Report Overview

Dehydrated Green Beans Market Highlights

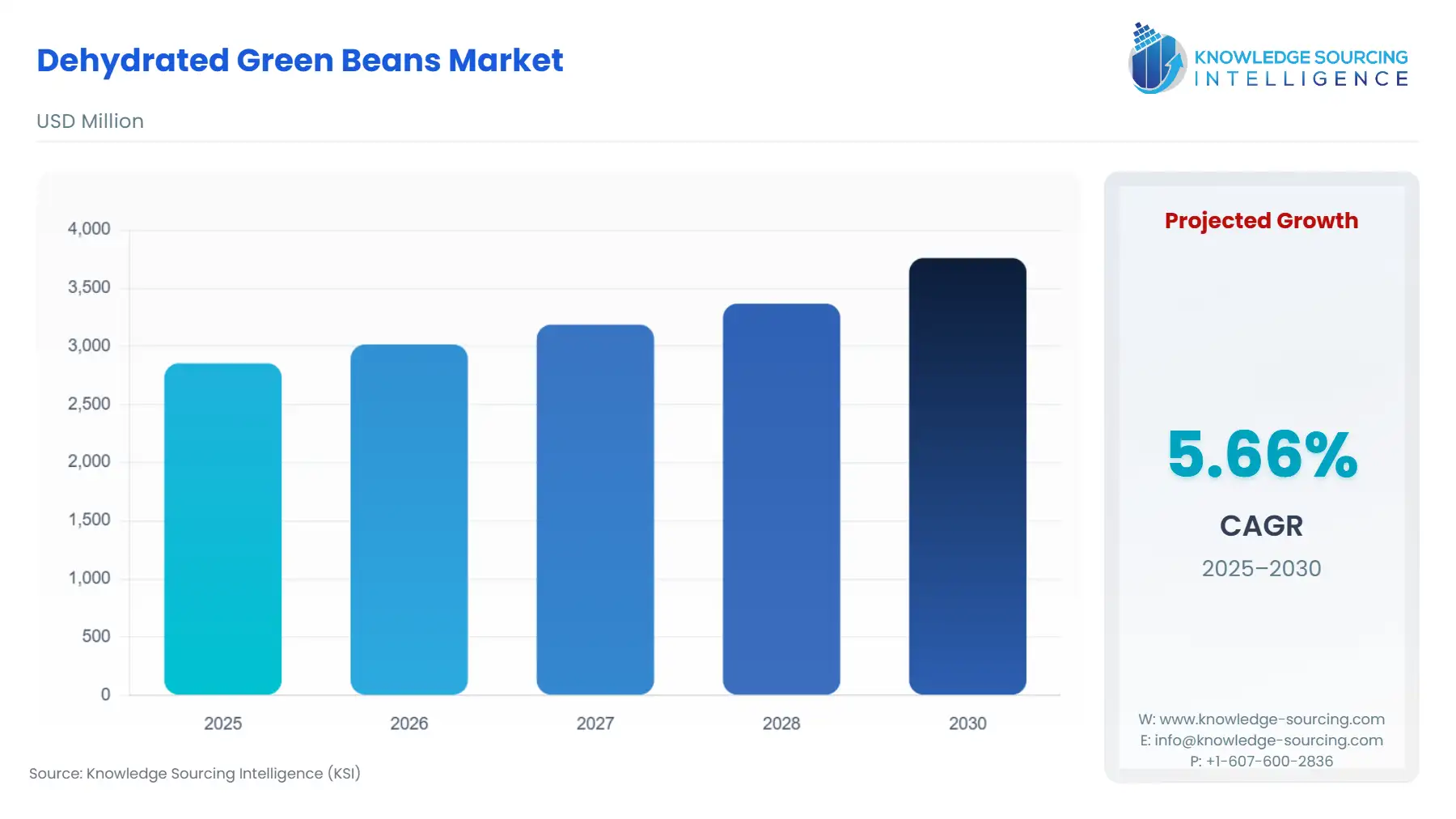

Dehydrated Green Beans Market Size:

The Dehydrated Green Beans Market is expected to grow from US$2.855 billion in 2025 to US$3.760 billion in 2030, at a CAGR of 5.66%.

The Dehydrated Green Beans Market operates at the intersection of agricultural commodity volatility and sophisticated food processing technology, serving a diverse client base ranging from large-scale food manufacturers to specialized ingredient houses. Its core value proposition lies in the substantial reduction of weight and volume, significantly extending shelf-life without the high energy costs associated with continuous refrigeration. This functional benefit is translating into measurable demand shifts, particularly within the ingredient-sourcing strategies of companies prioritizing logistical efficiency and stable supply chains. The market's complexity is further defined by the competitive tension between different drying technologies, where cost-effectiveness (Air Drying) contends directly with quality retention (Freeze Drying), creating distinct price tiers for end-use applications like high-value snack manufacturing versus bulk animal feed formulations.

Dehydrated Green Beans Market Growth Drivers

The market expansion is directly fueled by key demand-side factors:

- Logistical and Waste Efficiency in Food Service: The fundamental challenge for institutional food service and ready-meal manufacturers is managing perishable inventory and kitchen labor costs. Dehydrated green beans, offering a greater than 90% reduction in mass and a shelf-life measured in years, directly addresses this. This logistical advantage significantly increases demand for dehydrated formats by allowing food companies to centralize procurement, reduce refrigerated storage footprint, and practically eliminate spoilage from fresh produce, thereby improving unit economics.

- Consumer Demand for Clean-Label and Convenience Snacks: A secular trend towards healthier, vegetable-centric snacking is providing a substantial tailwind for the Freeze-Dried segment. Freeze-dried green beans, retaining a texture and nutritional profile superior to their air-dried counterparts, are directly incorporated into "vegetable chip" and trail mix products. This shift in final product formulation, prioritizing sensory experience and nutrient density, translates into a higher-volume and higher-value demand influx from the prepared foods sector.

- Increased Adoption in Infant Food Formulations: Global safety standards and consumer scrutiny within the infant food industry mandate minimal processing and maximum nutrient retention. Dehydrated green bean powders and granules, particularly those processed via vacuum or freeze-drying, serve as critical, concentrated vitamin and fiber sources. The need for verified, pathogen-reduced, and consistently micronutrient-dense ingredients demonstrably augments demand from major infant formula and baby food producers.

Challenges and Opportunities

The market faces structural headwinds alongside identifiable growth vectors that specifically impact demand.

- Challenges: The primary constraint is Raw Material Price Volatility. The raw material, fresh snap beans, is an agricultural commodity subject to regional weather patterns and seasonal yield variability. For instance, the U.S. snap bean production relies heavily on states like Wisconsin, which accounted for 40% of the nation's total U.S. production in 2024. Climatic events can create sharp, unpredictable increases in processing snap bean contract prices, which compresses the margins of dehydrators and forces end-users who often operate on long-term contracts to seek out lower-cost, often lower-quality, substitutes, thus decreasing demand for premium products.

- Opportunities: A major avenue for market expansion is the Bio-Circular Economy Integration. As industrial processors seek to utilize vegetable trimmings and by-products more effectively, the dehydrated bean market has an opportunity to capture demand from the Animal Feed and Pet Food sectors. Processing side-streams into powdered or granulated dehydrated green bean components for use in high-fiber, plant-based pet food formulations presents a new, resilient industrial demand channel, capitalizing on sustainability mandates.

Raw Material and Pricing Analysis

The Dehydrated Green Beans Market is inherently a physical product market. The supply and pricing dynamics of the fresh raw material snap beans (Phaseolus vulgaris) directly dictate final product cost and market accessibility. The price dynamics for processing snap beans, as distinct from the fresh market, are driven by contractual agreements with processors (dehydrators, canners, and freezers). The FOB shipping-point price for conventionally-grown snap beans in the U.S. averaged $0.81 per pound during October–November 2024, a notable decrease from the prior year. This price reduction offers a temporary procurement advantage for dehydrators, allowing for either margin expansion or a competitive pricing strategy that could stimulate demand by making the dehydrated product price-competitive against frozen alternatives. However, the high water content of fresh green beans (over 90%) means that raw material costs are multiplied by a factor of 10 to 15 in the final dehydrated product, making the entire value chain highly sensitive to even minor agricultural price fluctuations.

Supply Chain Analysis

The global supply chain for dehydrated green beans is segmented into primary and secondary production hubs. These hubs benefit from cost-competitive agricultural labor and established industrial drying infrastructure (predominantly Air Drying and Drum Drying). Secondary Production Hubs exist in North America and Europe, primarily focusing on high-specification, premium products utilizing Freeze Drying and Organic sourcing to serve stringent domestic end-user requirements. Logistical complexity is centered on maintaining ingredient integrity preventing moisture ingress and microbial contamination during ocean freight and managing the political and tariff risks associated with intercontinental trade flows, which can quickly alter the cost of goods sold and consequently shift demand toward domestically-sourced alternatives during trade disputes.

Dehydrated Green Beans Market Government Regulations:

Key government regulations impose specific compliance and formulation requirements that directly shape demand for dehydrated green beans.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Regulation (EC) No 396/2005 on Maximum Residue Levels (MRLs) for Pesticides |

Continuous updates, such as the July 2025 regulation setting new MRLs for substances like azoxystrobin, force exporters to adopt stringent Good Agricultural Practices (GAP). Non-compliance acts as a significant trade barrier, reducing the import demand for ingredients from non-compliant sources and increasing demand for certified, high-standard European and globally compliant dehydrators. |

|

United States |

Food Safety Modernization Act (FSMA) / FDA |

FSMA mandates preventative controls, including supplier verification for foreign manufacturers. This dramatically increases demand for dehydrated green bean suppliers who can provide validated documentation of their processing controls (e.g., thermal death time validation for Air Drying), shifting procurement away from unverified smaller processors. |

|

India |

Food Safety and Standards Authority of India (FSSAI) |

Regulations governing food safety and product standards, including specific requirements for processed vegetable products. Compliance ensures access to one of the world's fastest-growing consumer markets. |

Dehydrated Green Beans Market Segment Analysis:

- By Application: Infant Food

The Infant Food application segment represents a high-value, quality-critical component of the Dehydrated Green Beans Market. Demand in this sector is driven almost entirely by the non-negotiable imperative for ingredient safety, stability, and verifiable nutrient profile. Dehydrated green bean powder offers concentrated fiber, vitamins, and minerals in a low-moisture format that is crucial for formulated powdered infant food products, where water activity must be strictly controlled to prevent microbial growth. The demand driver is anchored in regulatory compliance and consumer confidence; specifically, manufacturers gravitate towards ingredients processed using advanced methods like Freeze Drying, which minimizes thermal degradation of nutrients and yields a finer, more easily blended powder. The segment's demand is inherently inelastic to price changes but highly sensitive to quality and certification, requiring suppliers to maintain stringent quality control records and Hazard Analysis and Critical Control Points (HACCP) protocols. This preference for documented excellence effectively increases the demand for premium, certified organic, or conventionally-grown, non-GMO dehydrated green bean products.

- By Drying Method: Freeze Drying

The Freeze Drying method segment commands the highest price point and experiences growth primarily from sophisticated food manufacturers. The process involves sublimation, removing water directly from the frozen state, which preserves the cellular structure of the green bean. This retention of structure is the paramount demand driver, as it results in a final product with excellent color, flavor, and a characteristic spongy texture that rehydrates near-perfectly or provides a crisp, appealing mouthfeel in a dry snack format. This technological advantage is why it is preferred for the premium Snacks & Savories and Specialty Ingredients applications. The direct link between process technology and end-product quality allows Freeze Drying to generate superior demand in sectors where ingredient performance justifies the higher processing cost. Conversely, Air Drying, while cheaper, results in a shriveled appearance and compromised texture, relegating its products to bulk applications like animal feed and industrial soup bases where visual and textural fidelity is less critical.

Dehydrated Green Beans Market Geographical Analysis

- US Market Analysis (North America)

Demand in the US market is fundamentally shaped by a robust domestic Food Processing industry and the consumer trend towards healthy, convenient meal solutions. The sheer volume of processing snap bean production in the US indicates an established supply chain, but the US remains a net importer of fresh snap beans, often from Mexico and Guatemala. Local demand for dehydrated green beans is bifurcated: high-volume, cost-sensitive demand comes from institutional kitchens and large-scale soup manufacturers, while high-value demand originates from the burgeoning "better-for-you" snack category. This dual structure propels demand for both bulk air-dried flakes and premium freeze-dried products. Compliance with the Food Safety Modernization Act (FSMA) is a non-negotiable local factor that drives end-users to select suppliers with verifiable food safety systems, creating a technical barrier to entry for many non-compliant foreign producers.

- Brazil Market Analysis (South America)

The Brazilian market is characterized by a strong agricultural base and rapidly increasing industrialization of its food sector, yet its demand for highly processed ingredients like dehydrated green beans is still evolving. Local demand factors are primarily centered on cost-efficiency for domestic soup, condiment, and ready-meal manufacturers. The high-humidity environment also makes the shelf-stable nature of dehydrated products a significant operational advantage, increasing demand from retailers struggling with cold chain integrity. Brazil's role as a major exporter of dry pulses indicates established, though domestically focused, agricultural infrastructure. Opportunities for dehydrated green bean imports exist in the premium and freeze-dried categories, which domestic producers are currently less equipped to supply efficiently at scale, resulting in a niche but growing import demand for high-quality, processed ingredients to support urbanized consumer product lines.

- Germany Market Analysis (Europe)

The German market acts as a highly quality-conscious and regulatory-driven hub within Europe. Local demand is defined by the strict compliance requirements of the European Union, particularly concerning pesticide MRLs and labeling standards. This regulatory environment acts as a demand filter, channeling procurement toward suppliers who have demonstrated long-term, verifiable adherence to EU standards. The German food manufacturing sector, known for its emphasis on quality and traceability, utilizes dehydrated green beans primarily in high-end soups, specialty seasonings, and functional ingredient blends. The strong environmental consciousness of the German consumer also stimulates demand for Organic and sustainably-sourced dehydrated products, compelling manufacturers to favor suppliers with clear farm-to-processing chain transparency.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market's demand for dehydrated green beans is a function of logistical necessity and import dependence. Due to the arid climate and limited domestic agricultural output, the country relies heavily on imports for its vegetable requirements. The critical local demand factor is the essential need for shelf-stable ingredients that withstand extreme heat during storage and distribution without refrigeration. This need significantly boosts demand for dehydrated ingredients in the institutional, military, and humanitarian aid sectors. Furthermore, the burgeoning prepared food sector that serves a rapidly urbanizing and expatriate population utilizes dehydrated green beans as a cost-effective, consistently-available ingredient in a variety of international cuisine ready-meals. Local demand often favors Air Dried flakes and granules due to their lower cost and primary use in processed applications where rehydration is acceptable.

- China Market Analysis (Asia-Pacific)

China is globally recognized as the largest exporter of Dried Vegetables, making its domestic market an intertwined complex of massive production and domestic consumption. Local demand for dehydrated green beans is driven by its use in three primary segments: ingredient manufacturing for its own substantial export-oriented processed food industry, high-volume domestic noodle and soup production, and as a component in a range of traditional and instant foods. The local supply chain is highly competitive, focusing heavily on cost-effective Air Drying technology. The country’s increasing focus on food safety, driven by regulatory oversight and rising middle-class consumer expectations, has increased demand for higher-quality, compliant production runs, moving away from lower-end, less regulated processors. China's massive export capacity in this sector fundamentally underpins the global supply of bulk, conventional dehydrated green beans.

Dehydrated Green Beans Market Competitive Environment and Analysis:

The Dehydrated Green Beans Market features a competitive landscape comprising large, globally diversified food ingredient specialists and smaller, regionally focused processors. Competition is centered on raw material sourcing efficiency, technological capability (especially the ability to execute high-quality Freeze Drying), and global certification compliance (e.g., FSSC 22000, Organic, Kosher). Key players leverage established agricultural supply chains and extensive product portfolios that span various dehydrated ingredients.

- Company Profile: BCFoods

BCFoods is strategically positioned as a major global supplier of dehydrated vegetables, herbs, and spices, operating on a vast, integrated global supply chain. Their competitive advantage rests on a high degree of vertical integration and supply security achieved through owned and partnered facilities across multiple continents, including North America and Asia. The company offers a broad portfolio encompassing Air Dried, Drum Dried, and specialty processed green bean products. Their strategic focus is on serving large multinational food manufacturers, leveraging their ability to provide high-volume, consistently-specified ingredients year-round. This strategy secures long-term demand by minimizing supply risk for their core food processing clients.

- Company Profile: Silva International, Inc.

Silva International, Inc. specializes in dehydrated vegetable and herb ingredients, primarily serving the processed food and snack sectors. The company’s strategic positioning emphasizes a commitment to quality and food safety, including an established process for steam sterilization to meet exacting microbial standards for sensitive applications. Their key products include air-dried green bean flakes and powder. Silva's competitive approach targets ingredient manufacturers requiring stringent, value-added processing and high standards of consistency. By focusing on specialized, safety-critical processing, their profile captures premium demand that is less sensitive to commodity pricing but highly sensitive to quality assurance.

- Company Profile: Van Drunen Farms

Van Drunen Farms (VDF) focuses its strategic efforts heavily on the higher-end, Freeze-Dried segment of the market, which is particularly relevant for dehydrated green beans used in snacks, instant meals, and nutraceutical applications. VDF emphasizes innovation in preservation and flavor, ensuring their ingredients retain superior color and texture. Their key strategic positioning involves a global reach and an investment strategy aimed at expanding their premium freeze-drying capacity and market presence. For example, the company invested in a South American freeze-dried fruit supplier, which, while not a direct green bean capacity expansion, signals a clear intent to expand its global platform for freeze-dried ingredients. This focus drives and satisfies demand in the rapidly growing premium and health-focused snack sectors.

Dehydrated Green Beans Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Dehydrated Green Beans Market Size in 2025 | US$2.855 billion |

| Dehydrated Green Beans Market Size in 2030 | US$3.760 billion |

| Growth Rate | CAGR of 5.66% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Dehydrated Green Beans Market |

|

| Customization Scope | Free report customization with purchase |

Dehydrated Green Beans Market Segmentation:

- By Nature

- Organic

- Conventional

- By Form

- Minced and Chopped

- Powdered and Granules

- Flakes

- By Drying Method

- Air Drying

- Spray Drying

- Freeze Drying

- Drum Drying

- Vacuum Drying

- By Application

- Snacks & Savories

- Infant Food

- Soups, Sausages & Dressings

- Animal Feed

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America