Report Overview

Distributed Energy Resource Market Highlights

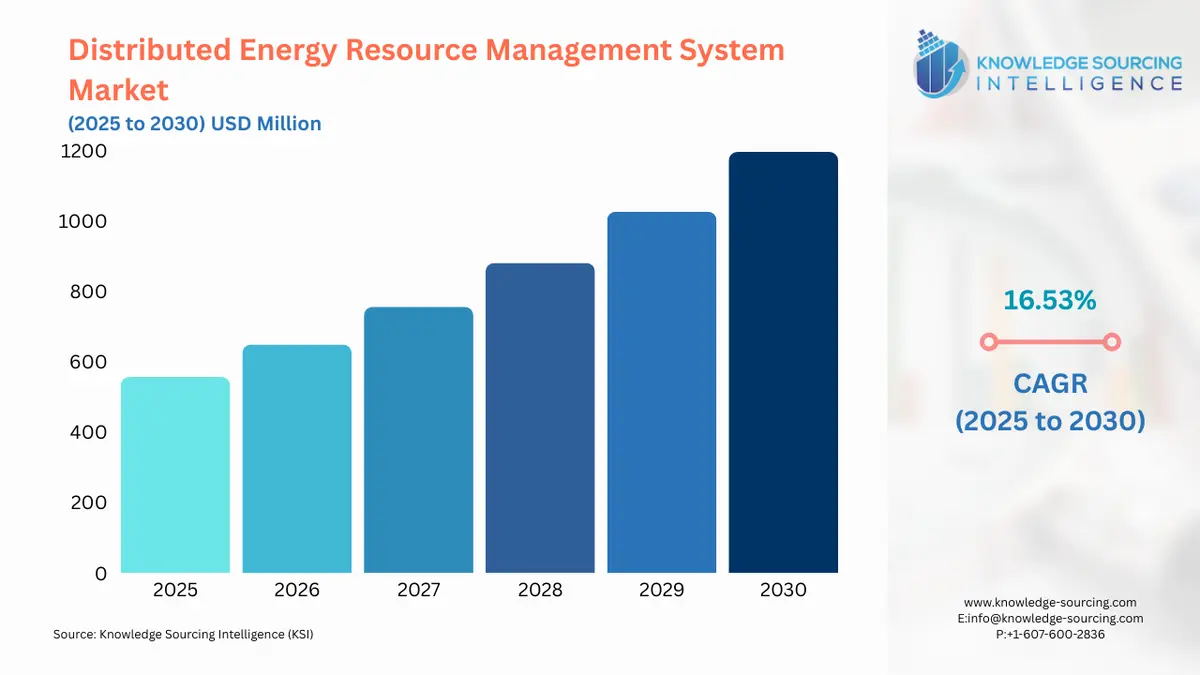

Distributed Energy Resource Market Size:

Distributed Energy Resource Market is forecasted to rise at a 18.84% CAGR, reaching USD 2456.459 million in 2031 from USD 872.149 million in 2025.

Distributed Energy Resource Market Trends:

Distributed Energy Resources (DERs) are compact, interconnected electricity generation or demand resources that are linked to the broader electric grid situated near load centers for efficiency, these power-producing entities can function independently or cumulatively, thereby enhancing the grid's value and stability. Distributed energy resources encompass various types, including solar panels, small wind farms, generators, and battery storage systems. The burgeoning trend of power generation decentralization, alongside the escalating demand for electricity and the cost-effectiveness of distributed energy resources, collectively serve as pivotal drivers propelling the growth of the distributed energy resource industry.

Distributed Energy Resource Market Segmentation Analysis:

Emerging power generation decentralization bolsters the distributed energy resource market growth.

Distributed energy resources are instrumental in the decentralization of power generation due to their inherent design of localized energy production. Distributed energy resources, being small-scale and located close to load centers, provide energy directly to the immediate vicinity, bypassing the need for complex, large-scale grid infrastructure. This decentralization process is gaining momentum worldwide, primarily driven by governmental initiatives and promotions. For instance, in February 2022, the Ministry of New and Renewable Energy unveiled a framework dedicated to promoting decentralized renewable energy (DRE) livelihood applications. This framework aimed to foster a conducive ecosystem that facilitates expansive access to DRE, thereby accelerating its adoption and use.

Rising electricity demand boosts distributed energy resource market size.

Distributed energy resources play a pivotal role in meeting growing electricity demand due to their capability to generate power locally and supply it directly to the end-users. The increased electrification of various sectors, rapid urbanization, population growth, and digitalization has accelerated electricity demand, and distributed energy resources offer an efficient solution to meet this surge. According to the U.S. Energy Information Administration, in 2021, the U.S generated 4,109.70 billion kilowatt-hours of electricity, which experienced a rise of 3.2% in 2022, amounting to a total of 4,243.14 billion kilowatt-hours.

Cost-effectiveness drives the distributed energy resource market.

The declining costs of distributed energy resources technologies, especially solar and wind, are major catalysts driving the remarkable growth of the distributed energy resource industry. Due to the upfront investment for installing solar panels and wind turbines becoming more affordable, a broader range of consumers and businesses are considering adopting distributed energy resources to generate clean and renewable energy on-site. The cost-effectiveness of these technologies positions DERs as competitive alternatives to conventional energy sources, fostering a sustainable energy landscape and reducing carbon emissions. For instance, in 2021, the cost of electricity generated from onshore wind decreased by 15%, offshore wind by 13%, and solar photovoltaic (PV) systems by 13% in comparison to the costs observed in 2020.

Distributed Energy Resource Market Geographical Outlook:

Asia-Pacific is projected to dominate the distributed energy resource market.

Asia Pacific will hold a significant share of the market due to proactive government initiatives and substantial investments in renewable energy. Hence major APAC economies are rolling out favourable policies, providing financial incentives, and implementing ambitious renewable energy targets, which are fuelling the proliferation of distributed energy resources. For instance, in February 2023, the Indian government unveiled a substantial investment of $4.3 billion in the clean energy sector, reinforcing the country's commitment to renewable energy sources. Also, in 2022, China made a substantial investment of $546 billion in the clean energy sector. The hefty investment was allocated across multiple areas including solar and wind energy, as well as electric vehicles and battery technologies.

Distributed Energy Resource Market Growth Drivers:

Intermittent nature may restrain the distributed energy resources market.

Certain renewable energy sources integral to the distributed energy resource market, notably solar and wind, inherently possess an intermittent and variable nature. Their energy production is inherently tied to weather conditions like sunlight for solar panels and wind for turbines. This means that their output is not constant and fluctuates based on time of day, season, and weather patterns, leading to periods of overproduction or underproduction. This unpredictability can pose significant challenges in managing and maintaining the stability and reliability of the energy grid, as it necessitates sophisticated balancing of energy supply and demand. Consequently, this aspect can potentially restrain the growth of the distributed energy resource market,

Distributed Energy Resource Market Company Products:

Distributed Energy Solution: General Electric's Distributed Energy solutions present an array of benefits. They offer a reduction in operational costs and an enhancement in power reliability, which are vital for efficient and uninterrupted energy consumption. Additionally, they support the electrification of transportation, providing a more sustainable alternative to conventional fuels. Importantly, these solutions contribute to reducing carbon footprints, aligning with global efforts to combat climate change and promote a greener future.

List of Top Distributed Energy Resource Companies:

General Electric

Siemens

Black & Veatch Holding Company

ABB Ltd.

Spirae LLC

Distributed Energy Resource Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Distributed Energy Resource Market Size in 2025 | USD 872.149 million |

Distributed Energy Resource Market Size in 2030 | USD 2,117.914 million |

Growth Rate | CAGR of 19.42% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Distributed Energy Resource Market |

|

Customization Scope | Free report customization with purchase |

Distributed Energy Resource Market Segmentation

By Type

Solar Panel

Small Wind Farms

Generators

Battery Storage System

Others

By Technology

Solar Photovoltaic (PV)

Electric Vehicles

Microgrids

Others

By End-User

Residential

Commercial

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others