Report Overview

Digital Dose Inhaler Market Highlights

Digital Dose Inhaler Market Size:

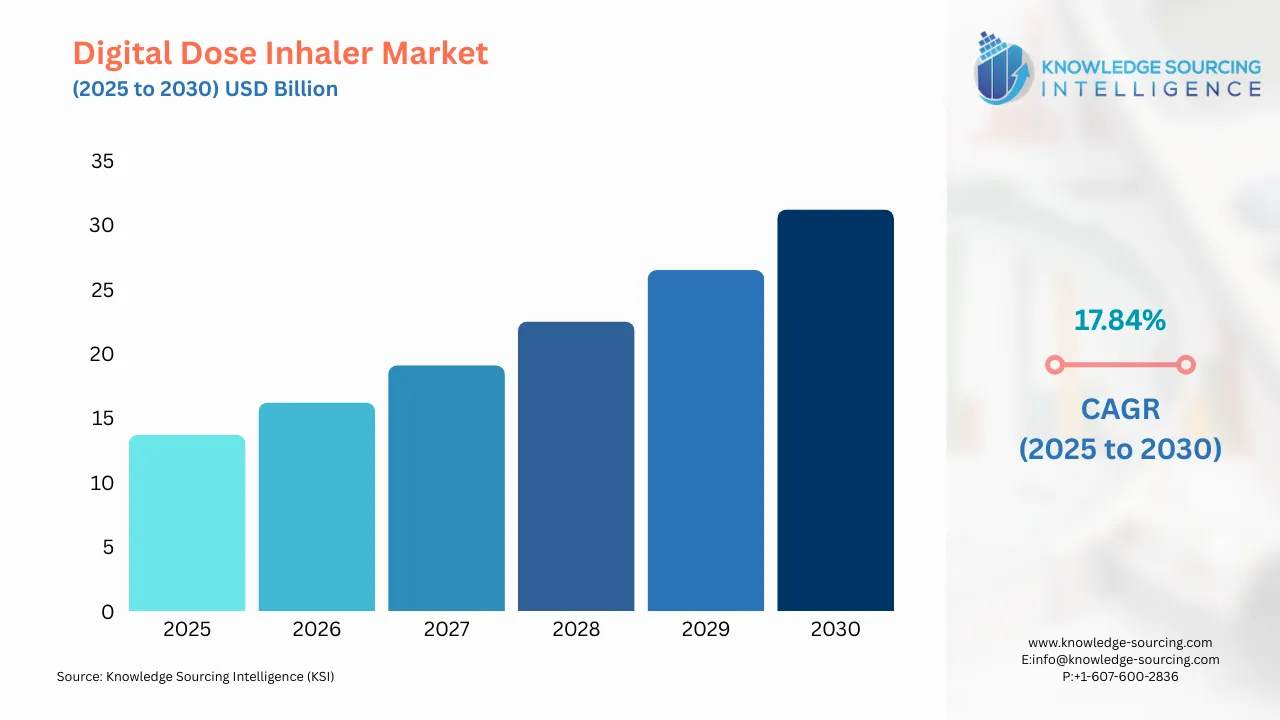

The digital dose inhaler market is expected to grow at a CAGR of 17.84%, reaching a market size of USD 31.178 billion in 2030 from USD 13.722 billion in 2025.

Key drivers include the rising incidence of asthma and chronic obstructive pulmonary disease (COPD), advancements in smart sensors, Bluetooth, and Wi-Fi connectivity, and the integration of artificial intelligence (AI) and Internet of Things (IoT) for personalized treatment. Metered Dose Inhalers (MDIs) dominate the product segment, while branded medications lead in type, and North America holds the largest regional market share. However, challenges such as high costs, data privacy concerns, and interoperability issues may impede adoption. Opportunities lie in telehealth integration, sustainable innovations, and expansion into emerging markets like the Asia-Pacific.

Digital Dose Inhaler Market Overview & Scope:

The digital dose inhaler market is segmented by:

- Product: The market is divided into two types: metered dose inhaler (MDI) and dry powder inhaler (DPI). MDIs dominate the market, holding a major share of the market in 2024 due to their affordability, portability, and widespread use. Recent advancements, such as e-dose counters and Bluetooth connectivity, enhance their appeal for asthma management and COPD management. For example, Aptar Pharma’s HeroTracker Sense transforms standard MDIs into smart metered dose inhalers. Meanwhile, DPIs are the fastest-growing segment, with a projected CAGR of 11.6%–16.9% through 2030. Their eco-friendly design, eliminating chlorofluorocarbon (CFC) propellants, positions them as green inhalers.

- Type: Branded medications dominate the market due to high healthcare expenditure, demand for innovative respiratory medications, and strong brand presence from companies like AstraZeneca and Teva Pharmaceuticals.

- Indication: Based on indication, the market is categorized into asthma, Chronic Obstructive Pulmonary Disease (COPD), and others. The asthma segment leads due to its high global prevalence (262 million cases, per WHO). Smart inhalers like Teva’s ProAir Digihaler improve asthma management by tracking usage and inhalation technique. Meanwhile, the COPD segment is expected to be driven by increasing incidence and demand for connected inhaler solutions for long-term disease management.

- Region: The Asia-Pacific will hold a significant market share due to the growing prevalence of asthma attacks, thereby creating an environment conducive to digital dose inhaler adoption. Also, supportive government initiatives to boost medical device production are additionally driving market growth. For instance, the National Medical Devices Policy, approved by the Indian government in April 2023, aims to foster a well-structured expansion of the medical device sector in India and to establish the country as a global leader in medical device manufacturing.

Digital Dose Inhaler Market Growth Drivers vs. Challenges:

Drivers:

- Growing Chronic Respiratory Disease Prevalence: The global surge in chronic respiratory diseases (CRDs), such as asthma and COPD, is a primary driver of the digital dose inhaler market. According to the World Health Organization, asthma affects approximately 262 million people globally, while COPD is projected to become the third leading cause of death by 2030. Environmental factors like air pollution, urbanization, and lifestyle changes, coupled with viral infections such as influenza and respiratory syncytial virus (RSV), are increasing the demand for smart inhalers that ensure precise medication delivery and improve patient outcomes.

- Rise in Adoption of Telehealth & Remote Patient Monitoring: The integration of digital dose inhalers with telehealth and remote patient monitoring (RPM) platforms is revolutionizing respiratory care. These devices enable real-time data sharing with healthcare providers, facilitating proactive interventions and reducing emergency visits. For instance, studies indicate that smart inhalers can reduce hospitalization rates by up to 30% through improved adherence and monitoring, as seen in initiatives like AstraZeneca’s BreathSmart program.

- Increasing Focus on Medication Adherence and Patient Outcomes: Medication adherence is a critical challenge in respiratory disease management, with non-adherence rates as high as 50% in asthma and COPD patients. Smart inhalers equipped with sensor-enabled technology provide real-time feedback on inhalation technique and adherence, improving therapeutic outcomes. Approximately 70% of newly developed inhalers incorporate digital components to enhance patient engagement and compliance.

- Technological Advancements in Device Connectivity & Data Analytics: Innovations in IoT inhalers, AI-powered inhalers, and sensor-enabled inhalers are driving market growth. Smart sensors track dosage and inhalation patterns, while Bluetooth connectivity and mobile health apps allow seamless data transmission to cloud platforms and electronic health records (EHRs). AI and IoT enable predictive analytics, identifying potential exacerbations and tailoring personalized respiratory care plans, significantly enhancing disease management.

Challenges:

Despite their benefits, smart inhalers face significant restraints:

- High Costs: Digital dose inhalers range from USD 100–300, compared to USD 20–60 for traditional inhalers, limiting adoption in cost-sensitive markets.

- Data Privacy and Cybersecurity: The integration of connectivity features raises concerns about data breaches. A 2023 IBM Security report noted a 25% increase in healthcare data breaches, impacting patient trust.

- Interoperability Issues: Integration with existing healthcare IT systems remains challenging, hindering widespread adoption.

- Patient Awareness: Limited technological literacy and resistance from patients and healthcare providers (HCPs) can slow market penetration.

Digital Dose Inhaler Market Regional Analysis:

- United States: Leading the digital dose inhaler market, the U.S. is benefiting from a robust healthcare system and high adoption of smart inhaler technologies. Rising cases of respiratory diseases like asthma and COPD, driven by environmental factors such as air pollution, are increasing demand for digital inhalers with real-time monitoring capabilities.

- Germany: Germany is experiencing significant market growth due to advancements in medical infrastructure and a focus on integrating innovative healthcare technologies. The adoption of digital dose inhalers is rising, supported by the country’s strong emphasis on precision medicine and smart healthcare devices for managing chronic respiratory conditions.

- United Kingdom: The UK is seeing a surge in demand for digital dose inhalers due to the growing prevalence of asthma and COPD, exacerbated by environmental factors like urban air pollution. Increased awareness of smart inhalers’ benefits, such as medication adherence tracking, is driving market expansion.

- China: China’s digital dose inhaler market is expanding rapidly, fueled by increasing respiratory disease rates and government investments in healthcare digitization. The growing adoption of IoT-enabled smart inhalers is addressing the rising burden of asthma and COPD in urban areas.

- India: India is witnessing steady market growth for digital dose inhalers, driven by rising respiratory issues due to air pollution and urbanization. Affordable smart inhaler solutions and improving healthcare access are boosting adoption among patients with chronic lung conditions.

- Japan: Japan’s market is growing due to its advanced healthcare system and aging population, with high rates of respiratory diseases. Digital dose inhalers with connected health features are gaining traction for effective disease management.

- Canada: Canada is adopting digital dose inhalers at a steady pace, supported by a strong healthcare framework and increasing awareness of smart inhalers for managing asthma and COPD, driven by environmental and lifestyle factors.

Digital Dose Inhaler Market Competitive Landscape:

The market has many notable players, including AstraZeneca Plc, AptarGroup, Inc., Novartis AG, Sensirion AG, Opko Health, Inc., Teva Pharmaceutical Industries Ltd., BEXIMCO Pharmaceuticals, GlaxoSmithKline Plc, Boehringer Ingelheim GmbH, and Glenmark Pharmaceuticals, among others.

- Aptar Pharma: A leader in drug delivery systems, Aptar Pharma’s HeroTracker Sense and ADHERO devices transform traditional inhalers into smart connected healthcare devices. Their 2022 acquisition of Pharmaxis’ Orbital inhaler enhances their high-payload DPI offerings.

- AstraZeneca: A pharmaceutical giant, AstraZeneca’s Symbicort and Breztri Digihalers leverage Bluetooth connectivity to enhance patient engagement and treatment outcomes for asthma and COPD.

- Teva Pharmaceutical Industries Ltd.: Teva’s ProAir, AirDuo, and ArmonAir Digihalers are FDA-approved smart inhalers that improve adherence through real-time dose monitoring and app integration.

Digital Dose Inhaler Market Key Developments:

- Study: In May 2024, Leicester started a UK-first National Health Service (NHS) study to explore the utilization of digital smart inhalers for children with asthma. The study plan is to identify high-risk children and young people who could benefit from Smart Inhalers through a systematic search of GP records. If successful, the study could work on the NHS adoption of Smart Inhalers.

- Approval: In April 2023, Adherium Limited announced it received FDA clearance for its Hailie Smartinhaler for utilization with AstraZeneca's Airsupra and Breztri inhalation devices. AirSupra was the first FDA-approved rescue medication for asthma and COPD patients.

- Partnership: In June 2023, Phil Inc. partnered with Teva Pharmaceuticals to advance access to the Digihaler family of inhalers for asthma management, with the use of the PhilRx Patient Access Platform.

- Acquisition: In December 2023, Adherium, which is a prominent digital health technology company, announced the commencement of production and market release of its Hailie Smartinhaler, which connects to Teva Pharmaceutical Industries Ltd.

Digital Dose Inhaler Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Digital Dose Inhaler Market Size in 2025 | USD 13.722 billion |

| Digital Dose Inhaler Market Size in 2030 | USD 31.178 billion |

| Growth Rate | CAGR of 17.84% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Digital Dose Inhaler Market |

|

| Customization Scope | Free report customization with purchase |

Digital Dose Inhaler Market Segmentation:

By Product

- Metered Dose Inhaler (MDI)

- Dry Powder Inhaler (DPI)

By Type

- Branded Medication

- Generic Medication

By Indication

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Our Best-Performing Industry Reports:

- Wearables For Asthma Management Market

- Inhalation Drug Delivery Market

- Pulmonary Drug Delivery Systems Market

Navigation

- Digital Dose Inhaler Market Size:

- Digital Dose Inhaler Market Highlights:

- Digital Dose Inhaler Market Overview & Scope:

- Digital Dose Inhaler Market Growth Drivers vs. Challenges:

- Digital Dose Inhaler Market Regional Analysis:

- Digital Dose Inhaler Market Competitive Landscape:

- Digital Dose Inhaler Market Key Developments:

- Digital Dose Inhaler Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 26, 2025