Report Overview

Defense Industry Antimony Market Highlights

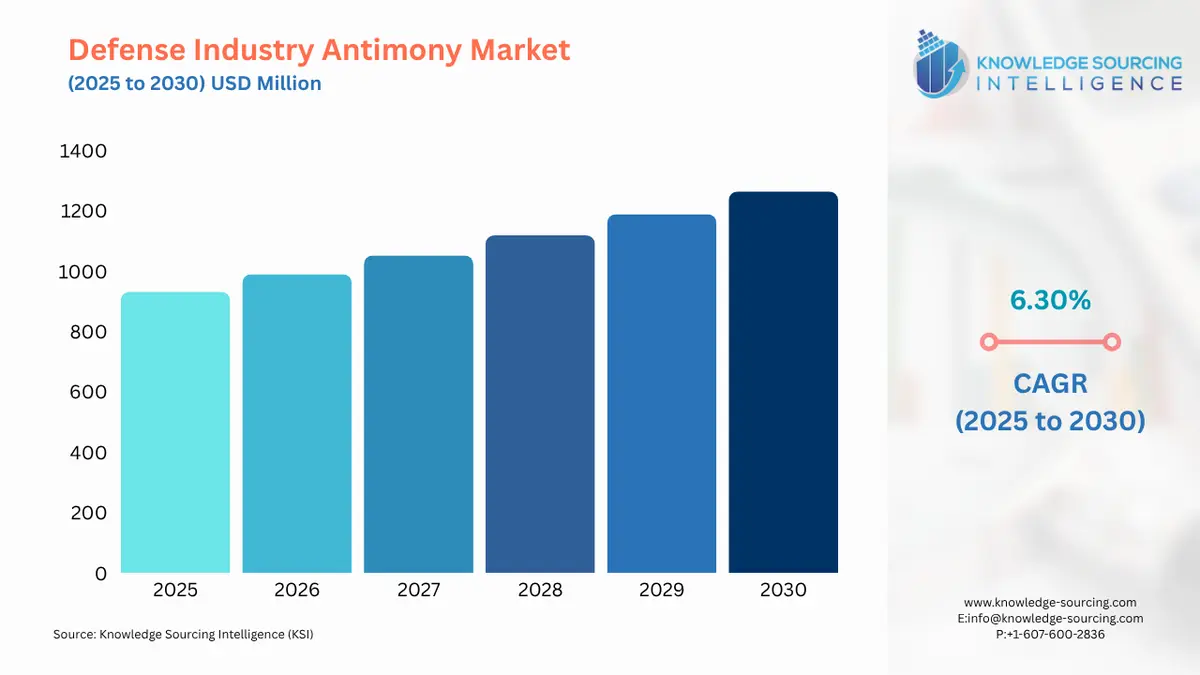

Defense Industry Antimony Market Size:

The Defense Industry Antimony Market is predicted to increase at a CAGR of 6.30%, achieving USD 1,264.173 million in 2030 from USD 931.408 million in 2025.

Defense Industry Antimony Market Key Highlights:

- Antimony is designated as a critical mineral for defense supply chains due to its indispensable role in ammunition hardening, flame-retardant soldier equipment, defense electronics, and vehicle armor.

- Antimony alloys are prized for their strength, hardness, and corrosion resistance, making them essential in ammunition casings, artillery shells, and lead-acid defense batteries used in armored vehicles, submarines, and backup systems.

Defense Industry Antimony is one of the more innovative spheres of the overall industrial environment. As the world shifts toward a new energy mix, antimony alloys are being understood as critical in next-generation rechargeable batteries and grid-scale energy storage systems. At the same time, interest in ceasing the use of safer, high-performance flame-retardants in buildings, electronics, and autos emphasizes how future-oriented and investment-worthy these chemicals are.

Defense Industry Antimony Market Overview & Scope:

The Defense Industry Antimony market is segmented by:

- Type: Antimony trioxide (ATO) leads use in the defense sector as a synergist for flame-retardant systems in military fabrics, protective clothing, composite enclosures, and aerospace-grade electronics, where fire endurance and safety are requirements. Antimony alloys are equally vital in ballistics and military batteries, where hardness, strength, and corrosion resistance are mission-critical characteristics. Sodium antimonate and antimony pentoxide, while smaller in the volume of consumption, are critical to high-value niche uses such as military glass, night vision optics, and guidance systems needing finer optical performance. All these categories of antimony materials constitute a diversified supply base for defense applications across the spectrum from bulk ammunition to niche aerospace composites.

- Application:The most significant and characteristic use of antimony in defense applications is in ammunition and ordnance production, where it is used to alloy lead and harden bullets, shells, and projectiles. Its applications continue to defense energy systems, such as lead-acid batteries powering tanks, submarines, communication nodes, and emergency backup systems uses where toughness, reliability, and recyclability are still crucial despite increasing lithium-ion uptake. Flame-retardant materials that have been antimony-treated are utilized in soldier uniforms, tactical tents, vehicle interiors, and electronics insulation, so fire safety is a non-compromising feature of defense design. Antimony compounds also play key functions in radar, avionics, and aerospace composites, where lightweight flame-resistant materials enhance mission dependability and safety margins.

- Form: Powdered antimony is most commonly used in defense industries due to its capacity to blend well in flame-resistant coatings, composite systems, uniform systems, and insulation systems, providing effective dispersability and economical use. Ingots are utilized for ammunition alloy and battery grid system production, where structural and compositional consistency is necessary in bulk production. Liquid derivatives are specialized but strategically critical in propellants, catalysts, and specialized explosive chemistry, providing unique performance characteristics in low-volume but highly technical defense applications. The form choice is therefore directly related to the end use, meaning powder for large-volume flame-retardancy applications, ingots for structural alloys, and liquids for specialized defense chemistry.

- Region: Geographically, the Defense Industry Antimony market is segmented into Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Asia Pacific is the biggest producer and consumer in the world market, with China taking over the position in supply chains and ensuring the world demand by issuing tons using large-scale mining activities and refining. The high rate of industrialization being witnessed in India and Southeast Asia adds more to the growth capabilities of the region. Europe is a mature market with a very rigid regulatory environment and sustainability targets, and demand is focused on flame retardants, renewable energy technologies, and advanced catalysts. North America has established itself as a reliable customer owing to increased fire safety regulations and the construction/ automotive sectors. These two areas, South America and the Middle East & Africa, are potential new markets with increasing industrial growth generating new demand, but due to a lack of domestic mining production, there is a need to use imports.

Top Trends Shaping the Defense Industry Antimony Market:

- Surging Demand for Hardened Ammunition

The revival of the hardened ammunition demand is one of the most characteristic trends of the defense-oriented antimony market. With the trend toward the development of ever-more-advanced armor-piercing rounds, artillery shells, and specialized projectiles alongside an ever-greater regionalization and proliferation of conflict across the world, a steady growth in demand has become apparent. Antimony assumes a niche position in this by strengthening lead to provide strength, hardness, and structural stability in bullets and shells, so that they can penetrate harder materials and perform much more reliably under high temperatures and pressure. The antimony-lead mix offers the level of machinability, durability, and overall cost-effectiveness that is required to produce mass amounts of defense materials, unlike other materials that currently exist. - Role in Defense Batteries and Field Energy Systems

The continued use of antimony in military energy systems, especially lead-acid battery technology, in the face of the global de-emphasis of lead-acid technology in the civilian energy sector in favour of lithium-ion technology, is another factor driving the market. Armored vehicles, submarines, marine fleets, backup power to command centers, field-level renewable energy storage devices, all still need the impact energy absorption that antimony alloyed lead grids provide. This is because these lead-acid batteries, combined with antimony reinforcement, offer the most rugged, unmatched durability and recyclability in grueling military environments (high vibration, temperature extremes, deep discharge cycles, and corrosive conditions). Military applications need battlefield reliability and a demonstrated lifecycle strength at the expense of energy density-one that makes antimony-alloyed batteries more suitable than newer alternatives in many military applications. The trend helps to highlight how military applications do not conform to the price and performance trends of consumer technology but instead take unique imperatives that make sure of the ever-present demand of antimony in military energy storage systems.

Defense Industry Antimony Market Growth Drivers vs. Challenges:

Drivers:

- Defense Modernization Programs: The largest source of demand for antimony in the military is the global defense modernization programs. Modern armies are restocking supplies of ammunition, armoring battlefield vehicles, increasing the protection of armor, and adding strong backup power systems to their activities. Each of these activities directly depends on antimony alloys or compounds, whether in hardening ammunition for offensive strategies or integrating flame-retardant coatings into soldier equipment.

- Critical Mineral Classification: The official declaration of antimony as a subject of critical mineral by military powers like the United States Department of Defense (DoD) and the European Union has added more strength to structural demand. This classification makes the consumption of antimony not only dependent on raw material economy but also a regulated network where supply chain investments and government procurement systems seek help. Stimulating recycling, financing in programs such as the Defense Production Act in the U.S., and Critical Raw Materials resilience policies in the EU are effectively funding initiatives that aim to ensure non-Chinese supply chains, increasing refining capacities, and processing supply materials. This can be seen as an advantage, as being integrated into such national security strategies can guarantee a demand for antimony even with downturns in the civilian market.

Challenges:

- Geopolitical Instability of Supply Sources: The last challenge is the macro geopolitical turbulence in other sourcing regions besides China. Reserves in countries such as Russia, Tajikistan, or Bolivia serve to support other parts of the global market, but this raises another risk factor due to sanctions and export restrictions, along with the political instabilities in their countries. The concentration of the supply base poses a double challenge to defense planners: besides being exposed to risks associated with imported material, the planners have to deal with unstable and undependable secondary sources. This dynamic compels militaries and defense contractors to continue to give more strategic priority to not only the creation of recycling infrastructures and alternative supply partners, but also to the accumulation of reserves to counteract possible supply shocks.

Defense Industry Antimony Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific is the center of worldwide antimony production and sets the trend of being the largest consumer of antimony in the defense sector. The Chinese sector, for instance, supports both domestic defense industries and the export of hardened ammunition materials, armor alloys, and flame-retardant compounds for textiles and electronics to global customers. Sustained governmental backing for resource security and advanced mining practices has consolidated China's dominance, making it the key supplier for ballistic alloys, protective gear, and energy grid backup systems in militaries within the region and worldwide. India and Southeast Asia also drive consumption due to active defense modernization programs, increasing the volume of antimony used in ammunition, radars, and military textiles. However, the regional supply chain remains vulnerable to policy shifts, export controls, and environmental regulations, which can rapidly affect downstream defense procurement schedules.

Defense Industry Antimony Market Competitive Landscape:

The market is fragmented, with many notable players:

- Company Funding: In May 2025, Perpetua Resources was awarded up to $6.9 million in additional funding from the U.S. Army via the Defense Ordnance Technology Consortium (DOTC), supplementing a prior $15.5 million award under the Ordnance Technology Initiative Agreement (OTIA) from August 2023. These funds support the expansion of material testing and the scale-up of a flexible, modular pilot plant designed to process material from Perpetua’s Stibnite Gold Project into military-grade antimony trisulfide, a critical element in munitions.

List of Top Defense Industry Antimony Companies:

Defense Industry Antimony Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 931.408 million |

| Total Market Size in 2031 | USD 1,264.173 million |

| Growth Rate | 6.30% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Form, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Defense Industry Antimony Market Segmentation:

- By Type

- Antimony Trioxide

- Antimony Alloys

- Sodium Antimonate

- Antimony Pentoxide

- Antimony Sulfides

- Others

- By Form

- Powder

- Ingot

- Liquid

- By Application

- Ammunition and Ordnance Production

- Defense Energy Systems

- Flame-Retardant Military Textiles and Protective Gear

- Defense Electronics and Aerospace Composites

- Specialized Optical Materials and Military Glass

- Protective Armor and Ballistic Materials

- Explosives and Propellants

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America