Report Overview

Dimethylformamide Market Size, Share, Highlights

Dimethylformamide Market Size:

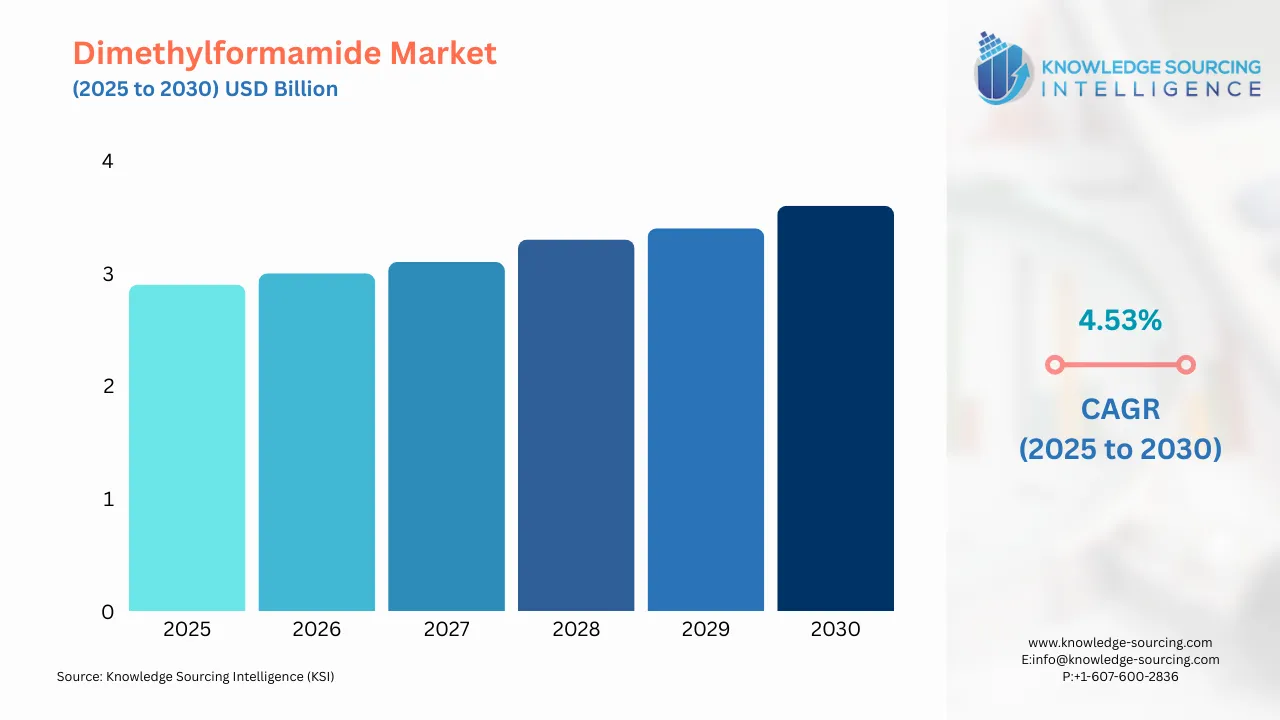

The dimethylformamide market is valued at a CAGR of 4.53%, reaching a market size of US$3.59 billion in 2030 from US$2.87 billion in 2025.

Dimethylformamide (DMF) is a crucial industrial solvent. It has consistent demand in key sectors. The market is navigating a major transformation. End-user industry growth remains strong. Raw material price volatility presents challenges. Strict health regulations are reshaping the market. This report provides expert analysis of these dynamics. It uses an inverted pyramid structure. We deliver in-depth insights for stakeholders.

Dimethylformamide Market Analysis

Growth Drivers

The pharmaceutical sector is the primary DMF market driver. The solvent is essential for synthesizing many APIs. It acts as a high-performance reaction medium. This improves yield. It also aids complex chemical transformations. Expanding global healthcare spending supports demand. A healthy drug development pipeline also helps. This trend is most pronounced in Asia-Pacific. The region is the leading hub for API manufacturing.

- China and India lead global API production. Their manufacturing capacity continues to grow. This is fueled by domestic and export opportunities. Policies like India's PLI scheme support this growth. These create a secure demand channel for DMF.

- New drug molecules are increasingly complex. They require high-performance aprotic solvents like DMF. This is true for oncology and antiviral therapies. Research in these areas intensifies solvent needs.

- The global CDMO network relies heavily on DMF. These organizations are concentrated in Asia. They use DMF for numerous client projects. This solidifies its importance in the value chain.

Industrial applications provide a broad demand base. This insulates the market from single-sector reliance. DMF is critical in producing PU synthetic leather. It is also used for making acrylic fibers. The automotive and fashion industries are major consumers. Consistent global demand for durable materials helps. This directly translates to sustained DMF consumption. The solvent's performance is difficult to replicate.

- The automotive industry uses high-quality PU leather. It is a durable and cost-effective alternative. DMF is essential for producing the required PU dispersions.

- The global textile industry uses DMF. It is for the wet-spinning of acrylic fibers. These fibers are used in apparel and home furnishings.

- The electronics sector also uses DMF. It is a solvent for resins in wire enamels. It also serves as an industrial cleaning agent.

Raw Material Pricing

DMF pricing is linked to its primary feedstocks. These include methanol, ammonia, and carbon monoxide. Raw material costs are notoriously volatile. They are subject to global energy price fluctuations. This volatility impacts DMF production costs. It creates significant margin pressure for producers. Cost management is a paramount concern.

- Methanol prices correlate with natural gas and coal. Geopolitical tensions can cause sharp price swings. Policy changes in China's coal industry also matter.

- Ammonia production is an energy-intensive process. It is primarily reliant on natural gas. Rising gas prices increase ammonia costs. This squeezes margins for DMF producers.

- Supply chain disruptions affect feedstock availability. A Q1 2025 report noted logistical challenges. These impacted global ammonia shipments. This led to temporary price spikes in key regions.

Manufacturers use sophisticated strategies to manage these risks. Mitigating feedstock volatility is a key differentiator. Proactive cost management is essential for profitability.

- Many large-scale producers use hedging strategies. They use financial instruments to lock in prices. This provides a degree of cost certainty.

- Investment in process optimization continues. Better catalyst technology improves reaction yields. This reduces specific consumption of raw materials.

- Some major producers are exploring backward integration. This involves controlling their own feedstock supply. It offers ultimate protection from market volatility.

Supply Chain Analysis

The global DMF supply chain is a complex network. It is heavily concentrated around a few production hubs. The chain begins with sourcing raw materials. Methanol and ammonia are globally traded commodities. They are sourced from major petrochemical centers. Feedstocks are transported to large-scale DMF facilities.

China is the epicenter of global DMF production. It is a critical node in the supply chain. The country is a major exporter to all regions. Logistics involve bulk shipment in chemical tankers. Regional distribution uses rail cars and tanker trucks. The supply chain has direct sales and distributors. DMF's hazardous classification requires strict regulations.

Government Regulations

Health and safety regulations shape the DMF market. Awareness of DMF's health concerns is growing. This has led to strict controls worldwide. Regulators focus on protecting worker health. This translates to higher compliance costs. It also creates operational complexities.

| Jurisdiction | Key Regulation / Agency | Market Implication |

| European Union | ECHA (under REACH) | Strict use restriction from Dec 2023. SVHC classification drives substitution |

| United States | EPA (under TSCA); FDA | Ongoing risk evaluation for industrial use. Strict purity standards for pharma |

| China | Ministry of Ecology and Environment | Stricter VOC emission standards, increasing compliance costs for producers and users |

Occupational Exposure Limits (OELs) for DMF are being systematically lowered in many jurisdictions as toxicological data is updated, forcing industries to re-evaluate their workplace safety protocols.

Companies using DMF are now frequently required to invest heavily in closed-loop systems, advanced ventilation, and high-performance personal protective equipment (PPE) to meet these new, stricter standards.

The European Chemicals Agency (ECHA) has implemented a landmark restriction on DMF under REACH, which took full effect in December 2023. This regulation establishes very low Derived No-Effect Levels (DNELs) for worker exposure, setting a new global benchmark for safety. This action is not only impacting the European market but is also influencing regulatory trends in other parts of the world and acting as a powerful catalyst for the search for safer alternative solvents.

- The stringent ECHA restriction is a primary driver for innovation in green and sustainable chemistry, with a marked increase in research and development focused on finding viable, safer alternatives to DMF.

- Many end-users in Europe, particularly in consumer-facing industries like textiles and synthetic leather, are actively reformulating their products to design out DMF and avoid the associated regulatory burden and reputational risk.

- This intense regulatory pressure is creating significant commercial opportunities for suppliers of alternative solvents like DMSO or novel bio-based options, as well as for manufacturers of advanced solvent recovery and emission control systems.

Challenges and Opportunities

Market Challenges

The most formidable challenge confronting the DMF market is the escalating concern over its health and safety profile. Its classification as a substance with reproductive toxicity has placed it under intense scrutiny from regulatory bodies globally. This is not merely a compliance issue; it represents a fundamental threat to the solvent's long-term market position, forcing end-users to actively seek and evaluate alternatives.

- High Compliance Costs: Adhering to the increasingly stringent Occupational Exposure Limits (OELs) requires substantial capital investment in engineering controls like closed-loop systems and advanced ventilation, along with ongoing operational costs for extensive personal protective equipment (PPE) and worker health monitoring. These costs can be prohibitive for smaller enterprises.

- Threat of Substitution: The regulatory pressure is a powerful catalyst for substitution. End-users, particularly in consumer-facing sectors like textiles and synthetic leather, are increasingly reformulating products to eliminate DMF. This trend is driven by a desire to mitigate regulatory risk, enhance brand reputation, and simplify supply chain compliance.

- Reputational Risk: The negative health classification of DMF creates a reputational risk for companies that use it. In an era of heightened consumer awareness and corporate social responsibility, brands are wary of being associated with chemicals deemed hazardous, further accelerating the search for greener alternatives.

Market Opportunities

Despite the significant challenges, the evolving market landscape is creating distinct and valuable commercial opportunities for forward-thinking companies. The push away from traditional solvents is simultaneously pulling the market toward innovation and new service models.

- Development of Green Solvents: The most significant opportunity lies in the development and commercialization of safer, bio-based, or biodegradable alternative solvents. A "drop-in" replacement that matches DMF's performance characteristics without its toxicological profile would command a significant market premium and could capture substantial market share. Companies investing in green chemistry R&D are positioning themselves for future leadership.

- Advanced Engineering and Recovery Systems: The need to comply with strict regulations creates a robust market for advanced technologies. This includes sophisticated solvent recovery systems that capture, purify, and recycle DMF, as well as state-of-the-art monitoring equipment and closed-loop handling systems. Engineering firms and technology providers specializing in these solutions have a growing addressable market.

- Compliance as a Service: The complexity of navigating global chemical regulations presents an opportunity for producers to offer value-added services. This can include "compliance as a service" models, where manufacturers provide customers with technical support, safety training, and guidance on implementing best practices to meet regulatory standards, transforming a supplier relationship into a strategic partnership.

In-Depth Segment Analysis

Analysis by Application: The Dominance of DMF as a Solvent

The primary function and largest application for Dimethylformamide, accounting for the vast majority of its global consumption, is its role as a high-performance polar aprotic solvent. Its unique combination of a high boiling point (153 °C), wide liquid range, and high dielectric constant makes it exceptionally effective at dissolving a broad spectrum of both organic and inorganic compounds. This versatility is the cornerstone of its market dominance. In chemical synthesis, DMF is not merely a medium but an enabler of reactions that would be slow or inefficient in other solvents. It excels at promoting S_N2 reactions, which are fundamental in the synthesis of many pharmaceuticals and specialty chemicals. Its ability to solvate cations effectively leaves anions more reactive, thereby accelerating reaction rates and improving yields. This performance characteristic is difficult to replicate with other solvents, making it indispensable in many established industrial processes.

In the polymer industry, DMF's role is critical. It is the solvent of choice for the production of polyurethane (PU) dispersions, which are foundational to the synthetic leather industry. It effectively dissolves the polymer segments, allowing for the formation of stable, high-quality coatings. Similarly, in the production of acrylic fibers, DMF is used in the wet-spinning process to dissolve the polyacrylonitrile polymer before it is extruded to form fibers. A technical paper published in a polymer journal in Q1 2025 reaffirmed the challenges of finding alternative solvents that can match DMF's dissolution efficiency and process stability for these specific high-molecular-weight polymers. The solvent's function extends to the electronics industry, where high-purity grades are used to dissolve resins for wire enamels and to act as a stripping and cleaning agent in semiconductor manufacturing, highlighting its broad industrial utility.

Analysis by End-User Industry: The Pharmaceutical Sector

Within the end-user industries, the pharmaceutical sector represents the highest-value and most critical market for Dimethylformamide. Its application in this segment is centered on the synthesis of Active Pharmaceutical Ingredients (APIs). The stringent purity, consistency, and reaction conditions required in pharmaceutical manufacturing make solvent selection a critical decision, and DMF's properties are exceptionally well-suited for these demands. It is widely used in the production of various classes of drugs, including certain antibiotics, antiviral agents, and complex oncology drugs. The solvent's ability to facilitate difficult reactions and purify final products through crystallization makes it a workhorse in the API production chain. The demand for pharmaceutical-grade DMF, which must meet rigorous purity standards defined by pharmacopeias like the USP and Ph. Eur., is a distinct and high-margin sub-segment.

The structural growth of the global pharmaceutical industry, particularly the expansion of the Contract Development and Manufacturing Organization (CDMO) model, directly fuels demand for DMF. As a significant portion of global API synthesis is now outsourced to CDMOs, predominantly located in India and China, these organizations have become major procurement centers for high-purity solvents. A report from a pharmaceutical trade association in May 2025 highlighted the continued double-digit growth in the Indian CDMO sector, with a corresponding increase in the consumption of key raw materials, including DMF. Furthermore, as pharmaceutical companies develop more complex and potent molecules, the need for a robust and reliable solvent like DMF in multi-step synthetic processes remains strong, ensuring its continued strategic importance to the industry despite the regulatory pressures.

Geographical Analysis

US Market Analysis

The United States represents a mature and significant market for DMF, with demand underpinned by its advanced pharmaceutical and specialty chemical industries. The country has a strong strategic focus on bolstering its domestic API production capabilities to reduce reliance on foreign supply chains, a trend that directly supports demand for high-purity, locally available DMF. The electronics and specialty polymers sectors, which require high-performance solvents for manufacturing processes, are also important and consistent consumers.

- The US Food and Drug Administration (FDA) has stringent regulations that influence the selection and purity requirements for solvents used in pharmaceutical manufacturing, ensuring a market for high-grade DMF.

- The Environmental Protection Agency (EPA), under the Toxic Substances Control Act (TSCA), actively monitors and evaluates the risks of industrial solvents like DMF, potentially leading to stricter use conditions in the future.

- Trade data from early 2025 continues to show stable DMF import levels, primarily from Europe and Asia, which are essential to meet the demand from the domestic industrial base.

Brazil Market Analysis

Brazil's DMF market is primarily driven by its robust industrial and agricultural sectors. The country is a major global producer of synthetic leather, especially for the footwear and automotive industries, making it a significant consumer of DMF for PU dispersion processes. Furthermore, Brazil's large and sophisticated agrochemical industry utilizes DMF as a solvent in the formulation of certain pesticides and other crop protection products. The market's performance is sensitive to domestic economic cycles, currency fluctuations, and the cost of imported raw materials.

- Brazil's chemical industry is heavily reliant on imported feedstocks and specialty chemicals, which makes its cost structure susceptible to global price volatility and exchange rate fluctuations.

- Government initiatives aimed at supporting local manufacturing and reducing import dependency are influencing investment decisions and sourcing strategies within the Brazilian chemical sector.

- ANVISA, the Brazilian Health Regulatory Agency, is responsible for overseeing the registration and safety of chemicals used in products like pesticides, which includes setting acceptable limits for solvents like DMF.

Germany Market Analysis

Germany stands as the largest and most sophisticated DMF market in Europe. Its highly developed and export-oriented chemical and pharmaceutical industries are the principal consumers. The country is a global hub for chemical research and development, which includes significant work on new applications for established solvents as well as a concerted effort to develop safer, more sustainable solvent alternatives in line with EU policy. The market's influence and is shaped by EU-wide regulations, most notably REACH.

- German chemical companies are global leaders in implementing advanced safety engineering, closed-loop systems, and solvent recovery technologies to ensure compliance with the strict European OELs for DMF.

- The country's powerful automotive sector drives strong demand for high-performance PU coatings, adhesives, and synthetic materials, many of which are produced using DMF-based processes.

- A government-backed industry report from late 2024 highlighted the German chemical industry's deep commitment to sustainability and circular economy principles, which is accelerating the transition towards greener chemical solutions.

Saudi Arabia Market Analysis

Saudi Arabia's DMF market is intrinsically linked to its vast petrochemical industry. The country is a major global producer of the key raw materials needed for DMF synthesis, such as methanol and ammonia. Downstream diversification into higher-value specialty chemicals is a central pillar of its national economic strategy, which includes expanding the production of products like DMF to serve both domestic and regional markets.

- Domestic DMF production is strategically supported by the availability of abundant and cost-advantaged feedstocks derived from the country's oil and gas resources.

- The market serves a growing regional demand in industries such as paints, coatings, textiles, and pharmaceuticals, particularly across the Middle East and North Africa.

- Government initiatives under the ambitious "Vision 2030" plan are actively encouraging and incentivizing foreign and domestic investment in the downstream chemical sector, creating a favorable environment for growth.

China Market Analysis

China is unequivocally the world's largest producer and consumer of DMF, holding a commanding position in the global market. Its massive and diverse chemical, pharmaceutical, and textile industries create an enormous and sustained demand for the solvent. The country's vast production capacity not only serves its immense domestic market but also dominates the global supply chain, making it a major exporter. The market's direction is heavily influenced by the central government's evolving environmental policies and five-year industrial plans.

- China's Ministry of Ecology and Environment is enforcing progressively stricter emission standards for volatile organic compounds (VOCs), which is forcing DMF producers and users to invest in better pollution control technologies.

- The country is a major exporter of DMF to other parts of Asia, as well as to Europe and the Americas, with its pricing often setting the benchmark for the global market.

- Recent company press releases from major Chinese producers in 2025 indicate a clear strategic focus on improving production efficiency, reducing energy consumption, and enhancing their overall environmental performance to align with national policy goals.

Competitive Environment and Analysis

- A strategic geographic presence, with production assets located close to major demand centers, is a key competitive advantage that helps to reduce logistics costs and improve customer service.

List of Top Dimethylformamide Companies:

- BASF SE

- Balaji Amines

- Belle Chemical

- Chemanol

- Eastman Chemical Company

Dimethylformamide Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Dimethylformamide Market Size in 2025 | US$2.87 billion |

| Dimethylformamide Market Size in 2030 | US$3.59 billion |

| Growth Rate | CAGR of 4.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Dimethylformamide Market |

|

| Customization Scope | Free report customization with purchase |

Dimethylformamide Market Segmentation:

- By Application:

- Solvent

- Catalyst

- Raw Material

- By End-User Industry:

- Chemical Processing

- Pharmaceuticals

- Textiles

- Paints & Coating

- Others

- By Geography:

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of the Middle East and Africa

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Navigation

Page last updated on: