Report Overview

Disposable Flexible Duodenoscope Market Highlights

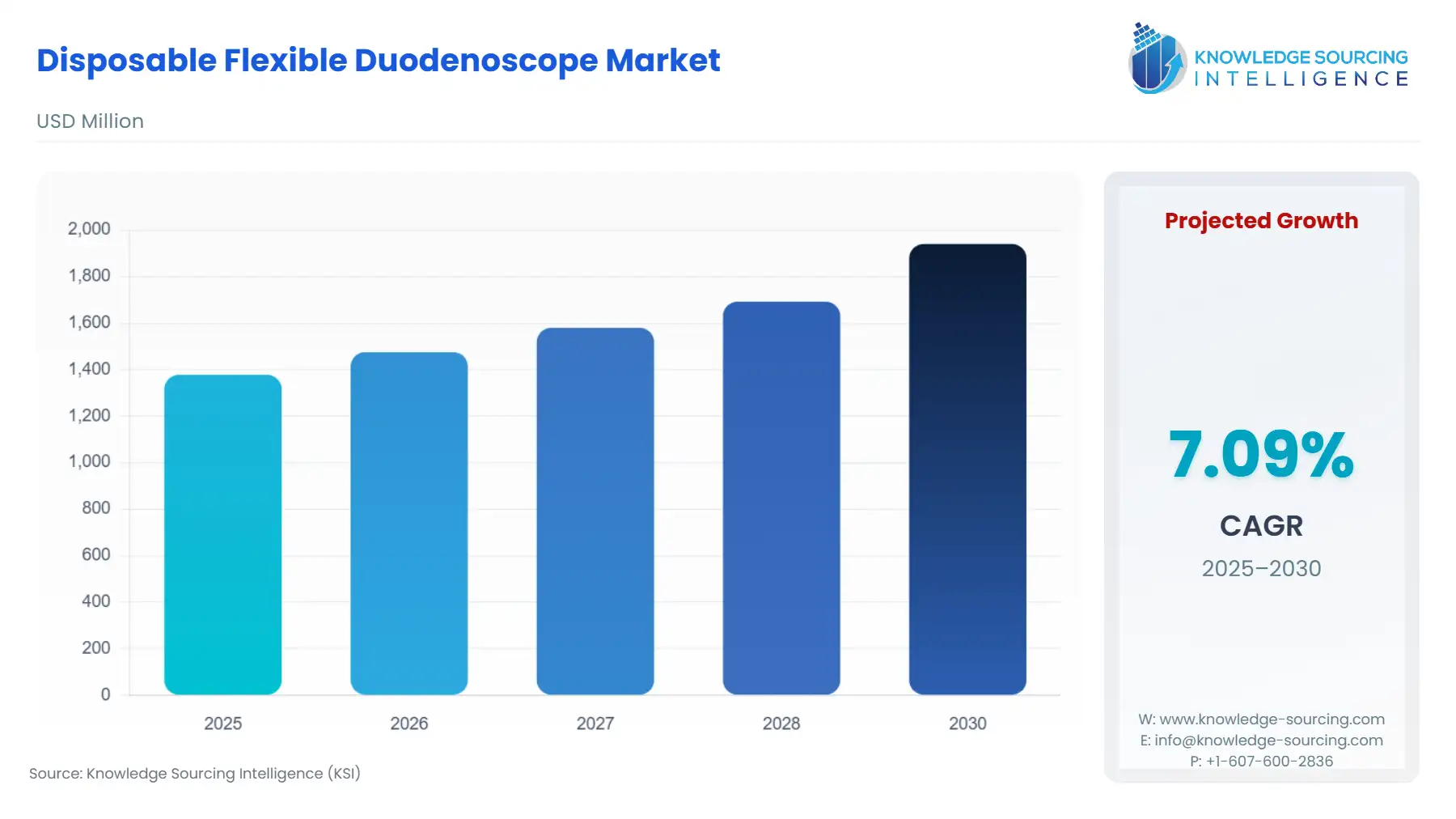

Disposable Flexible Duodenoscope Market Size:

The disposable flexible duodenoscope market is estimated to grow at a CAGR of 7.09%, attaining US$1,940.754 million by 2030, from US$1,377.901 million in 2025.

A duodenoscope is a type of long and flexible endoscope, which is inserted through the mouth. The duodenoscope is mainly used for endoscopic retrograde cholangiopancreatography or ERCP. The disposable and flexible duodenoscope offers sterile application of the duodenoscope and eliminates the use of reprocessing.

The major factor propelling the growth of the global disposable flexible duodenoscope market during the forecasted timeline is the increasing demand for ERCP procedures.

ERCP procedure, or endoscopic retrograde cholangiopancreatography procedure, is a type of diagnostic treatment that combines gastrointestinal endoscopy and X-ray diagnosis. The ERCP procedure offers key benefits in the diagnosis of multiple types of pancreatitis or liver cancer. Similarly, the ongoing advancements in biotechnology and medical technology are expected to significantly boost the global market for disposable flexible duodenoscopes. These technological improvements are anticipated to enhance the development of video duodenoscope solutions, which improve visualization and incorporate high-definition imaging systems. This revision maintains the original meaning while enhancing clarity and flow.

Disposable Flexible Duodenoscope Market Growth Drivers:

- Increasing global cases of pancreatitis

Pancreatitis is a disease in which the pancreas of the patient swells. Pancreatitis is among the most common types of gastrointestinal diseases that prevails among almost every age group of the population. The global cases of pancreatitis witnessed a significant increase, boosting the demand for duodenoscopes during the forecasted timeline. The duodenoscope diagnostic procedure helps medical professionals visualize and analyze the biliary and pancreatic ducts. Similarly, the utilization of single-use or disposable duodenoscopes helps reduce outbreaks, which are associated with the reuse of endoscopes.

The National Library of Medicine, of the US Government, stated that the prevalence and severity of acute pancreatitis in the individual varies widely among the population. The morbidity rate in acute pancreatitis is higher. The agency further stated that the mortality rate of acute pancreatitis in the individual ranges from 3% to 20%, in which the mortality rate of individuals with edematous pancreatitis is as low as 3%, and individual with pancreatitis necrosis is as high as 20% in the nation. Furthermore, the library also stated that about 200,000 hospital admissions in the nation annually are related to acute pancreatitis. In the nation, gallstones contribute to about 30% to 40% of the total cases of acute pancreatitis, whereas alcohol use contributes to 30% of the total cases annually.

- Growing global adult population

The growing global adult population is among the major factors propelling the growth of the disposable flexible duodenoscope market during the forecasted timeline. With the increasing age of the individual, the prevalence of various types of gastrointestinal disorders increases. Various global medical studies and reports stated that the adult population across the globe is more prone to several types of gastrointestinal diseases, which include diseases like pancreatitis and bile duct obstructions.

The global population aged 65 and above witnessed a major increase over the past few years. The World Health Organization, in its forecast report, stated that by 2030, every 1 in 6 individuals residing across the globe will be aged 60 or above. The agency further stated that by 2050, the total population of individuals aged 60 or above is estimated at 2.1 billion. Similarly, the World Bank, in its report, stated that in 2021, the total population aged 65 and above was recorded at 754.681 million, which increased to 778.122 million in 2022, and 804.475 million in 2023.

Disposable Flexible Duodenoscope Market Geographical Outlook:

The North American region is expected to witness major growth in the global disposable flexible duodenoscope market during the forecasted timeline, mainly due to the increasing technological advancement in the biomedical engineering sector. The North American region, especially the USA and Canada, is home to some of the biggest and most advanced research-based companies in the biomedical and biotechnology sector, which increases the investment in research and development of enhanced and more optimum solutions for the sector. Similarly, the increasing governmental initiatives in enhancing the technological development in the healthcare sector are also expected to propel the growth of the disposable flexible duodenoscope market during the estimated time period.

Disposable Flexible Duodenoscope Market Products Offered by Key Companies:

- Ambu Inc. is among the global leaders in the healthcare technology sector, which is among the leading manufacturers of medical devices. The company offers products and solutions for multiple therapeutic areas, which include endoscopy, cardiology, emergency care & training, and airway management & anesthesia, among others. The company also provides products and solutions, which offer its application across operating rooms, ICUs, training centers, emergency medical services, and aid & military organizations. In the global disposable flexible duodenoscope market, the company offers Ambu aScope Duodeno, which helps in the elimination of reprocessing and repair of the equipment.

- Boston Scientific Corporation is an American biotechnology and biomedical engineering provider. The company offers a wide range of products and solutions for healthcare professionals and patients. The company offers various types of biotechnology products, which include accessories, atherectomy systems, baskets, catheters, lasers, BPH, lithotripsy, and CTO systems, among many others. In the global disposable flexible duodenoscope market, the company offers EXALT Model D, a single-use duodenoscope that features a lightweight design with 4-way bending capability. The duodenoscope also features an elevator design, which offers consistent performance and helps in facilitating guidewires. It also offers enhanced image results and is compatible with BSC's single-use endoscope accessories.

- Olympus America Inc., a part of the Olympus Corporation, is a global leader in optical and digital precision technologies for the healthcare sector. The company offers a wide range of products and solutions for multiple medical specialties, which include bariatrics, ENT, anesthesiology, general surgery, pulmonology, and neurosurgery, among others. The products of the company include ultra-HD laparoscopy, an endoscopy system, an automated endoscope reprocessor, surgical energy, and a video microscope, among others. Under the disposable flexible duodenoscope market, the company offers a TJF-Q190V Duodenoscope, which features a single-use distal cover and distal-end flushing adaptor.

Disposable Flexible Duodenoscope Market Key Developments:

- October 2024: BD (Becton, Dickinson and Company) and ten23 health® announced a pilot RFID-enabled identification solution for prefillable syringe and endoscopy workflows, enhancing traceability and procedural safety.

- August 2024: PENTAX Medical received FDA clearance for the DEC™ Duodenoscope's compatibility with STERRAD™ 100NX Sterilizers, pioneering gas plasma sterilization for flexible endoscopes.

- April 2024: Ambu A/S received U.S. FDA 510(k) clearance for its aScope™ Gastro Large, expanding its single-use endoscopy portfolio for high-volume gastrointestinal interventions.

Disposable Flexible Duodenoscope Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Disposable Flexible Duodenoscope Market Size in 2025 | US$1,377.901 million |

| Disposable Flexible Duodenoscope Market Size in 2030 | US$1,940.754 million |

| Growth Rate | CAGR of 7.09% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Disposable Flexible Duodenoscope Market |

|

| Customization Scope | Free report customization with purchase |

Disposable Flexible Duodenoscope Market Segmentation:

- By Product Type

- Single-Use

- Reusable

- By Application

- Diagnostic Procedure

- Therapeutic Procedure

- By End-User

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Isreal

- Others

- Asia Pacific Region

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America