Report Overview

Direct Energy Conversion Device Highlights

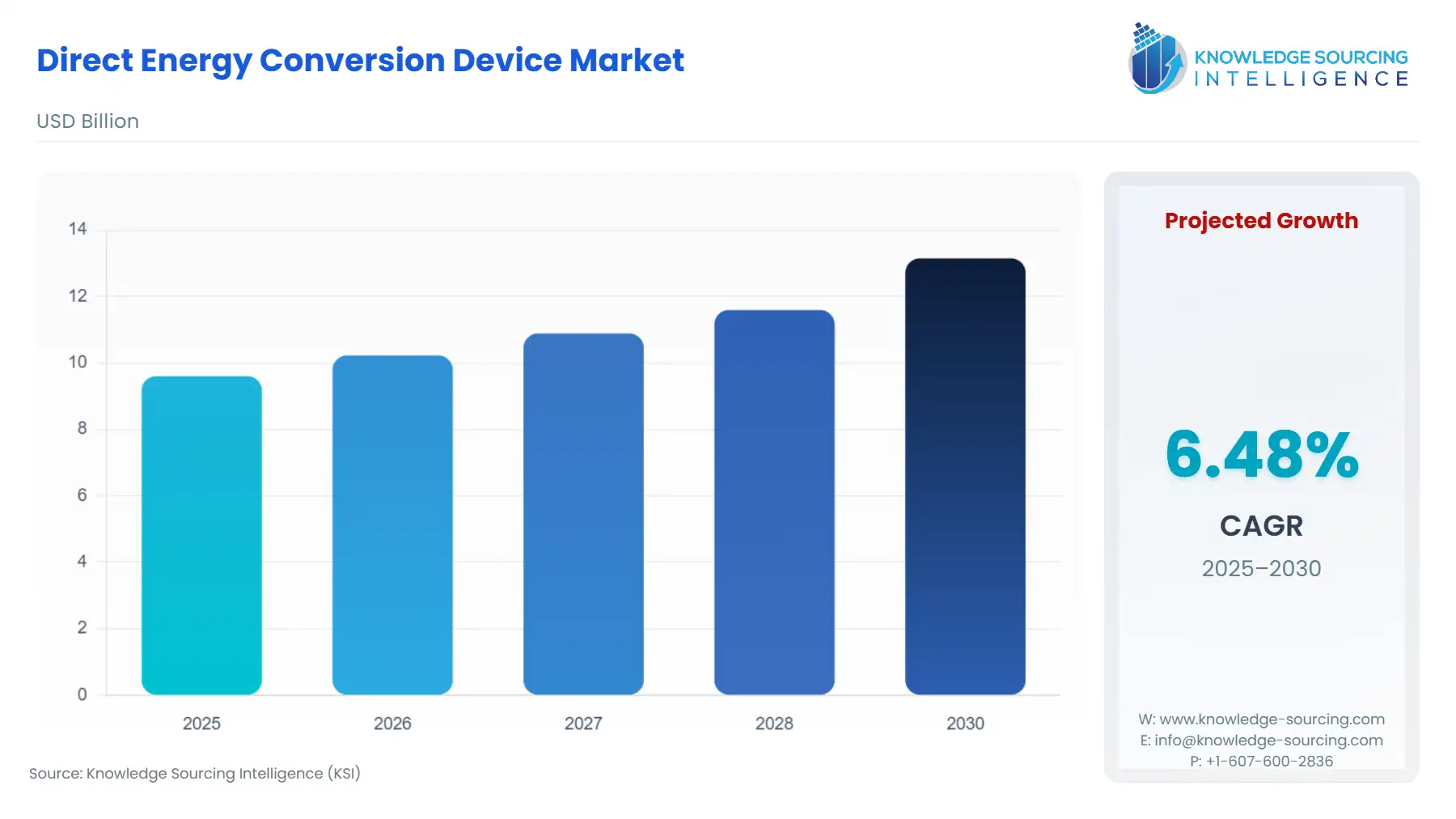

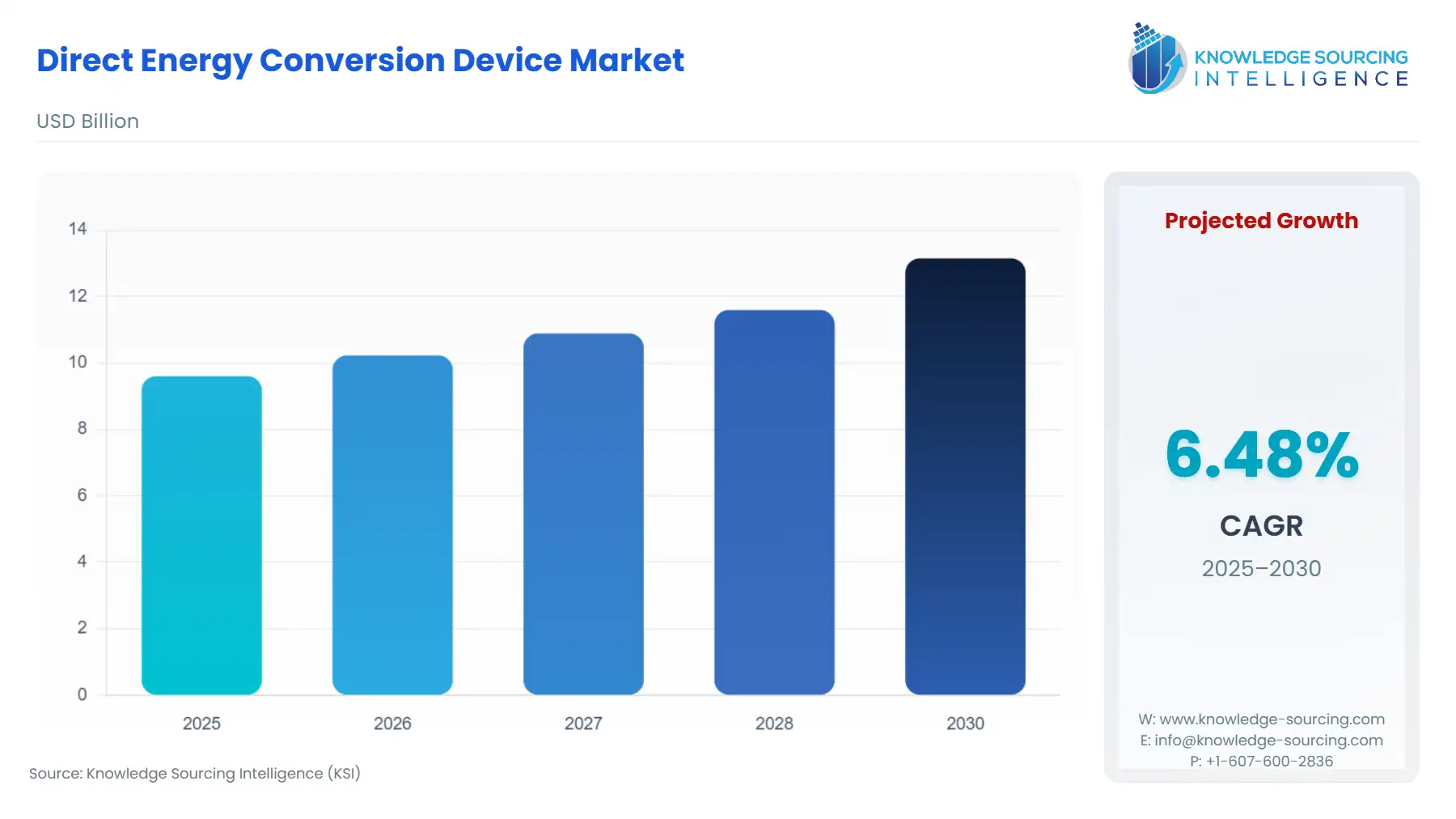

The direct energy conversion device market is projected to expand at a 6.48% CAGR, increasing from USD 9.605 billion in 2025 to USD 13.150 billion by 2030.

Direct Energy Conversion Device Market Key Highlights

________________________________________________________________

The Direct Energy Conversion Device Market encompasses technologies that transform one form of energy into another without an intermediate mechanical stage. Key devices, including solar cells (optical to electrical), fuel cells (chemical to electrical), and thermoelectric generators (heat to electrical), are foundational to the global shift towards distributed and low-carbon power generation. The market's complexity stems from its cross-sectoral applications, spanning from vast utility-scale photovoltaic farms to highly specialized aerospace power supplies and remote industrial monitoring systems.

Direct Energy Conversion Device Market Analysis

Growth Drivers

The aggressive pursuit of a low-carbon economy mandates the adoption of efficient, decentralized energy solutions, directly accelerating demand. Global energy targets compel utility providers and governments to expand photovoltaic and wind capacity, thereby increasing the procurement of solar cells and power electronics. Concurrently, the increasing focus on the hydrogen economy, particularly within the automotive and stationary power segments, directly translates into elevated demand for high-efficiency fuel cell stacks and associated balance-of-plant components. Finally, the industrial imperative to improve energy efficiency, recovering waste heat in manufacturing and transport, catalyzes demand for thermoelectric devices.

Challenges and Opportunities

A primary constraint is the inherent cost-to-efficiency ratio of certain technologies, such as advanced thermoelectric materials, which restricts mass-market uptake and limits demand primarily to niche, high-value applications like aerospace. However, this challenge generates the opportunity to capitalize on material science advancements, specifically through developing high-Seebeck coefficient materials to lower the Levelized Cost of Energy (LCOE) for thermoelectric devices. Furthermore, the lack of ubiquitous hydrogen refueling infrastructure poses a demand headwind for fuel cell vehicles, yet this simultaneously creates a significant investment opportunity in constructing decentralized hydrogen production and distribution hubs, which themselves require conversion devices.

Raw Material and Pricing Analysis

Direct energy conversion devices, being physical products, are heavily dependent on key raw materials. For solar cells, polysilicon spot pricing and the supply chain for silver paste and specialty glass dictate manufacturing costs and, consequently, final module pricing. Thermoelectric device costs are sensitive to the price volatility of rare earth elements, such as Tellurium (used in Bismuth Telluride modules), a constraint that limits production scalability and keeps end-product pricing high. Conversely, the mass standardization of fuel cell components, particularly Proton Exchange Membranes (PEMs), has enabled economies of scale, applying downward pressure on unit pricing and making the technology more accessible to the automotive sector.

Supply Chain Analysis

The global supply chain for direct energy conversion devices is bifurcated between high-volume, low-cost solar cell manufacturing and specialized, low-volume production for high-reliability devices. Asia-Pacific, particularly China, dominates the solar cell manufacturing value chain, creating a significant geopolitical dependency for North American and European solar projects. The supply chain for high-end thermoelectric and fuel cell systems is more distributed, with key production and research hubs in North America and Europe. Logistical complexity is primarily associated with the fragility of solar wafers and the specialized handling requirements for hydrogen in fuel cell systems, necessitating robust cold chain and hazardous material protocols.

Government Regulations

Government regulations are pivotal in shaping market expansion, often acting as a non-economic catalyst for adoption.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | U.S. Department of Energy (DOE) R&D Programs | Federal funding for research in advanced materials and manufacturing processes drives technological maturity, reducing long-term costs and indirectly stimulating commercial demand. |

| India | Saubhagya Scheme / Deen Dayal Upadhyaya Gram Jyoti Yojana | These government initiatives directly create demand for off-grid DC power systems and solar home lighting, leading to the mass procurement of solar cells and battery components for rural electrification. |

| European Union | Renewable Energy Directive (RED II) | Mandates for renewable energy shares in final consumption compel member states and utility companies to invest in non-fossil fuel power generation, dramatically increasing the demand for utility-scale solar and hydrogen-based fuel cells. |

In-Depth Segment Analysis

By Device Type: Fuel Cells

The fuel cell segment's growth is primarily driven by the imperative for zero-emission mobility and uninterrupted stationary power. Government-backed strategies for the hydrogen economy, particularly in East Asia and Europe, create a stable procurement pipeline for fuel cell electric vehicles (FCEVs). For instance, the transition of heavy-duty transportation fleets to hydrogen power requires high-power fuel cell stacks, driving demand for greater power density and durability. Furthermore, the need for reliable, long-duration backup power for critical infrastructure, such as data centers and telecommunications, necessitates the deployment of stationary fuel cell systems, as they offer longer run times and faster refueling compared to traditional battery solutions, cementing their demand in mission-critical applications.

By End-User: Space & Aerospace

The Space & Aerospace end-user segment is defined by a unique demand profile centered on extreme reliability, minimal mass, and operation in harsh environments. The growth catalyst here is not cost-sensitivity but mission-critical performance. Radioisotope Thermoelectric Generators (RTGs) and advanced solar array technologies are procured for deep space missions where solar irradiance is low or power output stability is paramount. The increasing frequency of low-Earth orbit (LEO) satellite launches drives demand for space-grade solar cells and highly efficient power conditioning units. These programs operate under stringent qualification standards, creating sustained, long-term demand for specialized, high-performance direct energy conversion devices that general commercial markets cannot meet.

Geographical Analysis

US Market Analysis (North America)

The US market is largely driven by a combination of federal tax credits, such as the Investment Tax Credit (ITC), and state-level Renewable Portfolio Standards (RPS). These policies create economic viability for utility-scale solar projects, resulting in consistent, high-volume demand for photovoltaic cells and inverters. Furthermore, the Department of Defense's focus on portable power for remote operations and the high-reliability needs of the aerospace sector maintain a strong, albeit niche, demand for advanced thermoelectric generators and fuel cell systems for unmanned aerial vehicles (UAVs) and ground operations.

Brazil Market Analysis (South America)

The Brazilian market is shaped by its need for decentralized power solutions in remote regions, particularly the Amazon basin, where grid infrastructure is non-existent or unreliable. This environment fosters significant demand for standalone solar systems and battery-backed DC microgrids. Government-supported energy access programs specifically target these underserved populations, leading to the procurement of basic, robust solar home systems. Moreover, the massive agricultural sector creates a nascent demand for fuel cell technology in large-scale farm equipment and off-road vehicles to meet environmental mandates.

Germany Market Analysis (Europe)

Germany's market is characterized by regulatory mandates and a high degree of technological sophistication, largely driven by its Energiewende policy. Feed-in tariffs, though decreasing, created an initial boom in solar cell installation, shifting the current demand focus toward high-efficiency, premium solar modules for residential and commercial rooftop applications. Critically, Germany's commitment to hydrogen infrastructure and the associated industrial clusters directly fuel a strong demand for Proton Exchange Membrane (PEM) fuel cells for industrial transport, intralogistics, and power-to-gas applications.

Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market is fundamentally tied to large-scale, state-backed megaprojects aimed at energy diversification, such as the ambitious 'Vision 2030' plan. This has led to the development of some of the world's largest solar power plants, generating colossal, episodic demand for high-efficiency solar cells and trackers. The country's extreme desert climate dictates a specific demand for robust, high-temperature-resilient photovoltaic technology, pushing manufacturers to develop devices optimized for desert environments.

China Market Analysis (Asia-Pacific)

China dominates the global supply side but is also a major growth center, driven by comprehensive government five-year plans that set aggressive capacity targets for renewable energy. The sheer scale of industrial and residential new construction necessitates massive deployment of solar installations, sustaining high-volume domestic demand for all types of photovoltaic modules. The nation's push for new energy vehicles (NEVs), including fuel cell electric vehicles, provides a substantial and growing market for fuel cells, supported by significant local government subsidies and infrastructure investment in hydrogen refueling stations.

Competitive Environment and Analysis

The Direct Energy Conversion Device Market features a complex competitive dynamic, ranging from commodity solar manufacturers to highly specialized defense and aerospace contractors. Competition is often bifurcated: price-based rivalry dominates the solar cell segment, while performance, reliability, and technical specifications govern the specialized thermoelectric and fuel cell sub-markets. Key players leverage proprietary materials science and component integration expertise to establish defensible market positions in niche, high-margin sectors.

Teledyne Technologies Incorporated

Teledyne Technologies focuses its strategic positioning on providing advanced imaging, instrumentation, and engineered systems, with its direct energy conversion capabilities often targeting high-reliability, challenging environment applications. The company leverages its deep integration expertise in defense and aerospace, supplying critical components such as specialized image sensors and advanced power management systems. Teledyne's positioning is defined by its ability to deliver fully qualified, mission-ready solutions, moving beyond component sales to system-level integration.

STMicroelectronics

STMicroelectronics is a global semiconductor leader whose competitive advantage in this market lies in its broad portfolio of power management and control integrated circuits (ICs) that are essential for optimizing the performance of conversion devices. The company's strategic focus is on the automotive and industrial segments, providing microcontrollers and power MOSFETs necessary for the efficient operation of electric vehicle battery management systems and solar inverters. Their pervasive presence in the foundational electronics of conversion systems makes them an integral enabler of the market's efficiency gains.

Recent Market Developments

- November 2025: Wolfspeed announced its new 1200V SiC six-pack power modules for high-power inverters. These advanced Gen 4 Silicon Carbide MOSFET modules offer three times the power cycling capability and 15% higher current in a standard footprint. This product launch targets enhanced performance and efficiency for the rapidly growing e-mobility and electric vehicle (EV) propulsion systems market.

- July 2025: Intelligent power management company Eaton signed an agreement to acquire Resilient Power Systems, a developer of solid-state transformer (SST)-based technology. The acquisition is focused on leveraging Resilient's medium-voltage SST solutions for high-power DC applications, specifically for EV charging depots. This move accelerates Eaton's growth in data centers and battery energy storage.

________________________________________________________________

Direct Energy Conversion Device Market Segmentation

- BY DEVICE TYPE

- Battery

- Solar Cells

- Fuel Cells

- Thermoelectric Device

- BY ENERGY TYPE

- Optical

- Kinetic

- Potential

- Others

- BY END-USER INDUSTRY

- Space & Aerospace

- Automotive

- Power & Energy

- Others

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America