rapid urbanization, and increasing technology adoption. In 2024, the region accounted for a significant share of global AgTech investment, with China and India as key contributors due to their large populations and food security imperatives. China, the world’s largest agricultural producer, is leveraging IoT and cloud-based platforms to enhance productivity. For instance, Alibaba’s ET Agricultural Brain, expanded in 2023, uses AI to optimize crop management and livestock monitoring. India’s National Pest Surveillance System, launched in August 2024, connects farmers with pest management experts via smartphones, boosting yields and reducing losses.

Rising disposable incomes and smartphone penetration, particularly in India, Thailand, and Indonesia, drive demand for mobile information and mobile payment services. The mobile information segment dominates in Asia Pacific, as farmers rely on apps for weather forecasts, market prices, and farming advice, with platforms like India’s NPSS serving millions of smallholder farmers. The micro-lending segment is also significant, addressing financial access challenges through digital platforms, with initiatives like India’s Digital Agriculture Mission (2021–2025) integrating mobile-based lending solutions.

Connected Agriculture Market Competitive Landscape:

Some of the key players in the connected agriculture market include Deere & Company, IBM Corporation, Trimble Inc., AGCO Corporation, SAP SE, DeLaval International AB, Syngenta AG, Cropin Technology Solutions Pvt. Ltd., Cisco Systems, Inc., Bayer AG, Hexagon AB, and Topcon Corporation.

- Product Innovation: In September 2024, Syngenta launched Cropwise AI. It is a GenAI system designed to increase the efficiency of agronomic advisors and growers in determining the best crop management practices. It uses advanced machine learning algorithms and data analytics to offer deep insights and enhanced decision-making capabilities to optimize crop yields, improve sustainability, and drive profitability.

- Government Support: In August 2024, the Government of India introduced the National Pest Surveillance System, connecting over 10 million farmers with pest management experts via mobile apps.

- Product Launch: In July 2024, Taranis launched the industry’s first generative AI-powered agronomy engine that transforms input and farm management decision-making. It introduces Ag Assistant™, which is powered by a generative AI model that integrates data sources from various modalities – including images, text, and audio – and with a profound understanding of agronomy.

Connected Agriculture Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Connected Agriculture Market Size in 2025 | USD 5.455 billion |

| Connected Agriculture Market Size in 2030 | USD 14.096 billion |

| Growth Rate | CAGR of 20.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Connected Agriculture Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Type

- Solutions

- Platforms & Services

- By Technology Type

- IoT Devices and Sensors

- AI and Data Analytics

- Robotics and Automation

- Connectivity Infrastructure

- By Application

- Precision Farming

- Smart Greenhouses

- Livestock Monitoring

- Fish Farming

- Field Operations Management

- Others

- By Farm Size

- Large Farms

- Small & Medium Farms

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Others

- North America