Report Overview

AMOLED Display Market Size, Highlights

AMOLED Display Market Size:

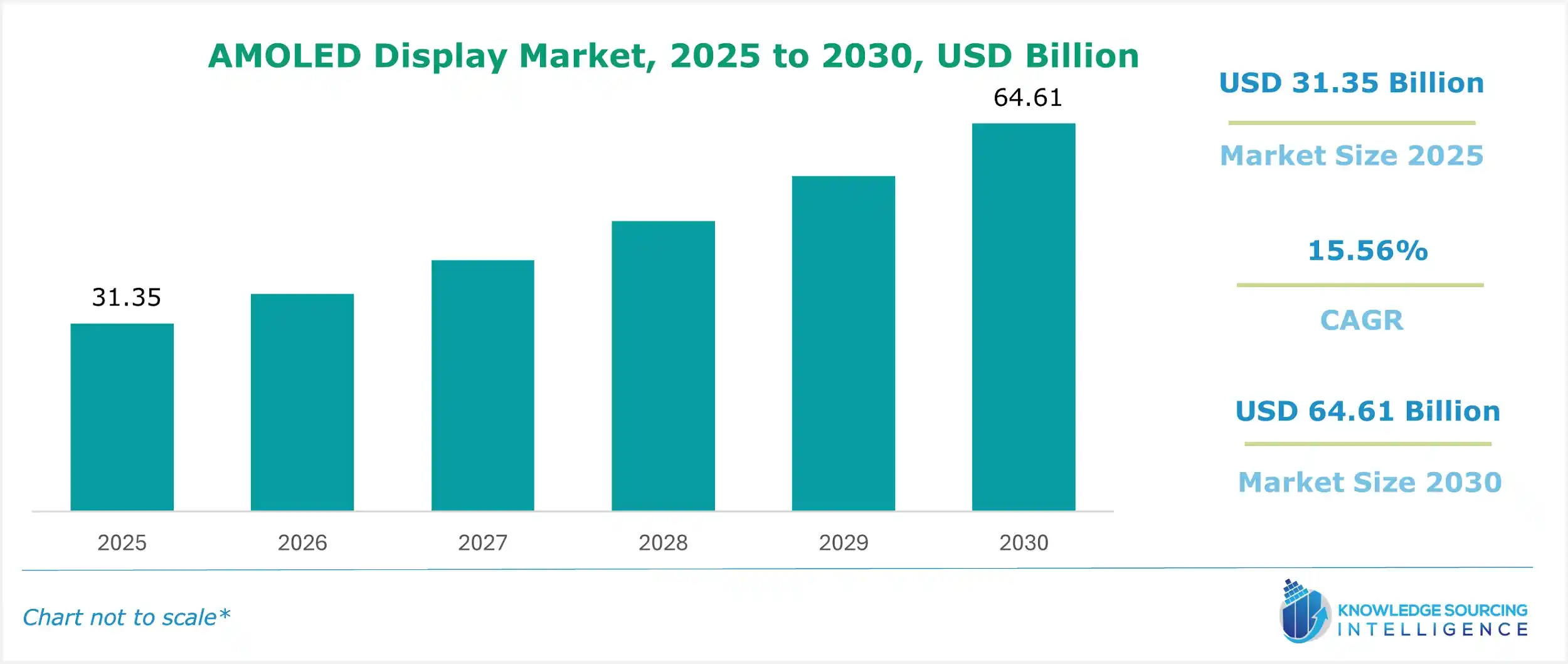

The AMOLED display market will grow at a CAGR of 15.56% to reach US$64.61 billion by 2030, from US$31.35 billion in 2025.

This growth is driven by the increasing demand for high-resolution and brighter displays in consumer electronics.

AMOLED Display Market Trends:

AMOLED technology employs an active-matrix thin-film transistor (TFT) array with storage capacitors, enabling large and high-resolution displays. Unlike LCDs, AMOLEDs do not require backlighting or color filters because they emit their own light, resulting in lower electricity consumption and higher image quality. However, their production costs are higher due to complexity.

Rapid urbanization, rising income levels, and increasing demand for entertainment and leisure are boosting consumer electronics sales worldwide. AMOLED displays offer several advantages over other technologies, including improved picture quality, wider viewing angles, and faster motion response times. These benefits are driving market development, especially in smartphones, where AMOLEDs are widely used by manufacturers like Samsung, Apple, Huawei, Sony, and Xiaomi.

The structural advantages of AMOLED displays, such as being thinner, lighter, and more flexible than LCDs, make them ideal for touchscreens in mobile phones, laptops, and tablets. However, high manufacturing and maintenance costs can restrain market growth.

The North American AMOLED display market is expected to contribute significantly to global revenue due to increasing demand for advanced display technologies. Growing entertainment expenditure is projected to stimulate demand for consumer electronics like televisions and cellphones, further boosting market growth in this region.

AMOLED Display Market Geographical Outlook:

In the Asia Pacific, the market is expected to expand considerably due to the strong presence of manufacturing bases and lower production costs, due to the availability of affordable raw materials and labor. This region's cost advantages are key drivers of its market expansion.

Overall, the AMOLED display market is poised for significant growth, driven by technological advantages and increasing demand for high-quality displays in consumer electronics. Despite challenges like high production costs, ongoing R&D efforts and advancements in technology are expected to further integrate AMOLEDs into various products.

The global AMOLED Display Market report delivers a comprehensive analysis of the industry landscape, offering strategic and executive-level insights supported by data-driven forecasts and thorough analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It explores demand across various applications, including Tablets and PCs, Smartphones, and TVs, while analyzing display types such as Flexible, 3D Displays, and Transparent. The report also examines key end-user segments, including Automotive, Retail, Military, and Others. Additionally, it evaluates technological advancements, critical government policies, regulatory frameworks, and macroeconomic factors, providing a holistic perspective of the market

AMOLED Display Market Segmentation:

AMOLED Display Market Segmentation by application:

The market is analyzed by application into the following:

- Tablets and PCs

- Smartphones

- TVs

AMOLED Display Market Segmentation by display type:

The report analyzes the market by display type as below:

- Flexible

- 3D Displays

- Transparent

AMOLED Display Market Segmentation by end-user industries:

The report analyzes the market by end-user segment as below:

- Automotive

- Retail

- Military

- Others

AMOLED Display Market Segmentation by regions:

The study also analyzed the AMOLED Display Market into the following regions, with country-level forecasts and analysis as below:

AMOLED Display Market Competitive Landscape:

The global AMOLED Display Market features key players such as Dresden Microdisplay, Japan Display Inc., LG Display Co. Ltd., Panasonic Corporation, Samsung Display, Sharp Corp., Sony Corporation, BOE Technology Group Co. Ltd., Innolux Corporation, Novaled GmbH (Samsung SDI Co. Ltd.) others.

AMOLED Display Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different application, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by display type, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-user industries, with historical revenue data and analysis of sales based on applications.

- AMOLED Display Market is also analyzed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario, and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents a complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation of the competitive structure of the market presented through a proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players, and recent major developments undertaken by the companies to gain a competitive edge.

- Research methodology: The assumptions and sources that were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure the most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for the purchase?

- The report provides a strategic outlook of the AMOLED Display Market to the decision-makers, analysts, and other stakeholders in an easy-to-read format for making informed decisions.

- The charts, tables, and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and emails for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports to help cater to additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

AMOLED Display Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AMOLED Display Market Size in 2025 | US$31.35 billion |

| AMOLED Display Market Size in 2030 | US$64.61 billion |

| Growth Rate | CAGR of 15.56% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the AMOLED Display Market |

|

| Customization Scope | Free report customization with purchase |