Report Overview

Duchenne Muscular Dystrophy (DMD) Highlights

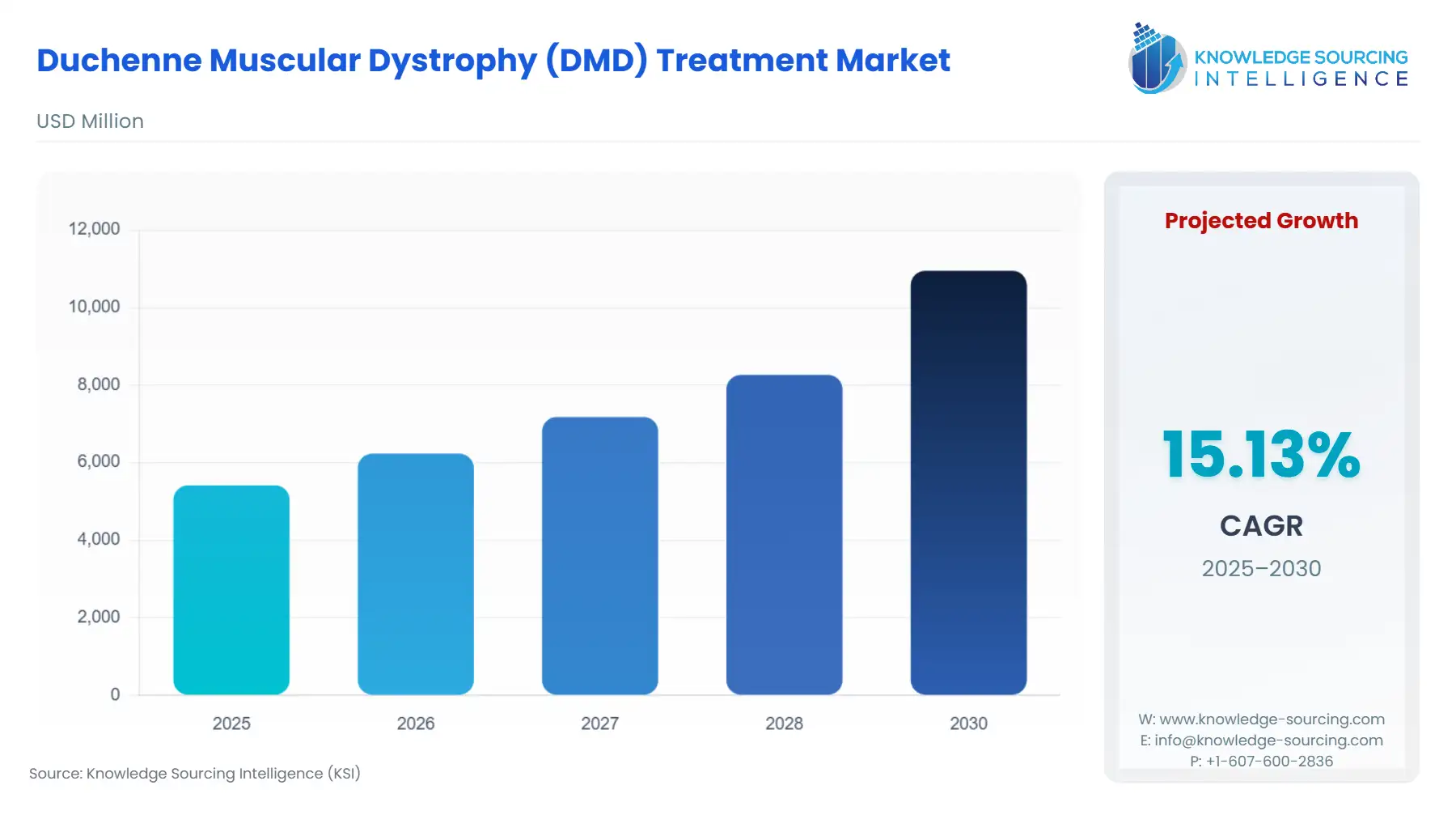

The Duchenne muscular dystrophy (DMD) treatment market is expected to grow from US$5,415.322 million in 2025 to US$10,954.230 million in 2030, at a CAGR of 15.13%.

Duchenne Muscular Dystrophy (DMD) Treatment Market Key Highlights

The Duchenne Muscular Dystrophy (DMD) treatment market is at a critical juncture, transitioning from a regimen focused primarily on palliative and supportive care, dominated by corticosteroids, to an era of precision genetic medicine. This shift is redefining the addressable patient population and imposing novel complexities on global payer systems. DMD, a rare X-linked neuromuscular disorder, presents a catastrophic disease burden, which has historically driven significant investment into complex biological and genetic interventions designed to address the underlying dystrophin deficiency.

The influx of advanced therapeutic modalities, including gene therapies and antisense oligonucleotides, is the core driver of market velocity, but it simultaneously introduces significant access and regulatory hurdles, fundamentally changing the dynamics of commercial demand. The market’s future is intrinsically tied to the ability of these advanced treatments to demonstrate long-term functional clinical benefit and the willingness of national health systems to finance their ultra-high price points.

________________________________________

Duchenne Muscular Dystrophy (DMD) Treatment Market Analysis

Growth Drivers

The primary factor propelling growth is the emergence of precision genetic and molecular therapies. The regulatory approval of products like Sarepta's Elevidys and various exon-skipping oligonucleotides transforms DMD from an unmitigated progressive disease to a potentially modifiable condition, fueling urgent patient and clinician demand for treatments targeting the root cause. Concurrently, the increasing adoption of routine Molecular Genetic Testing directly catalyzes therapeutic demand. By accurately identifying the specific DMD gene mutation (e.g., exon 51 deletion), testing qualifies a specific cohort for mutation-specific therapies, thereby converting clinical incidence into realized therapeutic demand for a narrow set of precision drugs. Furthermore, the supportive regulatory framework, notably the FDA's Rare Pediatric Disease Priority Review Voucher program, increases the incentive for manufacturers, accelerating the development pipeline and increasing the availability of approved products that meet unmet patient needs.

Challenges and Opportunities

A significant challenge constraining growth is the extraordinary cost of new gene therapies, which creates market access fragmentation and payer resistance. While clinical demand is high, the realization of commercial demand is subject to complex and protracted negotiations with national Health Technology Assessment (HTA) bodies and private insurers globally, particularly in Europe. This payment barrier restricts uptake. Conversely, the primary opportunity lies in the shift toward non-mutation-specific treatments. The approval of therapies like Italfarmaco's Duvyzat, an HDAC inhibitor, offers a viable, oral treatment option for a broader patient population (age ≥ 6), irrespective of the specific DMD gene mutation. This broad-spectrum approach expands the addressable market beyond the exon-skipping subset, creating a new, substantial demand pool for non-corticosteroid, disease-modifying oral medication.

Supply Chain Analysis

The supply chain for advanced DMD treatments is characterized by extreme complexity, high dependence on specialized Contract Development and Manufacturing Organizations (CDMOs), and strict cold chain requirements. Production hubs are concentrated in North America and Europe, largely dictated by the location of specialized viral vector manufacturing facilities necessary for Adeno-associated Virus (AAV) gene therapies. The logistical complexity is paramount, requiring highly controlled, unbroken -60°C to -80°C storage and delivery of a single-dose, patient-specific (or quasi-patient-specific) biologic product. This dependence on a limited number of high-grade Good Manufacturing Practice (GMP) facilities for viral vector production creates critical vulnerabilities and dependency on highly specialized logistics providers, leading to a restricted, high-cost, and capacity-constrained supply chain that struggles to scale rapidly enough to meet global demand surges post-approval.

Government Regulations

Key regulatory frameworks directly shape the commercial landscape by mitigating financial risk for developers and accelerating product availability, directly impacting demand by bringing new options to market sooner.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | FDA Orphan Drug Act (ODA) | Grants seven years of market exclusivity post-approval, significantly increasing potential return on investment. This incentive directly catalyzes research and development (R&D) investment in DMD, propelling new product demand. |

| European Union | European Medicines Agency (EMA) / Orphan Drug Regulation (ODR) | Provides 10 years of market exclusivity and protocol assistance. This harmonized regulatory pathway streamlines development across member states, facilitating simultaneous product launches and broadening market access more rapidly than country-by-country approvals. |

| Japan | Ministry of Health, Labour and Welfare (MHLW) / Orphan Drug Designation | Offers priority review and subsidy programs for clinical trials. This accelerates the timeline for therapeutic access in the Asia-Pacific region, increasing demand by making approved therapies available to the second-largest rare disease market sooner. |

________________________________________

In-Depth Segment Analysis

By Treatment: Steroids

Steroids, particularly Deflazacort, remain the foundational pillar of DMD management, establishing the standard of care for slowing disease progression and preserving motor and respiratory function. The need for Steroids is universal across the patient population, irrespective of genetic mutation, anchoring this segment as the largest by volume. However, the demand model is shifting from first-generation corticosteroids, which carry significant long-term side effects like weight gain, growth suppression, and bone fragility, toward newer, differentiated steroid therapies. The market is now experiencing demand for products like Agamree (vamorolone), a dissociated steroid with a potentially modified side-effect profile. This sub-segment is primarily driven by the imperative to improve quality of life and mitigate the long-term adverse events associated with continuous corticosteroid use, compelling physicians to switch to novel steroid-derived options that offer comparable efficacy with perceived safety advantages. This is a demand substitution effect, where the market is trading volume for value in the steroid category itself. The stability of this segment is also bolstered by the requirement to use steroids as an immunosuppressive regimen alongside advanced gene therapies, ensuring their continued, non-negotiable role in combination treatment protocols.

By Tests: Molecular Genetic Testing

The Molecular Genetic Testing segment serves as the critical gatekeeper for the high-value precision medicine market. The need for high-resolution genetic diagnosis (e.g., Multiplex Ligation-Dependent Probe Amplification (MLPA) followed by sequencing) is not standalone but is a prerequisite, directly and inextricably linked to therapeutic demand. The availability of mutation-specific drugs—such as the Exon 51 skipping drugs for ~13% of the patient population—means a confirmed genetic diagnosis of a specific mutation must precede prescription. Therefore, every successful drug approval that targets a distinct genetic mutation creates a compulsory demand for the corresponding diagnostic test. Furthermore, the push for newborn screening and earlier diagnosis to maximize the benefit window for therapies like gene therapy, which are most effective before significant muscle loss, is a powerful driver. Advocacy groups and clinical guidelines increasingly stress early genetic confirmation, driving demand for testing methodologies that are fast, comprehensive, and can delineate the exact deletion, duplication, or point mutation, thus defining the precise eligible patient pool for manufacturers.

________________________________________

Geographical Analysis

- US Market Analysis (North America): The US market is characterized by rapid adoption of novel, high-cost therapies, primarily due to the regulatory flexibility of the FDA's Accelerated Approval pathway and a commercial payer system that often grants access with fewer HTA restrictions than European counterparts. The presence of major biotechnology and pharmaceutical companies, such as Sarepta Therapeutics, further concentrates R&D investment and product launches in this region. High commercial demand is driven by a culture of patient advocacy and a system that permits premium pricing, though payer coverage decisions and state-level Medicaid variations introduce volatility and restrict uniform access across the entire patient population. The market demonstrates high price elasticity for transformative, one-time treatments.

- Brazil Market Analysis (South America): Brazil's market is constrained by public health budget limitations, despite the significant disease incidence inherent in its large population. The need for advanced therapies is predominantly driven by judicial action, wherein individual patients or families petition the court for access and mandatory reimbursement for unlisted, high-cost orphan drugs. This litigation-driven demand creates an unpredictable but significant procurement channel. The local market for established, lower-cost therapies like corticosteroids is stable, and the demand for new drugs is governed by the time-intensive processes of the National Health Surveillance Agency (ANVISA) and the necessity for subsequent price negotiation and inclusion on the public reimbursement list.

- Germany Market Analysis (Europe): The German market demonstrates strong, centralized demand for approved DMD treatments, underpinned by a robust statutory health insurance (SHI) system. However, market access for innovative, high-priced therapies is rigorously scrutinized by the Gemeinsamer Bundesausschuss (G-BA) for added therapeutic benefit. While regulatory approval is streamlined through the EMA, realized commercial demand hinges on the initial assessment period and subsequent price negotiations. This necessity is highly sensitive to the G-BA's benefit rating; a failure to demonstrate significant added benefit can severely restrict the negotiated price and limit market uptake, establishing a model where clinical evidence is the primary lever for commercial success.

- Saudi Arabia Market Analysis (Middle East & Africa): The Saudi Arabian market is largely government-funded, driven by specialized centers of excellence and an increasing focus on rare disease management within Vision 2030 initiatives. The market for high-cost orphan drugs, particularly gene therapy, is characterized by direct state procurement through specialized programs. Market is concentrated within a few major medical cities and is influenced by international expert recommendations. The constraint is the relatively small patient population and the dependency on foreign regulatory bodies (FDA, EMA) for initial validation before products are integrated into the national formulary and subsequently purchased to meet patient needs.

- Japan Market Analysis (Asia-Pacific): The Japanese market is a critical launch point for new DMD therapies, driven by proactive regulatory engagement from the Pharmaceutical and Medical Devices Agency (PMDA) and a relatively stable reimbursement system. The need for both exon-skipping and gene therapies is strong, exemplified by the 2025 approval of Sarepta's Elevidys. The regulatory designation of DMD as an intractable disease facilitates expedited review and guaranteed reimbursement. This environment fosters significant need for therapies that specifically target the local population’s genetic mutation distribution, creating a unique, demand-pull dynamic for regionally focused innovation.

________________________________________

Competitive Environment and Analysis

The competitive landscape of the DMD treatment market is an oligopoly dominated by companies pioneering advanced genetic and molecular mechanisms, with their strategic positioning centered on capturing a specific genetic subset of the patient population. Competition is focused on two key axes: the therapeutic mechanism (exon-skipping vs. gene therapy vs. small molecule) and the breadth of the treatable patient population (mutation-specific vs. mutation-agnostic).

Sarepta Therapeutics, Inc. maintains a high-innovation, first-mover strategic positioning, dominating the exon-skipping segment with four FDA-approved products: Exondys 51 (eteplirsen), Vyondys 53 (golodirsen), Amondys 45 (casimersen), and the gene therapy, Elevidys (delandistrogene moxeparvovec). The company’s strategy centers on precision medicine, using its foundational exon-skipping technology to address specific patient mutations. The expansion of Elevidys’ FDA approval to non-ambulatory individuals aged four and older strategically broadened its addressable market and cemented its early control over the high-value, single-dose gene therapy segment, despite the inherent competitive risk associated with post-marketing safety data.

ITALFARMACO S.p.A. has established a disruptive competitive position with its product, Duvyzat (givinostat), which received FDA approval in 2024. Duvyzat’s strategy is mutation-agnostic, targeting DMD through a histone deacetylase (HDAC) enzyme inhibition mechanism. This positioning bypasses the diagnostic bottleneck of mutation-specific therapies, offering an oral, non-corticosteroid treatment option for a potentially broader subset of patients (age ≥ 6). This approach presents a direct challenge to the traditional corticosteroid standard of care by offering a disease-modifying alternative and capturing demand from the entire non-ambulatory and older ambulatory population, regardless of their specific genetic defect.

________________________________________

Recent Market Developments

- November 2025: Sarepta Therapeutics received FDA approval for updated prescribing information for Elevidys (delandistrogene moxeparvovec). The updated label includes a boxed warning concerning the risk of acute liver failure and injury following treatment. This safety update mandates enhanced prescriber guidance, including a modified oral corticosteroid regimen before and after infusion, and weekly monitoring of liver function for three months post-treatment. This development, while primarily a safety-driven regulatory action, directly impacts commercial uptake by imposing a more stringent monitoring requirement and potentially constrains demand to only the most carefully selected ambulatory patient cohorts.

- June 2024: The U.S. FDA expanded the approval of Elevidys (delandistrogene moxeparvovec-rokl), the company’s AAV-based gene therapy. The action granted traditional approval for ambulatory individuals four years of age and older and accelerated approval for non-ambulatory individuals four years of age and older with a confirmed mutation in the DMD gene. This expansion, based on evaluation of data from clinical studies, significantly broadened the accessible patient population, instantly driving realized demand for the product across a wider age and functional range than its initial June 2023 approval.

- March 2024: The FDA approved Duvyzat, a histone deacetylase (HDAC) inhibitor, for the treatment of Duchenne Muscular Dystrophy in patients aged six years and older. This approval marked the market entry of a new, non-steroidal, oral, non-mutation-specific therapeutic class. The event immediately created a new and independent demand stream for a disease-modifying oral option, offering a crucial alternative to both traditional corticosteroids and highly-targeted genetic approaches.

Duchenne Muscular Dystrophy (DMD) Treatment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Duchenne Muscular Dystrophy (DMD) Treatment Market Size in 2025 | US$5,415.322 million |

| Duchenne Muscular Dystrophy (DMD) Treatment Market Size in 2030 | US$10,954.230 million |

| Growth Rate | CAGR of 15.13% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Duchenne Muscular Dystrophy (DMD) Treatment Market |

|

| Customization Scope | Free report customization with purchase |

Duchenne Muscular Dystrophy (DMD) Treatment Market Segmentation

- By Tests

- Blood Test

- Molecular Genetic Testing

- Electromyography

- Muscle Biopsy

- By Treatment

- Physical Therapy

- Orthopedic Devices

- Steroids

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America