Report Overview

Automotive Traction Inverter Market Highlights

Automotive Traction Inverter Market Size:

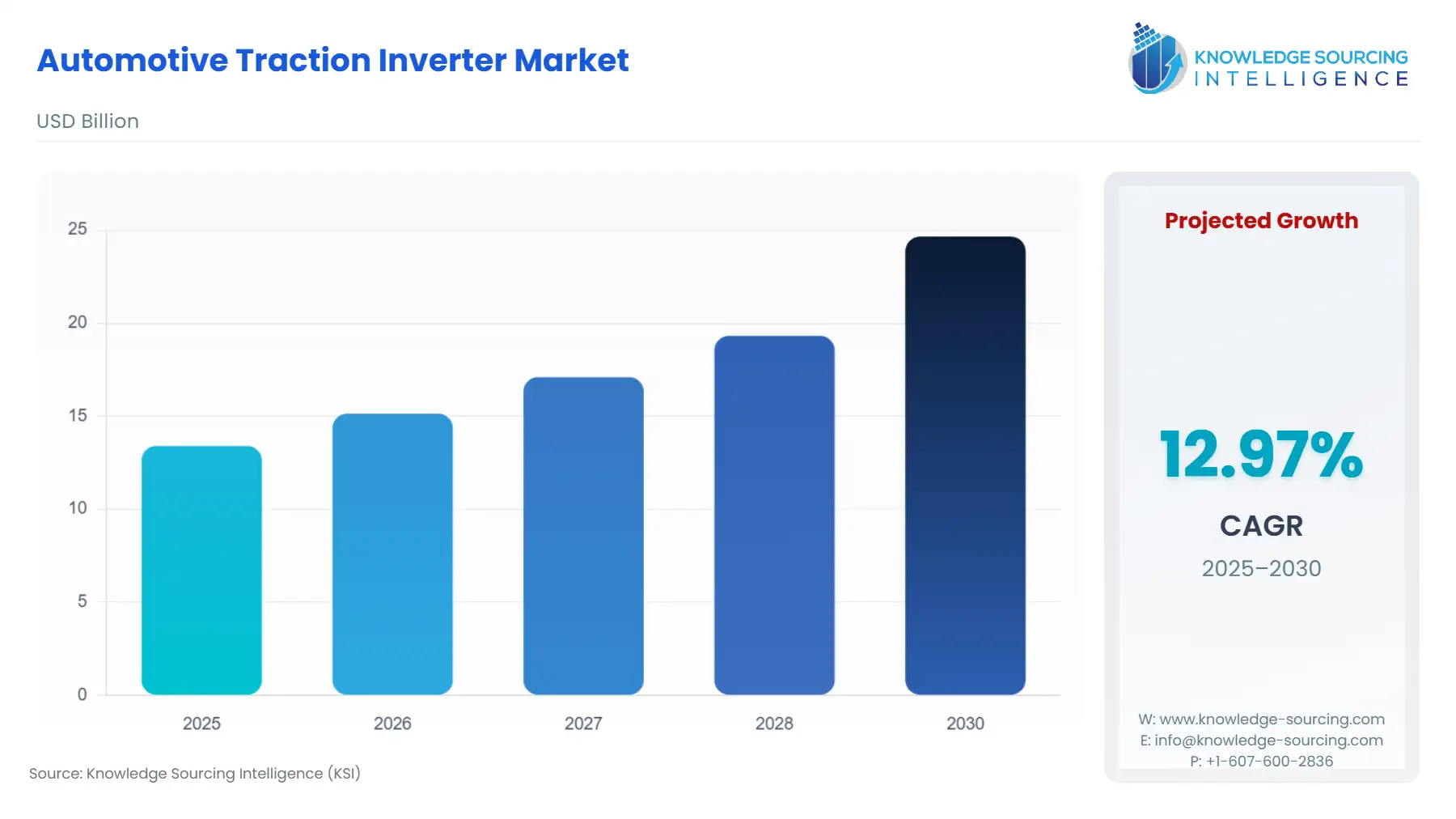

Automotive Traction Inverter Market is projected to expand at a 12.58% CAGR, attaining USD 27.277 billion in 2031 from USD 13.397 billion in 2025.

Automotive Traction Inverter Market Trends:

The automotive traction inverter market is witnessing growth as the inverter performs a similar function in an electric vehicle (EV) or a hybrid electric vehicle (HEV), converting electricity from a Direct Current (DC) source of power to Alternating Current (AC), which then powers up a device or appliance. Through an electronic switch, which is primarily a collection of semiconductor transistors, the primary winding of a transformer that houses an inverter receives the DC power from a hybrid electric vehicle battery. The electrical charge enters the primary winding of the transformer, reverses direction, and flows back out, producing AC current in the secondary winding circuit.

Automotive Traction Inverter Market Growth Drivers:

Increasing use of lithium-ion batteries

The increased demand for lithium-ion batteries is anticipated to lead to growth in the automotive traction inverter market size. The majority of electric and plug-in hybrid vehicles use lithium-ion batteries. In 2020, there was a 33% rise in vehicle lithium-ion battery output. Additionally, a number of technological advancements, especially SiC and GaN WBG devices, support market expansion. Due to its accessibility, effectiveness, and short-circuit capacity, the Si-IGBT is preferred throughout the automobile industry. Additionally, with regard to the increased production of electric cars, the strict regulatory reforms supported by the government and market stakeholders offer the profitable potential for growing traction inverter demand.

Rising use of advanced semiconductors

The automotive traction inverters market has seen a significant trend toward an increase in the use of sophisticated semiconductors. Electric car makers are continually working on cutting-edge technology to improve the performance of electric vehicles, such as extending the distance driven on a single charge and cutting down on charging time, without adding to the weight of the vehicle. Many automakers employ silicon carbide (SiC) and gallium nitride (GaN) semiconductors for this purpose since they have high switching frequencies and operating temperatures, and shorten the time required to charge high-voltage batteries. Therefore, a market trend is the employment of modern semiconductors to satisfy high-efficiency requirements in automobile traction inverters.

Increasing investment

In recent years, there has been a rise in investment in the development of electric vehicles. The sale of electric vehicles is increasing because of government initiatives that assist them. Additionally, OEMs are making significant investments in R&D efforts in light of the anticipated increase in demand for electric vehicles over the next ten years. In 2020, two new Silicon Carbide (SiC) inverters from Karma Automotive will improve the charging of electric vehicles. It is possible to adapt this 400V system to work with different car platforms and 800V power levels in order to take advantage of higher voltage for quick charging.

Increased demand for electric vehicles

The primary driver of growth for the automotive traction inverters market size is the rising production and sales of EVs. Governments throughout the world are pressuring automakers to produce more electric vehicles in general. Additionally, governments in many nations are offering subsidies and incentives to EV producers and customers with the intention of replacing the nation's entire fleet of conventional vehicles with these vehicles in the future years, which, in turn, fuels the market's expansion. For instance, according to the yearly Global Electric Vehicle Outlook of 2022, sales of electric cars rose in 2021 to a new record of 6.6 million.

Automotive Traction Inverter Market Geographical Outlook:

North America is projected to have the highest share in the automotive traction inverter market

North America holds the biggest automotive traction inverter market share as a result of numerous energy-saving programs now in progress there. This is because a large portion of the expansion has been attributed to a move to renewable energy sources.

Additionally, a number of legislative initiatives to lessen the region's carbon impact have helped to increase the need for traction inverters in this area. Due to ongoing infrastructure improvements, there will be an increase in demand for new infrastructure throughout the region in the years to come. Furthermore, electric vehicles have become the preferred road transport technology for the auto industry and the government. For instance, the US government declared a goal in November 2021 to electrify 50% of passenger vehicles by 2030. This goal was supported by the building of 500,000 charging stations.

Automotive Traction Inverter Market Key Developments:

In April 2023, the HybridPACKTM Drive G2 is a brand-new vehicle power module that Infineon Technologies AG introduced today. It expands on the tried-and-true HybridPACK Drive G1 integrated B6 package concept by providing scalability within the same size and expanding it to higher power and usability. Different current rates, voltage levels (750V and 1200V), and Infineon's cutting-edge semiconductor innovations, EDT3 (Si IGBT) and CoolSiCTM G2 MOSFET, will be offered in the HybridPACK Drive G2.

In December 2022. Customers of Future Electronics are offered comprehensive automotive ecosystem services, particularly in the area of new energy cars. Future Electronics has launched solutions based on the NXP Power Architecture series as of 2019 and has dedicated itself to the construction of traction inverter solutions for electric vehicles. Future Electronics released a traction inverter alternative for electric vehicles based on NXP's ARM platform S32K344, together with the introduction of the company's new automotive controller K3 series MCU, offering a more complete and advanced solution for the development of motor inverters for electric vehicles.

In November 2022. Electronica, the pioneer in automotive processors, NXP Semiconductors, unveiled the S32K39 series of automotive microcontrollers (MCUs) designed specifically for EV control applications. With high-speed and high-resolution control for greater power efficiency to prolong driving range and give a smoother EV driving experience, the current S32K39 MCUs bring electrification into the future. The networking, security, and functional safety capabilities of the S32K39 MCUs go beyond those of conventional automotive MCUs to meet the requirements of software-defined and zonal vehicle E/E architectures. The new MCUs make it possible for NXP's EV power inverters and battery management system (BMS) to offer complete solutions for next-generation EVs.

In July 2022. With the traction inverter product range expansion, Curtiss-Wright's industrial sector has reaffirmed its commitment to its long-term goal of developing the market. For usage in hybrid and pure-electric applications for on- and off-highway commercial vehicles, our most recent CWTIs provide the most highly efficient and innovative design.

Automotive Traction Inverter Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 13.397 billion |

| Total Market Size in 2031 | USD 24.654 billion |

| Growth Rate | 12.97% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Design, Technology, Propulsion Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Traction Inverter Market Segmentation:

By Design

Box-Design

Integrated Inverter Design

By Technology

Insulated-Gate Bipolar Transistors (IGBT)

Metal-Oxide Semiconductor Field-Effect Transistors (MOSFET)

By Propulsion Type

Electric Vehicles

Hybrid-Electric Vehicles

Plug-In Hybrid

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

Light Duty

Heavy Duty

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others