Report Overview

Electric Vehicle Power Inverter Highlights

Electric Vehicle Power Inverter Market Size:

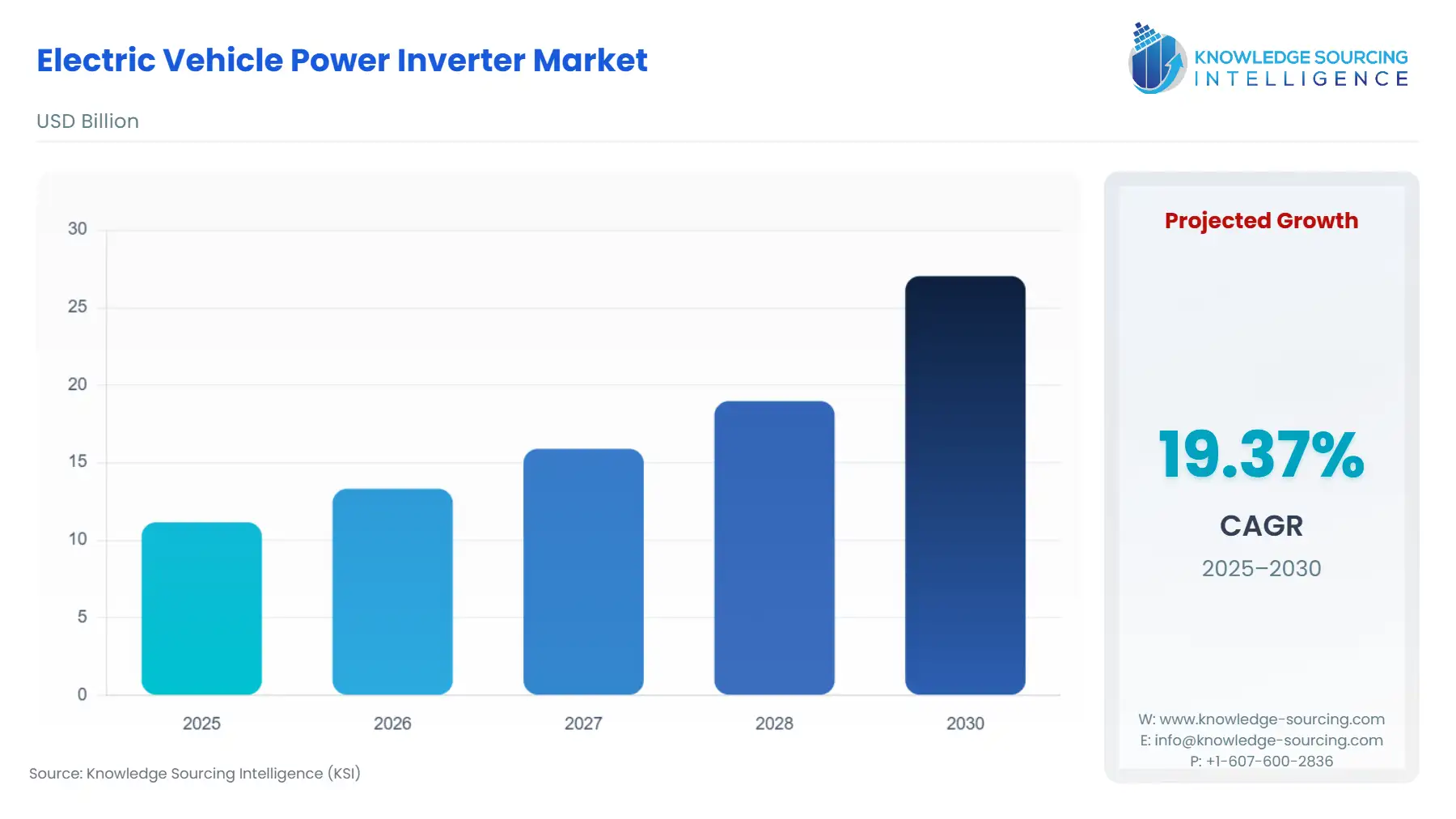

The electric vehicle power inverter market will grow from USD 11.155 billion in 2025 to USD 27.037 billion in 2030 at a CAGR of 19.37%.

Electric Vehicle Power Inverter Market Trends:

The global electric vehicle (EV) power inverter market is poised for significant growth, driven by the rising adoption of electric vehicles worldwide. As EV production scales to meet increasing demand, power inverters—essential components that convert DC electricity from batteries to AC for electric motors—are seeing heightened demand. According to recent analyses, the market is expected to expand in tandem with the global surge in EV sales, fueled by consumer demand for sustainable transportation and supportive government policies.

Among propulsion types, hybrid electric vehicles (HEVs) are projected to dominate the EV power inverter market share due to their widespread adoption and versatility in combining internal combustion engines with electric powertrains. In the vehicle type segment, passenger vehicles are anticipated to experience the fastest growth, driven by increasing consumer preference for electric cars and advancements in battery technology that enhance range and affordability.

Within the inverter type segment, traction inverters are expected to outpace soft-switching inverters in growth. Traction inverters are critical for delivering efficient power to EV motors, supporting the performance demands of modern electric vehicles. Meanwhile, the original equipment manufacturer (OEM) distribution channel is forecasted to see substantial growth, aligning with the global increase in EV production as automakers integrate inverters directly into new vehicle models.

Government initiatives play a pivotal role in this market’s expansion. Policies promoting low-emission vehicles, including subsidies, tax incentives, and investments in EV manufacturing and charging infrastructure, are accelerating market growth. Countries like China, the U.S., and those in the European Union are leading with aggressive EV adoption targets and funding for technological advancements.

However, challenges persist. The slow development of public charging infrastructure remains a significant constraint, potentially limiting EV adoption in regions with inadequate networks. This could indirectly impact the demand for power inverters, as EV production is closely tied to consumer confidence in charging accessibility. Despite this, innovations in inverter efficiency and cost reduction are expected to mitigate some limitations, supporting sustained market growth.

The global EV power inverter market is set to thrive, driven by rising EV demand, supportive policies, and technological advancements, though infrastructure challenges may temper the pace of expansion in certain regions.

Electric Vehicle Power Inverter Market Growth Drivers:

The global market is witnessing an increase in the uptake of EVs.

Several factors have led to people adopting EVs instead of petrol engines in recent years. These include the cheaper operating costs of EVs compared to internal combustion engines, the introduction of tough government policies that would help in reducing pollution and less exhaust emissions, among other factors, which in turn creates a huge demand for EV power inverters.

For instance, EV sales have increased due to market growth in China, the USA, and Europe. According to the global EV outlook report by the International Energy Agency, China managed to sell over 6 million EVs in 2022, while over 2.7 million and 1 million EVs were sold in Europe and the USA, respectively, in the same year. The total sales of EVs in China were approximately 8.1 million, while sales in Europe amounted to roughly 3.2 million and in the USA to 1.4 million, as of 2023. An increase in the demand for EVs globally will lead to a great increase in the demand for EV power inverters.

Rising government support for the establishment of the EV industry.

Governments' growing investments and expenditures across industries, particularly in the electric mobility sector, are projected to have a positive outlook on the EV power inverter market growth. The EV segment is one of the growing automotive sectors in the world. Following this, the Office of Manufacturing and Supply Chains offered its Domestic Manufacturing Conversion Grants in January 2024, increasing the country’s demand for EVs. The US Department of Energy also announced a new agenda called Investing in America, which is expected to ease the growth of EV production and assembly in the country.

Electric Vehicle Power Inverter Market Restraints:

Insufficient EV infrastructure hinders market growth.

A charging infrastructure for EVs is required before countries can have many EVs. Despite the existence of EV charging infrastructure, there is still a lack of it. The availability of charging stations is a limiting factor in the electric car business. For example, in the US, the growth in the adoption of EVs has seen a large increase. The total sales of EVs in China were, however, increasing at a slow pace. According to the report by the Department of Energy of the United States, the number of in-use EV charging ports in the state was roughly 151,273 and grew to about 184,098 ports. The department also reported that in the first quarter of 2023, there was an increase of around 3.2% in the number of EV charging ports in the country and about a 4% growth rate in the number of ports in the second quarter of 2023.

Similarly, the Ministry of Heavy Industries of the Government of India, in its press release in February 2024, informed that the country has more than 12,146 functional public EV charging stations spread across various locations of the country, which lags mostly because of the total EVs in the country. EVs imported into the country are more than the charging stations present to support them.

Electric Vehicle Power Inverter Market Geographical Outlook:

Asia Pacific is anticipated to have a considerable share of the electric vehicle power inverter market.

Asia-Pacific is at the forefront of the EV power inverter market. In China, the demand for EVs is growing rapidly to meet the emission reduction targets set by global standards, coupled with the rise of urbanization.

Meanwhile, in India, which is suppressed by traditional internal combustion technologies, the government has taken several steps to promote the production and adoption of EVs. Automakers are developing new technologies and ramping up production to satisfy the need created by the increase in the sale of EVs in India. For instance, in May 2022, the Toyota Group invested INR 48 billion (USD 624 million) in India to manufacture EV components. In addition, Maruti Suzuki's parent firm, Suzuki Motor, in March 2022, confirmed investments of INR 10,440 crore in India for the construction of a manufacturing plant for EVs and their batteries.

Electric Vehicle Power Inverter Market Key Players and Products:

Toyota Industries Corporation is a Japanese conglomerate that provides services and produces goods in numerous markets, including material handling, automotive, and textile machinery, among others. In the EV power inverter market, the company provides a 2400W DC-AC inverter as well as a 1500W DC-AC inverter.

Vitesco Technologies is a leading provider of sustainable mobility solutions globally, addressing different sectors such as electrification and combustion, powertrain, etc. High Voltage Axle Drive, High Voltage Battery Management System, High Voltage Battery Junction Box, High Voltage DC/DC Converter, and others are some of the products included in the company’s product portfolio. In the EV power inverter segment, the company provides high-voltage inverters.

Electric Vehicle Power Inverter Market Key Developments:

In May 2024, ABB Motion, a global leader in designing and manufacturing electric motors and drives, announced the introduction of its innovative high-performance motor package and inverter designed for e-bus applications. This inverter has a 3-level inverter specifically for the buses to enhance their lifespan, thereby increasing the efficiency gains.

In January 2024, the Stellantis group, one of the largest vehicle manufacturers globally, launched its new BEV-dedicated STLA Large platform with an operational range of 800km. The STLA Large, built and designed for BEVs, has applications with a motor, a power inverter, and a gear reduction assembly.

List of Top Electric Vehicle Power Inverter Companies:

Vitesco Technologies

Robert Bosch GMBH

DENSO Corporation

Toyota Industries Corporation

Hitachi Astemo Ltd

Electric Vehicle Power Inverter Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 11.155 billion |

| Total Market Size in 2028 | USD 27.037 billion |

| Forecast Unit | Billion |

| Growth Rate | 19.37% |

| Study Period | 2020 to 2028 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2028 |

| Segmentation | Propulsion Type, Vehicle Type, Inverter Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electric Vehicle Power Inverter Market Segmentation:

By Propulsion Type

Hybrid Vehicle

Plug-in Hybrid Vehicle

Battery Electric Vehicle

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

By Inverter Type

Traction Inverter

Soft Switching Inverter

By Distribution Channel

OEM

Aftermarket

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Thailand

Others